Research Report on Telematics Service Providers (TSP) and Their Products, 2021

Small and medium TSPs will fade away and TSP giants will come to the front

As “smart car as a service” grows, automakers focus more on introduction of technologies or platforms from big data and cloud computing to security, content platform and artificial intelligence, providing more intelligent, more diversified content and value-added services, while making an expansion in OEM market. As the gateway for vehicle traffic flow, telematics service providers (TSP) are catering to the industrial change by constantly extending services content and boundaries, across fields from initial remote service to phone mirroring and connectivity, then to connected IVI system, finally to integrated telematics system covering people, vehicle and life.

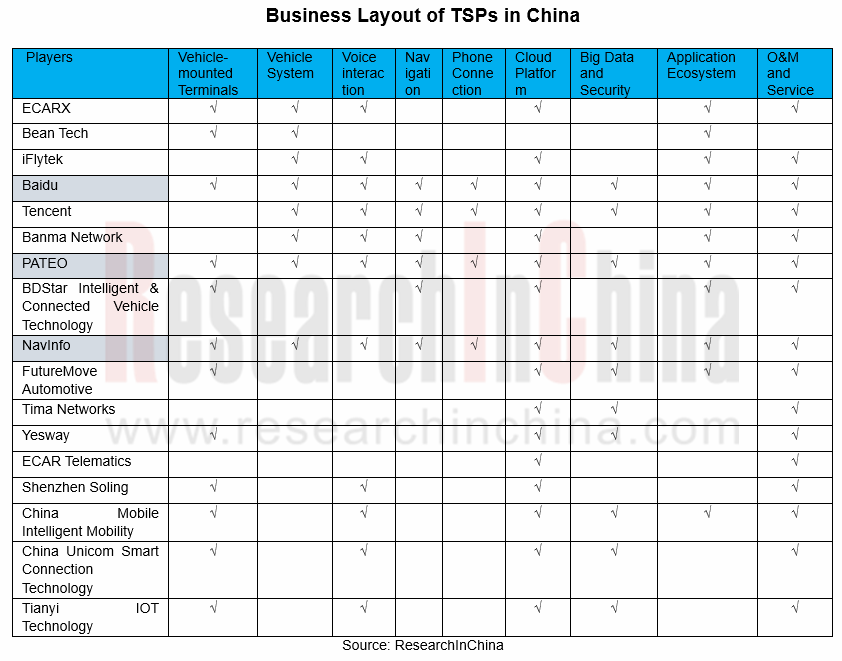

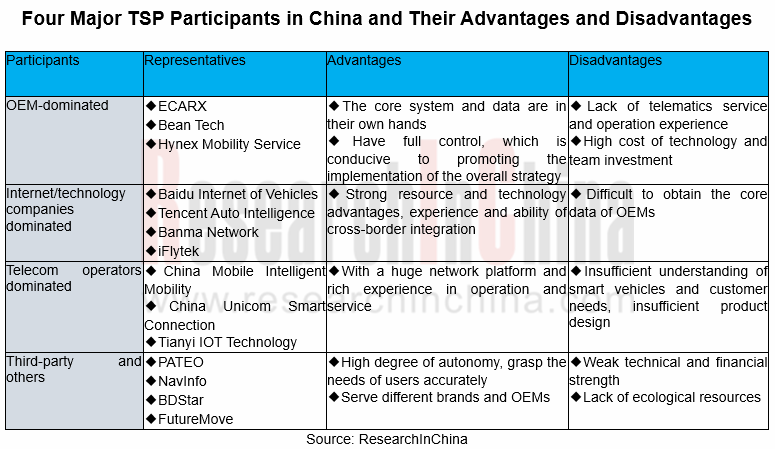

There are four typical types of TSPs: OEMs, telecom operators, internet/technology companies, and third-party platform providers. These players have built a mode of multi-party cooperation. For example, OEMs push for their partnerships with BATH, Pateo and more in their efforts to improve their ability to develop telematics and provide services, and work together with telecom operators to explore 5G + telematics application scenarios and application ecosystem. In the long run, the four major participants will integrate with each other across fields for win-win cooperation.

In future, China’s TSP industry will head in the following directions:

1. The closer connection of a vehicle with people, other vehicles, smart home appliances, living services and smart city comes with TSPs’ greater attempts to extend their services and open up their technology and ecosystem for a gradual coverage of all scenarios of mobile phone, car, home and city.

For example, based on extended BATH ecosystem (Baidu, Huawei, Tencent, Suning, Ping An, UnionPay, China Telecom, etc.) and third-party ecosystem, Pateo has made deployments in mobile phone, car, home and city scenarios, and will add “five new operations”, i.e., New Mobility, New Finance, New Retail, New Insurance and New Marketing. Now it has carried out its landing of new car retail strategy together with New Baojun and Sunning Car.

2. As cross-field integration becomes normal, players will achieve complementary advantages, resource sharing, and ecological integration to build a large ecosystem ultimately.

Examples include Baidu, Alibaba and Tencent (BAT) which are establishing closer partnerships with OEMs in more areas. Among them, in late 2020 Alibaba joined hands with SAIC again to set up IM Motors in charge of developing smart electric vehicles, following their establishment of Banma Network Technology (which finished strategic restructuring with AliOS in May 2020, aiming at improving automotive operating system and AI technology and upgrading the cloud-network-edge-terminal open system); based on their in-depth cooperation on intelligent connectivity, cloud technology and Baidu Ecosystem, Baidu and Geely announced they would co-found an intelligent vehicle company in January 2021, with Jidu Auto coming into being on March 2.

3. OEMs-lead TSPs to provide better IVI system-centric services.

Currently, OEMs have found common ground on intelligent connectivity and digital transformation acceleration. To hold core technology and data, Geely, Great Wall Motor and Honda China have founded their telematics company independently or together with others, with IVI system at the core of their multi-directional deployments:

ECARX: by the end of 2020, GKUI ECARX designed for Geely has been found in more than 40 models under Geely, Lynk & Co, Proton and served a total of over 2.3 million users.

On this basis, ECARX built in-depth cooperation with Baidu, with GKUI19-enabled Boyue PRO access to Baidu Map and Baidu Scenario for recommendation in 2020;

In November 2020, Baidu Map vehicle version became first available to Geely Preface upgrade edition.

In October 2020, ECARX raised RMB1.3 billion in a Series A funding round led by Baidu, which will be spent developing its automotive chip business.

In February 2021, ECARX joined hands with Visteon and Qualcomm to jointly provide intelligent cockpit solutions for the global market; in the same month, ECARX was invested USD200 million in its A+ funding round, which will be used for building an international R&D system and further expanding its global operation.

Bean Tech: Haval Fun-Life 2.0 system co-developed by Bean Tech and Haval integrates with Tencent TAI 3.0 features, and has been installed in several models like Haval Big Dog, Haval F7, Gen 3 H6, and WEY Tank 300. In future, Bean Tech will partner more closely with Haval and Tencent to promote its cloud services (supplied by Tencent Cloud Platform) in Great Wall Motor’s overseas markets and provide full-stack intelligent marketing closed loop services from user profiling and SCRM to advertising and user operation.

4. TSPs face intensified competition and a new reshuffle amid telematics industry change, with four or five giants expected to be born by 2025

Currently, most conventional TSPs have been acquired and integrated into other business by tycoons. A handful of TSPs can run independently. Even Baidu, Alibaba, Tencent and Huawei (BATH) are able to deploy just one of dozens of intelligent connected vehicle product lines each. As OEMs regain dominance in software development, TSPs will contend more fiercely and face a new reshuffle. It is predicted that by 2025, four or five bellwethers that have ability to develop full-stack telematics systems and link vehicles with V2X equipment facilities, earphones, watches, bracelets and various IOT (Internet of Things) device will come out. Small and medium TSPs will be edged out by TSP giants.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...