HD maps have been applied on a large scale, spreading from freeways to cities

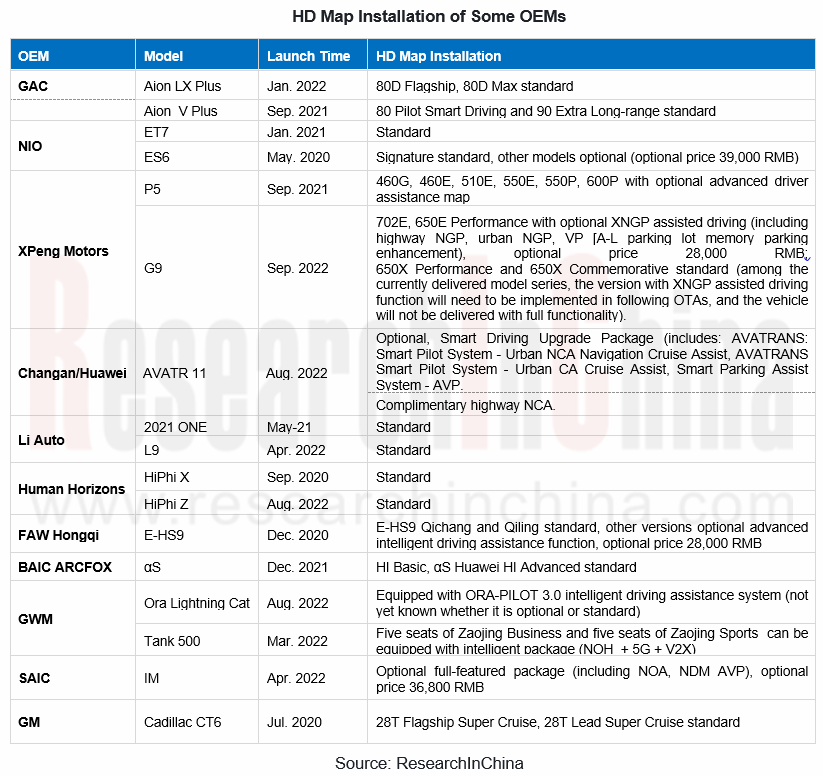

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first half of 2022. OEMs will constantly speed up the installation of HD maps. HD maps were mainly regarded as an option in the past, but now they have been gradually included in the standard configuration of vehicles, such as Li L9, NIO ET7, HiPhi, etc.

From the perspective of the layout of OEMs, advanced driver assistance in urban scenarios has become a new hot spot in intelligent field. At present, there are three technical routes for advanced driver assistance in cities:

(1) Pure vision: Companies represented by Tesla mainly rely on cameras, super powerful algorithms, etc. to realize assisted driving in cities. It is reported that Tesla may introduce FSD Beta to Chinese market.

(2) Perception + map: The solution does not depend heavily on pre-made HD maps. It builds real-time HD maps through vision systems in places where there are no HD maps. For example, the LiDAR version of WEY Mocha released by Great Wall in August 2022 adopts Haomo.AI's urban NOH technology with a weak HD map, which require fewer lane-level attributes than regular HD maps.

(3) Multi-sensor fusion + HD map: Companies represented by NIO, Li Auto and Xpeng enhance the intelligent driving experience by making use of HD maps and LiDAR to make up the insufficient computing power.

Xpeng expects to gradually introduce urban NGP functions to users in Guangzhou, Shenzhen, Beijing, Shanghai, Hangzhou and other cities since 2022.

After the launch of urban NGP by Xpeng, the point-to-point autonomous driving has been realized to some extent (except that drivers cannot take their hands off the steering wheel), covering more than 90% of daily driving scenarios including parking lots, cities and freeways.

NIO plans to make urban assisted driving possible on models such as ET7 and ET5 equipped with NAD system in 2022. When the driver sets a destination on the navigator, the IVI map shows the start and end sections of NOP. When the vehicle enters the sections, the driver can turn on or off the NOP function through the "Pilot Assist" in the lower left corner of the navigator.

Li L9 equipped with intelligent driving system “Li AD Max” can see navigation and assisted driving in all scenarios.

With the computing power as high as 400TOPS, Avatr 11 equipped with Huawei ADS can secure high-level intelligent driving functions at freeways, urban areas and parking.

BAIC ARCFOX αS HI Advance equipped with Huawei ADS can accomplish autonomous driving on freeways, high-level autonomous driving in urban areas, AVP and other functions.

In terms of mainstream solutions, OEMs except Tesla basically adopt the sensor + map solution, but they have different requirements for map accuracy. As per the development progress of HD maps, urban HD maps face long mileage, surveying and mapping restrictions and update challenges. Therefore, some OEMs consider using SD pro maps for urban assisted driving to avoid HD map elements as much as possible.

Map providers step up the layout of HD maps in urban scenarios

With a higher OEM installation rate of HD maps, the application in urban scenarios has become a new arena. Map players are aggressively deploying urban scenarios, mainly in the following ways:

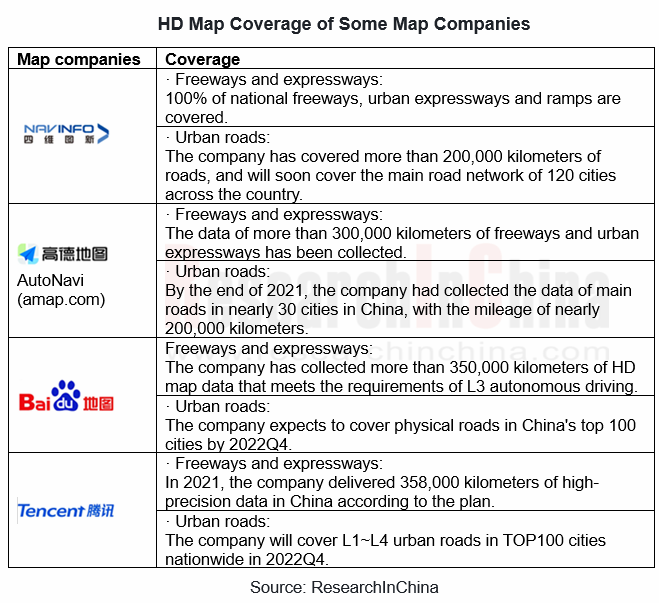

Faster collection of urban HD map data

The mileage of China's freeways is about 300,000 kilometers, and the mileage of urban roads is close to 10 million kilometers. Mainstream map players have basically completed the collection of HD maps for freeways and urban expressways. Therefore, the production passenger cars equipped with HD maps can realize advanced driver assistance in high-speed scenarios. In the future, map players will make breakthroughs in HD maps for cities to meet the demand of OEMs.

Integration of SD maps and HD maps

In high-speed scenarios, map companies can post-match SD maps with HD maps, with a high accuracy rate. However, in urban scenarios, SD maps and HD maps can't be associated in the later stage due to different production processes. Therefore, in order to facilitate advanced driver assistance in cities, map companies have begun to actively deploy the integrated production of SD maps and HD maps.

Baidu has developed SD-HD integrated AI map production platform, which integrates various data production structures and technological processes via a system. It satisfies the standardized and unified model expression of map data with different accuracy levels, thus solving the consistency problem.

For Here, different maps share the same map data, the same specification, and the same database. Here produces three modes of maps - SD, ADAS and HDML with the same standard, production environment and production process, so that they are interrelated by sharing and the same data and standard.

Strict supervision amid pilot application of HD maps

Six cities start HD map pilot application projects

In August, 2022, the General Office of the Ministry of Natural Resources of China issued the “Notice on HD Map Pilot Application Projects of Intelligent Connected Vehicles”. The pilot projects will stage in six cities including Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chongqing.

The Notice requires the provincial natural resources authorities in these pilot cities to work out pilot implementation plans, timetables and roadmaps in accordance with the deployment of the State Council and the national laws, regulations and policies on surveying, mapping, geographic information management and data security. Besides, they should rationally delineate the pilot scope according to the specific application scenarios of autonomous driving map data.

In August 2022, the Ministry of Transport of China issued "Opinions on HD map construction and other pilot projects of Beijing Baidu Netcom Science Technology Co., Ltd. for the purpose of building a transportation powerhouse". Baidu plans to provide centimeter-level HD map services on freeways and typical urban roads in three to five years, and make its integrated mobility service platform available in about 10 cities.

Strict supervision in HD map field

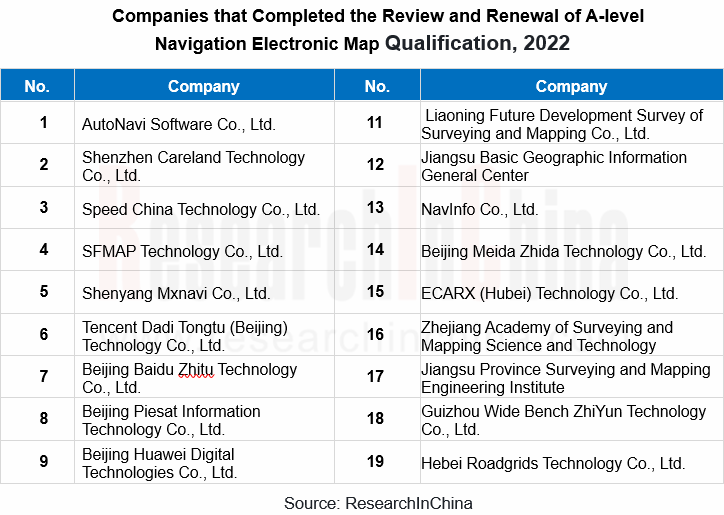

As China continues to strengthen the security management of geographic information, the Ministry of Natural Resources is intensifying the supervision over the HD map market while opening up pilot cities for application of intelligent connected vehicles.

Tightened supervision on surveying and mapping qualification:

by the end of 2021, a total of 31 companies were approved for a-level electronic navigation map qualification, which is valid for 5 years, many enterprises need to re-apply for A-level electronic navigation map qualification in 2022, and there are 19 companies of A-level mapping qualification for navigation electronic map production that completed the re-examination and renewal in 2022.

Subjects of surveying and mapping: In August 2022, the Ministry of Natural Resources clearly pointed out that the following activities should be subject to the "Surveying and Mapping Law of the People's Republic of China": The intelligent connected vehicles installed or integrated with sensors such as satellite navigation and positioning modules, inertial measurement units, cameras and LiDAR collect, store, transmit and process spatial coordinates, images, point clouds, attributes and the like of vehicles and surrounding road facilities during operation, service and road testing.

China's first road HD electronic navigation map quality standard was officially established.

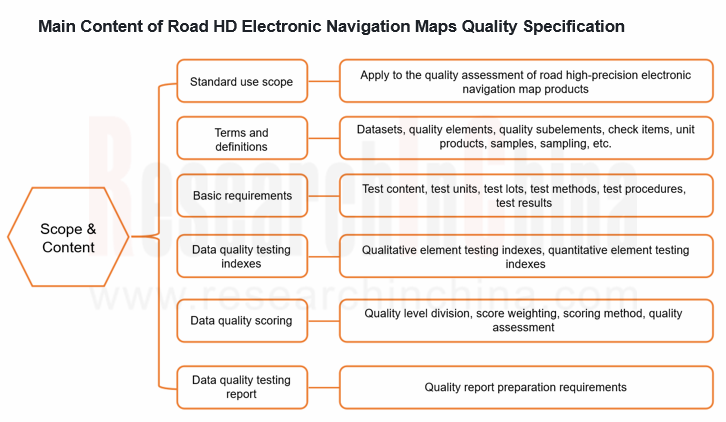

In September 2022, the Road HD Electronic Navigation Maps Quality Specification, recommended by Department of Land and Mapping of the Ministry of Natural Resources and led by Baidu, was officially approved by National Geographic Information Standardization Technical Committee, which is also the first industry standard for road HD electronic navigation map quality specification approved in China. It will solve “What to inspect, how to inspect, how to analyze and evaluate the inspection results, and how to compile the quality report”, which are concerned by map and car companies.

Global and China HD Industry Report, 2022 highlights the following:

Policies, regulations, standards and compliance about HD maps;

Policies, regulations, standards and compliance about HD maps;

HD map market size, market structure, business models, etc.

HD map market size, market structure, business models, etc.

HD map production technology, update technology, data distribution and fusion technology; the fusion application of HD maps and V2X; the application of HD maps in lane-level positioning, etc.

HD map production technology, update technology, data distribution and fusion technology; the fusion application of HD maps and V2X; the application of HD maps in lane-level positioning, etc.

Main application scenarios of HD maps, such as autonomous passenger cars, automated parking of passenger cars, passenger and cargo transportation by autonomous driving, etc.;

Main application scenarios of HD maps, such as autonomous passenger cars, automated parking of passenger cars, passenger and cargo transportation by autonomous driving, etc.;

HD map production and update technology, main products and application scenarios of major map companies at home and abroad;

HD map production and update technology, main products and application scenarios of major map companies at home and abroad;

HD map business layout and main technologies of major HD map technology providers at home and abroad.

HD map business layout and main technologies of major HD map technology providers at home and abroad.

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...

China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure This report highlights the passenger car L2+ and above (including L2+, ...