Fuel Cell Industry Research: Hydrogen energy has been put on the national agenda with scenario application being rolled out.

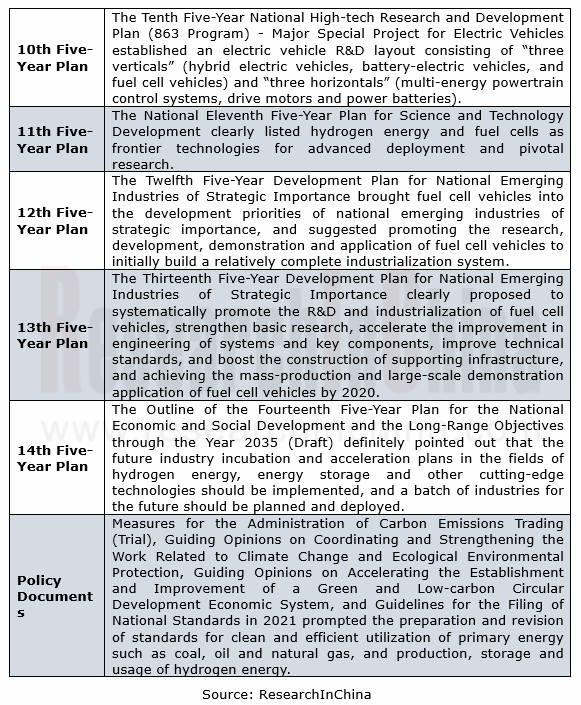

The hydrogen energy industry has been included into the national energy strategy.

Since the 14th Five-Year Plan, ministries and commissions have intensively issued favorable policies for hydrogen energy, covering research on key technologies in hydrogen energy production, storage, transportation and use, demonstration application of hydrogen energy, infrastructure construction, etc.

In March 2022, the National Development and Reform Commission and the National Energy Administration jointly issued the Medium-and Long-Term Plan for the Development of Hydrogen Energy Industry (2021-2035), clarifying that hydrogen energy plays an important part in the national energy system in the future and is a key emerging industry of strategic importance, and proposing three five-year development goals for the hydrogen energy industry so as to meet the goal of emission peak and carbon neutrality.

(1) Green hydrogen will be an investment hotspot in the future

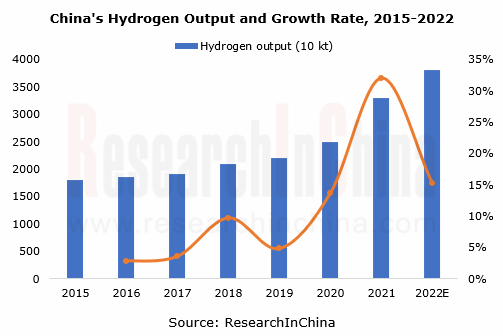

China, the largest hydrogen producer in the world, boasts hydrogen capacity of about 40 million tons/a and output of about 33 million tons/a. In 2021, China produced about 33 million tons of hydrogen, up 32% year on year. In 2022, the output will jump by 15% on the previous year to 38 million tons.

In the short and medium term, China’s hydrogen is mainly made from fossil, partially from industrial by-products, but the proportion of hydrogen produced by renewable energy will ramp up year by year. By 2050, about 70% of hydrogen will be made from renewable energy, 20% from fossil and 10% from other technologies such as biotech.

By region, China's hydrogen production is concentrated in Northwest and North China where fossils are abundant. China’s hydrogen market features a scattered competitive landscape: China Energy Investment Corporation and Sinopec are the largest hydrogen producers in China, accounting for about 30%; others are mostly small and medium-sized enterprises with a small hydrogen production scale. As other large enterprises dabble in the field of hydrogen energy, the hydrogen energy industry is expected to be more concentrated.

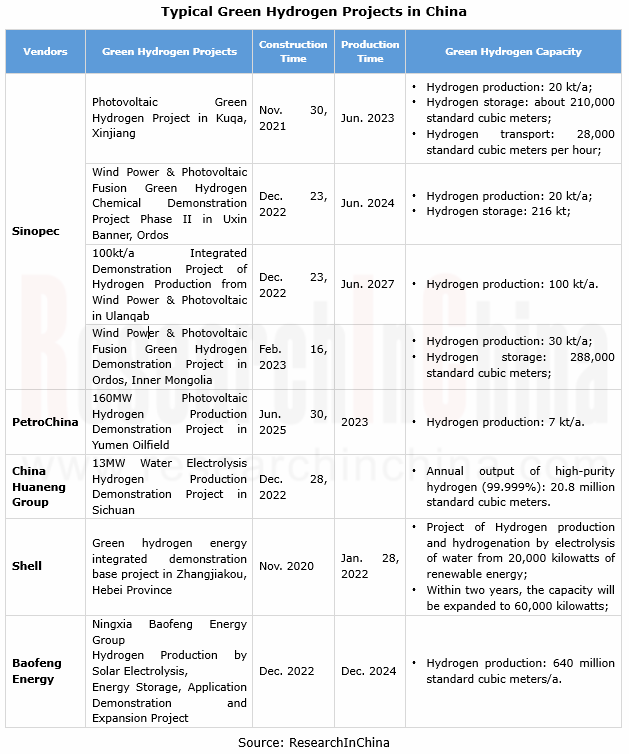

Green hydrogen is the key to the energy strategy and represents the development direction of the future hydrogen production. The huge market potential has attracted large energy enterprises, wind power and photovoltaic giants. From 2020 to 2022, China propelled the construction of several green hydrogen projects, such as hydrogen production from hydropower in Sichuan, photovoltaic hydrogen production in Xinjiang, and hydrogen production from wind power in Inner Mongolia, laying a good industrial foundation for large-scale production of green hydrogen.

(2) Hydrogen storage and transportation will become the pipeline of the hydrogen energy strategy.

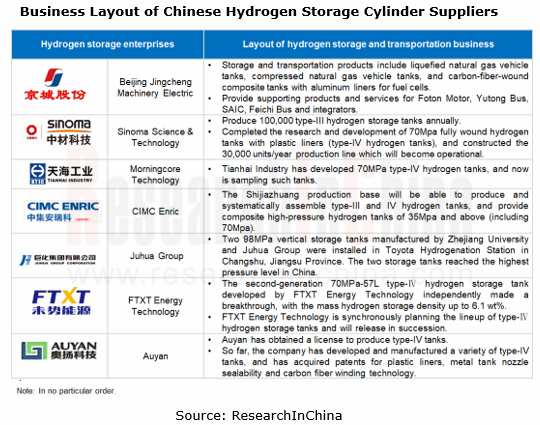

Commercial hydrogen is mainly transported in three forms: high-pressure gas hydrogen, low-temperature liquid hydrogen and hydrogen pipeline. At present, China mainly uses high-pressure gas hydrogen + 20Mpa long-tube trailers to transport hydrogen, which fails to meet the needs for large-scale use of hydrogen for the time being. In the future, as large-scale transportation of commercial hydrogen is in demand, China is bound to make progress in hydrogen storage materials.

For vehicle hydrogen storage in China, 35Mpa carbon-fiber-wound-type-III tanks are often seen, and 70MPa carbon-fiber-wound-type-III tanks have also been adopted in a small number of homemade vehicles. As concerns the future hydrogen storage and transportation technology, China will work on the standards and industrial application of 70MPa type-IV tanks, independent development of carbon fiber for gas tanks, and reduction of energy consumption and cost of hydrogen liquefaction, and make gradual breakthroughs in domestic civilian liquid hydrogen technology and equipment.

It is predicted that in 2025 70MPa type-IV tanks will be widely used, liquid hydrogen equipment will be initially self-developed, and a number of liquid hydrogen storage demonstration projects will be carried out.; by 2030, 98MPa type-IV cylinders will be produced on large scale at lower cost, and liquid hydrogen equipment will come into batch production at much lower cost and find broad application in mass storage and transportation at medium and long distances.

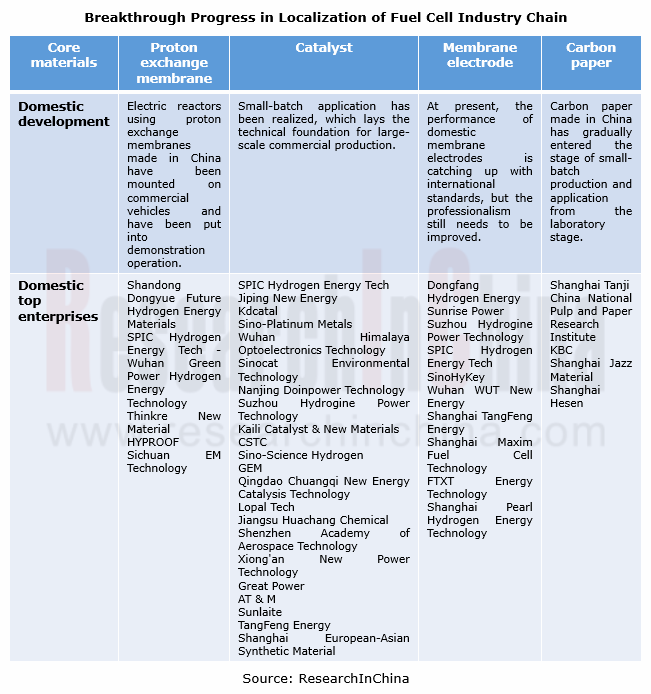

(3) Breakthroughs in localization of core fuel cell technology

The Guidance Catalog (First Batch) for the Application Demonstration of Key New Materials (2021) issued by the Ministry of Industry and Information Technology favors the breakthroughs in fuel cell technology, and the technological upgrade of hydrogen energy and fuel cell industries. The breakthroughs in manufacturing technology of core raw materials for fuel cells are the crux of cost reduction for China's fuel cell industry.

Accompanied by the construction of fuel cell model cities, the technological progress of China's core fuel cell material industry has obviously accelerated. Technological breakthroughs have been made in core materials in the hydrogen energy industry chain such as high-purity hydrogen, carbon fiber composites for hydrogen storage tanks, proton exchange membranes, catalysts, membrane electrodes, and gas diffusion layers, and production lines with considerable capacity have been built to produce some of them, providing the basis for further localization.

Under the joint influence of hydrogen energy policies and industrial chain cost reduction, China will build a complete hydrogen energy industrial system and diversified hydrogen energy application ecosystems covering transportation, energy storage, industry and other fields.

In the context of energy iteration, fuel cell vehicles have entered a new development cycle.

China's new energy vehicles have boomed, ranking first in the world for eight consecutive years. In 2022, the output and sales of new energy vehicles went up by 96.9% and 93.4% year on year to 7.058 million and 6.887 million units, respectively. Wherein, the output and sales of battery-electric vehicles jumped by 83.4% and 81.6% year on year to 5.467 million and 5.365 million units, respectively; the output and sales of fuel cell vehicles soared by 105.4% and 112.8% year on year to 4,000 and 3,000 units, respectively.

Hydrogen fuel cell vehicles and electric vehicles head in different directions. Hydrogen fuel cell vehicles will replace diesel engine vehicles in the future, while battery-electric vehicles will tend to substitute gasoline vehicles. Hydrogen fuel cell vehicles are positioned as a supplement to battery-electric vehicles. In many fields and scenarios where battery-electric vehicles are difficult to popularize, hydrogen fuel cell vehicles remain extremely superior.

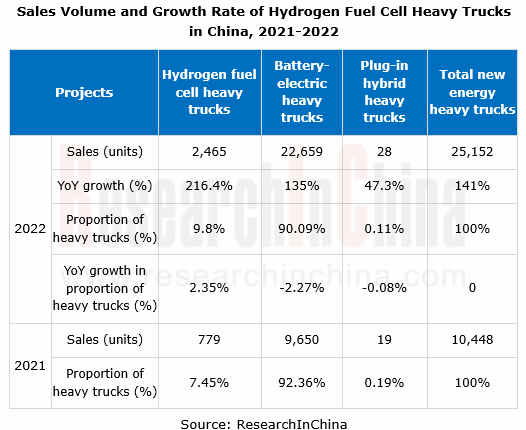

Hydrogen fuel cell heavy trucks now have become a promising segment in development of fuel cell vehicles. Hydrogen heavy trucks/mine trucks can still run stably in low temperatures and harsh environments, covering the defects and shortcomings of battery-electric vehicles. In 2022, 4,782 hydrogen fuel cell commercial vehicles were actually sold, a year-on-year upsurge of 155.2%. Especially, hydrogen fuel cell heavy trucks were a strong performer, with the full-year sales of 2,465 units, rocketing by 216% on an annual basis, higher than the growth of 141% made by new energy heavy trucks, thus becoming the main force to drive the rapid growth of hydrogen fuel cell commercial vehicles.

From the "49-ton fuel cell heavy truck project in Jiaxing Port Area", it can be seen that a batch of hydrogen energy equipment manufacturers have clustered and created a range of hydrogen energy application scenarios. Port logistics vehicles, forklifts and sea-river intermodal ships provide rich application scenarios for the hydrogen energy industry in Jiaxing Port Area. In May 2022, Zhejiang Feichi New Energy Vehicle Technology Co., Ltd. officially delivered 50 hydrogen heavy trucks to the national hydrogen fuel cell vehicle demonstration application program in Jiaxing.

In addition to hydrogen heavy trucks, hydrogen fuel cell special vehicles take a place in the demonstration area. Hydrogen fuel cell sweepers, hydrogen fuel cell refrigerated vehicles, hydrogen fuel cell logistics vehicles, and hydrogen fuel cell buses among others come into operation.

Automotive AUTOSAR Platform Research Report, 2024

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more o...

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...

Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to ...

Software-defined Vehicle Research Report, 2023-2024 - Industry Panorama and Strategy

1. How to build intelligent driving software-defined vehicle (SDV) architecture?

The autonomous driving intelligent platform can be roughly divided into four parts from the bottom up: hardware platf...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024

In-cabin Monitoring study: installation rate increases by 81.3% in first ten months of 2023, what are the driving factors?

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring Sys...

Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional s...

Autonomous Driving Map Industry Report,2024

As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent drivin...

Automotive Vision Industry Research Report, 2023

From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%; 3.875 million side vi...

Automotive Voice Industry Report, 2023-2024

The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

From 2019 to the first nine month...

Two-wheeler Intelligence and Industry Chain Research Report, 2023

In recent years, two-wheelers have headed in the direction of intelligent connection and intelligent driving, which has been accompanied by consumption upgrade, and mature applications of big data, ar...

Commercial Vehicle Telematics Industry Report, 2023-2024

The market tends to be more concentrated in leading companies in terms of hardware.

The commercial vehicle telematics industry chain covers several key links such as OEMs, operators, terminal device ...

Automotive Camera Tier2 Suppliers Research Report, 2023

1. Automotive lens companies: "camera module segment + emerging suppliers" facilitates the rise of Chinese products.

In 2023, automotive lens companies still maintain a three-echelon pattern. The fir...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...