China Around View System (AVS) Suppliers and Technology Trends Report, 2021 – Chinese Brands

Research on Chinese Brands’ Around View System: AVS Going to Integrate with Features of ADAS and Transparent Chassis

ResearchInChina published "China Around View System (AVS) Suppliers and Technology Trends Report, 2021 – Chinese Brands", which sorts and analyzes the Chinese OEMs’ around view functions, Chinese AVS suppliers’ technologies, typical Chinese manufacturers of AVS components, and the AVS development tendencies.

AVS (Around (Surround) View System) serves as a system that delivers real-time imaging to the driver in a 360-degree range around the vehicle at low speeds (excluding systems with only rear cameras).

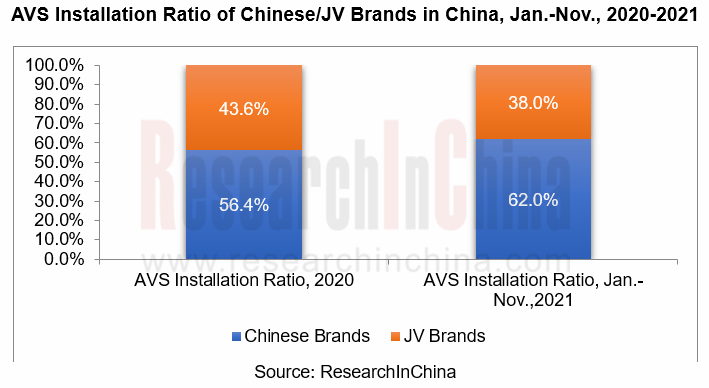

Chinese Brands Dominate the Market in Terms of AVS Installations

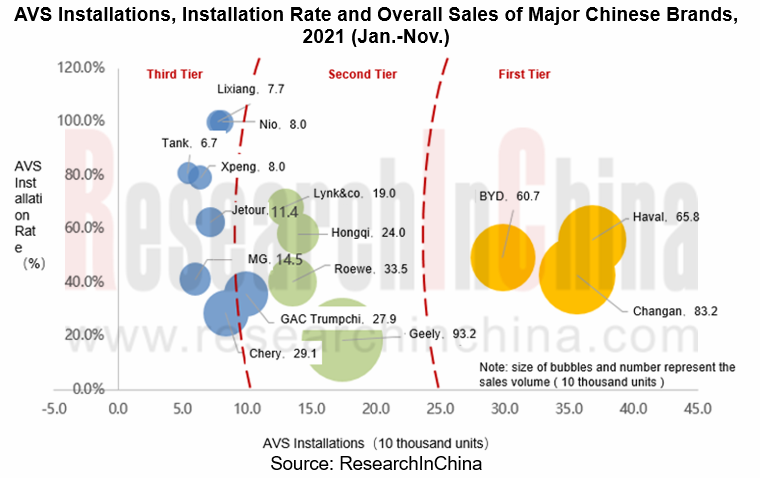

From January to November of 2021, AVS was available onto 4.266 million vehicles in China, an upsurge of 49.2% year-on-year; the installation rate of AVS registered 23.6%, a rise of 6 percentage points on an annualized basis, according to ResearchInChina. Elaborately, local Chinese brands’ AVS installations accounted for 62.0%, an increase of 5.6 percentage points year-on-year, among which Haval, Changan and BYD stand at the first tier; while Geely, Hongqi, Roewe and Lynk&co were in the second echelon.

By price, from January to November 2021, Chinese brand models priced between RMB100,000-RMB150,000 constitute the largest part of AVS installations, reaching 1,366,000 vehicles, sharing 51.7%, and the local brands AVS installation rate in this range is 48.1%, up 4.3 percentage points year-on-year, followed by the Chinese brand models priced at RMB150,000-RMB200,000 and a total of 496,000 vehicles installed with AVS, accounting for 18.8%, and the local brand AVS installation rate in this range is 67.0%, up 8.3 points year-on-year.

By models, from January to November 2021, the top three Chinese brands’ models in terms of installation were Haval H6 (208,000 units), Changan CS75 (156,000 units) and Hongqi HS5 (100,000 units).

In future, AVS installation rate will rise further with the cost reduction brought by gradual integration of AVS into the cockpit domain as well as the popularization of parking solutions combining surround view and ultrasonic.

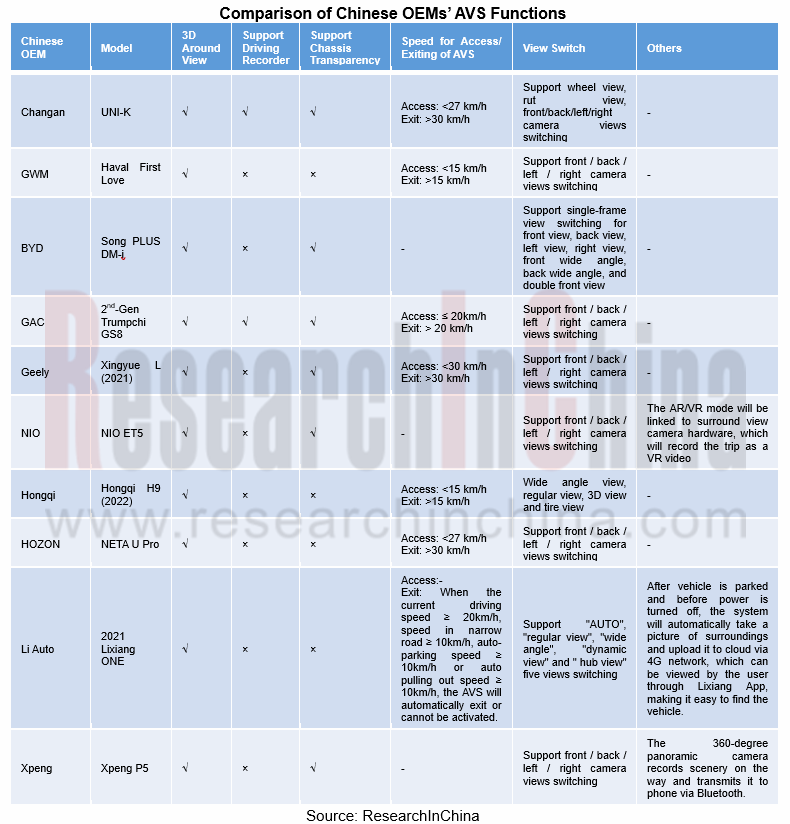

Chinese OEMs’ around view function gets continuously optimized, expanding to transparent chassis and ADAS function

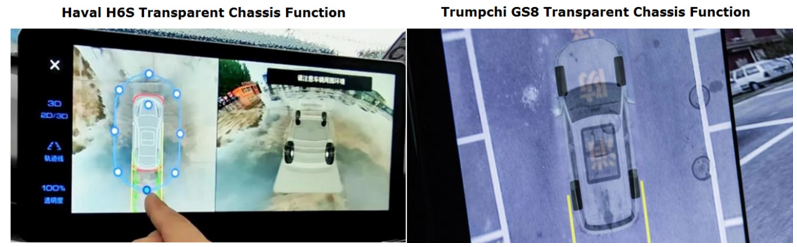

The AVS of Chinese OEMs is functionally evolving from a single 360° panoramic view in the past to rich ADAS features (such as moving object detection and warning (MOD), lane departure warning (LDW), and driving recorder, etc.) and transparent chassis.

For instance, Haval H6S (launched in October 2021) is added with 180-degree transparent chassis based on 360-degree panoramic image, which can realize 0%, 50% and 100% transparency settings; Trumpchi GS8 (unveiled in December 2021) has the AVS not only enabling 2D/3D panorama, MOD (moving object detection), driving recorder, and transparent chassis functions, but with a fusion of ultrasonic to achieve APA automatic parking.

Surround view cameras move toward higher pixel and more powerful perception

For clearer imaging, Chinese AVS suppliers are aggressively developing high pixel surround view cameras.

Ofilm, for example, spawned 2-megapixel HD surround view cameras in September 2021 and is working on 5-megapixel (to be launched in 2023) and 8-megapixel. SOE, a subsidiary of Minth Group, has upgraded its camera pixels from traditional VGA and current popular 1.3-megapixel HD camera to 2-megapixel FHD products, also with a plan for improvement to 8 megapixels in future. CalmCar, in cooperation with ZF, provides 192° fisheye cameras embedded with deep learning-based garage position recognition to enable higher perception capability in the AVP system based on surround view.

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...