Our recent report Global and China Automotive Seating Industry Report, 2020-2021 highlights the following: development history of automotive seating, industry pattern, market size, supplier relationships, “CASE” (Connected, Autonomous, Shared, Electrified) and cooperation dynamics of major automotive seat manufacturers, and ten trends for automotive seating industry in an upsurge of CASE.

Automotive seat is the interior component that occupants contact for the longest time during the ride. Since the world’s first automobile came into being in 1885, automotive seat has evolved for over a century from a simple component into a practical tool offering comfort and safety.

Global automotive seating market is dominated by American, European and Japanese brands.

In 2019, North American, Japanese and European seat manufacturers commanded around 50%, 14% and 11% of the global market, separately. China’s automotive seating market is grabbed by foreign companies such as Adient and Lear and their affiliates and Toyota Boshoku, or foreign-funded joint ventures, which together sweep more than 60%.

Ten trends for automotive seating industry amid CASE

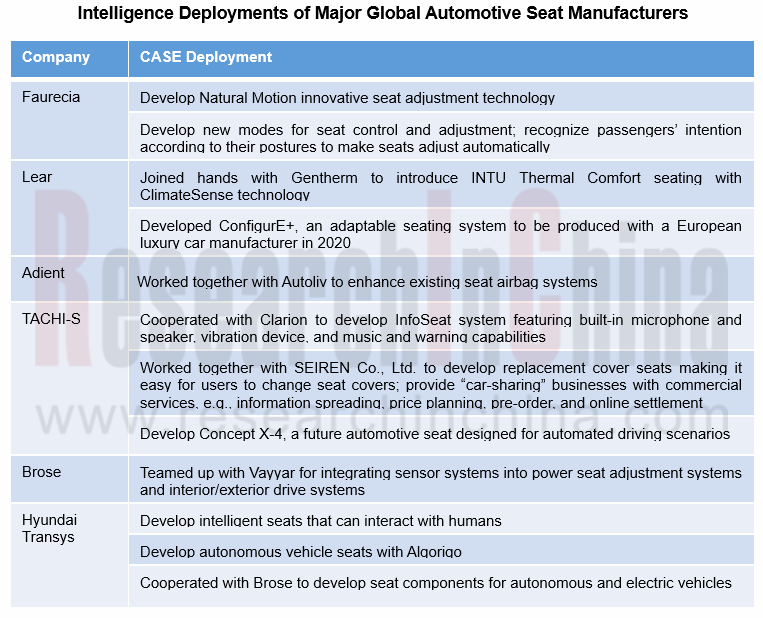

Under the development trend of CASE, the tide of software-defined cars is unstoppable. However, software cannot define everything about vehicles. Traditional auto parts manufacturers still have many core technologies, which cannot be replaced by emerging auto-making forces, such as automotive settings. Seat manufacturers have also made a lot of intelligent improvements to seats according to the development needs of intelligent connected vehicles. We summarized the ten development trends for automotive seating industry amid CASE boom.

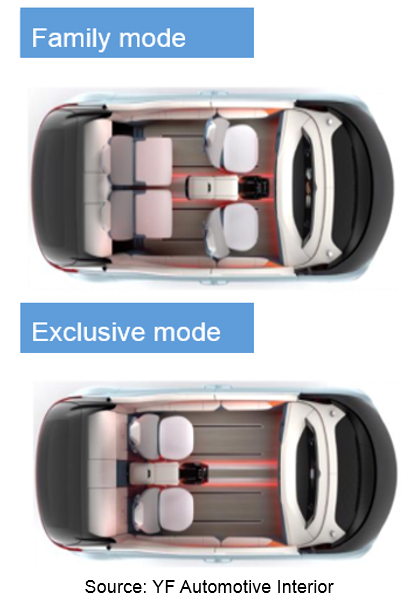

Trend 1: Multi-scenario Application

In future, autonomous vehicle cockpit will be a mobile space for office, living and entertainment, so seat needs to transform for different application scenarios. An example is the next-generation reconfigurable seating concept Magna showcased at CES 2019. Users can reconfigure seats via their smartphone APP, with reconfigurable modes including vehicle sharing, long journey, and autonomous shared mobility.

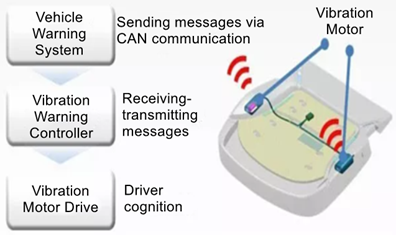

Trend 2: Integration with ADAS

In future, automotive seat that plays a crucial role in vehicle safety will integrate with ADAS to deliver more driving assistance capabilities. Examples include InfoSeat, an automotive seating system TACHI-S and Clarion co-developed and launched in 2019: when the vehicle travels too close to the front vehicle or the driver is drowsy, the vibration device installed in the seat will send a vibrative warning to occupants.

Trend 3: Intelligent Control

At present, CASE is reshaping the automotive industry. Facing the disruption in automotive industry, seat manufacturers race to double down on intelligence deployment by way of such as cooperation and independent development. Future intelligent seats can not only provide comfortable experience but learn to “know” what passengers want with AI technology and adjust and control themselves without any active operation. For instance, the fusion of sensors and seats makes seat control mode change from conventional button to intelligent control methods, e.g., APP, gesture control and intention perception.

Trend 4: Intelligent Monitoring

In future, automotive seat will also act as a “health manager” that can monitor heart and breath rates. Examples include HiRain Technologies’ intelligent automotive seating system with the ability to intelligently monitor health, heart and breath rates, and temperature.

Trend 5: Personalization

As well as function intelligence, personalized design holds a trend for automotive seat, helping users to create a more private interior space. In the case of gender-targeted design, ambient lamps are used to build exclusive private sound areas.

Trend 6: Modularization

Automotive modular platform that helps automakers reduce cost, development time, vehicle weight and fuel consumption will be well-welcomed. For example, Brose’s complete seat modular structure allows for higher uniformity of motors in size for quick response to different customers’ needs for—any drive for basic capabilities such as adjusting length, height, seat tilt and backrest tilt, serving as an efficient supplement in comfort and safety.

Trend 7: Application of Intelligent Surface

As intelligent cockpit booms, decorative, functional intelligent automotive surface attracts ever more attention from industry players. Examples include BWM Vision iNext, a concept car fully demonstrating which direction intelligent automotive surface will head in. iNext allows users to operate the infotainment system by interacting with and tracking symbols on seat or side panel woven fabrics with their fingers, which replaces traditional buttons and touch screen control capability.

Trend 8: Replacement Cover Seat

The growing awareness of hygiene and disinfection in car comes with popularity of car sharing and current pandemic. The emergence of replacement cover seat will be an efficient way to reduce the spread of viruses and bacteria and better protect the health of occupants.

An example is the replacement cover seat co-developed by TACHI-S and SEIREN Co., Ltd. Users can replace seat covers as they like in any time. For car sharing, corporate LOGO or QR code can be printed on the cover of the seat in support of offering commercial services from information spreading and price planning to pre-order and online settlement.

Trends 9: Lightweight

Seats make up 6% of vehicle curb weight, and 5% of total vehicle cost, the second highest share among all components. Lightweight seats are an effective solution to vehicle energy conservation and emission reduction. Reducing the weight of seats lies in use of lightweight seat frames or complete seats.

Trends 10: Zero Gravity

Statistics shows that in autopilot mode, the comfortable recumbent mode (zero gravity) gives users the greatest pleasure. A zero gravity seat is a boon for them to feel less tired during the journey. For example, in June 2020 Yanfeng Automotive Interiors introduced XiM21, a self-developed intelligent cockpit featuring a zero gravity seat that affords a large angle tilt, integrates with massage function and lets passengers relax their body and mind with fragrance from the hidden air outlet.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...