Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the security chip + HSM strategy to build their cybersecurity protection system.

At the core of cybersecurity hardware are security chip and hardware security module (HSM).

Security chip, or secure element (SE), is an integrated circuit that integrates cryptographic algorithms and features physical attack prevention design.

Hardware security module (HSM) is a computer device used to protect and manage the keys and sensitive data applied by the strong authentication system, and also provide related cryptographic operations. It is the basic support for automotive security solutions.

At present, most OEMs employ the security chip + HSM strategy to build an automotive cybersecurity protection system.

For example, in its automotive cybersecurity security system, NIO uses security chips and HSM to reinforce hardware and networks; in terms of secure communication, the HSM and certificate system featuring integrity, encryption, pseudonymization and anonymity is the basis for enabling data privacy protection. In addition, bug fixes over the air (OTA) are available in the case of emergency.

GAC completes the hardware security design and creates the four systems of border protection, automotive security, PKI certification & transmission, and security services, using security chip (SE) + HSM, and secure boot, trusted zone and encryption technologies. And at the vehicle end, GAC conducts in-depth research on vehicle inside and outside multi-node security protections, such as Linux OS for T BOX 4G module, Android OS for vehicle head unit, QNX OS for gateway and MCU, and communication interaction, aiming to establish an in-depth protection system for in-vehicle security.

2. Homemade SE chips are mass-produced and applied in vehicles.

As the US passed CHIPS Act, the localization of semiconductors in China assumes greater urgency. More chip equipment, materials and industrial software among others will be homemade. The cybersecurity hardware market is no exception. The need for local security chips that conform to the national encryption algorithms is a pressing problem.

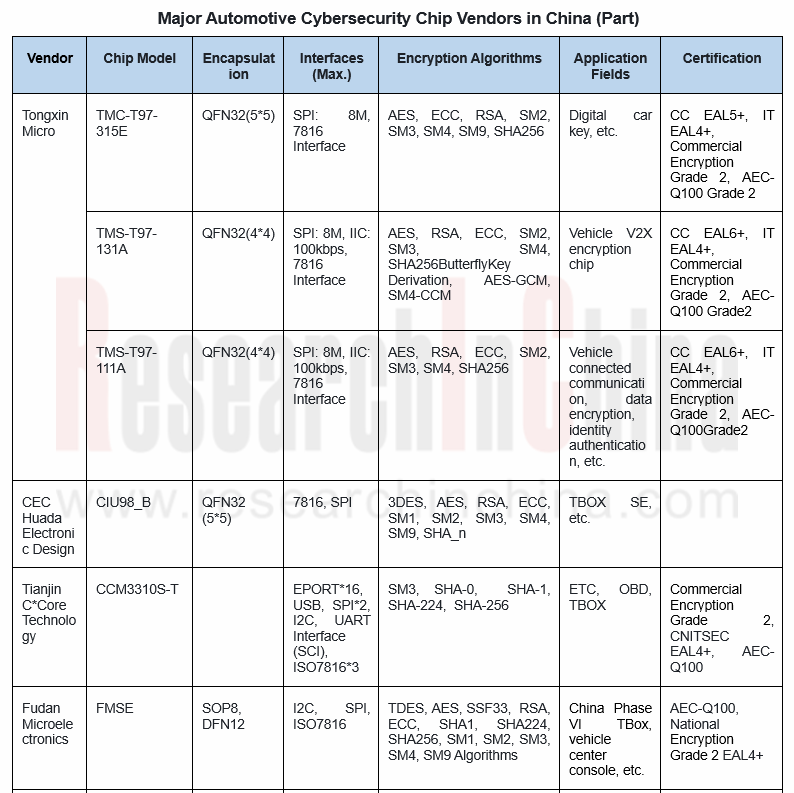

In current stage, Tongxin Micro’s automotive-grade security chips are often used in the Internet of Vehicles, and are being tried out in small batches by Chinese manufacturers. They are expected to be mass-produced during 2023-2024. In the future, Tongxin Micro’s SE chips will head in the direction of vehicle controllers that meet higher vehicle driving safety and product performance requirements. Following the completion of development and testing of samples of key products in this series in 2022, the research and development is expected to be fulfilled around 2025.

Despite a large number of companies, their mass production capacity is limited. Only a few players like Tongxin Micro and CEC Huada Electronic Design have products largely mounted on vehicles in the OEM market. Nations Technologies has mass-produced products for the aftermarket covering T-BOX, driving recorder, vehicle diagnosis, in-vehicle infotainment and navigation, vehicle ambient lighting, and 360-degree panoramic view.

Tongxin Micro was established by the national second-generation resident ID card chip R&D team at the Institute of Microelectronics of Tsinghua University. Its T9 Series security chips that were introduced into homegrown vehicle models in 2021 have been spawned and used in T-BOX, V2X, eUICC, China Phase VI OBD, and digital car keys, building a four-in-one trustworthy application environment for connected vehicles, that integrates cybersecurity, payment security, communication security, and identity authentication security.

Currently Tongxin Micro’s automotive-grade security chips are largely seen in the Internet of Vehicles, often not involving vehicle driving safety, with a relatively short assessment and certification cycle. Chinese manufacturers have the chips on trial in small batches, which are projected to be produced in quantities during 2023-2024. In the future, Tongxin Micro’s SE chips will head in the direction of vehicle controllers, involving high vehicle driving safety and product performance requirements, with a relatively long certification period. The key products in this series, with samples developed in 2022, are being tested, and the research and development is expected to be completed around 2025.

CEC Huada Electronic Design is a group company formed by CEC integrating its integrated circuit companies. In 2019, CEC Huada Electronic Design made a foray into telematics security chips. Its telematics solutions based on its high security SEs are led by:

The in-vehicle security involves the security protection of vehicle bus, ECU, OBD, TBOX and IVI system. The SEs deployed on key nodes guarantee the link security of the in-vehicle network and TSP platform.

The in-vehicle security involves the security protection of vehicle bus, ECU, OBD, TBOX and IVI system. The SEs deployed on key nodes guarantee the link security of the in-vehicle network and TSP platform.

For V2X security, devices such as on-board unit (OBU) and roadside unit (RSU) use the integrated SEs to store the unique network access identifier, registration certificate and application certificate; the verification of communication message signatures is a solution to such problems as protocol cracking, illegal authentication and privacy leakage in the direct connection environment.

For V2X security, devices such as on-board unit (OBU) and roadside unit (RSU) use the integrated SEs to store the unique network access identifier, registration certificate and application certificate; the verification of communication message signatures is a solution to such problems as protocol cracking, illegal authentication and privacy leakage in the direct connection environment.

CEC Huada Electronic Design’s series of automotive-grade security chip products have been spawned and launched on market, with more than 8 million units having been pre-installed and deployed in commercial vehicles and passenger cars.

3. Most HSM players are foreign companies, and the SecIC-HSM based on national encryption algorithms will become an application direction.

HSM providers are mainly foreign companies including Thales, Entrust Datacard, Utimaco, ATOS SE, Exceet Secure Solutions GmbH, Securosys, Ultra Electronics, Synopsys, Futurex, Marvell Technology Group, and Yubico. Typical application solutions are also from these foreign players, for example, the HSM framework in Infineon's AURIX chip and Vector's HSM firmware solution.

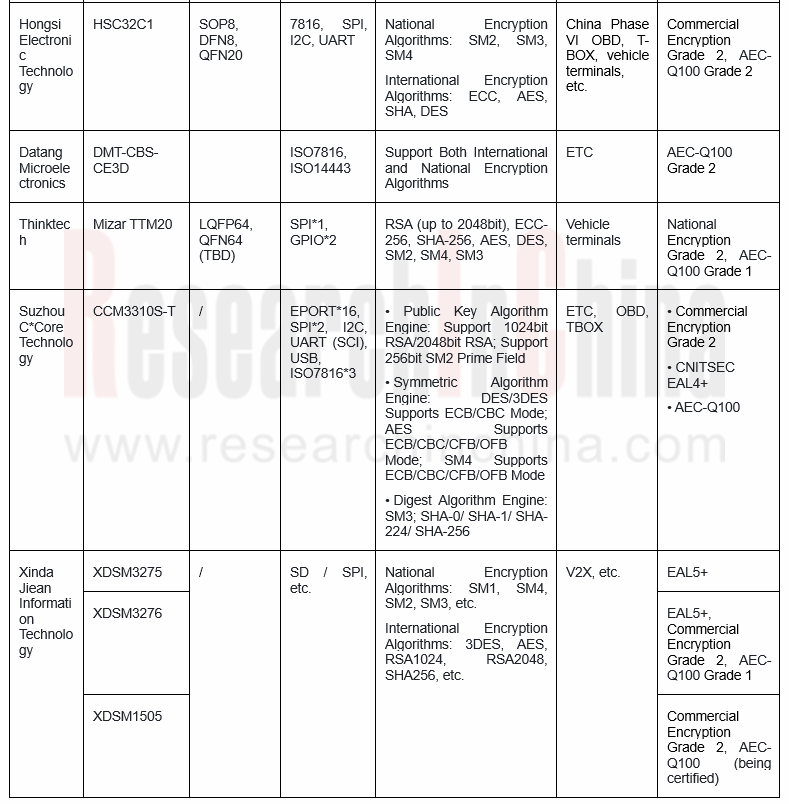

In the context of the hindered global semiconductor industry chain, the demand for homemade HSM and solutions in China is bound to rise. Westone and Sansec are among the few HSM providers in China. The SecIC-HSM Series security modules created by Shanghai Uni-Sentry adopt the HSM security stack that uses national encryption algorithms, support mainstream chips used in production vehicle models, and are compatible with chips of NXP and ST and domestic mainstream domain controllers, meeting the technical requirements of vehicle controller security.

4. The providers of software and hardware integrated solutions walk at a faster pace in application to vehicles.

In terms of mass production, providers of software and hardware integrated solutions go ahead of simple SE chip vendors.

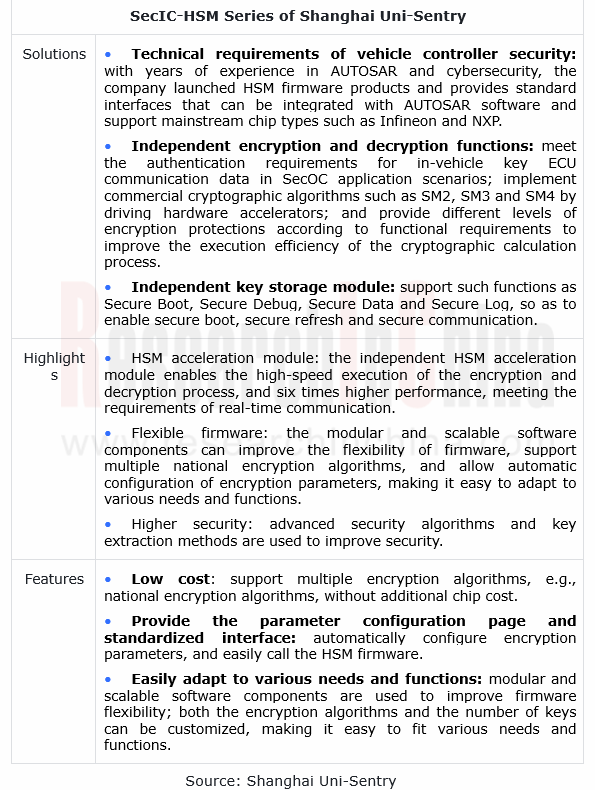

Since 2015, Zhengzhou Xinda Jiean Information Technology Co., Ltd. has signed agreements with BYD, AIWAYS, BAIC, Ingeek and Suzhou Zhito Technology among others, providing customized cybersecurity solutions as they require.

In addition, Xinda Jiean provides V2X security chips that comply with national encryption standards and supporting security services for its partners Huawei and Lear, in a bid to support Audi’s next-generation V2X intelligent connected vehicle project.

China Automotive Cybersecurity Hardware Research Report, 2022 combs through China’s automotive cybersecurity hardware system and highlights the following:

Automotive cybersecurity system architecture and the range of key hardware products, with vehicle systems as the main object;

Automotive cybersecurity system architecture and the range of key hardware products, with vehicle systems as the main object;

Cybersecurity policies, regulations and standard systems (the main content and certification process of ISO21434 and R155, and the process and planning of Chinese standards and regulations);

Cybersecurity policies, regulations and standard systems (the main content and certification process of ISO21434 and R155, and the process and planning of Chinese standards and regulations);

Automotive SE security chips (features, application scenarios, and major Chinese and foreign vendors);

Automotive SE security chips (features, application scenarios, and major Chinese and foreign vendors);

Features and application solutions of automotive hardware security module (HSM);

Features and application solutions of automotive hardware security module (HSM);

OEMs’ construction of cybersecurity systems and application of hardware modules.

OEMs’ construction of cybersecurity systems and application of hardware modules.

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...

Automotive Power Supply (OBC+DC/DC+PDU) and Integrated Circuits (IC) Industry Report, 2023

Automotive power supply and IC: Chinese chips are promising in the evolution from physical integration to system integration

As the core component of a new energy vehicle, automotive power supply is ...

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...