Since GM OnStar and Toyota G-Book officially embarked on China’s market in 2009, passenger car brands have launched their own Telematics products, such as Ford SYNC, Nissan CARWINGS, SAIC InKaNet, HondaLink, Geely G-NetLink, Mercedes-Benz CONNECT, Volvo Sensus, BMW ConnectedDrive, Yueda KIA UVO, Dongfeng Citro?n Connect, Dongfeng Peugeot Blue-i, Hyundai Blue Link, Changan in Call, Chery Cloudrive and so on.

In order to occupy "the fourth screen" in the mobile Internet era, domestic and foreign Internet giants begin to highlight Internet of Vehicles (IOV) in 2014, for example, Apple has released CarPlay vehicle system, Google has launched Android Auto, Alibaba has acquired AutoNavi and cooperated with SAIC to develop connected vehicles, Tencent unveiled Lubao Box and held stake in Navinfo, Baidu collaborated with TimaNetworks to launch CARNET. As China's position in the global automotive market becomes more important, the competition in the Chinese passenger car telematics market will turn to be more intense.

Chinese passenger car telematics market falls into OEM market and aftermarket. The traditional OEM market focuses on traffic safety, such as remote assistance and other functions; the aftermarket emphasizes entertainment and other personalized services. However, OEM brands have paid more attention to the combination with mobile Internet and hope to make users have better experience; coupled with their inherent advantages in the industrial chain, they expect to master higher market share in the future.

There were more than 4,000 enterprises engaged in telematics aftermarket in China around 2012, but most of them have closed down or been struggling to survive now. For now, even large suppliers (like PATEO and Chinatsp) linked with considerable automobile companies see unsatisfying profitability. The fundamental reason lies in the lack of eye-catching telematics applications which users are eager to pay for. Navigation and radio of the traditional vehicle information system are the most frequently used functions for users. Telematics vendors intend to introduce a variety of innovative applications to intensify user viscosity, but they see little effect, which directly makes the telematics activation rate of new cars remain at less than 30%.

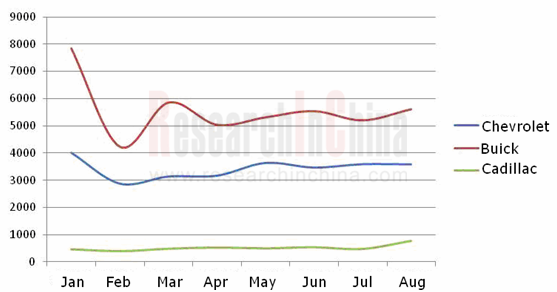

In the Chinese passenger car telematics market, GM OnStar has always played a leading role. In the first eight months of 2014, OnStar developed about 77,000 new passenger car users in China, and the majority of them were Buick owners.

Number of New Users of OnStar in China, Jan-Aug 2014

?

?

Source: ResearchInChina

Currently, the second-ranked passenger car telematics brand is Ford SYNC. In the first eight months of 2014, Ford SYNC attracted about 48,000 new users in China.

In the future, Telematics should not only function as a marketing tool for automobile enterprises to enhance sales volume, but also a product that users really need. In order to stimulate consumption, all manufacturers need to accelerate the integration of IVI and mobile Internet devices to provide users with diversified mobile Internet value-added services, as well as vigorously promote mobile mapping and connection with smart wearable devices to serve customers considerately.

With the participation of a large number of Internet companies and enriched telematics services, the activation rate of passenger car telematics services in China is expected to keep rising, and the telematics user base will also expand rapidly.

The report includes the following aspects:

Overview of Chinese passenger car telematics?market (including market profile, industry chain, market size, service contrast, product support, etc.)

Overview of Chinese passenger car telematics?market (including market profile, industry chain, market size, service contrast, product support, etc.)

Analysis on Chinese passenger car?telematics?brands (embracing business, pricing, number of new users, supported vehicle models, development strategy, technological trends, etc.);

Analysis on Chinese passenger car?telematics?brands (embracing business, pricing, number of new users, supported vehicle models, development strategy, technological trends, etc.);

Chinese passenger car TSP enterprises (products, business, application cases, customer structure, development modes, etc.).

Chinese passenger car TSP enterprises (products, business, application cases, customer structure, development modes, etc.).

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...