Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way.

1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

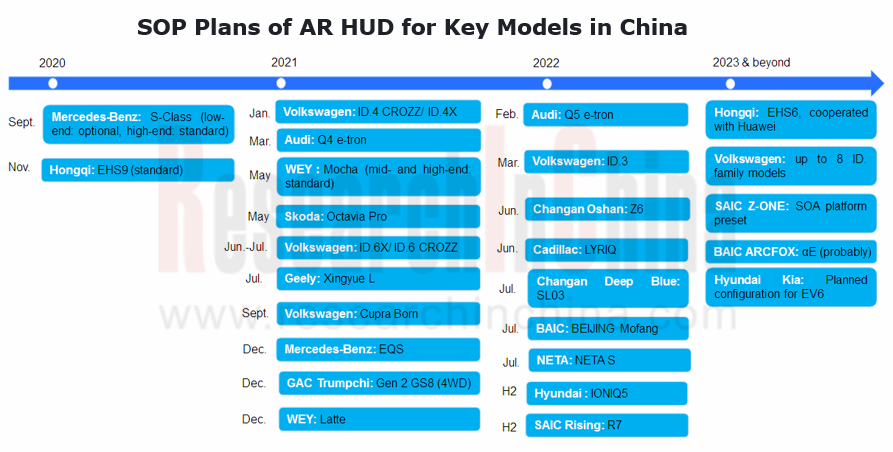

Since 2021, AR HUD has been installed in multiple new vehicle models, including Mercedes-Benz S-Class, Hongqi E-HS9, Great Wall Mocha, Geely Xingyue L, Volkswagen ID Series, GAC Trumpchi GS8, BAIC Mofang and Rising R7.

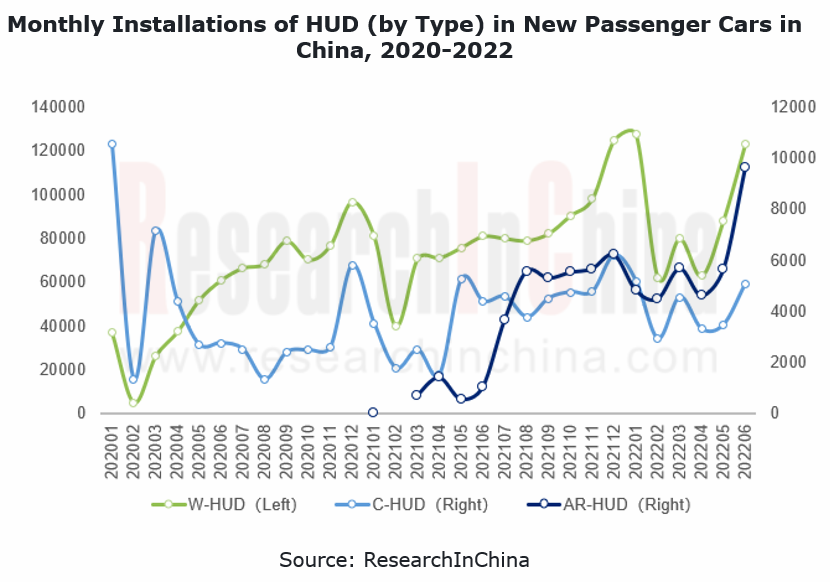

According to ResearchInChina, in the first half of 2021, 603,000 new passenger cars in China were equipped with HUD (C/W/AR), a like-on-like upsurge of 36.2%, of which 35,000 units packed AR-HUD, sharing 5.8% of the total, up 5.0 percentage points from the prior-year period.

From the monthly trend, it can be seen that the installations of AR HUD have been rising since mass production in early 2021, and began to surge in April 2022 after first outnumbering C-HUD in August 2021.

2. PGU becomes the key technology for realizing mass production of AR HUD.

At present, although many an OEM has launched AR HUD-enabled models, almost all of them are testing water on small scale. As for wide adoption, such problems as image distortion, sunlight inversion, high cost, and large size have yet to be solved. As a core component of AR HUD, PGU has become the key solution to the above problems.

There are four PGU technologies: TFT-LCD, DLP, LCOS, and laser scanning projection (LSP). Wherein, TFT-LCD and DLP are the mainstream solutions used in the current AR HUD-enabled production vehicle models in China. Volkswagen ID Series, Hongqi E-HS9 and WEY Mocha among others all bear TFT-LCD solutions. The DLP technology monopolized by TI delivers good imaging effects but its cost is high. The applied models include Mercedes-Benz S-Class and the 2nd-generation GAC Trumpchi GS8.

LCOS offering high resolution has made its way into the market in recent years. Typical vendors include Envisics, Huawei, ASU Tech, and Hardstone. SAIC Rising R7 released in May 2022 carries the LCOS-based AR HUD created by Huawei. The HUD features field of view of 13°*5°, luminance of 12000nits, and resolution of up to 1920×730.

MEMS laser scanning projection (LSP) is also a R&D direction for some companies like Panasonic, Pioneer and Shenzhen Dianshi Innovation Technology. In 2022, the dual-vision laser holographic AR HUD jointly developed by Panasonic and Envisics is to be first mounted on Cadillac LYRIQ. With two projection display areas, far and near, the system can display real-scene markers at the destination, real-scene navigation, forward collision warning, and lane change command.

3. Local suppliers like Foryou lead in mass production of AR HUD.

OEMs’ increasing demand for AR HUD expedites technology iteration and product commercialization by suppliers. Thereof, China’s local suppliers like Foryou Multimedia have secured multiple mass production orders.

Foryou Multimedia is a HUD leader in China. As of June 2022, the company has shipped a total of more than 560,000 units, with customers including Great Wall Motor, Changan Automobile, GAC, BAIC, Chery and Vietnam’s VINFAST. In late June 2022, it signed a letter of intent with Huawei on in-depth strategic cooperation on intelligent vehicle accessories, especially AR HUD.

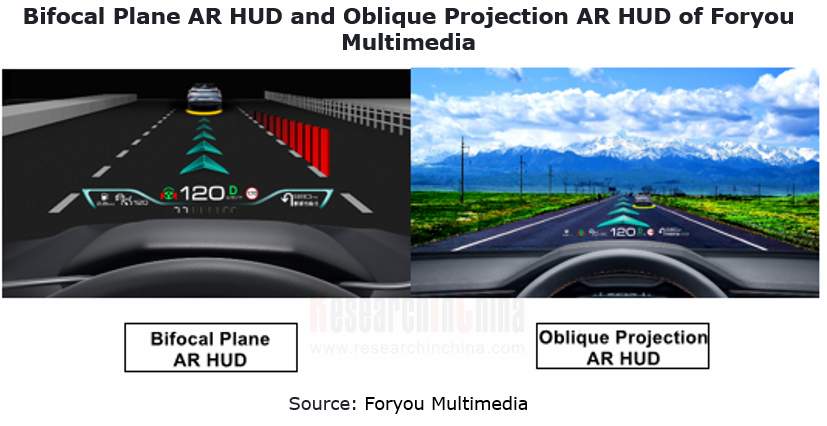

Foryou Multimedia also steps up its pace of new product iteration, having launched bifocal plane AR HUD and oblique projection AR HUD. Currently the bifocal plane AR HUD has been designated by Great Wall Motor, and the oblique projection AR HUD has been a substantive cooperative project of many automakers.

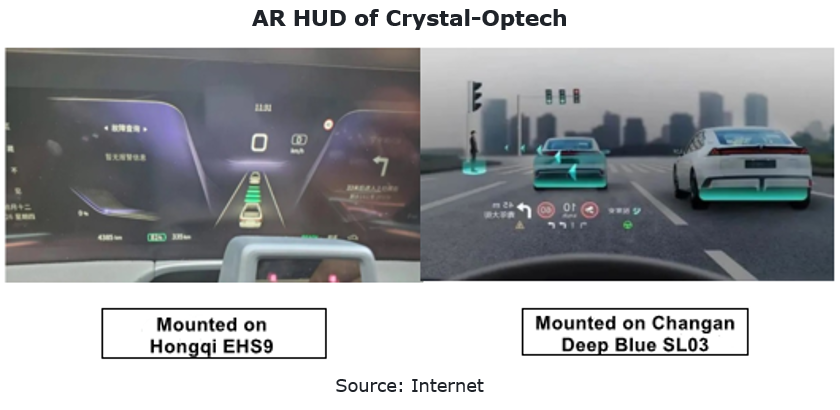

Zhejiang Crystal-Optech has partnered with quite a few OEMs to develop HUDs, and tries hard to mass-produce and market these products. Its AR HUD was produced in tiny quantities for Hongqi E-HS9 in March 2021, and was applied to Changan Deep Blue SL03 in July 2022. In the second half of 2022, Crystal-Optech is to provide HUDs including WHUD and AR HUD, for some models of Hongqi, Changan Automobile, BYD and Great Wall Motor.

4. AR HUD will be integrated with multiple vehicle systems.

AR HUD has become a new window for human-vehicle interaction, which is accompanied by the evolution of intelligent driving to L2+. It will be integrated with multiple systems from dashboard, navigation and ADAS to DMS, infotainment and V2X.

In January 2021, Qualcomm announced its 4th-generation Snapdragon Automotive Cockpit Platform, a digital cockpit solution that supports multi-ECU and multi-domain fusion, covering dashboard and cockpit, AR-HUD, infotainment, rear seat display, electronic rearview mirror and in-vehicle monitoring. The system will be first available to cars of JIDU Auto and is projected to be mass-produced and delivered in 2023.

At the CES 2022, Harman demonstrated its AR HUD technology, which combines AR vision with the voice assistant that helps to recommend nearby points of interest. This technology can intelligently activate the autonomous driving mode, or allow the driver as an AR avatar to have a meeting with colleagues. In February 2022, HARMAN acquired Apostera, aiming to use Apostera’s augmented reality (AR) and mixed reality (MR) software solutions to cement its position as a leader in the automotive AR/MR field. Before that, Apostera had provided technical support of AR HUD for Audi Q4 e-tron.

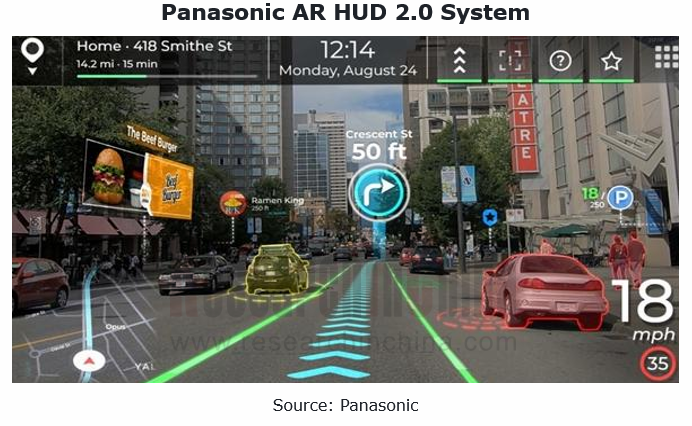

At the CES 2022, Panasonic unveiled its AR HUD 2.0 system. Powered by Panasonic’s SkipGen2, its eCockpit infotainment controller, AR HUD 2.0 adds the eye tracking system (ETS), a patented technology that enables automatic driver height adjustment, dynamic parallax compensation, dynamic auto focus and driver monitoring capability. “The Panasonic AR HUD 2.0 continues the trend of up-integration of display domains, such as Cluster and HUD, into the central infotainment compute module,” said Andrew Poliak, CTO, Panasonic Automotive Systems Company of America.

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...

China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure This report highlights the passenger car L2+ and above (including L2+, ...

Automotive Cockpit Domain Controller Research Report, 2023

Research on cockpit domain controllers: various forms of products are mass-produced and mounted on vehicles, and product iteration speeds up.

Both quality and quantity have been improved, and the it...

Chinese Passenger Car OEMs’ Overseas Layout Research Report, 2023

OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

During 2021-2022, the global economy ...

Global and Chinese Automakers’ Modular Platform and Technology Planning Research Report, 2023

Research on modular platforms: explore intelligent evolution strategy of automakers after modular platforms become widespread.

By analyzing the planning of international automakers, Chinese conventi...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

The automo...

NXP’s Intelligence Business Analysis Report, 2022-2023

In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replace...

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR5...

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...

China Autonomous Driving Domain Controller Research Report, 2023

Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry i...

China In-Vehicle Payment Market Research Report, 2023

China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout ...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes. 01 Build up their own software and hardware capabilities...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2023 (Foreign Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...