Research on digital transformation of automakers: Tesla is still the best reference

Digital transformation means that enterprises make full use of digital technologies (such as big data, cloud computing, artificial intelligence, etc.) in R&D, production, marketing and services to promote the transformation of business models, organizational structures, etc., so that concepts like intelligent manufacturing are derived.

Digital transformation in the automotive industry includes R&D and production digitalization, marketing service digitalization, product digitalization, and management digitalization.

In essence, digitization actually maps and orderly manages the real world (such as cars, roads, car owners, etc.) in the virtual world. The real world is transformed into various information systems through data collection from automobile production, R&D, marketing, services and management. Via the integration of information and data, big data and artificial intelligence technology which optimizes the processing of the virtual world, the process and management of the real world are optimized as well.

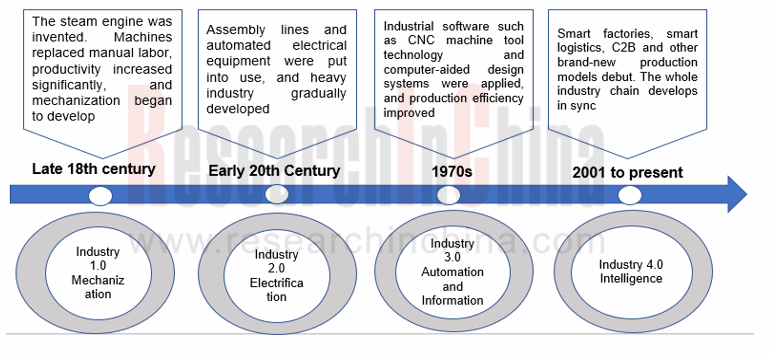

During the “Industry 3.0” era (automation and information age, approximately from 1980 to 2010), production information systems, R&D information systems, sales information systems, user and service information systems, etc. were formed, but these information systems were basically isolated then. Due to the low frequency of information collection, a lot of information still lagged.

With the substantial improvement in chip computing power and storage capacity, the automotive industry has entered the era of Industry 4.0 (intelligence) which will connect information systems in all business links. At the same time, the frequency and precision of information collection will be greatly improved, and some fields may even see digital twin (that is, the virtual world by digital mapping is highly consistent with the real world).

Tesla achieves the highest degree of intelligence among all automakers, and has basically connected the information systems and data of all business links. Tesla not only conducts self-research on electrification, connectivity and intelligence of cars, but also tries its best to develop software systems in the entire life cycle of cars.

Software-driven is the source of Tesla’s subversion of the entire automotive industry. Its self-developed software system named Warp supports its direct sales business in the United States and adapts to growth in China and other markets around the world. Warp is a combination of e-commerce and back-end management software and completely customized to support Tesla's counter-approach to selling and servicing cars. The automaker uses its Warp-powered e-commerce website and its own showrooms, not dealerships, to sell cars. Warp also handles all the back office functions for Tesla such as order processing, supply chain management, manufacturing workflow management, financial accounting and lead management.

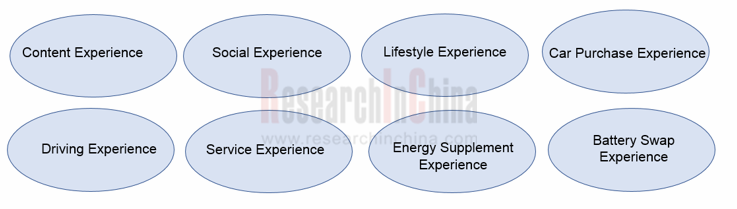

China's emerging automaker NIO adopts a sales model similar to Tesla’s. No matter online or offline, NIO prefers self-operation and self-establishment. It basically relies on online channels to sell products, while displays the brand and offers user experience services offline. NIO's experiential digital marketing is widely praised. In terms of experience marketing, NIO starts from eight aspects: content experience, social experience, lifestyle experience, car purchase experience, driving experience, service experience, energy supplement experience, and battery swap experience.

Take the social experience as an example: users can set up groups in the NIO App. In other words, once a user becomes a car owner, a dedicated car owner service group of 13 people will be formed. In the service group, there are sales partners, service specialists, power-on specialists, as well as various technical specialists and city general managers. When users have any problems in the process of using cars, they can inquire in the group, and someone will respond to and solve problems immediately.

The traditional automakers BMW and Mercedes-Benz have developed APPs which pay attention to functions and require registration. They only provide services for existing car owners, so they are unattractive to potential car owners. The limited traffic cannot support sales volume conversion.

As the emerging automakers represented by Tesla have been digitally operated from the beginning, they are sought after by consumers and recognized by the market. The emergence of new forces has posed tremendous pressure on traditional automakers who thus have formulated digital strategies one after another to boost digital transformation.

At present, automakers mainly deploy digital transformation in five aspects:

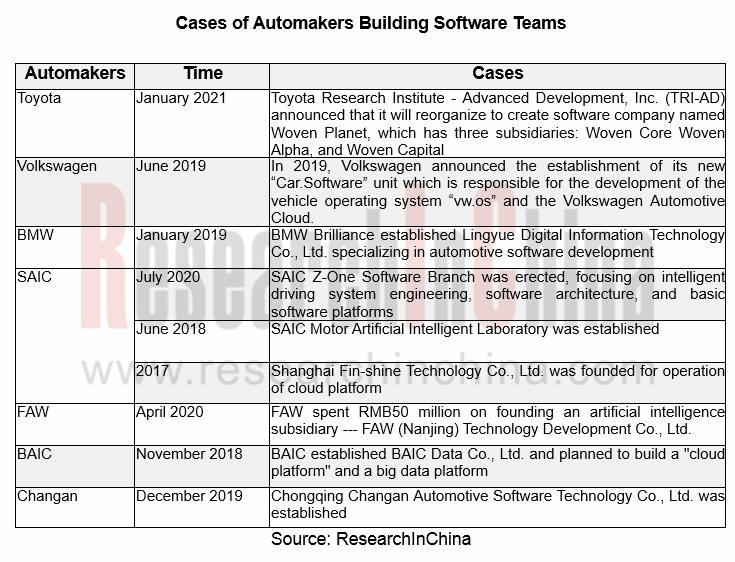

First, they establish software companies or R&D divisions as well as build software teams through self-construction or cooperation.

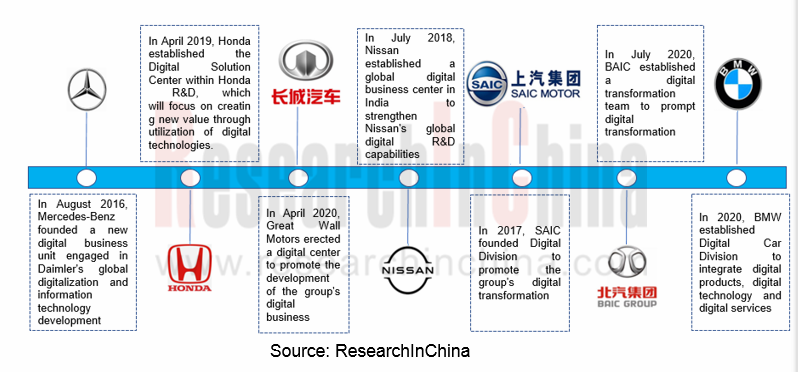

Second, automakers set up digital centers internally to coordinate the digital transformation of the entire groups and promote the implementation of overall digital strategy.

Third, automakers can reduce costs and improve competitiveness by allying with other automakers.

Fourth, automakers prompt digital transformation through cooperation with technology companies (such as Baidu, Alibaba, Tencent, Huawei, etc.).

Fifth, automakers create an online & offline user-centric digital marketing model.

GM’s 4S stores have evolved into a "7S modular dealer service system" consisting of New Car Sale, After-Sales Services, Spare Parts, Information Survey, Pre-owned Car Services, Sharing and Financial Support.

Xpeng's "2S+2S" marketing model disassembles "4S" into two parts: online (marketing and parts available on Tmall) and offline (after-sales services and information feedback). Through the dual-channel linkage of "the Tmall flagship store + offline stores", Xpeng connects both online and offline fields, which not only greatly reduces costs, but also brings consumers with new experience.

This report analyzes 21 OEMs’ strategies and specific measures for transformation. Conventional automakers like Toyota and Changan Automobile have made successes in digital transformation as well, in addition to emerging carmakers.

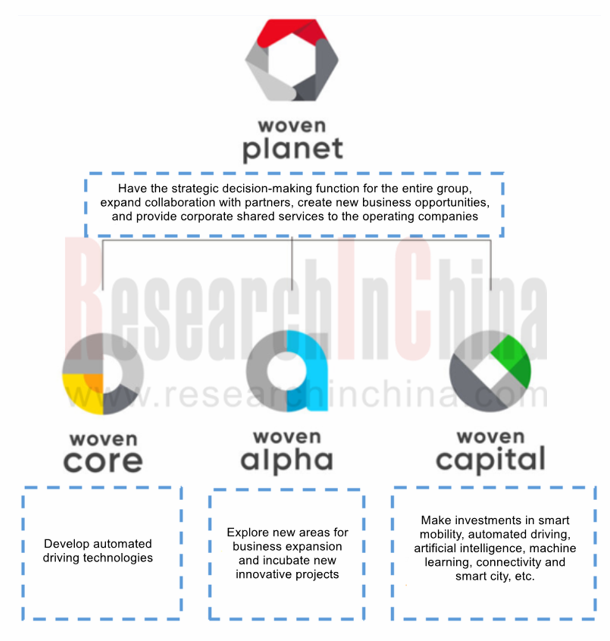

Toyota Digital Transformation focuses on five aspects: first, adjusting organizational structure, with high priority on restructuring of TRI-AD, Toyota’s advanced software company and segmenting its business into “R&D of Automated Driving Technologies”, “Incubation of Innovative Projects” and “Investment in Emerging Areas”; second, launching the Mobility Services Platform (MSPF) for an upgrade to the next-generation mobility services; third, building a cloud service platform for better business and operation models; fourth, creating Toyota New Global Architecture (TNGA) to reform R&D and production links; fifth, developing digital products, with deployments in autonomous driving, HD map, chip, HMI, etc.

Changan Automobile takes software as its corporate strategy, setting up a software center to enhance its digital transformation. For R&D and production, the automaker builds a R&D cloud platform for advancing construction of smart cities; for marketing, it creates an integrated marketing cloud platform and self-establishes an ecommerce platform; for product digitization, it makes deployments in areas from cloud platform and intelligence to telematics by way of independent construction and cooperation.

Despite great efforts on digital transformation, quite a few automakers still face some challenges, such as:

Underpowered transformation, disputed transformation model, and some departments’ reluctance to transform;

Underpowered transformation, disputed transformation model, and some departments’ reluctance to transform;

Poor ability to attract customers online in digital marketing, and lower-than-expected return on offline high investment;

Poor ability to attract customers online in digital marketing, and lower-than-expected return on offline high investment;

Under-investment in digital transformation, which blames for conventional businesses;

Under-investment in digital transformation, which blames for conventional businesses;

Lack of software teams and user operation experience.

Lack of software teams and user operation experience.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...