TOP4 Emerging Automakers’ CASE Layout and Strategy Research Report, 2020

Our TOP4 Emerging Automakers’ CASE Layout and Strategy Research Report, 2020 highlights in-depth analysis of CASE situation (connectivity, automation, sharing and electrification) of NIO, Xiaopeng Motors, Weltmeister and Leading Ideal.

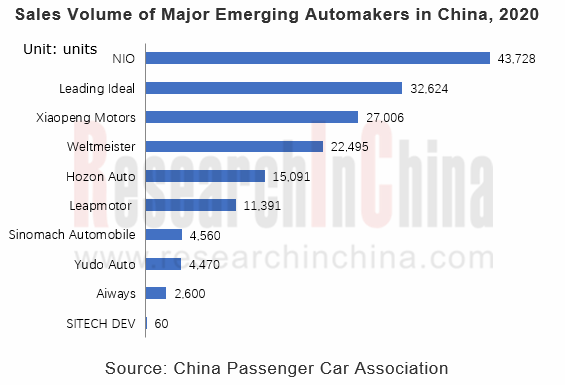

By sales, vehicle model and brand recognition, NIO, Leading Ideal, Xiaopeng Motors and Weltmeister are the first-echelon emerging automakers in China.

Favored by investors, the top four emerging automakers have raised more than RMB100 billion in all.

Internet firms and strategic investment companies are particularly optimistic about intelligent new energy vehicles, and some investors make simultaneous deployments of more than one emerging automakers. Examples include Sequoia Capital investing NIO, Xiaopeng Motors and Weltmeister, and Tencent that has funded NIO, Weltmeister and Aiways. Local governments attract new energy automakers to settle as well. For instance, NIO secured RMB7 billion strategic investment from Hefei in April 2020; Xiaopeng Motors raised RMB4 billion from Guangzhou Development District in September 2020.

As of December 2020, NIO has closed 14 funding rounds and raised around RMB71.3 billion, the largest amount among all emerging automakers in China; Xiaopeng Motors has obtained approximately RMB51.8 billion in its 15 funding rounds; a total of 8 funding rounds have raised over RMB30 billion for Weltmeister; Leading Ideal has reported 8 funding rounds and raised funds of more than RMB32.9 billion.

This report summarizes fives reasons why emerging automakers are a hotspot for investors and explains what emerging automakers mean.

1.Adopt direct sales or partially direct sales model, with digital operation covering full life cycle of vehicle.

Through the lens of business model, emerging automakers employ direct sales or partial direct sales model, which means they put greater emphasis on user operation and bind themselves to users for close communication. An example is NIO which uses fully direct sales model where car picking and customization are done online and most customer feedback and communications are carried out offline. NIO House provides car owners with free meeting rooms and libraries, among others. NIO APP connects users in full life cycle from pre-sales consultation to online picking and reservation for test drive, then to fully digital tracking in after-sales service, enabling the carmaker to know using habit, needs and preference of its users and potential users. Moreover, NIO APP that is open to NIO users or non-users, allows them to contact with each other or share experience in the community, not only improving customer loyalty but enlarging fan and potential user bases.

Xiaopeng Motors adopts a model of partially pre-sales franchise and fully direct after-sales service, paying more attention to after-sales service experience. It has three types of physical stores: 2S (experience + sales), 2S (delivery + service), and 4S (experience + sales + delivery + service).

Weltmeister sets up “new 4S” outlets: Space (experience store, displaying its products and providing premium fan services), Store (user center, offering test drive, delivery, maintenance, mobility, charging, etc.), Station (service home, after-sales services, e.g., charging, maintenance and repair and emergency rescue), and Spot (E station, convenient services, e.g., car washing, beauty and daily maintenance, being planned).

Leading Ideal uses a direct pre-sales and after-sales franchise model where retail and delivery centers are set up separately. In future, the carmaker will increase its service outlets, expectedly up to over 1,000 in 2024.

2. Superior autonomous driving configurations for new cars, especially ET7, pose great stress to conventional automakers.

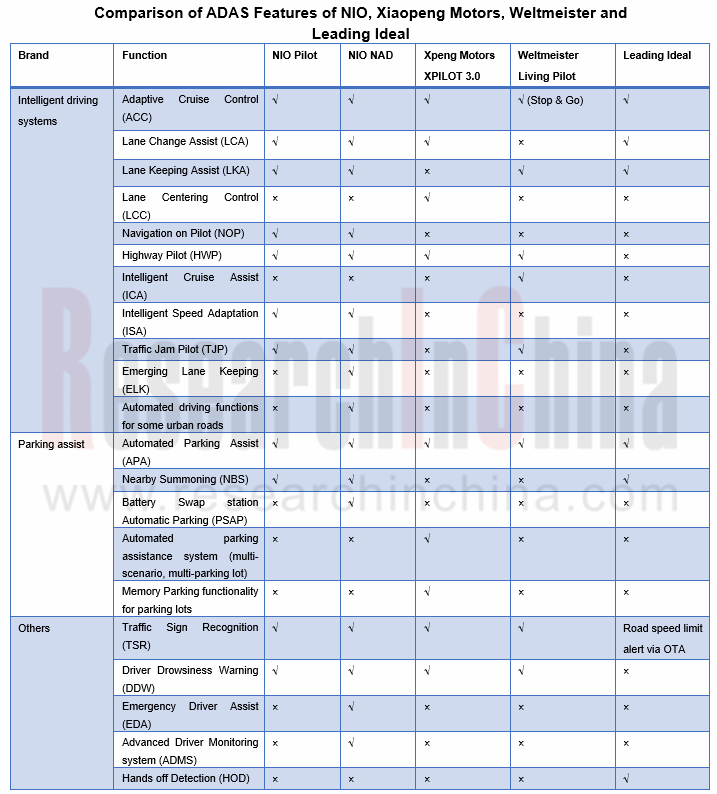

NIO Autonomous Driving (NAD), a safety and driving assistance system mounted on ET7 which was launched in January 2020, delivers functions such as advanced driver monitoring system (ADMS), autonomous driving (available to some urban roads and closed highways), and low-speed automated parking (fully automated parking pilot, remote parking, remote summon, narrow road passing and reversing in a parking lot), and driving assistance (navigation on pilot (NOP) and auto lane change (ALC)). ET7 features 1016TOPS computing force, 300-channel LiDAR, 2 positioning units, V2X vehicle-infrastructure cooperation and perception, and higher precision hardware like ADMS, supporting future upgrades to more functions.

New car launches like ET7 make emerging automakers stay ahead in the race to configure intelligent connected vehicle capabilities, weighing heavily on conventional automakers.

Xiaopeng Motors’ XPILOT 3.0 boasts navigation guided pilot (NGP) and a Memory Parking functionality for parking lots. The NGP highway solution enables traffic cone recognition and avoidance, super follow-up on congested roads, night overtaking reminder, faulty vehicle avoidance, large truck avoidance, automatic speed limit adjustment, optimal lane selection, automatic on/off-ramp, and automatic overtaking, and works on highways, expressways, and some urban trunk roads. The automaker plans release of mass-produced intelligent vehicles equipped with Lidar and L3 autonomous driving function in 2021, L4 autonomous driving technologies in 2023 and implementation of XPILOT 5.0 in 2025 to realize L5 full automation.

Weltmeister and Baidu partner more closely. Their L3 driving assistance functions are expected to be rolled out and mounted on mass-produced cars in 2021.

Leading Ideal plans to deliver navigate on autopilot (NOA) capability between 2021 and 2022, and introduce X01, a model with standard configurations of L4 hardware and single NVIDIA Orin SoC that affords 200TOPS computing force (upgraded to dual SoC, 400TOPS) and 45W power consumption.

3. Brand-new architecture design allows for more frequent OTA updates and rapid function iteration

As of December 2020, NIO’s IVI system has undergone 16 OTA updates, every 1.9 months a time on average, of which at least 7 OTA updates were on the intelligent voice system NOMI, which totally added 8 features and optimized 3 functions. NOMI that increased 6 new in-vehicle control functions in the latest update, is expected to achieve more control features. Moreover, the digital operation throughout the life cycle enables NIO to collect user data quickly for offering targeted better product experience.

Xiaopeng Motors backed by Alibaba, introduces applets like Tmall Yangche, Tao Piao Piao, Fliggy, Ele.me, Che Dian Dian, Tuhu, AliHealth and Umetrip, and provides more convenient services, for example, when a vehicle knows the driver goes to the office, an applet will wake up itself to ask if there is a need to reserve breakfast.

Weltmeister and Xiaomi have established a close partnership. Xiaoai Speaker allows users to control their vehicle remotely and also to control 8 categories of Xiaomi smart home appliances in over 20 kinds just in their vehicle.

4. Adopt a totally new mode of hardware first and charged software upgrade

As a pioneer of the “embedded hardware + charged software unlock” model, Tesla is expected to introduce FSD subscription service before July 2021. Charged software service has been a business model of Tesla.

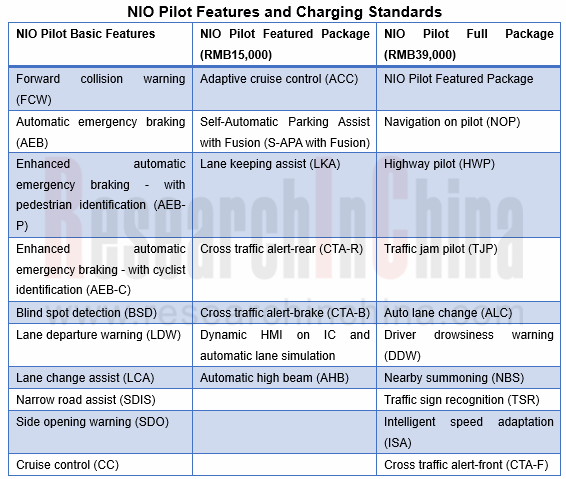

Following Tesla that has rolled out its software service model, NIO and Xiaopeng Motors have unveiled related services as well. For instance, NIO Pilot Featured Package service priced at RMB15,000 incorporates such capabilities as automated parking system and adaptive cruise control, and NIO Pilot Full Package service priced at RMB39,000 offers navigation on pilot, automated driving in traffic jams and other functions.

Xiaopeng Motors’ XPILOT 3.0 software and upgrade services are split into: Standard Lifetime Service (RMB36,000), Preferential Lifetime Service ordered with car (RMB20,000), and Yearly Service (RMB12,000/year).

5. Emerging automakers hoard more R&D talents and constantly enlarge their software talent base.

In 2020, NIO had a R&D workforce of 3,400, or 50% of its total employees; as of June 2020, Xiaopeng Motors has hired 3,676 persons in all, including 1,570 R&D workers, or 42.7% of the total; Leading Ideal’s Shanghai R&D Center plans to employ 2,000 engineers and add another 300 persons in its 300-person automated driving R&D team by the end of 2021, with half R&D budget to be spent on autonomous driving.

Comparably, conventional automakers have 10%-20% R&D employees, lack of software talents, especially the top-class software engineers who prefer emerging automakers with internet/IT genes. Yet they learn fast how emerging bellwethers make successes, and have begun to rid themselves of old systems in order to build themselves into innovative companies. For example, Geely and Baidu co-funded Jidu Auto; SAIC and Alibaba jointly founded IM Motors; Great Wall Motor set up HAOMO.AI, its autonomous driving subsidiary which introduces former Baidu worker Gu Weihao as CEO.

Mutual contest and learning between emerging and established automakers is a booster to make the Chinese automotive market the most innovative and dynamic one across the globe.

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...