Automotive Power Management Integrated Circuits (PMIC) Industry Report, 2023

Automotive PMIC research: the process of domestic automotive PMICs replacing foreign ones in China in the “crisis of chip shortage”.

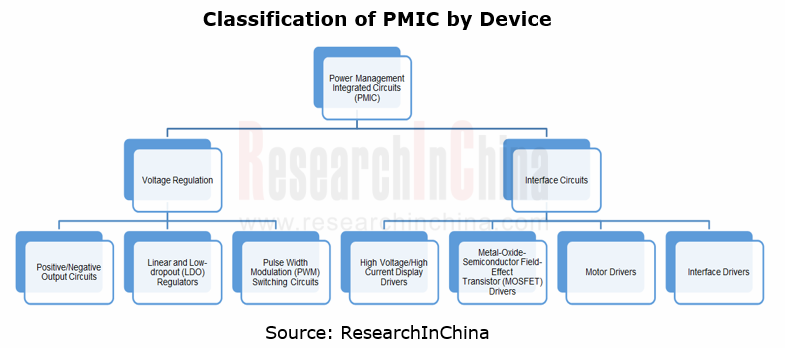

Automotive power management integrated circuits (PMIC) find broad application in vehicle intelligent cockpits, autonomous driving, body electronics, clusters and entertainment systems, lighting systems, and BMS. By product, PMICs fall into AC/DC, DC/DC, LDO, driver IC, and battery management IC.

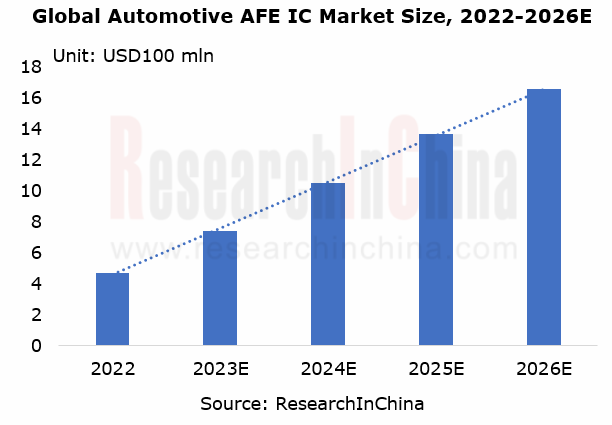

The enormous supply gap in automotive power battery management system AFE ICs creates a strong desire to replace foreign products in China.

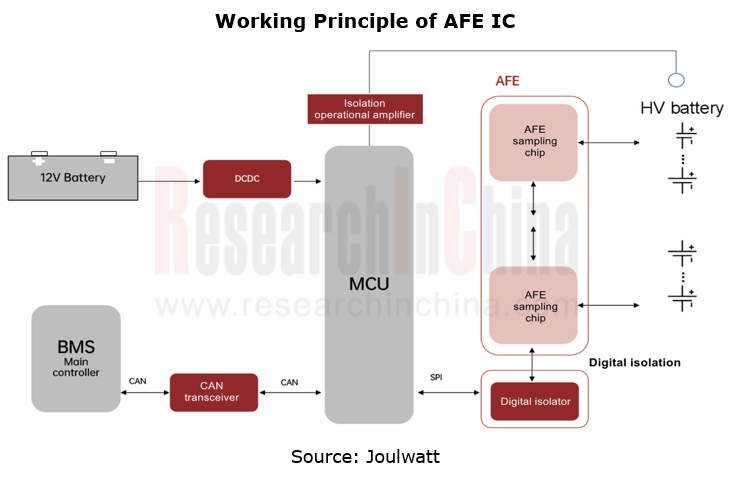

Among automotive PMICs, AFE ICs for battery management systems (BMS) are in the shortest supply. The analog front end (AFE) IC is the most important device in BMS, responsible for collecting voltage and temperature of battery cells. AFE IC uses specific algorithms to estimate battery parameters (e.g., SOC and SOH), and sends the results to the control chip.

(1) Demand for automotive AFE ICs: in the evolution from 400V to 800V platform, the demand for AFE ICs doubles.

Considering endurance range and charging efficiency of new energy vehicles, mainstream automakers have begun to deploy high-voltage platforms. The evolution from the current mainstream 400V platform to 800V platform has become a megatrend. For higher voltage requires an almost equal proportion of more battery cells in series, the demand for AFE ICs thus surges. It is expected that the platform voltage will increase from 400V to 800V, doubling the demand for automotive AFE ICs.

(2) Supply of automotive AFE ICs: the Chinese market relies on imports, creating a huge gap, so replacing foreign products with the homemade is a matter of great urgency.

High technical barriers, high automotive certification requirements, big challenges, and long cycle are constraints on the mass production of automotive AFE ICs in China. More than 90% of the AFE ICs used in vehicle power batteries still need to be imported. This market is monopolized by foreign analog chip giants like TI, ADI and Infineon. Chinese AFE IC vendors still make initial deployments in the automotive power battery field.

As a mainstream supplier in the automotive battery management integrated circuits (BMIC) market, TI has extended its order delivery time to 2023 as its BQ Series chips are out of stock and become more expensive, producing a large gap in the market.

Due to the gap between supply and demand in the Chinese automotive AFE IC market, domestic terminal manufacturers and lithium battery suppliers with strong demand for homemade chips are trying to enter the power BMIC segment from different angles.

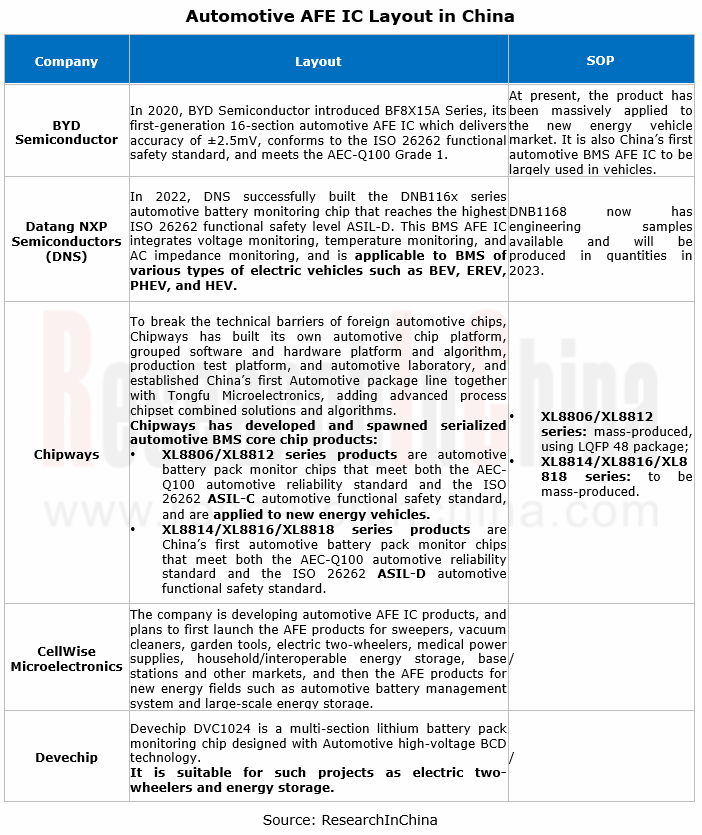

Chipways: it has made several breakthroughs in core technologies of BMS chipsets, including automotive BMS AFE sampling chip (ASIL C/D), automotive BMS digital isolation and communication interface chip, and automotive 32-bit microcontroller unit (MCU), and can provide complete grouped software development tools for product development.

Chipways’ XL8806/XL8812 series automotive battery pack monitor chips can meet both the AEC-Q100 automotive reliability standard and the ISO 26262 ASIL-C automotive functional safety standard. With LQFP 48 package, they can work in a temperature range of -40°C~125°C, single chip supporting 4 to 12 series of batteries. They adopt the high-precision ΣΔ ADC method with measurement accuracy up to ±1.5mV, and support multiple series of chips and master-slave reversible two-way communication.

The XL8814/XL8816/XL8818 series automotive battery pack monitor chips can meet the AEC-Q100 automotive reliability standard and the ISO 26262 ASIL-D automotive functional safety standard. They add another more than 30 safety mechanisms, reaching the ASIL D functional safety level. While ensuring the measurement accuracy, they increase the monitoring strings on a single chip. They support up to 14/16/18 battery strings in series, and control the measurement time within 120us. They feature the maximum built-in equalizing current of 400mA, and also add such capabilities as busbar monitoring, sleep monitoring and reverse wake-up.

Datang NXP Semiconductors (DNS): DNB1168 is a BMS AFE IC that integrates voltage monitoring, temperature monitoring, and AC impedance monitoring. It supports 250 rings of cascading chips, and daisy chain communication, and meets automotive certification, having passed the ISO 26262:2018 ASIL-D certification. For example, for thermal runaway that is hard to control in power batteries, DNB1168 solution uses the AC impedance monitoring function for rapid detection of thermal runaway. Compared with the conventional NTC (thermocouple) method, AC impedance monitoring can provide a second-level response, which greatly improves the safety threshold of power batteries and prolongs the service life of batteries.

DNS DNB1168 series automotive AFE ICs offer three benefits in application, namely, material saving, space saving, and faster and safer 3D monitoring. They are applicable to the BMS of various types of electric vehicles like BEV, EREV, PHEV, and HEV. DNB1168 now has engineering samples available and will start volume production in 2023.

BYD Semiconductor: in 2020, it unveiled BF8X15A Series, its first-generation 16-section automotive AFE IC which delivers accuracy of ±2.5mV, conforms to the ISO 26262 functional safety standard, and meets the AEC-Q100 Grade 1.

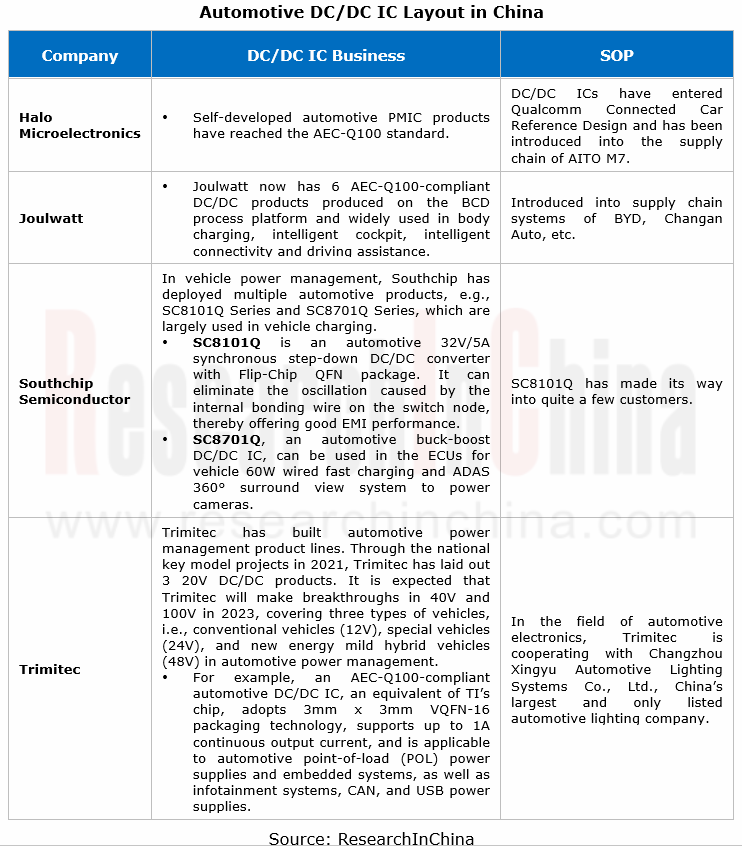

In China automotive DC/DC ICs will enter the cycle of replacing foreign ones.

DC/DC ICs have a wide range of uses in automotive electronics, and apply to scenarios from vehicle intelligent cockpits, charging piles and motor controllers to on-board chargers and automotive lighting. At present, Chinese PMIC vendors successively achieve mass production of automotive products in categories like LDO and DC/DC.

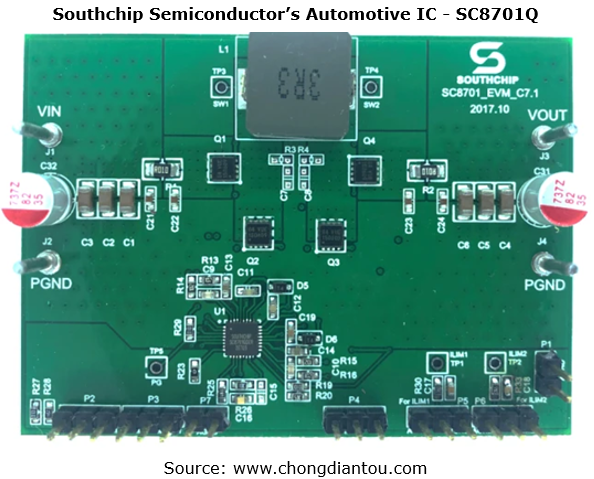

For vehicle charging, Southchip has launched SC8101Q series automotive 32V/5A synchronous step-down converter, and SC8701Q series automotive buck-boost chip, which can be used in ECUs for 60W wired fast charging and ADAS 360° surround view system to power cameras, as well as vehicle wireless charging. Currently they have been adopted by many Tier 1 suppliers, and have been seen in models of multiple brands like BYD, SAIC-GM, FAW Hongqi and Hyundai. They will be mounted on several overseas models soon.

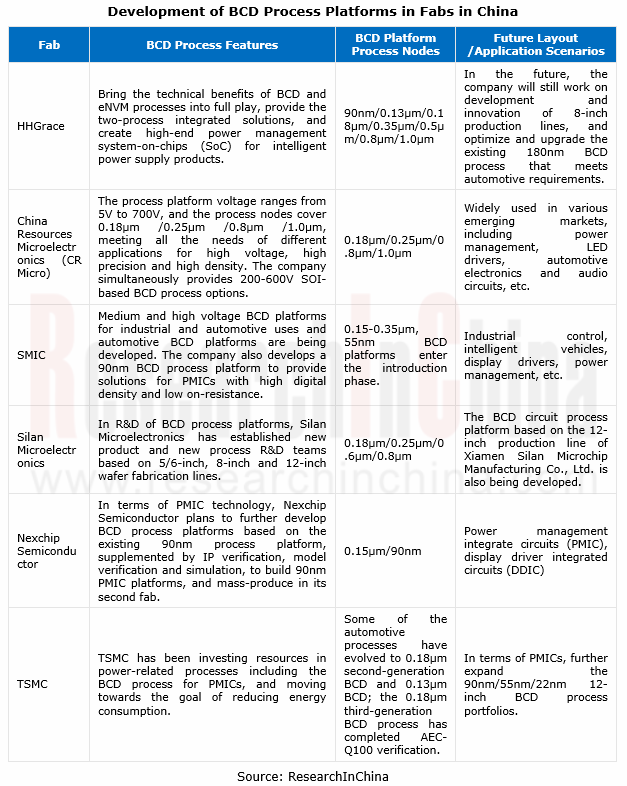

Chinese fabs make breakthroughs in BCD process, and the" crisis of chip shortage" revs up the localization of automotive PMICs.

PMICs pose relatively low requirements for manufacturing process instead of following Moore's Law. Compared with other types of integrated circuits, PMICs are a relatively mature and stable segment. At present, the mainstream mature process of PMICs is 8-inch process with nodes ranging from 0.32μm to 90nm. Fabs often use the special fabrication process of BCD (Bipolar-CMOS-DMOS), with many product numbers and types available. The market is highly fragmented.

In 2022, there was a structural shortage of chips in the automotive industry. Wherein, the 8-inch PMIC production capacity with mature process nodes above 0.18um felt much pinch. Giant IDMs like TI, Infineon, ADI, STMicroelectronics and NXP boast most automotive PMIC capacity. Other chip design firms (Fabless mode) need to obtain capacity from wafer foundries.

In China, SMIC, GTA Semiconductor, HHGrace and Nexchip Semiconductor among others all can provide PMIC wafer foundry services, and they are also stepping up the expansion of production lines with mature and characteristic process. In 2022, SMIC completed development of 55nm BCD process platform (high-voltage display driver platform), and introduced to customers for mass production. The vendor will play an extremely important role in industrial control, intelligent vehicles, display drivers, and power management. The current mainstream BCD process in the world is 180/130/90nm, and the industry's top level is 60nm.

To deal with the surging demand from automotive and the insufficient capacity of automotive chips, wafer foundries like TSMC and UMC expand their automotive chip capacity. International IDMs have started large-scale capacity expansion while deploying their automotive chip capacity.

At present, the supply and demand in some automotive PMIC segments has improved, and the prices of some automotive chips have begun to be lowered, including driver ICs (e.g., LED driver and motor driver), PMICs, and some control ICs. Yet in the process of switching from fuel-powered vehicles to electric ones, the demand for the automotive products remains relatively stable, and the price will not take a nosedive.

This "crisis of chip shortage" buys more time for Chinese PMIC vendors to deploy automotive electronics and make breakthroughs in automotive PMICs, which accelerates the replacement of foreign automotive PMICs. Moreover, automakers also need to re-examine their industrial layout strategies in special circumstances, especially in cross-regional production and transportation of parts and components. The localization of the components supply chain may be more beneficial to organizing the whole supply chain, and build synergy with local vehicle dealers. Once force majeure hinders normal vehicle sales, components will also fell the pinch simultaneously. The big mismatch between supply and demand in the automotive PMIC market gives Chinese PMIC vendors scope for entry into the supply chain of the automotive industry.

Qualcomm 8295 Based Cockpit Domain Controller Dismantling Analysis Report

ResearchInChina dismantled 8295-based cockpit domain controller of an electric sedan launched in December 2023, and produced the report SA8295P Series Based Cockpit Domain Controller Analysis and Dism...

Global and China Automotive Comfort System (Seating system, Air Conditioning System) Research Report, 2024

Automotive comfort systems include seating system, air conditioning system, soundproof system and chassis suspension to improve comfort of drivers and passengers. This report highlights seating system...

Automotive Memory Chip and Storage Industry Report, 2024

The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market...

Automotive Memory Chip and Storage Industry Report, 2024

The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market...

Automotive AUTOSAR Platform Research Report, 2024

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more o...

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...

Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to ...

Software-defined Vehicle Research Report, 2023-2024 - Industry Panorama and Strategy

1. How to build intelligent driving software-defined vehicle (SDV) architecture?

The autonomous driving intelligent platform can be roughly divided into four parts from the bottom up: hardware platf...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024

In-cabin Monitoring study: installation rate increases by 81.3% in first ten months of 2023, what are the driving factors?

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring Sys...

Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional s...

Autonomous Driving Map Industry Report,2024

As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent drivin...

Automotive Vision Industry Research Report, 2023

From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%; 3.875 million side vi...

Automotive Voice Industry Report, 2023-2024

The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

From 2019 to the first nine month...