Automotive gateway industry research: the gateway ushered in a significant transformation while high-performance processors became the hot cakes

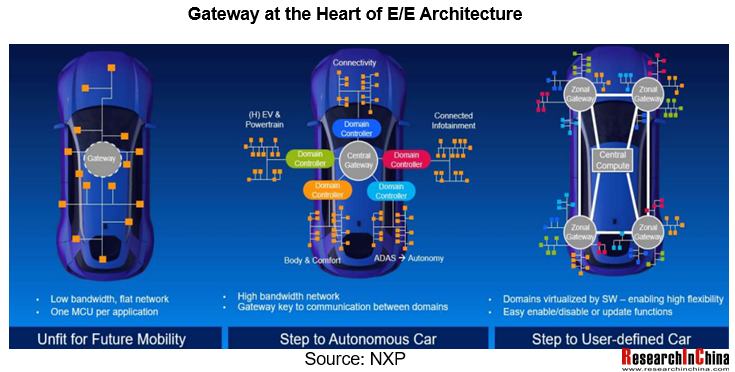

Gateway serves as the core hub of vehicle network, handling functions such as data transmission, security prevention and control, and remote diagnostics.

As the E/E architecture evolves from distributed to centralized domain architecture, the central gateway also provides functions such as interconnection and processing of data between safety and functional domains (powertrain, chassis and safety, body control, infotainment and ADAS, etc.).

In the future, the central gateway will evolve into an HPC or central computer in the "Central Computer + Zone Controller" architecture, while the Domain Gateway will evolve into a Zonal Gateway.

01 In line with market changes, the gateway suppliers introduced a series of new products

Since 2020, most Chinese OEMs make great efforts in functional domain architecture and achieve mass production in mid- to high-end models of Xpeng, FAW Hongqi, GWM, etc.

In accordance with the trend of change in automotive industry, automotive gateway suppliers, such as Inchtek, have launched a new generation of security gateway products.

In August 2021, Inchtek released L3000, the first automotive-grade 5G autonomous driving in-vehicle safety gateway, which adopts G9 series central gateway processor from SemiDrive and integrates automotive-grade Ethernet, 5G/C-V2X, Wi-Fi/BT and high-precision GNSS/IMU modules, enabling the high-level real-time transmission of data such as C-V2X and 5G.

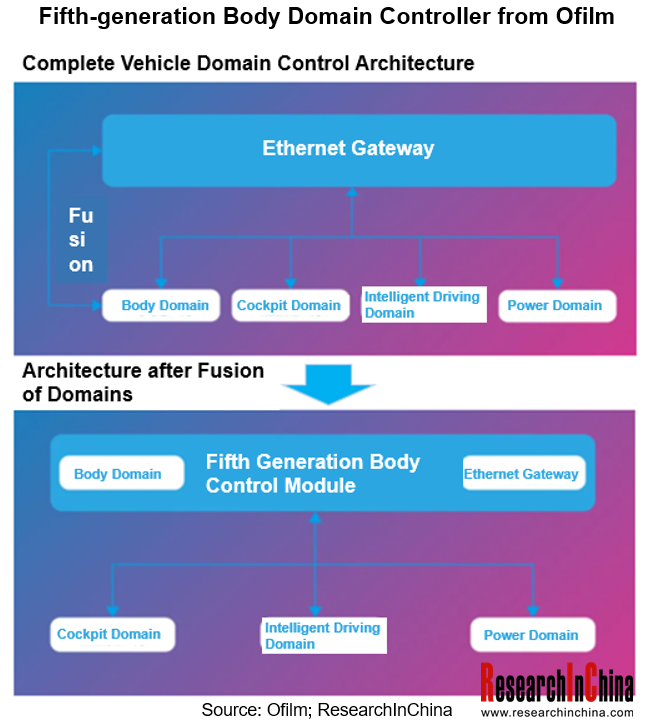

So as to further simplify the architecture, centralize the computing power, improve the communication transmission rate and OTA efficiency of the whole vehicle, some OEMs have started to try solutions such as domain convergence or HPC. Among them, the integration of body and Ethernet gateway has been the preferred solution.

In December 2020, Ofilm rolled out the fifth generation of body domain controller, which integrates body domain with Ethernet gateway, reducing the delay of bus signal transmission and improving the depth of information sharing between systems.

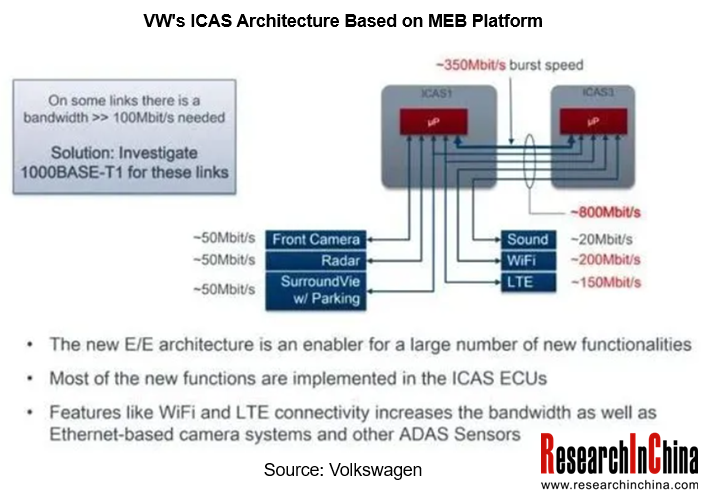

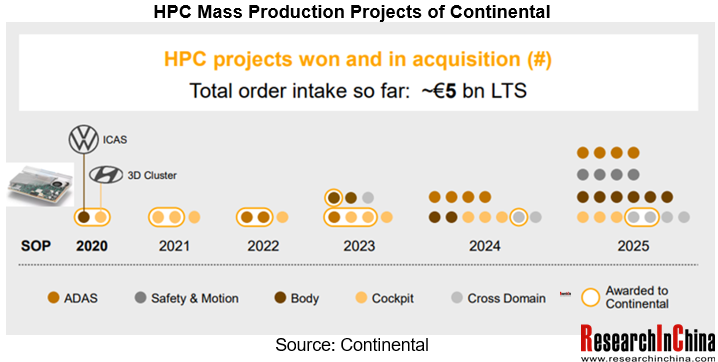

In 2020, the first generation of Continental's Body High Performance Computing Unit (Body HPC), as an in-vehicle application server (ICAS1), went into mass production on ID.3 of MEB-based platform at Volkswagen. In 2021, it was mass production again on ID.4.

The body HPC from Continental combines the previously separately implemented gateway function with the body controller function to act as a central gateway for all connected services, providing data processing and data security functions, as well as supporting vehicle OTA updates.

In 2021, Continental has also engaged in a strategic cooperation with GAC R&D Center, which will bring in high-performance central computing unit hardware and basic software platform development for GAC for creating a leading E/E architecture.

In the future, more features will be integrated into Continental's HPC, such as ADAS.

02 High-performance Gateway Processor Sparks New Round of "Battle"

High-performance gateway processor, as the core of the SOA change for smart vehicles, has triggered a new round of "scramble".

Since 2020, NXP, Renesas Electronics, TI, Infineon and other market-leading gateway processor suppliers have unveiled a new generation of gateway chips and solutions.

? In January 2020, TI released the DRA829V gateway processor based on Jacinto 7 processor platform;

? In March 2020, ST unveiled the SGP, a smart gateway platform targeted at automotive gateway and domain controller applications;

? In June 2021, the mass production of new S32G automotive network processor by NXP based on 16nm process;

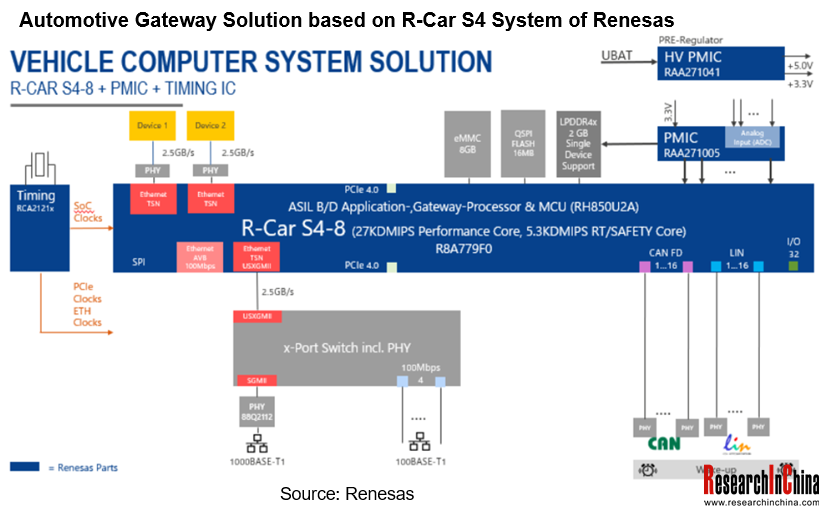

? In October 2021, Renesas announced a new automotive gateway solution based on R-Car S4 system;

......

Among them, the above-mentioned Volkswagen ID series, which applied Continental's body HPC, uses the high-performance R-Car M3 system-on-chip (SoC) from Renesas Electronics, while the novel gateway solution developed based on the R-Car S4 system solution with SoC and power management IC will be used for next-generation automotive computers, communication gateways, domain servers and application servers.

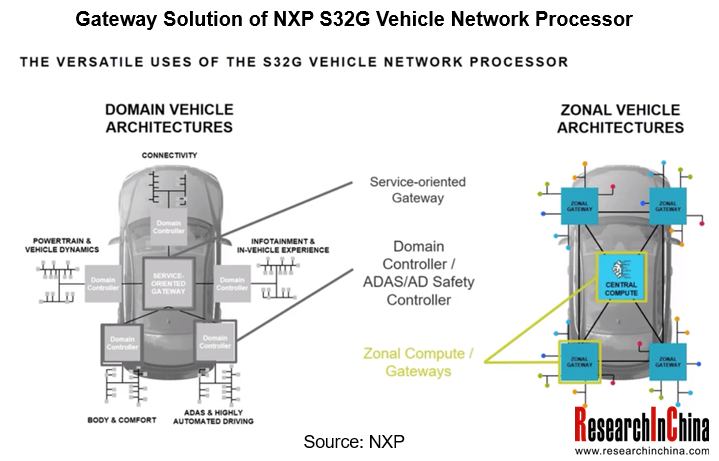

The second-generation body HPC, a product produced by collaboration between Continental and GAC, is equipped with the new S32G automotive network processor based on 16nm process, the latest mass production of NXP.

NXP S32G processor adopts 16nm process and has more than 10,000DMIPS of computing power which shows over 10 times of computing power than traditional NXP gateway chip. It combines ASIL D-level functional safety, hardware HSE encryption module and dedicated communication accelerator for service gateway, domain controller and co-processor of security domain.

In 2020, SemiDrive, a Chinese company, released G9X central gateway chip; based on G9X, it has joined hands with FAW General Research and Development Institute to launch "Longchi" central gateway platform, which will be installed in models such as Hongqi SUV and intelligent minibus.

In 2021, SemiDrive has launched G9Q, upgrading the single-core CPU to quad-core CPU so as to further enhance its computing power.

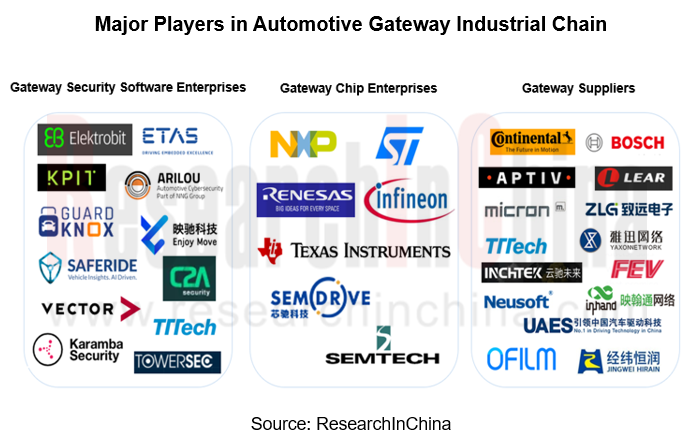

03 Industrial Chain

Currently, the gateway industry is undergoing a great evolution, and all involved players are racing to grab the dividends of "software-defined vehicles". In this campaign, the gateway processor in the core is expected to become the focus of competition. At the same time, with the application of higher computing power, lower power consumption and lower cost gateway chip, it will certainly accelerate the advent of the era of unmanned vehicles.

Automotive Memory Chip Industry Research Report, 2022

Automotive Memory Chip Research: Localization is imperative amid intense competition

The global smart phone storage market size hit US$46 billion in 2021 when the global automotive storage market siz...

Autonomous Driving Simulation Industry Chain Report (Foreign Companies), 2022

Simulation test research: foreign autonomous driving simulation companies forge ahead steadily with localization services.

As the functions of ADAS and autonomous driving systems are developed and th...

China Automotive Multimodal Interaction Development Research Report, 2022

Multimodal interaction research: more hardware entered the interaction, immersive cockpit experience is continuously enhanced

ResearchInChina's “China Automotive Multimodal Interaction Development Re...

Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

Basic operating system: foreign providers refine and burnish functions; Chinese ...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...