Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.

Smart surfaces represent the development trend of automotive interiors and exteriors.

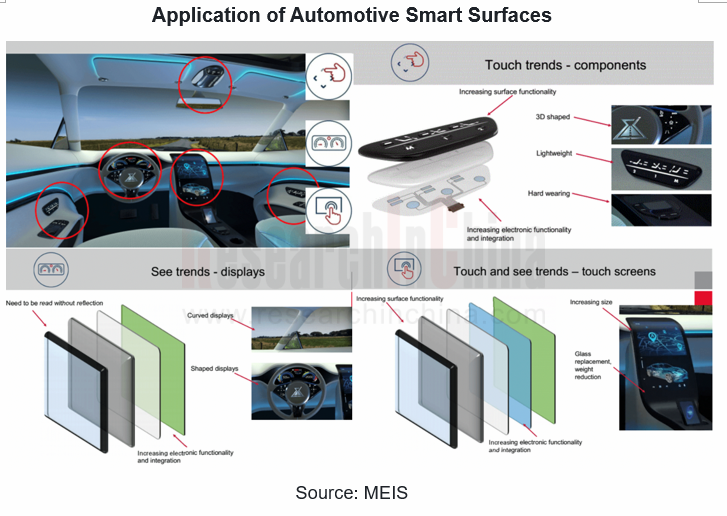

Smart surfaces represent the development trend of automotive interiors and exteriors, as an important part of smart cockpits and a crucial medium of multi-modal interaction. On center consoles, steering wheels, doors, windows and other automotive interior parts, smart surfaces upgrade traditional interactive media such as buttons or knobs in traditional automotive interiors to touch interactive media made of surface materials such as plastic or fabric.

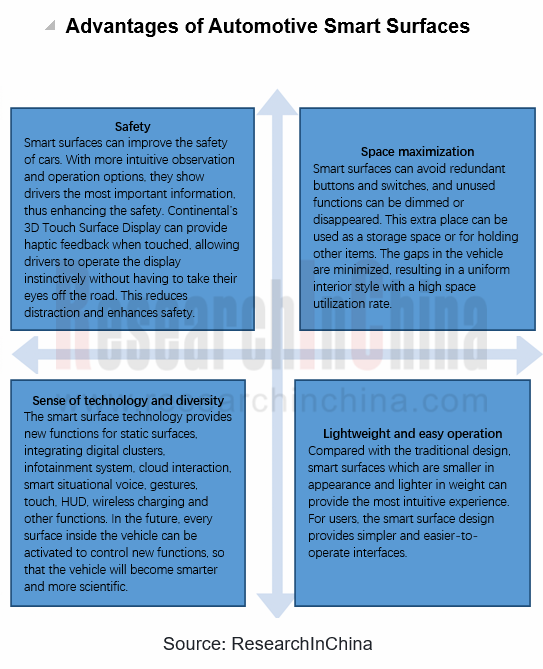

Compared with traditional automotive interiors, smart surfaces feature lightweight, intelligence and functionality.

Lightweight: The weight is reduced by 60%-80%, the thickness is cut by 90%, the PCBA area drops by 25%, and the number of parts is slashed by 95%.

Intelligence: The integration of intelligent components such as electronic switches, lighting, and sensors provides a medium for multimodal interactions.

Functionality: With more design freedom and higher functional integration, smart surfaces can provide more functions for drivers and passengers in a more convenient way.

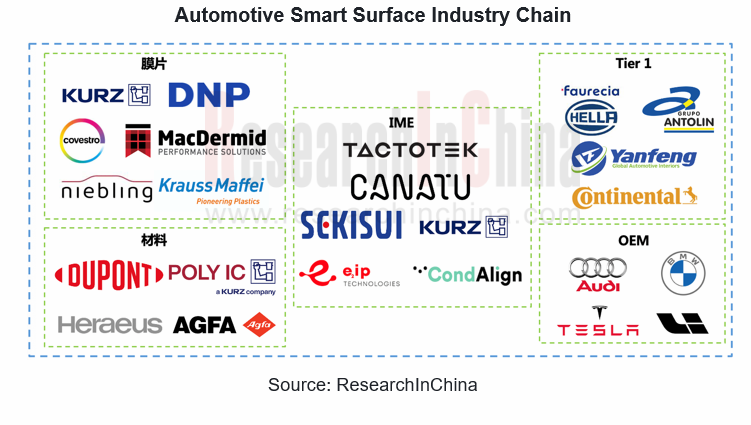

Professional IME enterprises and Tier1 interior enterprises jointly promote the development of automotive smart surfaces.

In-Mold Electronics is the main smart surface technology at present, featuring excellent bending and tensile properties, supporting 3D molding, requiring no new molds and enabling more free modeling design. Moreover, environmentally friendly and economical printed conductive ink solutions can meet the growing demand for model facelifts.

At present, there are not many companies that focus on automotive IME technology. Most companies take into account consumer electronics or industrial electronic components, such as Tactotek, Canatu, Sekisui, Kurz, e2ip, etc. At the same time, most automotive interior Tier1 companies are paying more and more attention to the application and development of smart surface components.

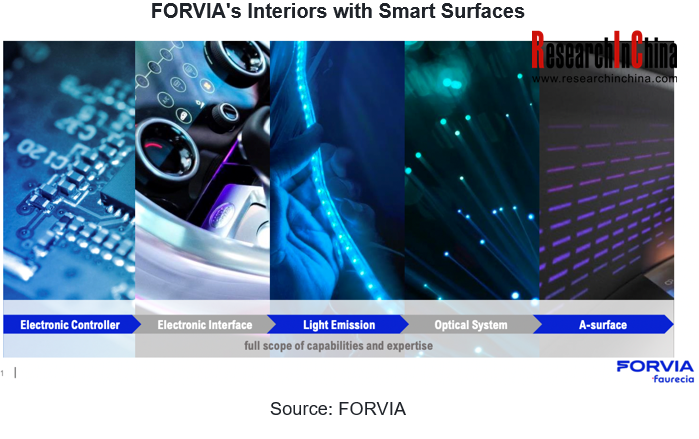

Faurecia envisions the cockpit of the future as a multifunctional, connected and intelligent space. The smart surface developed by Faurecia draws on the Group's experience in many professional fields: cockpit architecture, system integration, kinematics and mechatronics. In 2021, Faurecia and Immersion announced a multi-year license agreement, providing Faurecia with access to Immersion's patented technology as well as haptic technology solutions for automotive touch screens and control systems. In 2022, Faurecia completed the acquisition of Hella, and named the newly combined Group “FORVIA”. Smart surface products will also integrate more smart lighting functions.

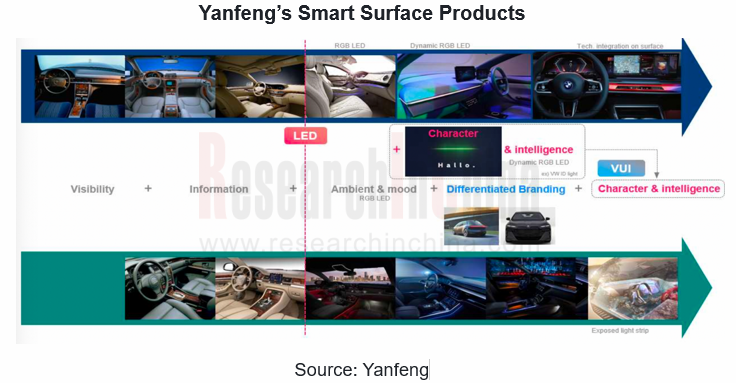

The smart interior surface being developed by Yanfeng Automotive Interiors (YFAI) combines automotive interior aesthetics with HMI technology, and seamlessly integrates control, information display, lighting and heating onto the same surface. In February, 2020, Yanfeng demonstrated its latest smart surface technology through a "smart surface model” which includes seven HMIs and is seamlessly integrated on various interior surfaces. In March, 2022, Yanfeng and SemsoTec signed a Memorandum of Understanding (MOU) for collaboration in display and sensor technologies, components and products for automotive application. The cooperation between the two parties aims to accelerate the seamless integration of HMI onto all interior surfaces of future cars, thereby offering unique in-car user experience.

Smart surfaces provide more possibilities for the smart cockpit strategies of OEMs

More and more OEMs apply smart surfaces to smart cockpits of both luxury cars and entry-level cars. Touch center consoles, touch door control modules and touch window control modules are very common, and even touch modules appear on steering wheels.

In Porsche's new interactive interface design, the 8.4-inch inclined screen at the lower part of the center console mainly displays the power, charging status, air conditioning control, writing pad, etc., with tactile feedback and error-proof operation functions.

Li L9 cancels the cluster in front of the driver, and instead adds a small TouchBar above the steering wheel. The combination of 5-screen touch control, 6 microphones, 3D ToF sensors, and the multi-modal 3D interactive technology developed by Li Auto based on deep learning exalts the audio-visual and entertainment experience of the smart car to a new level.

In order to embody a sense of science and technology and a simple design style, WM M7 not only removes all physical buttons, but also creates a touch gearshift mode integrated into the steering wheel. WM's "i-Surf Technology Skin" adopts superfine blended knitting technology, so that the texture feels like wool blend. At the same time, it features transparency. Combined with a flexible screen, it supports custom text or pictures.

New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

To follow the development trend for electrified and lightweight vehicles, new energy vehic...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2023

From the layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, which are mainly charged i...

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...

Automotive Power Supply (OBC+DC/DC+PDU) and Integrated Circuits (IC) Industry Report, 2023

Automotive power supply and IC: Chinese chips are promising in the evolution from physical integration to system integration

As the core component of a new energy vehicle, automotive power supply is ...

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...