Global and China Automotive Wireless Communication Module Market Report, 2022

Automotive wireless module is gearing towards a fusion of 5G, C-V2X, GNSS and smart antennas.

Smart connectivity makes the car a new mobile terminal, to which being connected and intelligent is indispensable. Intelligent connected vehicles (ICVs) are more demanding on in-car data exchange and communication with the outside. Automotive wireless communication module capable of data transmission acts as a key integral of vehicle intelligence.

Chinese suppliers of automotive wireless communication module play a dominant part in the industry.

Connected vehicles still at a gallop in 2021 when the shortage of vehicle chips deteriorated see an ever rise in penetration rate. In 2020, ICV sales worldwide registered 39.52 million units with a year-on-year upsurge of 36.6%, a figure projected to hit 53.2 million units in 2021 and more than 100 million units in 2025.

In China, a total of 14.6 million ICVs are sold in 2021, a figure expected to outnumber 26.0 million units with a penetration rate of above 90% in 2025.

Based on that one set of T-Box / TCU (Telematics Control Unit) is configured for each vehicle and packaged with multi-in-one wireless communication module, the global shipments of automotive wireless communication module would reach 53.2 million units and that in China 14.6 million units in 2021, and the shipments worldwide will expectedly rise to 107.59 million units and that in China 26.54 million units in 2025.

Meanwhile, T-Box in a car has a growing value from RMB500-600 to RMB1,000-2,000 with the evolution of the T-Box toward the integrated module (4G+V2X, 5G, 5G+V2X, etc.) from a single 4G module. Actually, the integrated (incl. 5G, V2X, GNSS localization and WIFI) T-Box terminal in single vehicle is valued above RMB2,000, which spurs the automotive wireless communication module market to expand ever.

If by the vehicle communication module shipments in varied communication modes in China, the Chinese market of vehicle wireless communication modules is sized by RMB3.2 billion in 2021, a figure projected to report RMB9.14 billion in 2025.

Automotive wireless communication modules find clear applications and play a crucial role. Against the burgeoning intelligent connected vehicles, the Chinese players are seeking strongholds in the wireless communication module field and faster branching out to the international automotive market.

In the automotive wireless communication module market, Chinese communication module manufacturers are developing rapidly, including Quectel, Fibocom, GosuncnWelink, Huawei, Neoway Technology, Sunsea AIoT Technology (LongSung Technology, SIMCom Wireless Solutions), MeiG Smart Technology, etc., while foreign peers include Sierra Wireless (acquired by Fibocom), Telit (acquired by Tus-Holdings) , Gemalto (acquired by Thales) and u-blox, among others. It is over the recent years that the mergers and acquisitions in the world’s automotive wireless communication module industry are gathering pace, and the industry concentration will rise further in the future.

Through the lens of corporate competition, Chinese suppliers of automotive wireless communication module outperform foreign counterparts in whatever technology, industrial chain, product competiveness or capital attraction, and they tend to be in full swing.

By comparing the technical capability, production layout and "going global" of the influential Chinese providers of automotive wireless communication module, we can see:

- Automotive-grade 5G module: Quectel’s 5G module AG55xQ series empower the implementation of more than thirty ‘5G + C-V2X’ projects from automotive clients; Fibocom Auto, Inc., a wholly-owned subsidiary of Fibocom, launched its proprietary 5G, 5G + V2X automotive-grade modules AN958 and AN958T, which are suitable for telematics, smart cockpit and autonomous driving scenarios; GosuncnWelink rolled out the world's first commercial automotive-grade 5G + C-V2X module – GM860A in LGA package and with the smallest size in the industry, as well as vehicle 5G modules – 860A-CIAG and 860A-C1AX; Sunsea AIoT Technology unveiled the automotive-grade 5G+C-V2X module, i.e., SIM8800CE.

- Automotive-grade model factories: Quectel’ Hefei base has been operational, and its Changzhou base will be in full operation in 2022; the Guangzhou base of GosuncnWelink will go into production in 2022; and the Zhuhai base of Sunsea AIoT Technology commenced construction in June 2020 and has already been in partial production, and will become operational fully in 2022.

- Foreign Tier1 customers: Quectel serves a total of over 60 tier1 suppliers around the globe; Fibocom taps into the international market through the acquisition of Sierra Wireless automotive operations; GosuncnWelink has such clients as Bosch, Continental, Yanfeng Visteon, Pioneer, Hyundai Mobis, and also cover the aftermarket OBD, etc.

Vehicle communication module is evolving towards an integration of 5G, C-V2X, GNSS, smart antennas, etc.

Vehicle infrastructure cooperation, automotive intelligence and synergy with 5G construction are underlined in the Strategy of Development and Innovation of Intelligent Vehicle (issued by National Development and Reform Commission together with other ten ministries in February 2020). As the growing demand for automotive communications is a boon for the wireless communication module market, the availability of 4G modules onto cars is on a rapid rise, and the automotive 5G communication module of more value accelerates to be popularized amid the robust need for OTA updates, high-definition entertainment inside the care as well as automated driving, etc.

The intelligent connected vehicles in the 5G era will bring a fundamental change in future mobility, which calls for a fusion of technologies like 4G/5G, C-V2X, Wi-Fi, Bluetooth, GNSS high-precision localization, and which requires being integrated with onboard smart antennas. In short, the value of automotive wireless communication module continues to rise in the future.

The active involvement of OEMs invigorates practical implementation of automotive 5G and C-V2X wireless communication modules.

In recent years, the car models with 5G and C-V2X have been launched successively on the market, with a huge demand for vehicle 5G and C-V2X wireless communication modules that are not only technically demanding with a long cycle of certification, but has the first-mover advantage. The companies that can be verified by the OEM and can cooperate with the latter will hold supremacy in the industry. The industrial barriers impel automotive-grade wireless communication modules to gear towards 5G and C-V2X.

The report is structured around the following:

In terms of policy, economy and industrial chain development, China has the most ideal development environment in the world for automotive wireless communication module industry and more breakthroughs are hopefully made in technology and industry layout;

In terms of policy, economy and industrial chain development, China has the most ideal development environment in the world for automotive wireless communication module industry and more breakthroughs are hopefully made in technology and industry layout;

Chinese automotive wireless communication module manufacturers are technologically leading the world, with more shipments than foreign competitors, but the industry features a high concentration of resources, which is easy to form an oligarch market;

Chinese automotive wireless communication module manufacturers are technologically leading the world, with more shipments than foreign competitors, but the industry features a high concentration of resources, which is easy to form an oligarch market;

China's wireless communication modules are mainly sold in large quantities but at low prices, and the Chinese players have poor bargaining power. There is still a long way to go if they wish to explore the international market;

China's wireless communication modules are mainly sold in large quantities but at low prices, and the Chinese players have poor bargaining power. There is still a long way to go if they wish to explore the international market;

Against the severe shortage of automotive chips over the recent two years, 5G / C-V2X vehicle module shipments hardly show explosive growth, and we look forward to a boom between 2023 and 2025;

Against the severe shortage of automotive chips over the recent two years, 5G / C-V2X vehicle module shipments hardly show explosive growth, and we look forward to a boom between 2023 and 2025;

Although Chinese automotive wireless communication module manufacturers remain superior in T-Box production, it is actually not a piece of cake to access into the supply chain of world-renowned automakers and it takes time.

Although Chinese automotive wireless communication module manufacturers remain superior in T-Box production, it is actually not a piece of cake to access into the supply chain of world-renowned automakers and it takes time.

Chapter 1 Automotive Wireless Communication Module Industry Overview and Policies & Standards

1.1 Industry Overview

1.1.1 Classification

1.1.2 Composition

1.1.3 Application

1.1.4 Industrial Chain

1.2 Policies

1.2.1 China’s Policies on the Development of Automotive Wireless Communication Module

1.2.2 The Guidance for the Construction of National Internet of Vehicle (IOV) Industry Standard System (Intelligent Vehicle Management)

1.2.3 The Guidance for the Construction of National Internet of Vehicle (IOV) Industry Standard System (Information Communication)

1.2.4 China IOV LTE-V2X Wireless Communication Standard System

1.2.5 3GPP Organizing C-V2X Standards

1.2.6 Automotive Wireless Short-range Communication Technology – SparkLink (I)

1.2.7 Automotive Wireless Short-range Communication Technology – SparkLink (II)

Chapter 2 Status Quo and Trends of Automotive Wireless Communication Module Industry

2.1 Status Quo and Trends of IoT Development Worldwide

2.1.1 Communication Module as a Key Link in the IoT System

2.1.2 Drivers for IoT Development

2.1.3 Global Connected IoT Devices Grow 9% in Numbers

2.1.4 The Connected IoT Devices Using Cellular Technology Grow 18% YoY in Numbers

2.1.5 Global IoT Market Size Will Grow 24% in 2021

2.1.6 Cellular IoT Module Market Size

2.1.7 Cellular Communication Technology Trends

2.1.8 5G Leads the IoT Industry into the ‘Smart Connectivity to Everything’ Era

2.2 Status Quo and Trends of Connected Vehicles in China and the World

2.2.1 Sales Forecast of Passenger Cars and Commercial Vehicles in China and the World

2.2.2 Global and China’s Connected Vehicle Sales and Percentage

2.2.3 ICV Development Outlook in China

2.3 Status Quo and Trends of Automotive Wireless Communication Module

2.3.1 Forecast of Automotive Wireless Communication Module Shipments in China and the World

2.3.2 Forecast of Automotive Wireless Communication Module Shipments in China and the World (the Attached Sheet)

2.3.3 China’s Automotive Wireless Communication Module Installations by Communication Mode

2.4 Wireless Communication Module Development Trends in China

2.4.1 Status Quo of China Automotive Wireless Communication Module Industry

2.4.2 Development Direction of Automotive Wireless Communication Module

2.4.3 Development Trends of Automotive Wireless Communication Module 5G/C-V2X

2.4.4 Technical Difficulties in Automotive Wireless Communication Module 5G/C-V2X Development

2.4.5 Technical Barriers of Automotive Wireless Communication Module

2.4.6 Industrial Barriers of Automotive Wireless Communication Module

Chapter 3 Automotive Wireless Communication Module Industry Chain and Competition Pattern

3.1 Automotive Wireless Communication Module Industry Chain

3.1.1 Wireless Communication Module Industry Chain

3.1.2 Changes in Wireless Communication Module Industry Chain

3.1.3 Automotive Wireless Communication Module Industry Chain

3.1.4 World-renowned Chip Vendors in the Upstream of Automotive Wireless Communication Module

3.1.5 Progress Made by Automotive Wireless Communication Module Chip Vendors (I)

3.1.6 Progress Made by Automotive Wireless Communication Module Chip Vendors (II)

3.1.7 Progress Made by Automotive Wireless Communication Module Chip Vendors (III)

3.1.8 Automotive Wireless Communication Module Chips and Planning (I)

3.1.9 Automotive Wireless Communication Module Chips and Planning (II)

3.1.10 Some T-Box/Module/Chip Vendors and Collaborations

3.2 Cost Analysis of Automotive Wireless Communication Module

3.2.1 Value Distribution of Wireless Communication Module (I)

3.2.2 Value Distribution of Wireless Communication Module (II

3.2.3 Changes in Cost Structure of Automotive Wireless Communication Module

3.3 Automotive Wireless Communication Module Competition Pattern

3.3.1 World’s Leading Suppliers of Wireless Communication Module

3.3.2 Market Shares of Wireless Communication Module Manufacturers Worldwide

3.3.3 Comparison of Profits between Wireless Communication Module Manufacturers Worldwide

3.3.4 Global Automotive Wireless Communication Module Market Share

3.3.5 Development of Chinese Automotive Wireless Communication Module Suppliers

3.3.6 Comparison of Technical Capabilities between Leading Chinese Wireless Communication Module Manufacturers

3.3.7 Comparison of Development between Leading Chinese Wireless Communication Module Manufacturers

3.4 Comparison of Automotive Wireless Communication Modules

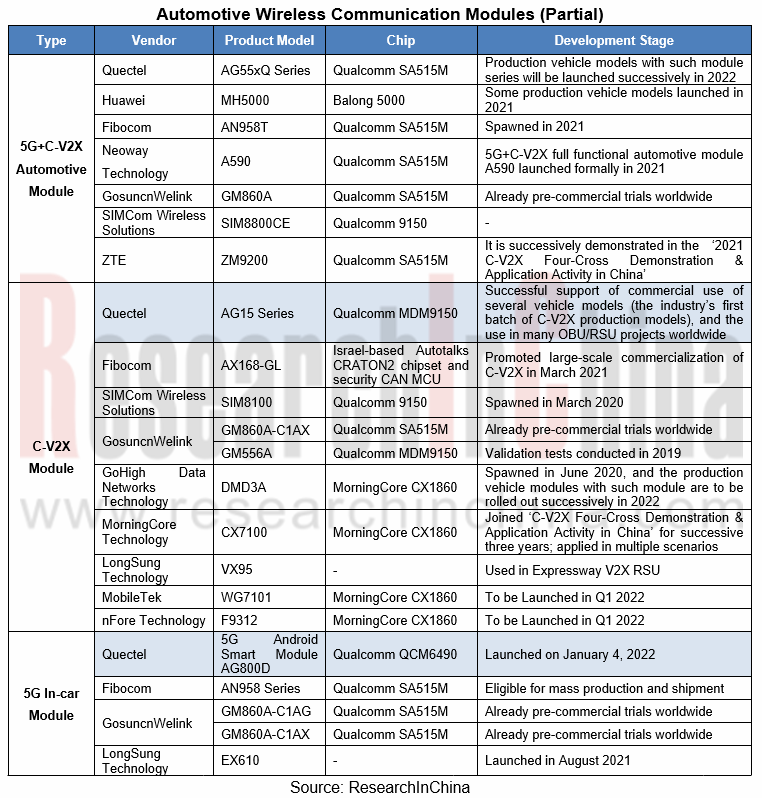

3.4.1 Major Chinese Automotive Communication Module Manufacturers’ Product Layout (I)

3.4.2 Major Chinese Automotive Communication Module Manufacturers’ Product Layout (II)

3.4.3 Major Chinese Automotive Communication Module Manufacturers’ Product Layout (III)

3.4.4 Major Chinese Automotive Communication Module Manufacturers’ Product Layout (IV)

3.4.5 Major Chinese Automotive Communication Module Manufacturers’ Product Layout (V)

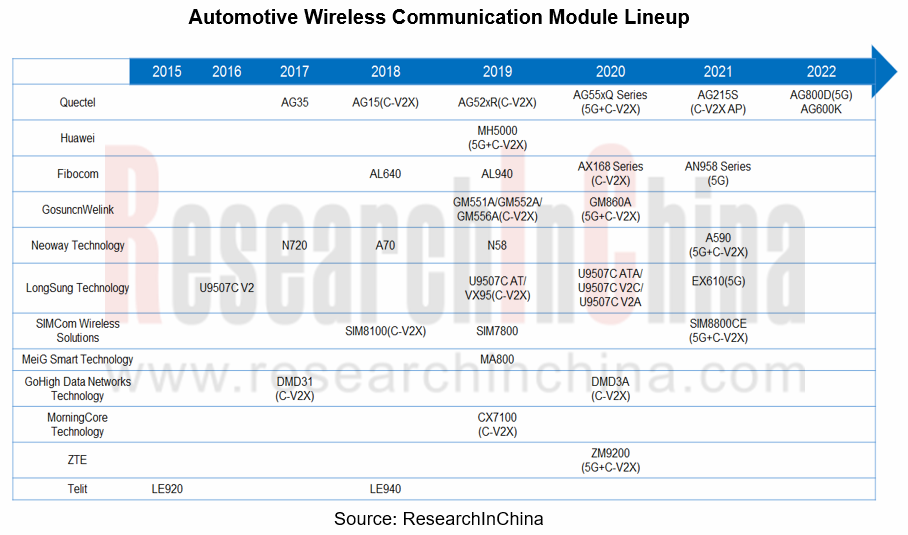

3.4.6 Timeline for China’s Automotive Communication Module Products

3.4.7 Chinese Automotive Communication Module Manufacturers’ Product Application (I)

3.4.8 Chinese Automotive Communication Module Manufacturers’ Product Application (II)

Chapter 4 Automotive Wireless Communication Module Solutions of OEMs

4.1 Foreign Automakers’ Technical Planning for Wireless Communication Module

4.1.1 Foreign Automakers’ Technical Planning for Wireless Communication Module (I)

4.1.2 Foreign Automakers’ Technical Planning for Wireless Communication Module (II)

4.2 Chinese Automakers’ Technical Planning for Wireless Communication Module

4.2.1 Chinese Automakers’ Technical Planning for Wireless Communication Module (I)

4.2.2 Chinese Automakers’ Technical Planning for Wireless Communication Module (II)

4.2.3 Chinese Automakers’ Technical Planning for Wireless Communication Module (III)

4.3 OEMs’ Application of 5G Wireless Communication Module

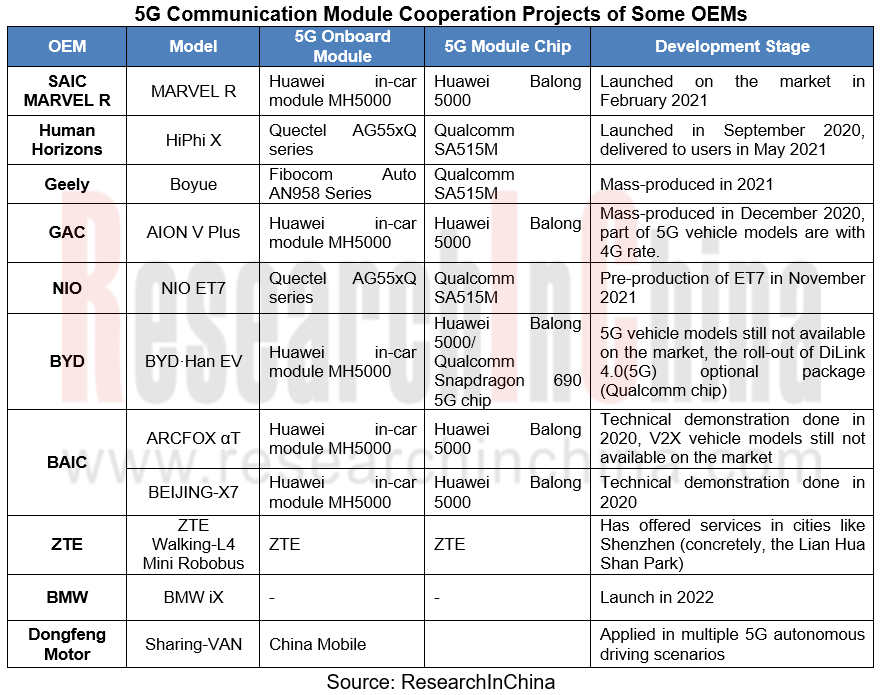

4.3.1 OEMs’ Cooperation in 5G Module

4.3.2 OEMs’ 5G Module Cooperation Case (I)

4.3.3 OEMs’ 5G Module Cooperation Case (II)

4.3.4 OEMs’ 5G Module Cooperation Case (III)

4.3.5 OEMs’ 5G Module Cooperation Case (IV)

4.4 OEMs’ Application of C-V2X Module

4.4.1 Chinese Production Models’ Cooperation in C-V2X Module

4.4.2 OEMs’ C-V2X Module Cooperation Case (I)

4.4.3 OEMs’ C-V2X Module Cooperation Case (II)

4.4.3 OEMs’ C-V2X Module Cooperation Case (III)

4.4.4 OEMs’ C-V2X Module Cooperation Case (IV)

4.5 OEMs’ Application of 5G + C-V2X Module

4.5.1 Chinese OEMs’ Cooperation in 5G + C-V2X Module

4.5.2 OEMs’ 5G + C-V2X Vehicle Model (I)

4.5.3 OEMs’ 5G + C-V2X Vehicle Model (II)

4.5.4 OEMs’ 5G + C-V2X Vehicle Model (III)

4.5.5 OEMs’ 5G + C-V2X Vehicle Model (IV)

4.5.6 OEMs’ 5G + C-V2X Vehicle Model (V)

4.5.7 OEMs’ 5G +C-V2X Vehicle Model (VI)

Chapter 5 Leading Suppliers of Automotive Wireless Communication Module

5.1 Huawei

5.1.1Profile

5.1.2 Intelligent Vehicle Solution

5.1.3Smart Connectivity Solution Architecture

5.1.4 Wireless Basestation – SingleRAN (Huawei “1+N”)

5.1.5 T-Box Platform

5.1.6 Automotive Communication System Huawei HiFin

5.1.7 5G+V2X Automotive Module

5.1.8 4.5G LTE-V Onboard Terminal

5.1.9 Wireless Communication Module Chip

5.1.10 Automotive Baseband Chip

5.1.11 Wireless Communication Module Chip

5.1.12 Huawei’s Extensive Cooperation with World’s Leading Automakers

5.1.13 Vehicle Models Equipped with Huawei 5G Communication Module

5.1.14 Talent Reserves for Huawei Automotive Business

5.1.15 Huawei Builds Its Automotive R&D Center

5.2 Quectel

5.2.1 Profile

5.2.2 Equity Structure

5.2.3 Revenue

5.2.4 Shipments

5.2.5 Main Business

5.2.6 Product Layout

5.2.7 Automotive Module Business

5.2.8 Introduction to Automotive Wireless Communication Module

5.2.9 New Intelligent Modules to be Launched in 2022

5.2.10 Automotive 5G NR Sub-6GHz Module

5.2.11Automotive LTE-A Module

5.2.12 Automotive C-V2X Module

5.2.13 Automotive LTE Module

5.2.14 Automotive AP Module

5.2.15 Cooperative Automakers in Automotive Modules

5.2.16 Cooperation in Automotive Modules and Vehicle Modules Supported

5.2.17 Active Promotion of C-V2X Ecosystem Construction

5.2.18 Production Bases

5.2.19 Competitiveness

5.2.20 Global Presence

5.3 Fibocom

5.3.1 Profile

5.3.2 Equity Structure

5.3.3 Operation and Development Priorities

5.3.4 Business Structure

5.3.5 R&D Input

5.3.6 Introduction to Products

5.3.7 Automotive Communication Module Layout

5.3.8 Automotive Modules

5.3.9 Automotive 5G Communication Modules

5.3.10 5G High-rate Vehicular Module Parameters

5.3.11 Automotive C-V2X Module

5.3.12 Automotive LTE Cat 4 Module

5.3.13 Automotive Wireless Communication Module Application

5.3.14 To Complete Its Global Internet of Vehicle Strategy Layout via Share Participation and Acquisitions

5.3.15 Automotive Module Industry Chain System Development

5.3.16 Global Operation/Support

5.4 Neoway Technology

5.4.1 Profile

5.4.2 Revenue

5.4.3 R&D Input

5.4.4 Main Business

5.4.5Major Customers

5.4.6 Key Suppliers

5.4.7 Automotive Product Development Roadmap

5.4.8 5G+C-V2X Automotive Wireless Communication Module

5.4.9 Automotive LTE Module

5.4.10 Telematics Application

5.4.11 Development Direction of Automotive Wireless Communication Module

5.4.12 Market Coverage

5.5 GosuncnWelink

5.5.1 Profile

5.5.2 Development History

5.5.3 Revenue

5.5.4 Telematics Business

5.5.5 Telematics Technologies

5.5.6 Telematics Related Modules

5.5.7 Planning for Telematics Related Modules

5.5.8 Automotive 5G Module

5.5.9 Automotive 5G+C-V2X Module

5.5.10 Automotive 4G Module (I)

5.5.11 Automotive 4G Module (II)

5.5.12 Automotive 4G Module (III)

5.5.13 Automotive 4G Module (IV)

5.5.14 T-Box Products

5.5.15 Key Suppliers

5.5.16 Major Customers

5.5.17 Product Application

5.5.18 Major Customers for Automotive Communication Modules

5.5.19 Major Customers for 4G T-Box Products

5.5.20 Automotive Module Development Trend

5.5.21 R&D Strength (I)

5.5.22 R&D Strength (II)

5.6 MorningCore Technology

5.6.1 Profile

5.6.2 Telematics Business Development

5.6.3 C-V2X Communication Chip Series

5.6.4 C-V2X Full Stack Solutions (I)

5.6.5 C-V2X Full Stack Solutions (II)

5.6.6 Automotive C-V2X Modules (I)

5.6.7 Automotive C-V2X Modules (II)

5.6.8 Automotive C-V2X Module Application

5.6.9 Market Coverage

5.7 Sunsea AIoT Technology (LongSung Module+SIMCom Module)

5.7.1 Sunsea AIoT Technology - Profile

5.7.2 LongSung Technology - Profile

5.7.3 LongSung - Main Business

5.7.4 LongSung - Automotive 5G Wireless Communication Modules

5.7.5 LongSung - Automotive Wireless Communication Modules (I)

5.7.6 LongSung - Automotive Wireless Communication Modules (II)

5.7.7 LongSung - Automotive LTE Cat4 Wireless Communication Modules (I)

5.7.8 LongSung - Automotive LTE Cat4 Wireless Communication Modules (II)

5.7.9 LongSung - Automotive LTE Cat4 Wireless Communication Modules (III)

5.7.10 LongSung - Automotive LTE Cat4 Wireless Communication Modules (IV)

5.7.11 LongSung - Automotive LTE Cat4 Wireless Communication Modules (V)

5.7.12 LongSung - Automotive Wireless Communication Module Application

5.7.13 SIMCom Wireless Solutions - Profile

5.7.14 SIMCom - Automotive Wireless Communication Modules

5.7.15 SIMCom - Automotive 5G+C-V2X Wireless Communication Modules

5.7.15 SIMCom - Automotive C-V2X Wireless Communication Module

5.7.16 SIMCom - Automotive LTE Cat 4 Module (I)

5.7.17 SIMCom - Automotive LTE Cat 4 Module (II)

5.7.19 SIMCom - Automotive Wireless Communication Module Application (I)

5.7.20 SIMCom - Automotive Wireless Communication Module Application (II)

5.7.21 SIMCom - R&D Strength

5.7.22 SIMCom - Market Coverage

5.8 ZTE

5.8.1 Profile

5.8.2 Telematics Product Layout

5.8.3 5G-V2X Automotive Modules

5.8.4 Automotive 5G+V2X Product Matrix

5.8.5 Automotive Chip Collaborations

5.8.6 Automotive Module Application

5.9 MeiG Smart Technology

5.9.1 Profile

5.9.2 Current Development of Telematics Modules

5.9.3 “5G Module+ Automotive Module + Vehicle AI BOX” Solution

5.9.4 5G Intelligent Module with High Compute

5.9.5 Automotive LTE Communication Modules

5.9.6 Automotive LTE Communication Module Parameters (I)

5.9.7 Automotive LTE Communication Module Parameters (II)

5.9.8 Automotive Wireless Communication Module Application (I)

5.9.9 Automotive Wireless Communication Module Application (II)

5.9.10 R&D Strength

5.9.11 Market Coverage

5.9.12 Major Customers

5.10 Flaircomm Microelectronics (Flairmicro)

5.10.1 Profile

5.10.2 Automotive Communication Modules (I)

5.10.3 Automotive Communication Modules (II)

5.10.4 Major Customers

5.11 Sierra Wireless

5.11.1 Profile

5.11.2 Wireless Communication Module Business Overview (I)

5.11.3 Wireless Communication Module Business Overview (II)

5.11.4 Automotive Wireless Communication Modules

5.11.5 Automotive Wireless Communication Module Solutions (I)

5.11.6 Automotive Wireless Communication Module Solutions (II)

5.11.7 Business Range

5.11.8 Modes of Cooperation

5.11.9 Automotive Business Change

5.11.10 Major Customers for Automotive Modules

5.12 Telit

5.12.1 Profile

5.12.2 Automotive Business Development

5.12.3 Automotive Intelligent Modules (I)

5.12.4 Automotive Intelligent Modules (II)

5.12.5 Automotive LTE Modules

5.12.6 5G Communication Module

5.12.7 Automotive Wireless Communication Module Cases

5.13 Gemalto (Thales)

5.13.1 Profile

5.13.2 Business Overview

5.13.3 Automotive Wireless Communication Modules

5.13.4 Automotive Wireless Communication Module Solutions

5.14 u-blox

5.14.1 Profile

5.14.2 Automotive Wireless Communication Modules

5.14.3 Automotive Wireless Communication Module Solutions

5.14.4 Scope of Coverage

Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

Basic operating system: foreign providers refine and burnish functions; Chinese ...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...