Autosar research: How Chinese providers seize the opportunity in the wave of software-defined vehicles.

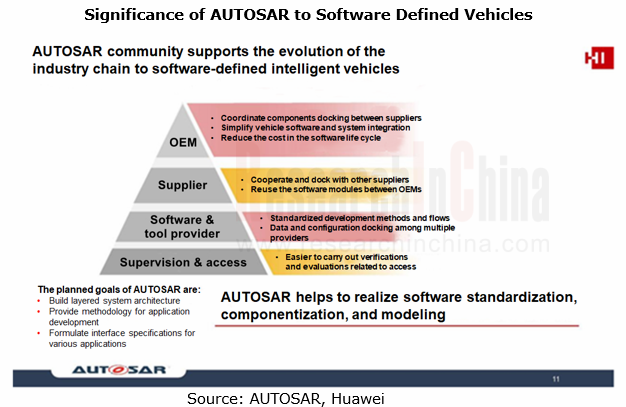

As vehicle software becomes more complicated and single vehicle software value rises, AUTOSAR empowers the automotive industry chain to evolve to software-defined vehicles rapidly, in the megatrend of software-defined vehicles. As an open system architecture and also a standard, AUTOSAR enables standardization, reusability and interoperability of software, and helps OEMs and Tier1s cut more costs.

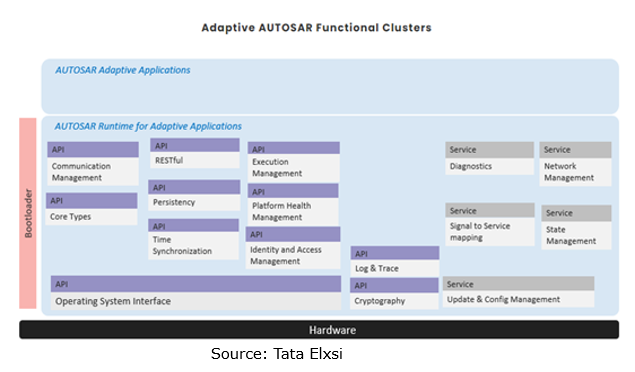

AUTOSAR has released Classic and Adaptive platform specifications. AUTOSAR Classic corresponds to the security control architecture which adopts layered design and enables decoupling of basic software layer and application layer. As E/E architectures evolve and more domain controllers are used, the central computing platform becomes a development trend, and just AUTOSAR Classic is not enough to meet the market needs. So AUTOSAR Adaptive comes into being and becomes an indispensable element to the new-generation E/E architectures.

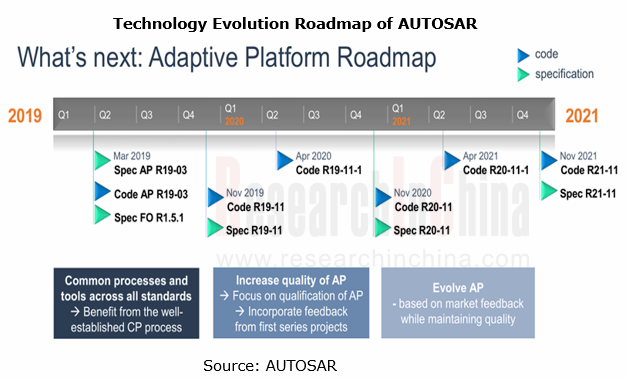

The future version of AUTOSAR Adaptive has planned 23 new features, including better interaction between AUTOSAR Classic and AUTOSAR Adaptive, and upgrade of Security and Safety. According to the roadmap, AUTOSAR will offer a new software architecture version every year.

According to the official definition, AUTOSAR Adaptive supports all future vehicle APPs, e.g., IVI, V2X, multi-sensor fusion and ADAS. AUTOSAR is a standard option of next-generation automotive basic software architectures, for many automakers, components suppliers, and software providers among others.

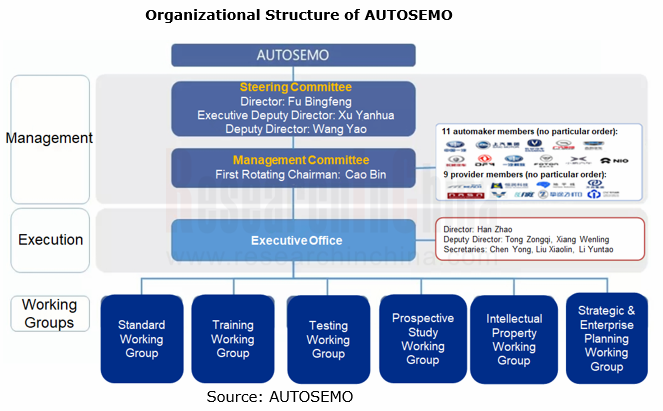

China’s vehicle basic software industry started late. The early basic software providers were foreign players. To expedite China’s vehicle basic software and create its own intellectual property system and harmonious ecosystem, Neusoft Reach and China Association of Automobile Manufactures (CAAM) jointly planed and initiated the Automotive Software Ecosystem Member Organization of China (AUTOSEMO) under the guidance of the Ministry of Industry and Information Technology of China, aiming to share and practice innovations and build open standardized software architectures, interface specifications and application frameworks together with other over 20 member units. The AUTOSEMO is dedicated to developing China’s proprietary vehicle basic software industry ecosystem and facilitate the transformation of the country’s automotive industry into an intelligent one.

The AUTOSEMO was founded in Shanghai on July 22, 2020, with 20 founder members: FAW, SAIC, GAC, NIO, Geely, Great Wall Motor, Changan Auto, Beiqi Foton, Dongfeng Motor, FAW Jiefang, Xpeng Motors, Neusoft Reach, HiRain Technologies, Shanghai Nasn Automotive Electronics, Horizon Robotics, Suzhou Zhito Technology, Wanxiang Qianchao, Shenzhen VMAX Power, Shanghai Re-Fire Technology, and China Automotive Innovation. Neusoft Reach acted as the first rotating chairman.

The missions of the AUTOSEMO are: to formulate local companies-led proprietary basic software architecture standards and interface specifications for future intelligent connected vehicles (ICV) to share knowledge and results and build an industrial ecosystem; to create a vehicle software ecosystem communication platform for the industry with the concept of independence, development and innovation.

In November 2020, the AUTOSEMO introduced the China Automotive Basic Software Development White Paper 1.0, which analyzes all opportunities and challenges in the development of China's automotive basic software, sorts out the status quo of China's automotive basic software industry, and puts forward the hot issues in the industry.

In June 2021, the AUTOSEMO publicized the Vehicle SOA Software Architecture Specification 1.0, the first theoretical system of SOA software architecture for the automotive industry.

In September 2021, the AUTOSEMO released China Automotive Basic Software Development White Paper 2.0 and Vehicle SOA Software Architecture Specification 1.1 at the World Intelligent Connected Vehicles (ICV) Conference, two upgraded versions which elaborate background and architecture of SOA standards, overall framework of AUTOSEMO Service Framework (ASF), promotion plan of ASF group standards working group, and development of AUTOSEMO standards.

Foreign providers work to explore the application of AUTOSAR in ICV.

Through the lens of market pattern, overseas providers such as EB (Continental), ETAS (Bosch) and VECTOR have played a dominant role in AUTOSAR Classic standard-compliant development tool chain and basic software; typical Chinese players are Neusoft Reach, Huawei and iSoft Infrastructure Software. Foreign companies with a long foothold in AUTOSAR are endeavoring to explore the application of AUTOSAR Adaptive in ICV fields (ADAS, intelligent cockpit, OTA, etc.). Examples include EB, the first one to probe AUTOSAR Adaptive Platform (AUTOSAR AP), having partnered with Volkswagen on use of its SOA platform in ID.3 (4) and gaining a leading edge.

? EB keeps extending its AUTOSAR tool chain and adding product features.

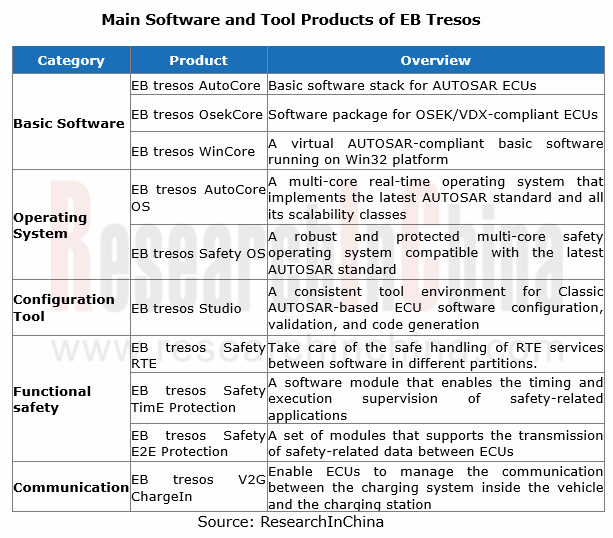

As an established AUTOSAR provider, EB boasts a full range of product lines, including AUTOSAR Adaptive products like EB Corbos Linux, EB corbos Hypervisor, EB corbos Studio, EB corbos Adaptive Core and EB xelor, and the AUTOSAR Classic software tool EB tresos.

In late 2020, EB launched EB xelor, an all-in-one software platform for creating next-generation automotive electronics architectures based on high-performance computers (HPCs). It can reduce OEMs’ HPC engineering efforts by up to 30%.

In June 2021, EB added EB tresos V2G ChargeIn, a new, in-vehicle, AUTOSAR-compatible software module that—in combination with an ISO 15118-compliant communication stack—enables ECUs to manage the communication between the charging system inside the vehicle and the charging station. In addition, through a partnership with SEVENSTAX, EB tresos AutoCore now integrates the fully ISO 15118-compliant SEVENSTAX application stack, supporting the latest V2G communication features.

? Tata Elxsi unveiled a new intelligent cockpit application.

In November 2021, Tata Elxsi and Green Hills Software announced their collaboration on a Driver Monitoring System (DMS) platform that combines advanced DMS software (V.O.E.O.S.Y.S, Vehicle Operator Environment Observation System) and AUTOSAR Adaptive from Tata Elxsi integrated with the safe and secure INTEGRITY? real-time operating system (RTOS) from Green Hills Software optimized to run on the latest families of automotive-grade microprocessors.

The integrated AUTOSAR Adaptive-based DMS delivers intelligent determination of a driver’s readiness and state of attentiveness and runs on the safe, secure INTEGRITY-based high-performance platform.

? Wind River makes great efforts on autonomous driving application.

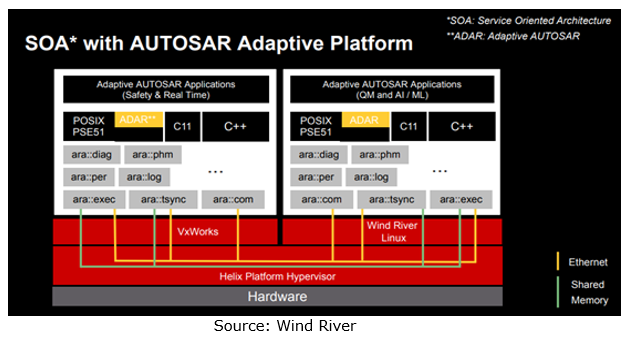

In April 2021, Wind River collaborated with Vector to deliver service-oriented architecture (SOA) capabilities for the development of advanced driver assistance systems (ADAS) and autonomous driving based on the AUTOSAR Adaptive standard. The joint solution comprises Vector’s AUTOSAR Adaptive technologies and the new Wind River Studio, which includes the VxWorks? real-time operating system (RTOS).

In October 2021, Wind River announced that TüV SüD endorsed an ISO 26262 ASIL-D certification program for its AUTOSAR Adaptive software platform which provides a foundation for a next-generation ADAS and autonomous driving systems.

Chinese providers try hard to deploy and develop independently.

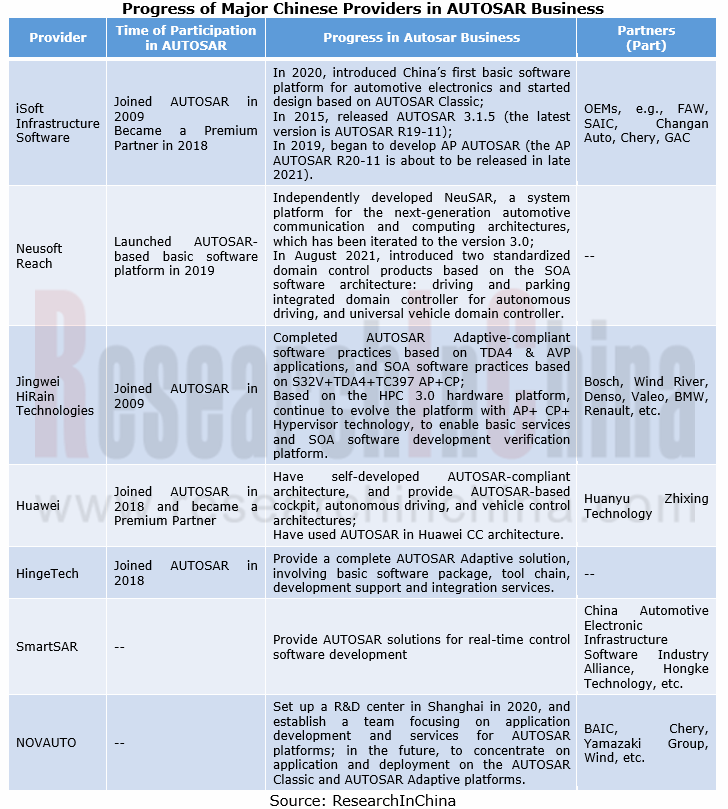

In China, local companies are trying hard to self-develop AUTOSAR Classic. Both Chinese and foreign companies are still in their infancy in AUTOSAR Adaptive development. Chinese providers exert great efforts on it amid an unclear competitive pattern.

? iSoft Infrastructure Software

In November 2021, iSoft Infrastructure Software and SemiDrive built strategic cooperation on automotive chips, operating systems, and basic software. They have launched a complete AUTOSAR Classic solution based on SemiDrive G9X smart gateway chip.

With MCAL from SemiDrive, and AUTOSAR OS, RTE and BSW provided by iSoft Infrastructure Software, the solution is a totally proprietary software and hardware AUTOSAR solution that meets functional safety requirements. The software and hardware integrated digital base of the solution not only helps customers shorten the evaluation cycle and save development costs but brings the computing capability of SemiDrive chips into a better play, making it easier to develop software.

iSoft Infrastructure Software’s Configuration Tool at the underlying layer MCAL of the solution seamlessly connects ORIENTAIS AUTOSAR products and components. Based on ORIENTAIS AUTOSAR, it enables complete gateway basic functions: AUTOSAR OS, CAN communication, LIN communication, CAN network management, NVM protocol stack, system management, CSM, Wathchdog, etc.

SemiDrive previously used EB tresos Studio based on AUTOSAR Classic to develop automotive chip underlying software on the AUTOSAR standard-compliant microcontroller abstraction layer (MCAL) development platform. The selection of iSoft’s basic software is the evidence that the technical strength of Chinese providers is gaining recognition.

? Neusoft Reach

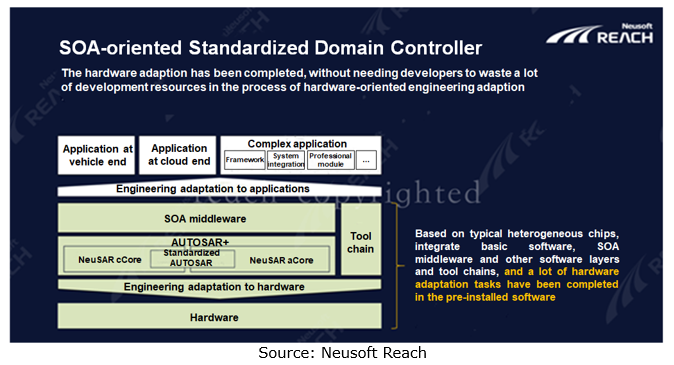

In November 2020, Neusoft Reach upgraded NeuSAR, its self-developed AUTOSAR-compliant system platform for next-generation automotive communication and computing architectures, to the version 3.0. With years of iteration and development, NeuSAR has been used widely and deployed in such application scenarios as traditional ECU, domain controller, central computing unit and vehicle cloud integration, providing AUTOSAR standard-compliant products and services like aCore, cCore, middleware, and tool chain, for autonomous driving, intelligent connection, vehicle domain, EV power domain and other fields.

In August 2021, Neusoft Reach rolled out two standardized domain control products: driving and parking integrated domain controller for autonomous driving, and universal vehicle domain controller. At the software layer, the two products are SOA-based software architectures with preset standardized basic software and middleware for autonomous driving, and standard configuration of Neusoft Reach’s self-developed AUTOSAR-compliant basic software products—NeuSAR and related development tools, based on which developers can develop upper layer applications and iterate functions rapidly.

In the fast disruption in the intelligent vehicle industry, basic software providers need to partner closely with automakers to satisfy the changing needs of the upper-layer applications for the underlying software. Neusoft Reach hopes to be a participant in framework construction and a provider of key components and services (e.g., standard AUTOSAR components and middleware on AUTOSAR basic software) in the development of the industry, and help automakers build their own iterable software systems by catering to their application development needs, so as to speed up the evolution of the automotive industry to an intelligent one.

? Huawei

Huawei’s self-developed AUTOSAR-based architectures are autonomous and controllable, delivering high matching rate, high integration and high degree of freedom. Based on its deep understanding of AUTOSAR, Huawei introduced its self-developed VOS architecture that supports the evolution from the international AUTOSAR specifications to Chinese vehicle specifications.

Based on AUTOSAR AP architecture, Huawei is working to make its vehicle products deploy and upgrade applications just as a smartphone. Moreover, it is easier for different Tier-1 suppliers to integrate and upgrade on a single multi-core controller. They are also allowed to independently develop power domain, chassis domain, body domain and entertainment domain and eventually realize more efficient integration.

The AUTOSAR Basic Software Platform Report, 2021 highlights the following:

AUTOSAR (basic concept, classification, industry standards, competitive pattern, etc.);

AUTOSAR (basic concept, classification, industry standards, competitive pattern, etc.);

The role of AUTOSAR in the evolution of EE architectures, the impact of AUTOSAR on vehicle networks, the development roadmap of AUTOSAR Adaptive, etc.;

The role of AUTOSAR in the evolution of EE architectures, the impact of AUTOSAR on vehicle networks, the development roadmap of AUTOSAR Adaptive, etc.;

AUTOSAR application (OTA, ADAS, intelligent cockpit, vehicle control, SOA, etc.);

AUTOSAR application (OTA, ADAS, intelligent cockpit, vehicle control, SOA, etc.);

Foreign and Chinese AUTOSAR companies (product lines, new business orientations, etc.).

Foreign and Chinese AUTOSAR companies (product lines, new business orientations, etc.).

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...

New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and com...