Autonomous Driving Tier1 Supplier Research: centralized implementation of L2+, middleware layout of Tier 1 suppliers

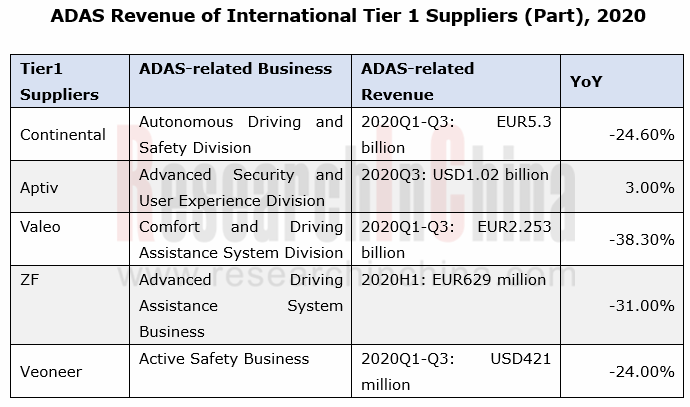

1. The ADAS revenue of foreign Tier 1 suppliers declines amid the pandemic

The outbreak of COVID-19 has led to the declining demand for automobiles and the temporary suspension of production in the automobile industry. In this case, the overall revenue of most Tier1 suppliers has fallen sharply as they have difficulties in business development. For example, more than 40% of Continental's 249 production bases around the world decided in April 2020 to temporarily suspend production for several days or several weeks in order to protect employees and respond to lower demand.

2. Tier 1 suppliers actively promote the mass implementation of L2 autonomous driving, and L3 autonomous driving enters the market

While Tier 1 suppliers' normal production is hindered, the technology of L2/L3 autonomous driving is advancing in an orderly manner.

From January to November 2020, 57 domestic auto brands launched 208 L2 models, and sold 2.60 million vehicles with a year-on-year upsurge of 118.9% thanks to the efforts of Tier 1 suppliers. For example, Bosch helped 40 local models achieve L2 autonomous driving in 2019, and focused on the implementation of L2+ autonomous driving in 2020.

Benefiting from the effective control over the domestic epidemic, Chinese Tier1 suppliers have constantly launched new products. Among them, Huawei and Baidu have attracted the most attention from the market. Huawei has successively unveiled perception layer products such as radar and LiDAR, as well as decision layer products like intelligent driving computing platform MDC and intelligent driving operating system AOS. Baidu APOLLO has released the autonomous driving computing platform ACU (1.0/2.0/3.0) and the L2 intelligent driving solution ANP, and also has successively landed in Changsha, Cangzhou, and Beijing with Robotaxi which is fully open to the society for operation.

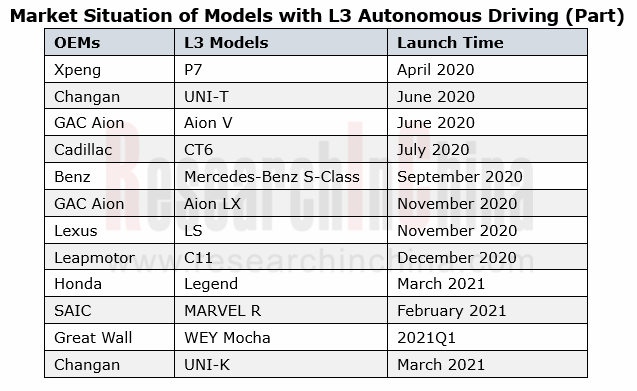

With the introduction of HD maps, Tier 1 suppliers have assisted OEMs to head towards L3 autonomous driving. Xpeng P7, GAC Aion LX and other models with L3 autonomous driving have debuted successively.

3. Foreign Tier 1 suppliers dabble in middleware, while domestic Tier 1 suppliers are deeply tied up with OEMs

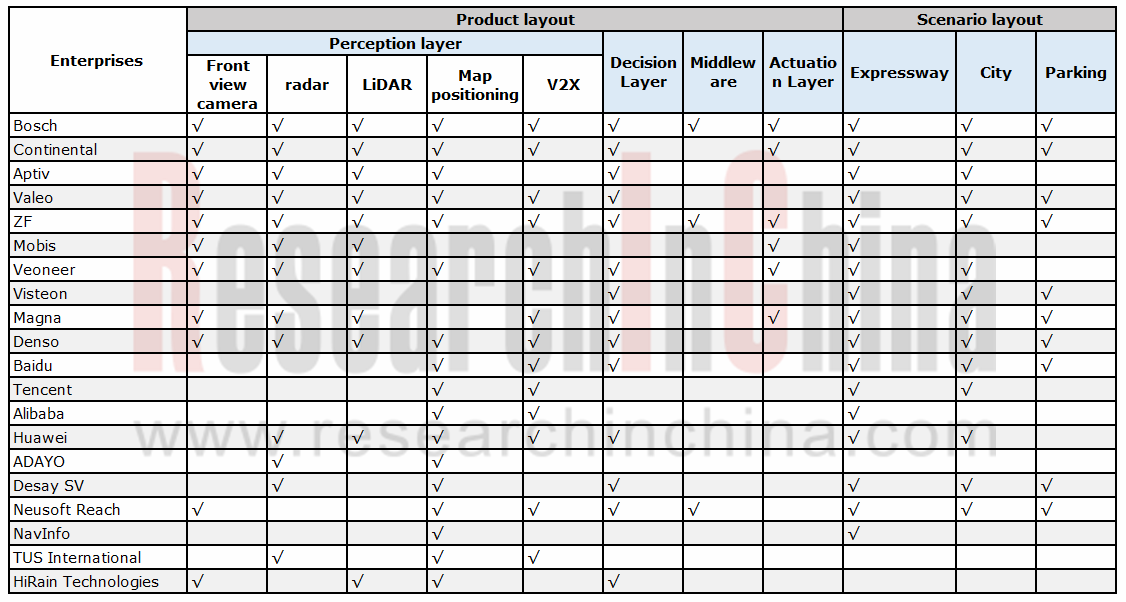

From the perspective of autonomous driving products and scenarios, Bosch, Continental and ZF have the most comprehensive layout among foreign Tier1 suppliers. Both Bosch and ZF launched middleware designed for autonomous driving in 2020. As for the domestic Tier 1 suppliers, Huawei and Desay SV take the lead in the perception layout; however, all the domestic Tier1 suppliers are absent in the field of actuation.

In July 2020, Bosch launched Iceoryx, a middleware for advanced autonomous driving, compatible with ROS2 and Adaptive AutoSAR interfaces to meet the requirements of different development periods (pre-ROS, mass production of Autosar).

In July 2020, Bosch launched Iceoryx, a middleware for advanced autonomous driving, compatible with ROS2 and Adaptive AutoSAR interfaces to meet the requirements of different development periods (pre-ROS, mass production of Autosar).

In December 2020, ZF released ZF Middleware, providing a modular solution that can be integrated into automakers' software platforms. At the same time, the middleware will be installed on mass-produced vehicles in 2024.

In December 2020, ZF released ZF Middleware, providing a modular solution that can be integrated into automakers' software platforms. At the same time, the middleware will be installed on mass-produced vehicles in 2024.

It is worth noting that foreign Tier 1 suppliers dabble in underlying system R&D and build a bridge between system and software applications while accomplishing functions. Bosch and ZF have successively released middleware products, hoping to centrally configure autonomous driving solutions for OEMs through a comprehensive sensor layout so as to simplify system integration, lower development costs and accelerate product launch.

The domestic Tier 1 suppliers (Huawei, Alibaba and Baidu) have teamed up with OEMs to launch autonomous driving and other technologies by in-depth cooperation or establishment of joint ventures to jointly help automakers build high-end brands or accelerate transformation to electrification, connectivity, intelligence and sharing.

Changan and Huawei. On November 14, 2020, Changan, Huawei and CATL established a new high-end smart car brand together. They will jointly develop the CHN smart electric vehicle platform, which will be equipped with Huawei's smart cockpit platform CDC, autonomous driving domain controller ADC, and some components of electric drive, batteries and electric control.

Changan and Huawei. On November 14, 2020, Changan, Huawei and CATL established a new high-end smart car brand together. They will jointly develop the CHN smart electric vehicle platform, which will be equipped with Huawei's smart cockpit platform CDC, autonomous driving domain controller ADC, and some components of electric drive, batteries and electric control.

SAIC and Alibaba. On November 26, 2020, SAIC and Alibaba jointly founded a high-end battery-electric vehicle brand "IM", which will adopt Alibaba's Banma Telematics system and SAIC's electric drive, battery, electric control and intelligent driving technologies.

SAIC and Alibaba. On November 26, 2020, SAIC and Alibaba jointly founded a high-end battery-electric vehicle brand "IM", which will adopt Alibaba's Banma Telematics system and SAIC's electric drive, battery, electric control and intelligent driving technologies.

Geely and Baidu. On January 11, 2020, Geely and Baidu erected a smart electric vehicle company. Baidu will fully empower the joint venture with technologies such as artificial intelligence, autonomous driving, Apollo, and Baidu Map.

Geely and Baidu. On January 11, 2020, Geely and Baidu erected a smart electric vehicle company. Baidu will fully empower the joint venture with technologies such as artificial intelligence, autonomous driving, Apollo, and Baidu Map.

4. Summary

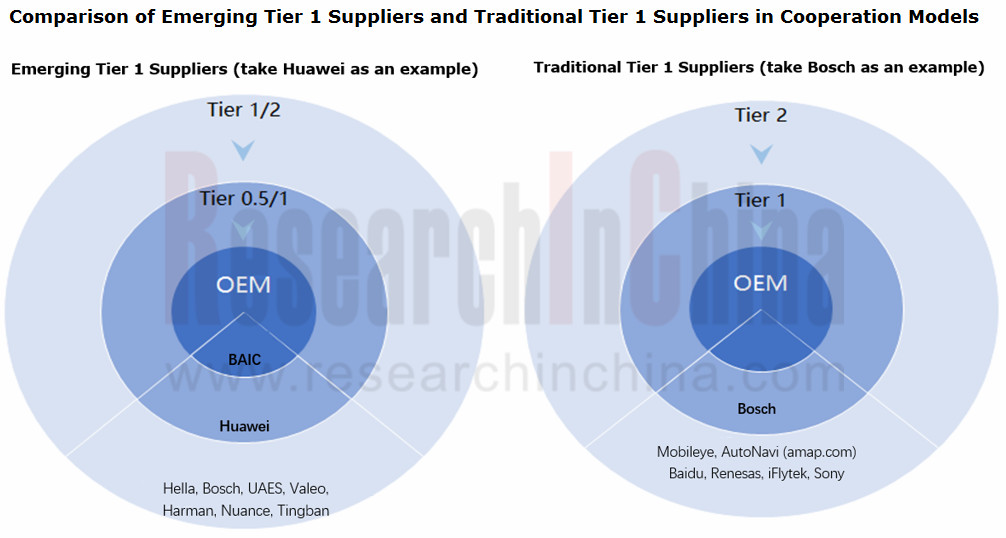

Comparing the development models of Tier 1 suppliers at home and abroad, emerging Tier 1 suppliers represented by Huawei and Mobileye directly penetrate into OEMs, deeply participate in product R&D, and position themselves as Tier 0.5 suppliers. For example, at the beginning of BAIC ARCFOX R&D, Huawei directly took part in R&D of many system functions of the vehicle, including smart driving, smart cockpit and smart electronics. Similarly, Mobileye acted as a Tier 0.5 supplier amid the cooperation with Geely Lynk & Co. Previously, Mobileye only supplied semi-finished components to Tier 1 suppliers, but now it is responsible for the complete solution stack for the first time, including hardware, software, drive strategy and control. Mobileye will also provide a multi-domain controller and provide software OTA updates after the system is deployed.

The emergence of the Tier 0.5 cooperation model will reshape the cooperation pattern of the traditional automobile industry chain.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...