Autonomous heavy truck research: front runners first going public

Our Autonomous Heavy Truck Industry Report, 2020-2021 carries out research into highway scenario-oriented autonomous heavy truck industry, including OEMs and autonomous driving solution providers inside and outside China.

Several autonomous heavy truck companies try to list their shares for financing.

The surging road freight volume and a widening gap in demand for truck drivers, promote the financing boom of self-driving heavy truck industry, and accelerate the R&D of related products and technology landing.

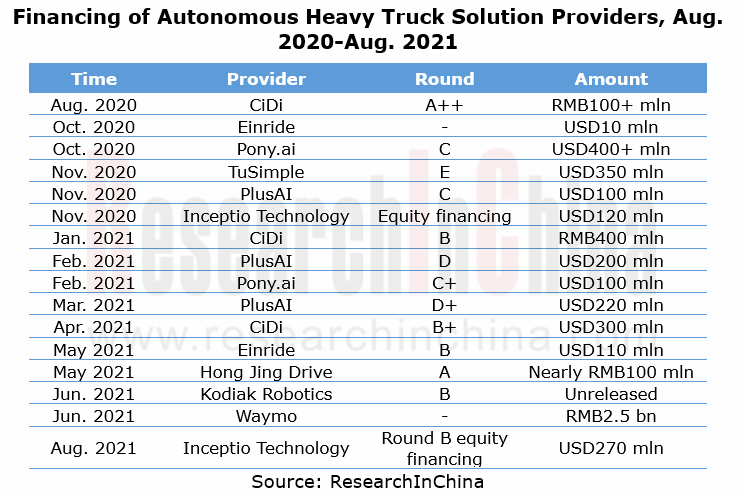

According to incomplete statistics, several autonomous heavy truck solution providers at home and abroad have closed a total of at least 16 funding rounds in the most recent year (August 2020 to August 2021). Examples include PlusAI and Inceptio Technology, two Chinese firms which have raised over USD800 million in all in their recent several funding rounds.

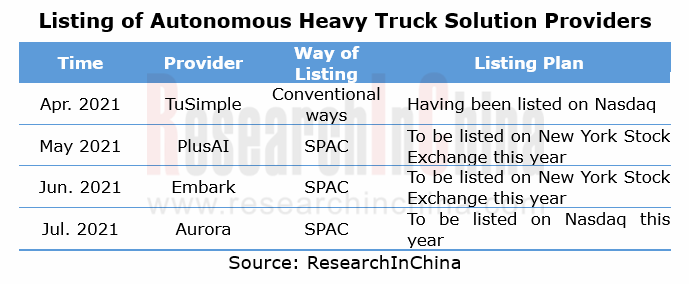

In the meanwhile, some solution providers which suffered sustained losses, and high input and low output, have started resorting to IPO for raising more funds. On April 15, 2021, TuSimple went public on Nasdaq, becoming the world’s first listed company in autonomous driving field. And then a few other autonomous heavy truck solution providers announced listing in the US as special purpose acquisition companies (SPAC).

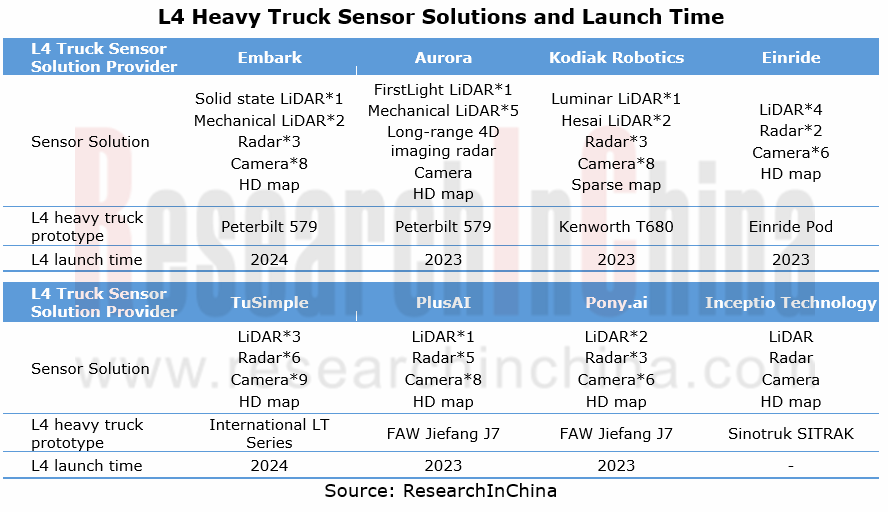

The LiDAR + camera + radar fusion solutions have become mainstream.

Most providers adopt the LiDAR + camera + radar fusion solutions combined with HD map and high-precision positioning, which enable their heavy trucks to drive themselves. Some solution providers like Embark use hybrid LiDAR solutions, that is, the combination of solid-state and mechanical LiDARs enables omnidirectional depth perception of the surroundings of a vehicle.

The time that mainstream solution providers inside and outside China are expected to launch the technology is relatively consistent. In the case of loose policies, autonomous heavy trucks will come into service on highways between 2023 and 2024.

Cooperation modes of autonomous heavy truck industry

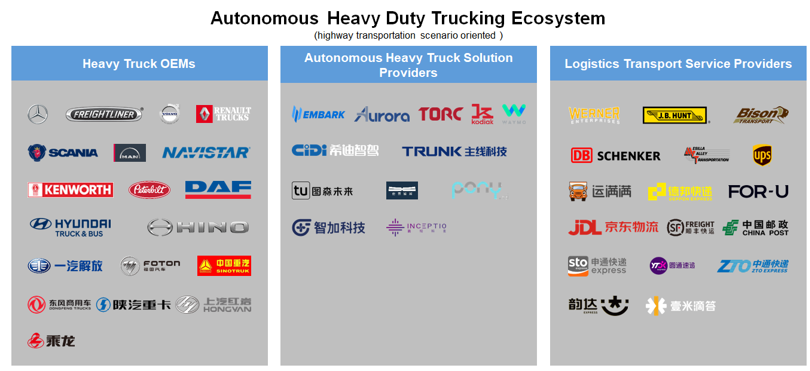

Quite a few heavy truck OEMs and logistics companies race to land on highway scenarios in addition to capital betting on autonomous heavy trucks.

The highway transportation scenario-oriented autonomous heavy truck ecosystem accommodates autonomous heavy truck solution providers, heavy truck manufacturers and logistics transport service providers, which work together to propel commercialization of autonomous heavy trucks. As concerns research and development, solution providers and heavy truck manufacturers jointly develop L4 autonomous heavy trucks based on OEM or AM vehicle models. With regard to commercial operation, solution providers partner with logistics transport service providers on commercial operation and actual freight transport test of autonomous heavy trucks.

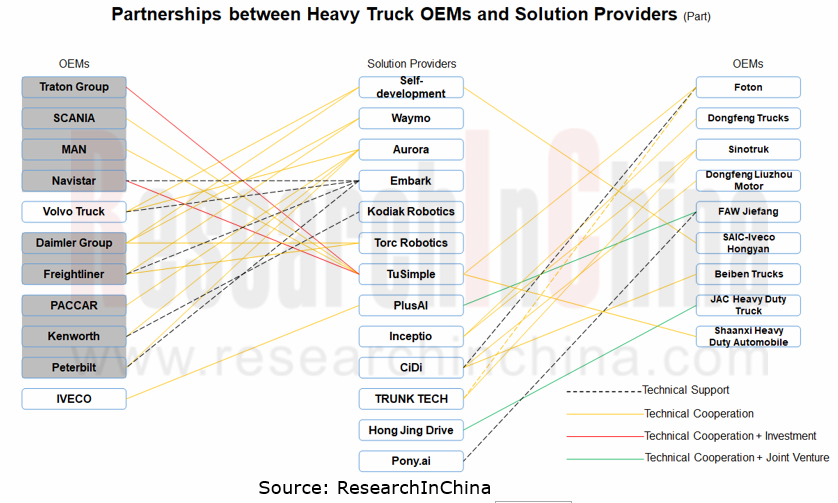

In terms of partnerships, autonomous heavy truck solution providers often team up with OEMs, co-developing L4 autonomous heavy trucks based on flagship models in OEM or AM market. Foreign autonomous heavy truck companies develop autonomous driving often under the leadership of their group companies, which means sub-brands of these group companies build technological cooperation with solution providers. For example, Traton under Volkswagen formed a global partnership with TuSimple to jointly develop L4 autonomous driving technology and apply to Volkswagen’s brands like SCANIA and MAN.

Development trends of autonomous heavy trucks

Trend 1: to achieve the goal of “emissions peak in 2030, carbon neutrality in 2060”, the power source of autonomous heavy trucks will shift from diesel to low or zero carbon energy like natural gas and hydrogen.

Trend 2: platooning technology is being reviewed. In January 2019, Daimler Trucks held a contrary opinion on platooning. After thousands of miles of testing, Daimler has come to the conclusion that truck platooning delivers low economic benefits and has natural defects such as needing a driver, so it will end development of the technology and turn to L4 autonomous heavy trucks. Also, what impacts the actual use of platooning will put on the normal traffic has yet to be verified in real road tests.

In the short run, there will be certain barriers to large-scale commercial use of autonomous heavy trucks in China’s business environment.

The development goal of L4 autonomous heavy trucks is to remove driver and let vehicles complete logistics transport and delivery without needing a human driver to monitor. The most direct customers are logistics companies which operate their own fleets, such as JD, SF Express, YTO Express, STO Express, ZTO Express and YunDa Express. Such companies have much expectation of autonomous heavy trucks lowering their total cost of ownership (TCO), which will make autonomous heavy trucks a big market.

In China, truck drivers are generally self-employed and only 17% of them have their vehicles employed by companies or owned by fleets; 83% drive their own vehicles, according to the Survey Report on Employment of Truck Drivers in 2021 released by China Federation of Logistics & Purchasing (CFLP). The blossom of autonomous heavy trucks in China is still a long way off.

Automotive Head-up Display (HUD) Industry Report, 2022

Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way. 1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

S...

Intelligent Vehicle E/E Architecture Research Report, 2022

E/E architecture research: 14 key technologies, and innovative layout of 24 OEMsKey technologies of next-generation electronic and electrical architectures (EEA)

The definition of next-generation E/E...

China Automotive Lighting Market Research Report, 2022

Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automake...

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...

China Automotive LiDAR Industry Research Report, 2022

LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

...

China Autonomous Driving Data Closed Loop Research Report, 2022

1. The development of autonomous driving is gradually driven by data rather than technology

Today, autonomous driving sensor solutions and computing platforms have become increasingly homogeneous, an...

Overseas LiDAR Industry Research Report, 2022

LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OE...

Smart Car OTA Industry Research Report, 2022

Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According ...

Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Drivi...

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...

China Smart-Road Roadside Perception Industry Report, 2022

Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financ...

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...