Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

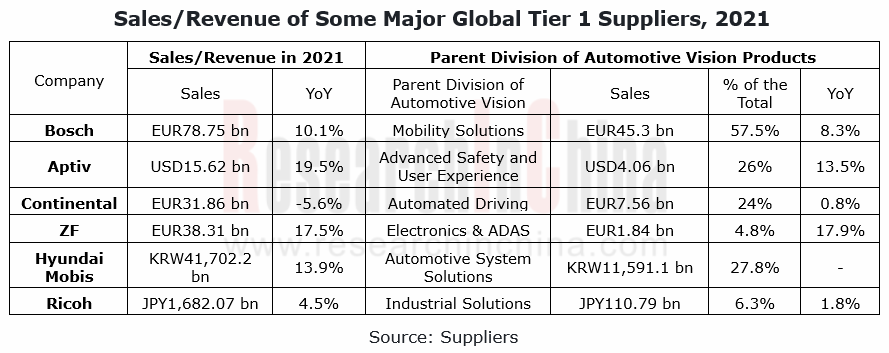

1. The revenues of major Tier 1 suppliers in 2021 sustained growth, as they made comprehensive layout of automotive vision business.

Denso registered total sales JPY5.5 trillion in 2021, of which JPY1.4 trillion (6.6% YoY), or 24.6% of the total was contributed by Mobility Electronics Division that operates automotive vision products. Denso's existing products contain front-view mono/stereo cameras, surround-view cameras, electronic rear-view mirrors and DMS as well as camera/radar combinations and ADAS/autonomous driving solutions.

Bosch sold a total of EUR78.75 billion (equivalent to USD78.55 billion) in 2021, a year-on-year increase of 10.1%, of which the sales of Mobility Solutions, a business sector operating automotive vision products, rose by 8.3% to EUR45.3 billion, sweeping 57.5% of the total. At present Bosch's products include front-view mono/stereo cameras, rear-view mirrors, surround-view cameras, DMS and OMS, as well as ADAS/autonomous driving/automated parking solutions.

Hyundai Mobis’ total sales jumped by 13.9% from a year earlier to KRW41,702.2 billion (equivalent to USD29.9 billion) in 2021, and Automotive System Solutions Division engaged in automotive vision products sold KRW11,591.1 billion, or 27.8% of the total. Hyundai Mobis' products cover front-view mono cameras, surround-view cameras, electronic rear-view mirrors, DMS, and OMS.

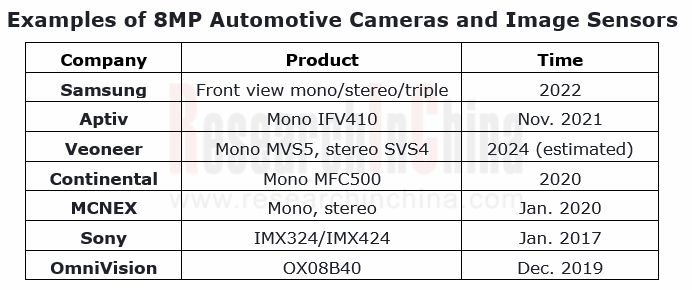

2. Camera resolution becomes increasingly high, and the era of 8 megapixels is around the corner.

The upgrade of ADAS sensing functions requires higher camera resolution. Ordinary automotive cameras generally feature about 1.2 megapixels. As ADAS sensing function upgrade algorithms get improved, a higher camera resolution is required. 8MP cameras deliver a detection range 3 times longer than 1.2MP cameras. High resolution automotive cameras will become a megatrend.

As concerns upstream contact image sensor (CIS) suppliers, OmniVision OX08B40 has supported 8-megapixel cameras in 2019; ON Semiconductor AR0820AT rolled out in 2018 boasts 8.3 megapixels; based on the previous generation with 7.42 megapixels, Sony's next-generation image sensors will offer 8 megapixels.

As for camera suppliers, many of the cameras starting mass production in 2020 are 8-megapixel front-view cameras, including: 8MP front-view mono camera Aptiv introduced in 2021; 8MP front-view mono camera Continental began to spawn in 2020; Samsung's front-view mono/stereo/triple cameras with the maximum resolution up to 12 megapixels. In June 2022, Samsung announced that it will start providing cameras for most Tesla models from the next year.

3. 120-140dB HDR becomes widespread, and 140+dB HDR becomes a future trend.

High dynamic range (HDR) allows quick recognition of details in brightness and darkness in different lighting conditions, and enables accurate image capture. For example, a typical HDR scenario requires vehicles to recognize details in both brightness and darkness when exiting a tunnel, and at night to detect pedestrians in extreme darkness and fairly bright vehicle lights and LED signal lights.

At present, the dynamic range of automotive cameras often ranges at 120-140dB. 130-140dB HDR image sensors have been largely seen. One example is OX03C10, a 2.5MP ASIL-C image sensor introduced by OmniVision in 2020, which provides 140dB HDR and supports rearview cameras, surround view systems and electronic rearview mirrors among others.

140+dB HDR will become a future trend. For example, the 8MP image sensor announced by ON Semiconductor in May 2022 achieves 155 dB HDR, and features LED flicker mitigation (LFM) super exposure (SE) technology.

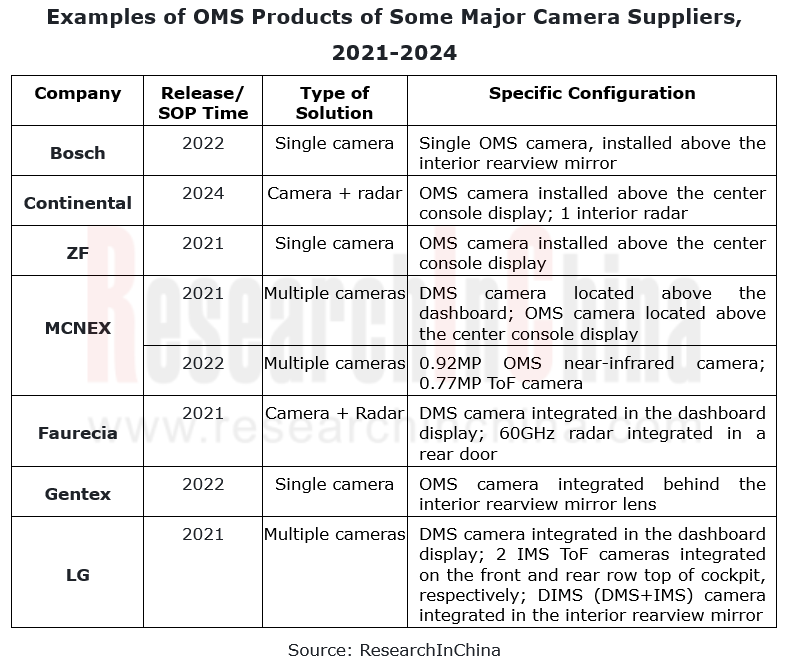

4. Leading Tier 1s work to deploy DMS/OMS, and vital sign detection function becomes a standard configuration for OMS.

The vital sign detection function is used for detecting children. Application of this feature is primarily pushed by regulations, policies and safety standards. For example, starting in 2023, Euro NCAP Child Presence Detection (CPD) requirement will be worth up to four points. This feature is required to detect a child’s presence in the vehicle and alert the vehicle user or emergency services. The Hot Car Act of 2021 (proposed in 2019) the US published in May 2019 requires all new passenger motor vehicles to be equipped with a child safety alert system.

At present, the common vital sign monitoring solutions include camera, radar, ultrasonic, gravity sensor, and in-vehicle carbon dioxide concentration monitor. Through the lens of development trends, OMS camera and interior radar are the solutions most widely adopted by OEMs.

The camera-based vital sign detection uses a camera to directly recognize occupants in the car. The main technologies include structured light and AI cloud. The camera is often installed at the top center of cockpit, or above center console display or interior rearview mirror. Models equipped with this solution like 2022 BMW iX adopt Aptiv’s occupant perception platform where an OMS camera above interior rearview mirror enables vital sign detection in the cockpit.

For interior radar-based vital sign detection, the radar generally lies at B-pillars or rear doors. For example, the cockpit monitoring system to be unveiled by Continental in 2024 enables redundancy detection with interior radar on the top of cockpit and OMS camera above center console display, detecting adults, children, objects and pets. In terms of models with interior radar-enabled OMS, like Great Wall 2021 WEY VV6, after driver turns off car and locks doors, if detecting vital signs in the car with the radar built in driver's side B-pillar, the system will send vital sign information to driver's mobile phone.

1 Status Quo and Development Trend of Global Passenger Car Vision Industry

1.1 Overview

1.1.1 Introduction and Functional Classification of Automotive ADAS

1.1.2 Vehicle Camera Classification and Supported ADAS Functions

1.1.3 Vehicle Camera Industry Chain

1.1.4 Enterprise Layout of Vehicle Camera Industry Chain

1.2 Status Quo and Development Trend of Global Passenger Car Vision Industry

1.2.1 Trend 1

1.2.2 Trend 2

1.2.3 Trend 3

1.2.4 Trend 4

1.2.5 Trend 5

1.2.6 Trend 6

1.2.7 Trend 7

1.2.8 Trend 8

1.2.9 Trend 9

1.2.10 Trend 10

1.2.11 Trend 11

1.2.12 Trend 12

1.2.13 Trend 13

1.2.14 Trends 14

1.2.15 Trend 15

2 Research on Foreign Passenger Car Vision Enterprises

2.1 Summary Analysis of Foreign Passenger Car Vision Enterprises - Basic Information

2.2 Summary Analysis of Foreign Passenger Car Vision Enterprises - Product Summary

2.3 Denso

2.3.1 Profile

2.3.2 Revenue

2.3.3 Vision Product Category & Product Customers

2.3.4 Passenger Car Vision Products - Front View Camera

2.3.5 Passenger Car Vision Products - Surround View System

2.3.6 Passenger Car Vision Products - Electronic Rearview Mirrors

2.3.7 Passenger Car Vision Products-DMS

2.3.8 Commercial Vehicle Vision Products-DMS

2.3.9 Summary of Passenger Car Vision Products

2.3.10 Vision Product Timeline

2.3.11 Dynamics of Vision Products

2.3.12 ADAS Product Timeline

2.3.13 Autonomous Driving Solutions

2.3.14 ADAS Solutions

2.3.15 Intelligent Mobile Electronics Department

2.3.16 Autonomous Driving Development Plan

2.3.17 Long-term Development Plan

2.4 Bosch

2.4.1 Profile

2.4.2 Revenue

2.4.3 Vision Product Category & Product Customers

2.4.4 Passenger Car Vision Products - Front View Cameras

2.4.5 Passenger Car Vision Products - Surround View System & Rearview Camera

2.4.6 Passenger Car Vision Products - DMS & OMS

2.4.7 Summary of Passenger Car Vision Products

2.4.8 Vision Product Timeline

2.4.9 Development History of Bosch Vision Products

2.4.10 ADAS Solutions

2.4.11 Autonomous Driving Solutions

2.5 APTIV

2.5.1 Profile

2.5.2 Revenue

2.5.3 Product Category & Product Customers

2.5.4 Passenger Car Vision Products - Front View Cameras

2.5.5 Passenger Car Vision Products - Front View Camera Fusion Products

2.5.6 Passenger Car Vision Products - OMS

2.5.7 Summary of Passenger Car Vision Products

2.5.8 Development History of Vision Products

2.5.9 ADAS Solutions

2.5.10 Autonomous Driving Solutions

2.6 Panasonic Automobile

2.6.1 Profile

2.6.2 Vision Product Classification

2.6.3 Passenger Car Vision Products - Rear View Camera

2.6.4 Passenger Car Vision Products - Surround View System

2.6.5 Passenger Car Vision Products - Electronic Rearview Mirrors

2.6.6 Passenger Car Vision Products - DMS & OMS

2.6.7 Commercial Vehicle Vision Products - Electronic Front View Mirrors

2.6.8 Summary of Passenger Car Vision Products

2.6.9 Vision Product Timeline

2.6.10 Automatic Parking Solutions

2.6.11 Automotive Vision Technology

2.6.12 Summary of Vision Business Development

2.6.13 Changes in Corporate Structure

2.7 Veoneer

2.7.1 Profile

2.7.2 Revenue

2.7.3 Vision Product Classification

2.7.4 Passenger Car Vision Products - Front View Cameras

2.7.5 Passenger Car Vision Products - Night Vision Systems

2.7.6 Passenger Car Vision Products - DMS

2.7.7 Summary of Vision Products

2.7.8 Vision Product Timeline

2.7.9 ADAS Technology Release in 2021

2.7.10 ADAS Products Installation in 2021

2.7.11 ADAS Product Customer Distribution in 2021

2.8 Continental

2.8.1 Profile

2.8.2 Revenue

2.8.3 Vision Product Classification

2.8.4 Passenger Car Vision Products - Camera Summary & Front View Camera Fusion

2.8.5 Passenger Car Vision Products - Front View Camera

2.8.6 Passenger Car Vision Products - Surround View System & Rearview Camera

2.8.7 Passenger Car Vision Products - DMS & OMS

2.8.8 Passenger Car Vision Products - Electronic Mirrors & Virtual A-Pillars

2.8.9 Summary of Vision Products

2.8.10 Vision Product Timeline

2.8.11Autonomous Driving Solutions

2.8.12 Automatic Parking Solutions

2.8.13 Sensor Fusion Technology

2.9 ZF

2.9.1 Profile

2.9.2 Organizational Structure

2.9.3 Operations

2.9.4 Vision Product Classification

2.9.5 Passenger Car Vision Products - Front View Cameras

2.9.6 Passenger Car Vision Products - Surround View System

2.9.7 Passenger Car Vision Products - OMS

2.9.8 Automotive Product Summary

2.10 MCNEX

2.10.1 Profile

2.10.2 Revenue

2.10.3 Vision Product Category & Product Customers

2.10.4 Passenger Car Vision Products - Front View Cameras

2.10.5 Passenger Car Vision Products - Front View Cameras & Rear View Cameras

2.10.6 Passenger Car Vision Products - Electronic Mirrors

2.10.7 Passenger Car Vision Products - OMS

2.10.8 Passenger Car Vision Products - Surround View System & Vision System Integration Solution

2.10.9 Vision System Fusion Solution

2.10.10 Camera Housing & Layer Solutions

2.10.11 Summary of Vision Products

2.10.12 Development History & Dynamics of Vision Products

2.11 Magna

2.11.1 Profile

2.11.2 Revenue

2.11.3 Vision Product Classification

2.11.4 Passenger Car Vision Products - Front View Cameras & Surround View Systems

2.11.5 Passenger Car Vision Products - Electronic Mirrors

2.11.6 Passenger Car Vision Products - DMS & OMS

2.11.7 Summary of Passenger Car Vision Products

2.11.8 Autonomous Driving Solutions

2.11.9 Automated Parking Solutions

2.12 Valeo

2.12.1 Profile

2.12.2 Revenue

2.12.3 Autonomous Driving Product Category & Product Customers

2.12.4 Vision Product Classification

2.12.5 Passenger Car Vision Products - Front View Cameras

2.12.6 Passenger Car Vision Products - Surround View System

2.12.7 Passenger Car Vision Products - Electronic Mirrors

2.12.8 Summary of Vision Products

2.12.9 Development History of Vision Products

2.12.10 Automated Parking Solutions

2.12.11ADAS Solutions

2.12.12Autonomous Driving Solutions

2.12.13 Intent Prediction Technology

2.12.14 Vision Product Partners

2.13 Faurecia

2.13.1 Profile

2.13.2 Revenue

2.13.3 Vehicle Vision Product Classification

2.13.4 Timeline of Vehicle Vision Products

2.13.5 Passenger Car Vision Products - Electronic Mirrors

2.13.6 Passenger Car Vision Products - OMS

2.13.7 Passenger Car Vision Products - Rear View Cameras

2.13.8 Commercial Vehicle Vision Products - Rear View Cameras

2.13.9 Commercial Vehicle Vision Products - Rear Angle Camera & Side Camera

2.13.10 Commercial Vehicle Vision Products - All Position Cameras & Wireless Cameras

2.13.11 Commercial Vehicle Vision Products - Surround View System

2.13.12 Commercial Vehicle Vision Products - Vision System Solutions

2.13.13 Summary of Passenger Car Vision Products

2.13.14 Summary of Commercial Vehicle Vision Products

2.13.15 Automatic Parking Solutions

2.14 Gentex

2.14.1 Profile

2.14.2 Revenue

2.14.3 Vision Product Classification

2.14.4 Passenger Car Vision Products - OMS

2.14.5 Passenger Car Vision Products - Electronic Rearview Mirrors

2.14.6 Summary of Passenger Car Vision Products

2.14.7 Development Plan

2.15 First Sensor

2.15.1 Profile

2.15.2 Revenue

2.15.3 Vision Product Classification

2.15.4 Vision Product Customer

2.15.5 Passenger Car Vision Products - DMS

2.15.6 Passenger Car Vision Products - Rear View Cameras

2.15.7 Passenger Car Vision Products - Front View Cameras

2.15.8 Passenger Car Vision Products - Surround View Systems & Custom Cameras

2.15.9 Summary of Vision Products

2.16 Hyundai Mobis

2.16.1 Profile

2.16.2 Revenue

2.16.3 Vision Product Category & Product Customers

2.16.4 Passenger Car Vision Products - Cameras

2.16.5 Passenger Car Vision Products - DMS & OMS

2.16.6 Summary of Passenger Car Vision Products

2.16.7 Technical Summary of ADAS/Autonomous Driving Products

2.16.8 Development History & Planning of Automotive Products

2.16.9 Investment Cooperation and Global Expansion History

2.16.10 Layout in China

2.17 LG

2.17.1 Profile

2.17.2 Automotive Product Layout

2.17.3 Passenger Car Vision Products - Front View Camera & Surround View System

2.17.4 Passenger Car Vision Products - OMS

2.17.5 Summary of Automotive Products

2.17.6 Development Trends of Vision Products

2.18 Ricoh

2.18.1 Profile

2.18.2 Revenue

2.18.3 Automobile Product Classification

2.18.4 Passenger Car Vision Products - Front View Camera

2.18.5 Passenger Car Vision Products - Lens Units & Cameras

2.18.6 Summary of Automobile Products

2.18.7 Development Trends of Automobile Products

2.19 Hitachi Astemo

2.19.1 Profile

2.19.2 Revenue

2.19.3 Vision Product Classification

2.19.4 Passenger Car Vision Products - Front View Cameras

2.19.5 Development Trends of Vision Products

2.20 Samsung

2.20.1 Profile

2.20.2 Revenue

2.20.3 Vision Product Category

2.20.4 Vision Product Production & Major Customers

2.20.5 Passenger Car Vision Products - Cameras

2.20.6 Samsung Harman Passenger Car Vision Products - Surround View System

2.20.7 Samsung Harman Passenger Car Vision Products - Electronic Mirrors

2.20.8 Samsung Harman Passenger Car Vision Products - DMS/OMS

2.20.9 Samsung Semiconductor Products

2.20.10 Samsung Semiconductor Products - Image Sensors

2.20.11 Summary of Vehicle Vision Products

2.20.12 Vision Product Timeline

2.20.13 Dynamics of Samsung Vision Products

2.20.14 Development Trend of Samsung Automotive Semiconductor Products

3 Foreign Key Passenger Car Vision Chip Vendors and Algorithm Companies

3.1 Mobileye

3.1.1 Profile

3.1.2 Vision Chip

3.1.3 Implementation of Vision Chip Products

3.1.4 Vision System Solutions

3.1.5 Mobileye Vision Algorithm

3.1.6 Object Recognition Technology

3.2 On Semiconductor

3.2.1 Profile

3.2.2 Vision Product Category & Product Customers

3.2.3 CMOS Image Sensor

3.2.4 Summary of Vision Products

3.2.5 Dynamics of Vision Products

3.2.6 Automotive Product Partners

3.3 OmniVision Technologies

3.3.1 Profile

3.3.2 Image Processor

3.3.3 Development Trends of Vision Products

3.4 Sony

3.4.1 Profile

3.4.2 Automotive Product Classification

3.4.3 Automotive CMOS Products

3.4.4 Summary of Vision Products

3.4.5 Vision Product Timeline

3.4.6 Development History of Automotive CMOS

3.5 Texas Instruments

3.5.1 Profile

3.5.2 Vision Product Classification

3.5.3 SoC-TDA2 Series

3.5.4 SoC-TDA3 Series

3.5.5 SoC-TDA4 Series

3.5.6 Summary of Some Automotive SoC Products

3.6 Xilinx

3.6.1 Profile

3.6.2 Vision Product Classification

3.6.3 SoC

3.6.4 Summary of Vision Products

3.7 Cipia

3.7.1 Profile

3.7.2 Vision Product Category & Product Timeline

3.7.3 Vision Algorithm

3.7.4 Commercial Vehicle Vision Products - DMS & OMS

3.7.5 Summary of Vision Products

3.7.6 Dynamics of Vision Products

3.8 StradVision

3.8.1 Profile

3.8.2 Product Categories & Customers & Product Timeline

3.8.3 Autonomous Driving Algorithm

3.8.4 Autonomous Driving SoC

3.8.5 Summary of Vision Products

3.8.6 Dynamics of Vision Products

3.9 Foresight

3.9.1 Profile

3.9.2 Vision Product Category & Product Customers

3.9.3 Vision System Solutions

3.9.4 Summary of Vision Products

3.9.5 Foresight Vision Product Timeline

3.9.6 Dynamics of Vision Products

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...

China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure This report highlights the passenger car L2+ and above (including L2+, ...

Automotive Cockpit Domain Controller Research Report, 2023

Research on cockpit domain controllers: various forms of products are mass-produced and mounted on vehicles, and product iteration speeds up.

Both quality and quantity have been improved, and the it...

Chinese Passenger Car OEMs’ Overseas Layout Research Report, 2023

OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

During 2021-2022, the global economy ...

Global and Chinese Automakers’ Modular Platform and Technology Planning Research Report, 2023

Research on modular platforms: explore intelligent evolution strategy of automakers after modular platforms become widespread.

By analyzing the planning of international automakers, Chinese conventi...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

The automo...