Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positioned as a "third mobile space" centering on human-vehicle interaction experience. As an important part of the "third mobile space", seating is also evolving in an intelligent direction. This report summarizes the main development trends of the automotive seating industry by combining the planning and layout of the world's major automotive seat suppliers and the seat configurations of marketed vehicle models and concept cars of OEMs in recent years.

1. Seating becomes more comfortable and intelligent.

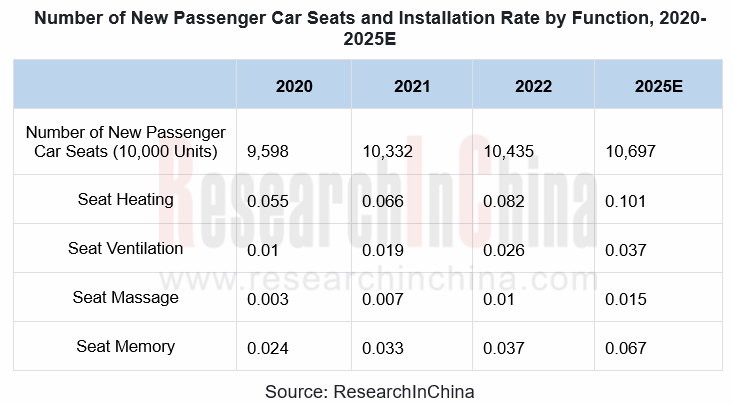

From January to August 2022, China demanded 63.09 million units of new automotive seats, of which fabric, leather and artificial leather ones shared 21.7%, 18.8% and 47.8%, respectively. In terms of seat functions, seat heating boasted an installation rate of 7.9%, and 52.2% of vehicle models priced at RMB100,000-250,000 installed this function; the installation rate of seat ventilation stood at 2.7%, and 55.3% of vehicle models priced at RMB100,000-250,000 carried this function, of which the RMB100,000-200,000 models showed a rising installation; the installation rate of seat massage reached 1.1%, and the percentage of RMB200,000-350,000 vehicle models packing this function reached 49.0%, a surging rate mainly driven by Volkswagen ID Series, AITO, TANK 300 and Li Auto ONE.

2. Carbon fiber composites become the first choice for lightweight seats.

Carbon fiber composite is a structural material compounded by carbon fiber and metal, ceramics, resin, etc. This lightweight, high strength material with a quarter of steel density and tensile strength higher than 3500Mpa, is a very suitable alternative to metal materials to make seat frames.

For example, in April 2021, Nobo Automotive Systems displayed a carbon fiber frame seat at the Shanghai International Automobile Industry Exhibition. The back frame of this seat is integrally formed with carbon fiber composites, and uses a small number of parts, reducing the weight by a staggering 35%. The high-end carbon fiber seat introduced by Zhejiang Tiancheng Controls in November 2021 adopts one-piece molding, thermosetting and injection molding processes, with weight about 30% lighter than conventional steel ones.

As well as use of new materials, suppliers also reduce seat weight through structural optimization and manufacturing processes.

For example, the UltraThin seat launched by Adient in August 2022 adopts the seat construction of thermoplastic elastomer (TPE) panels, reducing overall seat trim outline volume by 30%, overall seat part count by 10%, and overall mass by 14%.

3. Recyclable and renewable materials help to achieve the goal of carbon neutrality.

In response to energy conservation and emission reduction, suppliers put more focus on "green" and renewable eco-friendly materials in seat design and development.

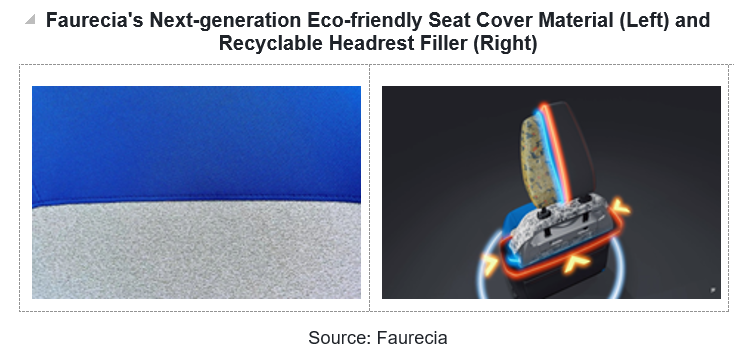

For example, in August 2022, Faurecia launched a new eco-friendly seat. The seat cover material is a recyclable material with a recycling rate of 85%, reducing 52% carbon emissions compared with conventional cover materials; the seat headrest filler uses foam material, a lightweight recyclable material based on the concept of blended fibers, with a recycling rate of up to 70%, slashing 56% carbon emissions. In February 2022, Hyundai Transys unveiled its future green mobility concept seat, a new seat concept co-created with Italian and Korean manufacturers using leather waste. The seat part uses recycled tanned leather; the seat backrest uses woven leather; the seat headrest is structured using recycled aluminum powder.

4. Intelligent technology redefines automotive seating comfort.

Intelligent adjustment seats can be adjusted via mobile phone, voice or intention perception. For example, the SU seat launched by Yanfeng in 2022 has a pneumatic backrest that can sense the pressure distribution and adjust adaptively according to changes in the passenger's body size and sitting posture; the four-way pressure-sensitive headrest can automatically recognize the occupant's head position to intelligently adjust the height.

Xpeng G9 marketed in September 2022 packs an ultra-low frequency rhythm seat provided by Adient. The seat can vibrate with the beat of music, and move with the plot of the film source. Using artificial intelligence and other technologies, Hyundai Transys provides comfortable ride experience that matches body sizes of occupants, for example, the seat can make active adjustments according to body size, posture and habits of occupants.

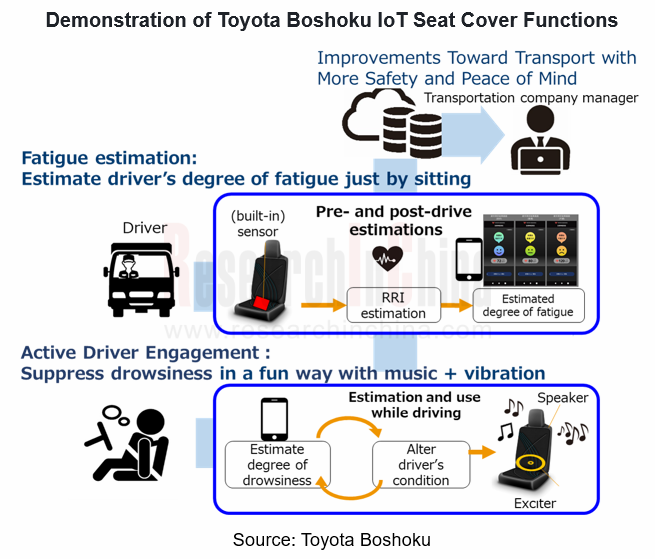

The intelligent health sensor automatically senses health indicators such as heartbeat and breathing rate via the non-contact sensor installed inside the seat, and then automatically provides intelligent adjustments such as massage, music play and ambient light control, according to physical state. For example, in March 2022, Toyota Boshoku announced an IoT seat cover equipped with two systems: the fatigue estimation system that uses a built-in sensor to measure the driver's heart beat and thereby estimate their state of fatigue; the active driver engagement system that vibrates the seat cover and plays music accordingly to suppress drowsiness.

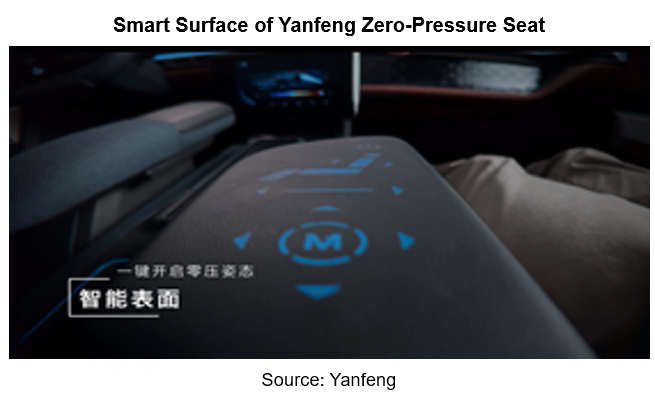

Smart surfaces not only allow touch control on seats instead of conventional buttons, but display information. For example, the zero-pressure seat, integrated luxury seat and SU seat unveiled by Yanfeng in 2022 all pack smart touch control armrests that enable such functions as seat position adjustment, seat ventilation, heating, massage and leg drag, as well as one-button activation of zero-pressure posture.

5. The "changeable cockpit" in the autonomous driving environment.

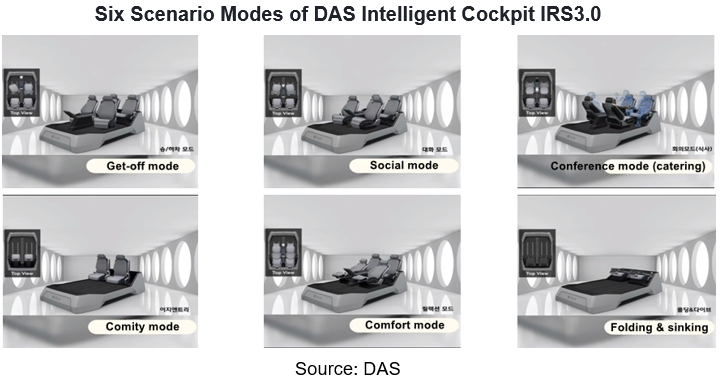

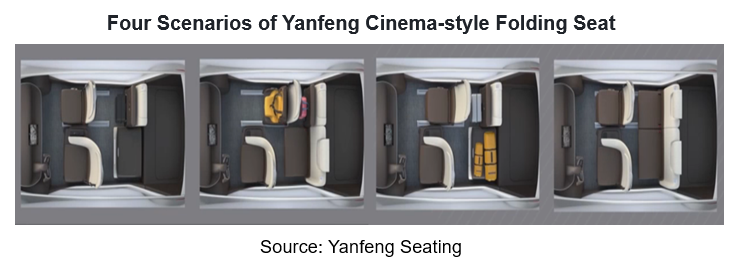

In the future, vehicle cockpits will not only be used for riding, but enables switching between different scenarios by flexibly adjusting seats, so as to meet people's needs.

For example, in the new intelligent cockpit IRS3.0 launched by South Korea's DAS Corporation in 2021, the seats carry ultra-long slides and allow 360° omnidirectional rotation, realizing six scenarios including social contact mode, conference mode and comfort mode. The cinema-style folding seat released by Yanfeng Seating in 2022 can be folded and slid to enable scenarios like commuting mode, family mode, travel mode and joy mode.

Automotive Infrared Night Vision System Research Report, 2023

According to the data from ResearchInChina, during 2022-2023, the installations of NVS (night vision system) in new passenger cars in China went up at first and then down. From January to July 2022, t...

New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

To follow the development trend for electrified and lightweight vehicles, new energy vehic...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2023

From the layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, which are mainly charged i...

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...

Automotive Power Supply (OBC+DC/DC+PDU) and Integrated Circuits (IC) Industry Report, 2023

Automotive power supply and IC: Chinese chips are promising in the evolution from physical integration to system integration

As the core component of a new energy vehicle, automotive power supply is ...

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...