China Silicon Carbide Industry Report, 2015-2019

-

Jan.2016

- Hard Copy

- USD

$1,900

-

- Pages:86

- Single User License

(PDF Unprintable)

- USD

$1,800

-

- Code:

ZLC029

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,800

-

- Hard Copy + Single User License

- USD

$2,100

-

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, accounting for more than 80% of the global total. In 2014, the total silicon carbide output in China approximated 1.03 million tons, including 670,000 tons of black silicon carbide and 360,000 tons of green silicon carbide, with a very low capacity utilization rate. It is projected that the total output in 2015 would reach 1.2 million tons.

As China's silicon carbide export quota was abolished in 2013, China’s silicon carbide exports have, to a greater or lesser degree, expanded in recent years. But this was not true in 2015, which saw a low-speed growth rate. In Jan.-Nov. 2015, China’s silicon carbide exports came to 291,100 tons, up 0.4% from the same period of last year; and the average export price fell from USD1.1/kg in 2013 to USD0.97/kg.

There are about 200 SiC raw materials manufacturers in China, including Yicheng New Energy, Xinjiang Longhai Silicon, Lanzhou Heqiao, and Ningxia Jinjing, etc. Among them, Yicheng New Energy constitutes China's largest silicon carbide blade material production and recycling company, with its annual silicon carbide capacity totaling 210,000 tons and its annual wafer cutting mortar recycling capacity more than 60,000 tons.

With overcapacity of SiC raw materials and ongoing falling prices in China, the corporate profits were severely squeezed. Hence, it becomes an inevitable trend to aggressively develop high value-added SiC wafer products so as to raise SiC value. Despite the fact that SiC wafer production technologies were previously in the hands of Cree, a US company, China has now broken the monopoly and achieved mass production of SiC wafer of certain size.

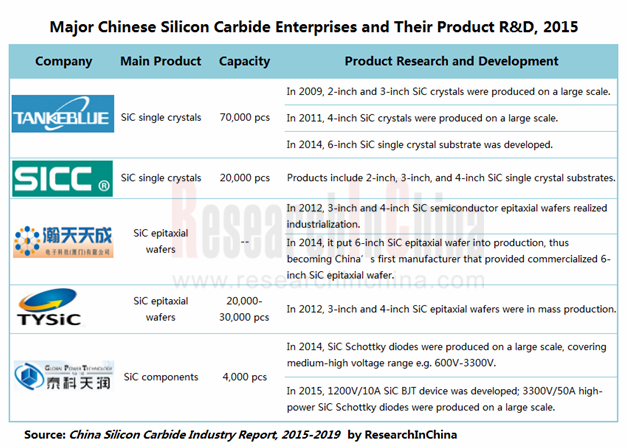

At present, the enterprises that mass produce SiC wafer include TanKeBlue Semiconductor, SICC Materials, EpiWorld International, and Dongguan Tianyu Semiconductor; the sole enterprise that can produce SiC devices is Global Power Technology.

TanKeBlue Semiconductor, a wholly-owned subsidiary of Xinjiang Tianfu Energy, is the first and largest supplier of SiC mono-crystal products in China. Currently, the company has developed 2-inch, 3-inch, 4-inch and 6-inch SiC wafers, with its annual capacity of 70,000 pieces.

Global Power Technology, a leader in China in industrialization of SiC power devices, has China’s only SiC device production line. In 2014, the company succeeded in mass producing SiC Schottky Barrier Diode, but the scale was still at the starting stage, with the current capacity of only 4,000 pieces/a.

The report mainly deals with the followings:

Development of global silicon carbide industry, including the status quo of SiC raw materials and SiC wafer, etc.

Development of global silicon carbide industry, including the status quo of SiC raw materials and SiC wafer, etc.

Development of China silicon carbide industry, including status quo, supply and demand, competition landscape, import & export, price trend, and development trends, etc.;

Development of China silicon carbide industry, including status quo, supply and demand, competition landscape, import & export, price trend, and development trends, etc.;

Development of upstream and downstream sectors of silicon carbide industry;

Development of upstream and downstream sectors of silicon carbide industry;

Operation and silicon carbide business of 18 silicon carbide manufacturers in China.

Operation and silicon carbide business of 18 silicon carbide manufacturers in China.

1 Overview

1.1 Definition and Classification

1.2 Properties and Applications

1.3 Market Features

2 Development of Global Silicon Carbide Industry

2.1 SiC Raw Materials

2.2 SiC Wafer

3 Development of China Silicon Carbide Industry

3.1 Status Quo

3.2 Related Policies

3.3 Supply and Demand

3.4 Competitive Landscape

3.4.1 Raw Materials Manufacturers

3.4.2 Wafer-related Enterprises

3.5 Import and Export

3.5.1 Import

3.5.2 Export

3.5.3 Average Price Comparison

3.6 Price Trend

3.6.1 Black Silicon Carbide

3.6.2 Green Silicon Carbide

3.7 Development Trend

3.7.1 Industrial Integration Helps Boost Industrial Concentration

3.7.2 Growth in Demand from Downstream Sectors Promote the Development of the Industry

3.7.3 Product Quality Gets Improved

3.7.4 Gradual Popularization of Silicon Carbide Semiconductor Devices

4 Development of Upstream and Downstream Sectors of China Silicon Carbide Industry

4.1 Upstream Sectors

4.1.1 Quartz Sand

4.1.2 Anthracite

4.1.3 Petroleum Coke

4.2 Downstream Sectors

4.2.1 Abrasives

4.2.2 Refractories

4.2.3 Iron & Steel

4.2.4 Ceramics

4.2.5 Electronics

5 Key Enterprises

5.1 Henan Yicheng New Energy Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 R&D and Investment

5.1.6 Silicon Carbide Business

5.1.7 Anticipation and Outlook

5.2 Ningxia Orient Tantalum Industry Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 R & D and Investment

5.2.6 Silicon Carbide Business

5.2.7 Anticipation and Outlook

5.3 Xinjiang Tianfu Energy Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Silicon Carbide Business

5.4 Lanzhou Heqiao Resource Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.5 Ningxia Jinjing Metallurgicals and Minerals Industrial Co., Ltd

5.5.1 Profile

5.5.2 Silicon Carbide Business

5.6 Linshu Zhengyu Silicon Carbide Factory

5.6.1 Profile

5.6.2 Development Advantages

5.7 Tonghua Hongxin Abrasive Co., Ltd.

5.7.1 Profile

5.7.2 Silicon Carbide Business

5.8 Jiangsu Leyuan Material Co., Ltd.

5.8.1 Profile

5.8.2 Silicon Carbide Business

5.9 Hanjiang Hongyuan Xiangyang Silicon Carbide Special Ceramics Co., Ltd.

5.9.1 Profile

5.9.2 Silicon Carbide Business

5.9.3 Development Advantages

5.10 YILI MASTER Carborundum Products Co., Ltd.

5.10.1 Profile

5.10.2 Silicon Carbide Business

5.11 Other Enterprises

5.11.1 Xinjiang Longhai Silicon Co., Ltd.

5.11.2 Weifang Liuhe Sic Micro Powder Co., Ltd.

5.11.3 Shandong Jinmeng New Materials Co., Ltd.

5.11.4 SICC Materials Co., Ltd

5.11.5 EpiWorld International Co., Ltd

5.11.6 Dongguan Tianyu Semiconductor Technology Co., Ltd.

5.11.7 Global Power Technology (Beijing) Co. Ltd.

5.11.8 Gansu Jiangang Silicon Carbide Co. Ltd.

Global Silicon Carbide Capacity (by Region), 2015

Major Global Silicon Carbide Manufacturers and Their Capacity

Structure (%) of Downstream Demand for Silicon Carbide Worldwide, 2009-2015

Performance Comparison of SiC Chips

Classification of Silicon Carbide Wafer Power Devices

Global Silicon Carbide Device Companies

Policies on Silicon Carbide Industry in China, 2005-2015

Capacity of Major Silicon Carbide Manufacturers in China, 2015

SiC Device Enterprises in China

China's Silicon Carbide Import Volume and Value, 2009-2015

China’s Top 10 Silicon Carbide Import Origins by Import Volume, 2015

China’s Top 10 Provinces by Import Volume of Silicon Carbide, 2015

China's Silicon Carbide Export Volume and Value, 2009-2015

China’s Top 10 Silicon Carbide Export Destinations by Export Volume, 2015

China’s Top 10 Provinces by Export Volume of Silicon Carbide, 2015

Average Import and Export Price Comparison of Silicon Carbide in China, 2009-2015

Price Trend for Black SiC Lump in China, 2015

Price Trend for Black SiC Sand in China, 2015

Price Trend for Black SiC Various Grit Sand in Gansu, 2015

Price Trend for Black SiC Powder in Gansu, 2015

Price Trend for Green SiC Lump in China, 2015

Price Trend for Green SiC Powder (European Standard) in China, 2015

Price Trend for Green SiC Powder (Japanese Standard) in China, 2015

Distribution of Quartz Sand Reserves in China

China's Anthracite Output, 2009-2015

China's Petroleum Coke Output, 2009-2015

China's Petroleum Coke Output, 2014-2015

Photovoltaic Installed Capacity and YoY Growth in China, 2009-2015

Output Structure (%) of Global Refractory Materials by Region, 2015

Output of Refractory Materials in China by Type, 2012-2015

Output of Refractory Raw Materials and Products in China, 2009-2015

Output of Crude Steel in China, 2009-2015

Output of Ceramic Tiles in China, 2009-2015

Number of Special Ceramics Enterprises above Designated Size in China and Their Operating Revenue, 2009-2015

Regional Distribution of LED Industry in China

Output Value of China LED Industry, 2009-2015

Output Value of China LED Industry (by Type), 2009-2015

China's MOCVD Ownership, 2009-2015

China's Output of Electronic Components, 2009-2015

Revenue and Net Income of Yicheng New Energy, 2011-2015

Revenue Breakdown of Yicheng New Energy by Product, 2011-2015

Revenue Structure of Yicheng New Energy by Product, 2011-2015

Revenue Breakdown of Yicheng New Energy by Region, 2011-2015

Revenue Structure of Yicheng New Energy by Region, 2011-2015

Gross Margin of Yicheng New Energy, 2011-2015

Gross Margin of Yicheng New Energy by Product, 2011-2015

Gross Margin of Yicheng New Energy by Region, 2011-2015

R&D Costs and % of Total Revenue of Yicheng New Energy, 2012-2015

Output, Sales Volume, and Inventory of Yicheng New Energy, 2013-2014

Silicon Wafer Cutting Edge Material Revenue of Yicheng New Energy, 2011-2015

Revenue and Net Income of Yicheng New Energy, 2014-2019E

Revenue and Net Income of Ningxia Orient Tantalum Industry, 2011-2015

Revenue Breakdown of Ningxia Orient Tantalum Industry by Product, 2012-2015

Revenue Structure of Ningxia Orient Tantalum Industry by Product, 2012-2015

Revenue Breakdown of Ningxia Orient Tantalum Industry by Region, 2012-2015

Revenue Structure of Ningxia Orient Tantalum Industry by Region, 2012-2015

Gross Margin of Ningxia Orient Tantalum Industry, 2011-2015

Gross Margin of Ningxia Orient Tantalum Industry by Product, 2012-2015

R&D Costs and % of Total Revenue of Ningxia Orient Tantalum Industry, 2012-2015

Silicon Carbide Revenue of Ningxia Orient Tantalum Industry, 2012-2015

Revenue and Net Income of Ningxia Orient Tantalum Industry, 2014-2019E

Revenue and Net Income of Xinjiang Tianfu Energy, 2011-2015

Revenue Breakdown of Xinjiang Tianfu Energy by Product, 2012-2015

Gross Margin of Xinjiang Tianfu Energy by Product, 2012-2015

Equity Structure of TanKeBlue Semiconductor, 2015

Key Technologies of TanKeBlue Semiconductor

Corporate Structure of TanKeBlue Semiconductor

Revenue and Net Income of TanKeBlue Semiconductor, 2011-2015

TankeBlue's Semiconductor 2-inch SiC Wafer Standards

TankeBlue's Semiconductor 3-inch SiC Wafer Standards

TankeBlue's Semiconductor 4-inch SiC Wafer Standards

TankeBlue's D-grade Silicon Carbide Crystal Standards

Main Performance Indicators of Large Crystalline Black SiC of Hanjiang Hongyuan,

Product Specification, Application, and Capacity of Weifang Liuhe

Parameters of SICC Materials N 2-inch Substrates

Parameters of SICC Materials N 3-inch Substrates

Parameters of SICC Materials N 4-inch Substrates

Parameters of Dongguan Tianyu Semiconductor’s 6-inch SiC Epitaxial Wafer

Parameters of Dongguan Tianyu Semiconductor’s 4-inch SiC Epitaxial Wafer

Global and China Vanadium Industry Report, 2018-2023

Vanadium, deemed as the “vitamin” of metals, finds wide application in steel, chemicals, new materials and new energy. There is now global research and development of vanadium for applying it to more ...

Global and China Cobalt Industry Report, 2018-2023

Cobalt, an essential raw material for lithium battery, is widely used in electric vehicles as well as computer, communication and consumer electronics. 59% of cobalt was used in lithium battery global...

Global and China Nickel Industry Report, 2017-2020

Global primary nickel output in 2016 fell 1.5% to 1.934 million tons. In 2017, as China’s nickel pig iron project in Indonesia reaches design capacity gradually, nickel metal supply is expected to hit...

Global and China Cobalt Industry Report, 2017-2021

In recent years, the global refined cobalt market has been in a state of oversupply, but the inventory has been decreasing year by year. In 2016, the global refined cobalt output and consumption were ...

China Silicon Carbide Industry Report, 2016-2020

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, sweeping more than 80% of the global total. However, excessive capacity expansi...

China Antimony Industry Report, 2016-2020

According to USGS, global antimony reserves totaled 2 million tons and antimony ore production 150,000 tons in 2015. In China, the reserves of antimony stood at 950,000 tons and antimony ore productio...

Global and China Cobalt Industry Report, 2016-2020

Cobalt is an important strategic metal used in lithium battery manufacturing, hard alloy smelting and superalloy production, mainly available in Congo, Australia, Cuba and other countries.

In 2015, t...

China Silicon Carbide Industry Report, 2015-2019

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, accounting for more than 80% of the global total. In 2014, the total silicon ca...

Global and China Antimony Industry Report, 2015

Since 2015, China’s antimony industry has been characterized by the followings:

China sees a continued decline in the output of antimony concentrates and antimony products. Owing to weak demand from ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2015-2018

Since the year 2012, due to the aftermath of the global financial crisis and the sub-prime crisis, the prosperity index of manufacturing in China has continued to decline, and the machine tool industr...

Global and China Aluminum Alloy Automotive Sheet Industry Report, 2014-2017

In recent years, driven by energy conservation and emissions reduction and improvement of fuel efficiency, auto industry has been required to develop towards an increasingly lightweight trend. A great...

China Silicon Carbide Industry Report, 2014-2017

As a major producer and exporter of silicon carbide, China contributes about 80% to the global silicon carbide capacity. In 2013, China exported 286,800 tons of silicon carbide after the abolition of ...

China Antimony Industry Report, 2014-2017

Since 2014, China’s antimony industry has been characterized by the following:

First, China holds a stable position as a major antimony producer. According to the statistics by USGS, in 2013, up...

Global and China Bi-Metal Band Saw Blade Industry Report, 2014-2017

The sales volume of bi-metal band saw blade continued to slide in China, totaling 49.45 million meters throughout the year 2013, down 2.5% year on year, largely due to international financial crisis, ...

Global and China Germanium Industry Report, 2013-2016

Germanium is a typical rare and dispersed element, associating with lignite, lead-zinc deposit and copper ore. Global proven recoverable deposits of germanium amount to 8,600 metal metric tons (MMT), ...

China Petroleum and Natural Gas Drilling and Transmission Steel Pipe Market Report, 2013-2016

Along with the sustained and stable development of China's economy as well as the accelerated industrialization, China’s demand for oil and natural gas has kept rising rapidly in recent years. In 2013...

China Aluminum Rolling Industry Report, 2013-2016

As of late 2013, the capacity of aluminum foil in China, as the world’s largest producer of aluminum sheets, strips and foils, hit 3.4 million tons/a; the capacity of aluminum cold rolling sheet/strip...

China Magnesium and Magnesium Alloy Industry Report, 2013-2016

Magnesium which is featured with low density and high strength can form high-strength alloy with aluminum, copper, zinc and other metals as an important alloying element. Currently, China is a major p...