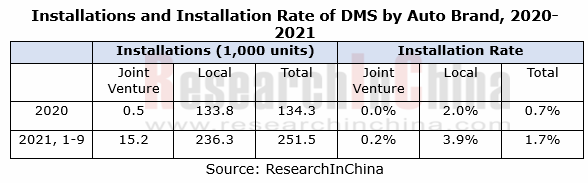

Automotive DMS research: the installations of DMS soared by 244% on a like-on-like basis in the first nine months of 2021.

Our data show that in the first nine months of 2021, China sold 251,511 sets of DMS for new passenger cars, 244% more than in the same period of the previous year, of which 15,201 sets, or 6% of the total were for joint venture brand cars, and 236,310 sets, or 94% of the total were for local brand cars. Top-ranked brands were Changan, Xpeng, Haval, BMW, NIO, WEY, Leapmotor, GAC Aion, ORA and JETOUR.

The main reason for the boom of DMS in China in 2021 is that local brands installed DMS in more of their models. 96,700 units of new models launched in 2021 are equipped with DMS, making up 38% of the total installations. Wherein, the key contributors include Changan UNI-T, Haval First Love (100%), Changan UNI-K (100%), Xpeng P7 (17%), Aion Y (100%), WEY Mocha (100%), Neta U (91%) , Leapmotor T03 (49%), Haval Chitu (100%), and JETOUR X70 (40%).

In the future, DMS will sustain growth, and policies will be the key driver. For example, the Guidelines for Administration of Entry of Intelligent Connected Vehicle Manufacturers and Their Products (Trial) (Draft for Comments) released by Ministry of Industry and Information Technology in April 2021 requires that companies should have monitoring capabilities of human-computer interaction and driver participative behaviors, boosting DMS growth; also, OEMs should equip more of their models with DMS with declining prices.

OEMs not only install more DMSs but refine and expand DMS capabilities. As well as driver drowsiness detection and face recognition, their all new DMSs tend to enable more related functions such as gesture interaction, action recognition, expression recognition, and eyesight screen brightening.

For example, the DMS for Haval Chitu enables fatigue/distraction monitoring, face recognition (face login to IVI account, automatic personalized adjustment of seat, theme interface, etc.), and expression recognition (recognizing expressions, e.g., happy, angry and surprised, and pushing corresponding music, air-conditioning and other features). The supplier is ArcSoft.

The DMS for SAIC Feifan MARVEL R enables fatigue/distraction monitoring, face recognition, gesture interaction (waving a hand to open and close sunroof before and after the recognition, etc.), and video conferencing (DingTalk).

Local OEMs not only favor DMS but start deploying OMS. Models including HiPhi X, Voyah FREE, GAC Aion Y, Trumpchi GS4 PLUS, Trumpchi EMPOW, ORA Good Cat, Haval Chitu, Haval First Love, WEY Mocha/VV6/VV7, JETOUR X70 PLUS, and Changan UNI-T/UNI-K have packed both DMS and OMS.

For suppliers, it can be seen that DMS solutions are rapidly fusing with other cockpit functions, or integrating with hardware.

Fusion with HUD among others. For instance, in September 2021, Melexis and emotion3D joined forces to offer a 3D Time-of-Flight (ToF) demonstrator, a solution that combines the driver monitoring system (DMS) with high-precision 3D driver localization, to dynamically align augmented reality head-up displays (AR HUD) objects.

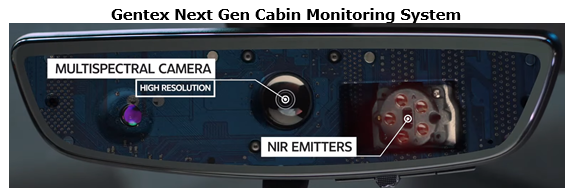

Products that integrate cluster display and interior rearview mirror come into being as well. Examples include an integrated solution for interior sensor technology unveiled by Continental in October 2021, integrating the camera directly into the cluster display for the first time ever; and the next-gen cabin monitoring system launched by Gentex in January 2021, integrated into the interior rearview mirror and combining DMS and OMS.

Extension to or fusion with in-cabin perceptions like IMS. For example, the AutoSense solution XPERI DTS introduced in late 2020, integrates DMS and OMS; the I-CS (In-Cabin Sensing) solution launched by MINIEYE in September 2021 allows accurate detection of occupants including their facial features, line of sight, gestures and joints.

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...