China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

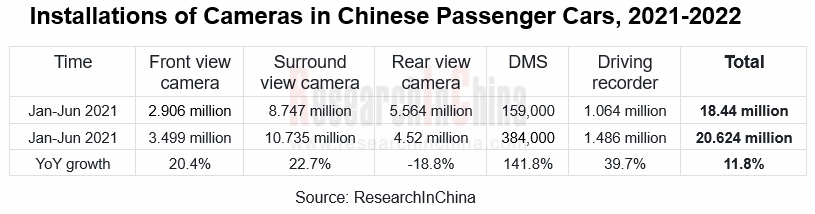

According to ResearchInChina, China installed 20.624 million cameras in new cars in 2022H1, a year-on-year increase of 11.8%. By market segments, the installations of front view cameras increased by 20.4% year-on-year to 3.499 million units in 2022H1; the installations of surround view cameras jumped by 22.7% year-on-year to 10.735 million units; the installations of rear view cameras decreased by 18.8% year-on-year to 4.52 million units; the installations of DMS cameras swelled by 141.8% year-on-year to 384,000 units; the installations of driving recorders ascended by 39.7% year-on-year to 1.486 million units.

China will install 75.4 million cameras in 2025 under the impulse of following factors:

1) Policies

The state and cities have actively launched policies related to autonomous driving in order to promote development and commercialization of autonomous driving industry. On March 1, 2022, China officially implemented "Autonomous Driving Classification” as a new national standard. On August 1, Shenzhen officially enforced "Regulations on Administration of Intelligent Connected Vehicles in Shenzhen Special Economic Zone", allowing fully autonomous vehicles to hit the road. On September 5, Shanghai issued "Implementation Plan for Accelerating Innovation and Development of Intelligent Connected Vehicles in Shanghai", stipulating that Shanghai should initially build a leading domestic innovation and development system for intelligent connected vehicles by 2025.

2) OEMs

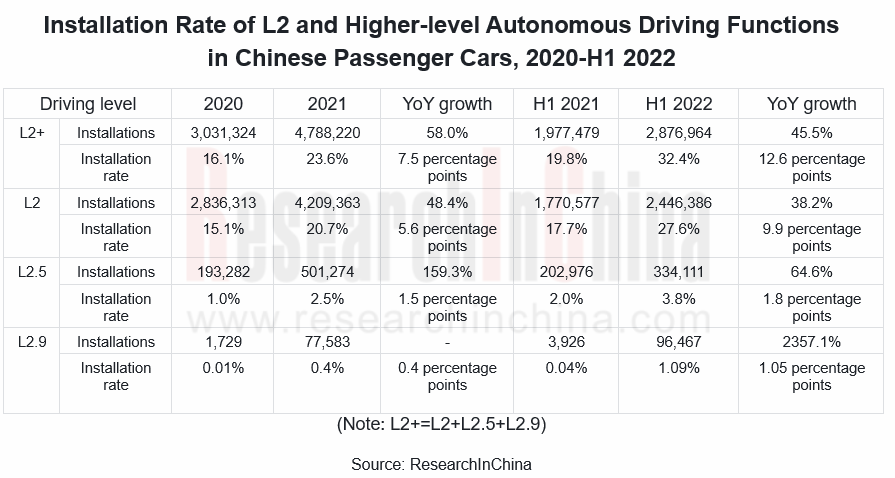

In 2022H1, 2.877 million vehicles boasted L2+ functions, accounting for 32.4% which jumped 12.6 percentage points year-on-year. In particular, the installation rate of L2.5 and L2.9 ticked up dramatically. Many OEMs are deploying L3 and higher-level autonomous driving. In the later stage, autonomous driving above L2.9 will become standard.

Traditional OEMs deploy autonomous driving by partnering with technology companies or launching new brands. For example, BYD teamed up with NVIDIA and Baidu in February and March 2022 respectively. NVIDIA will provide intelligent driving technology, and Baidu will offer a complete solution for L3 intelligent driving. In March 2022, GAC released its new electric brand “e:NP” and the first battery-electric vehicle “e:NP1” under the brand to embody "electrification". The vehicle enables L3 intelligent driving.

Emerging automakers focus on independent development. NIO, Li Auto and Xpeng have successively embarked on full-stack self-research of software and algorithms. Xpeng’s full-stack self-developed XPilot driving assistance system has continuously upgraded. Currently, XPilot 3.5 can make L3 autonomous driving possible. XPilot 4 is now available on G9, and it is scheduled to complete the transition to autonomous driving in 2026.

2. 2022H1, Bosch, Denso, and Aptiv enjoyed 52.28% share of the front view camera market, and Chinese local player Jingwei Hirain Technologies was shortlisted in the top ten

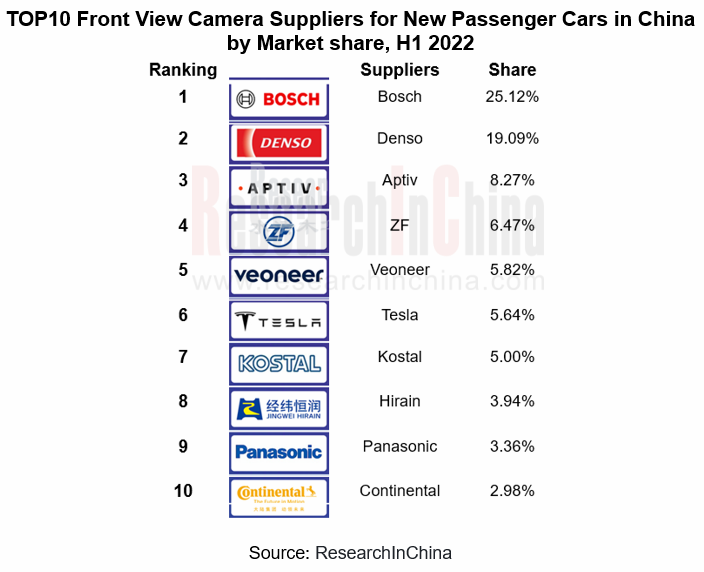

In 2022H1, Chinese front view camera market for new passenger cars was mainly occupied by foreign suppliers like Bosch, Denso, and Aptiv. Bosch grasped the market share of 25.12% by serving BYD, Honda, BMW, Changan, etc. Denso secured the market share of 19.09% as a partner of Toyota. The market share of Aptiv whose main customers included Volvo, GAC, SAIC, etc. hit 8.27%.

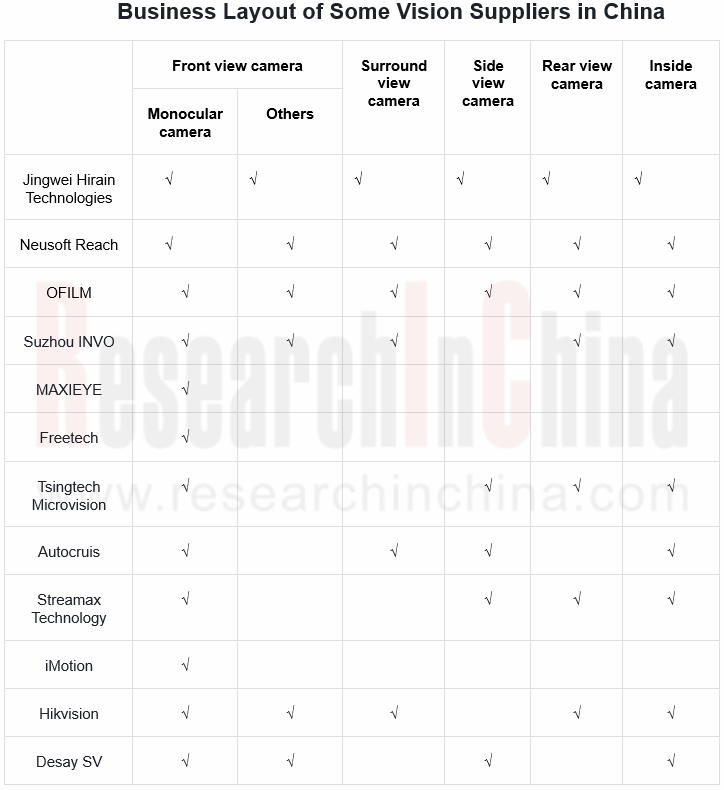

Jingwei Hirain Technologies is the only Chinese local company that ranked among the top 10 front view camera suppliers for new passenger cars in China. Established in 2003, Jingwei Hirain Technologies entered ADAS field in 2016, mainly serving OEMs such as SAIC, FAW, Geely, etc.. Its main products include ADCU, ADAS, LMU, DMS, T-BOX, GW, etc., among which ADAS cameras have evolved to the fifth generation. In the future, a new generation of super-high-computing-power intelligent driving domain controllers, intelligent cockpit perception controllers, 3D cameras and other new products will be developed for domestic chips or foreign higher-computing-power chips, ISP technology, and in-cockpit three-dimensional perception technology.

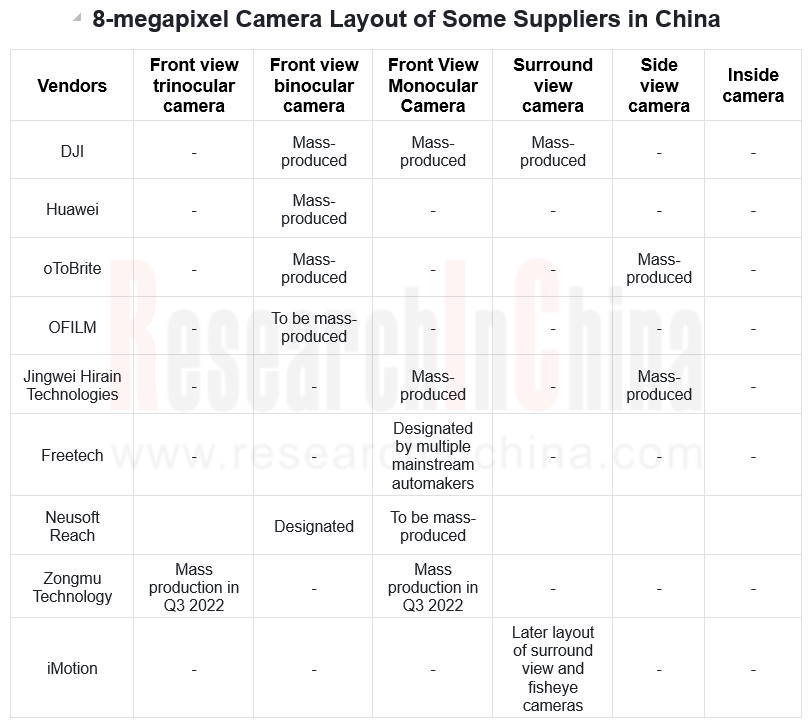

3. The 8-megapixel era of automotive cameras began

As autonomous driving levels up, the demand for automotive cameras is reflected in perception lenses instead of imaging lenses, and the application scenarios have expanded from simple scenarios to multi-directional scenarios. Besides, the system has higher and higher requirements for camera resolution. Driven by market demand, 8-megapixel cameras with higher definition, wider field of view and longer detection distance are more and more favored by OEMs.

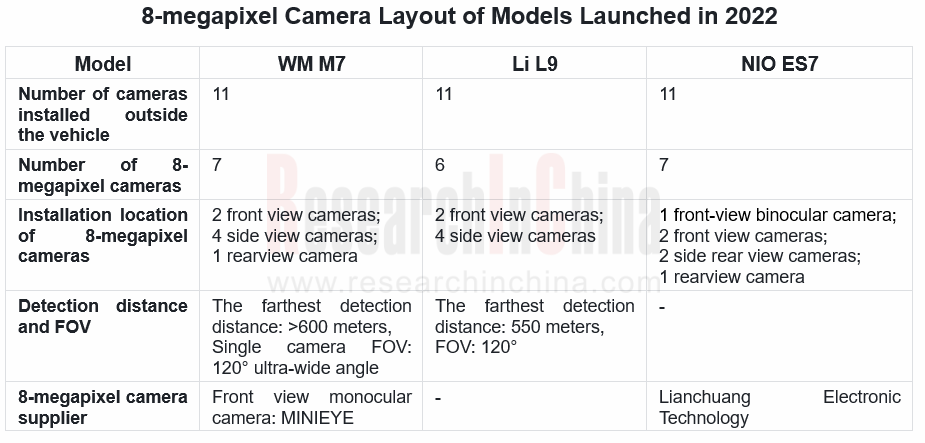

Of the models launched in 2022, those with 8-megapixel cameras account for a higher proportion than before. For example, Li L9 and NIO ES7 unveiled in June 2022 are equipped with 11 cameras each; specifically, Li L9 has six 8-megapixel cameras, and NIO ES7 boasts seven 8-megapixel cameras. WM M7, which will debut in 2022Q4, will feature a total of 11 cameras (including seven 8-megapixel cameras) which cover all scenarios ranging from parking in compounds, urban roads to intercity expressways.

With the support of OEMs for assisted driving functions, suppliers have begun to vigorously deploy R&D and production of high-resolution camera modules. For example, the third-generation front view camera FVC3 released by Freetech in August 2022 has 8 megapixels, the farthest vehicle detection distance of 250 meters, and the farthest pedestrian detection distance of 120 meters. It bolsters Navigate on Autopilot (NOA) on expressways and recognition of Chinese traffic signs and scenarios.

4. 3D Sensing Technology

3D sensing is a depth sensing technology that can measure and collect the height, depth and shape of objects. Compared to traditional solutions, 3D ToF can capture depth and infrared images under harsh lighting conditions with a higher lens frame, which is more suitable for dynamic scenarios. At present, 3D sensing technology is mainly used in the interior of the cockpit, such as DMS.

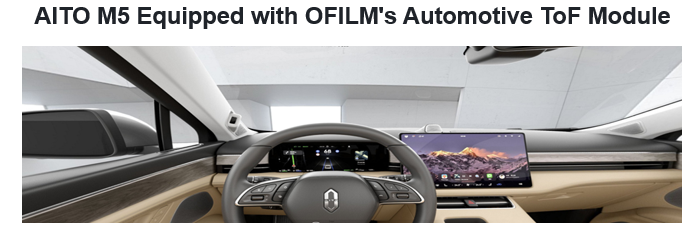

As the mainstream technical solutions of 3D sensing, structured light and ToF technology have become the hotspots of major automotive lens vendors for technical breakthrough. OFILM is currently the main supplier of 3D sensing modules in China. In 2017, OFILM made a layout in this field, and developed structured light and ToF solutions simultaneously. It took the lead in the mass production of automotive ToF visual perception modules for AITO M5 released in March 2022 as a pioneer in the automotive industry.

ArcSoft's latest 3D ToF gesture interaction technology debuted on Li L9 in June 2022.

Oradar will release its 3D ToF smart cockpit solution in September 2022.

5. As an important part of smart cockpit, DMS/OMS will see a surge in installations

In 2022H1, DMS installations swelled by 141.8% year-on-year to 384,000 units. The current mainstream DMS solutions can be divided into cockpit integrated solutions and independent hardware solutions. Integrated cockpit solutions offer rich functions and mobile phone interconnection in terms of entertainment functions and social media functions. Independent hardware solutions can meet the requirements of L2+ and L3 autonomous driving in view of functional safety level, and effectively monitor the state of human-machine co-driving.

Mainstream providers of independent hardware solutions include Neusoft Reach, Suzhou INVO, OFILM, and Hikvision. In particular, Neusoft Reach's independent hardware DMS solution has conducted functional safety development in accordance with ISO2 6262 ASIL-B in terms of system, hardware and software, and has realized deployment of full-chain information security modules on controller, vehicle, cloud, and mobile phone. Combined with L3 intelligent driving domain controller of vehicle, it has been mounted on mainstream models of many automakers.

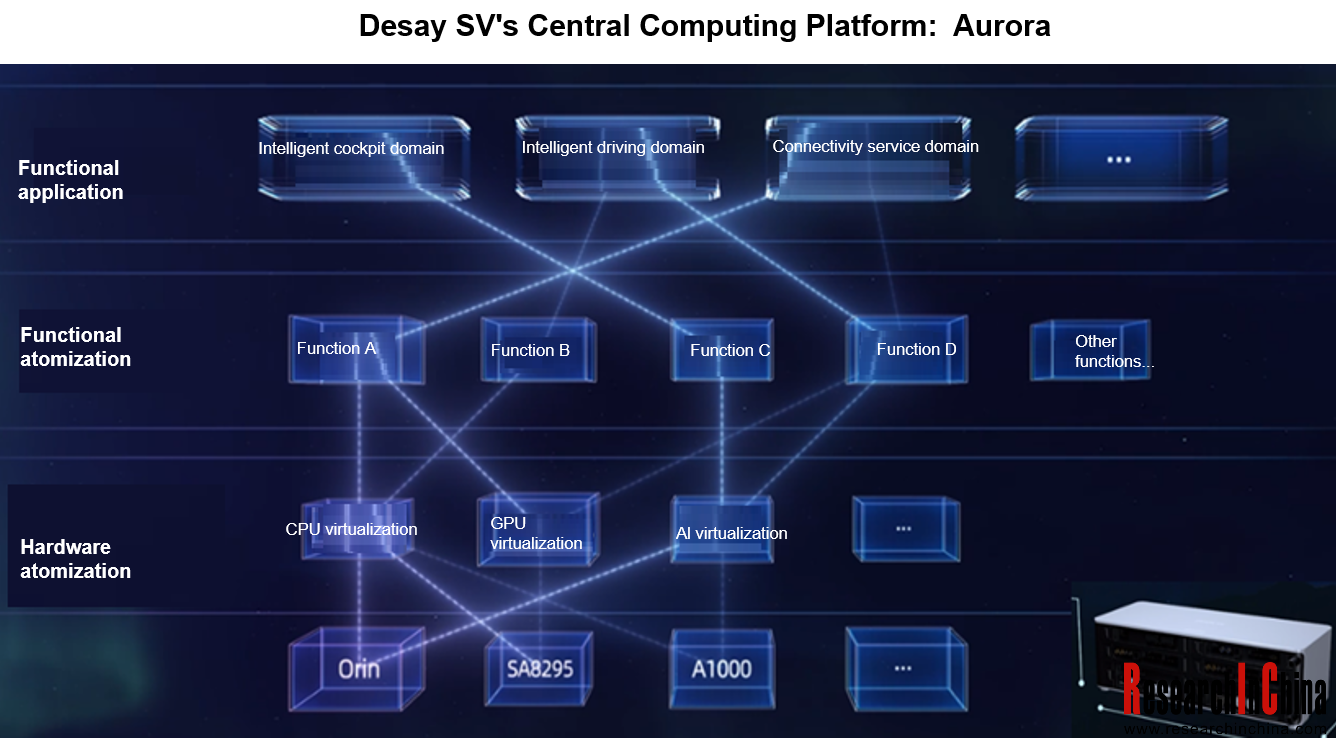

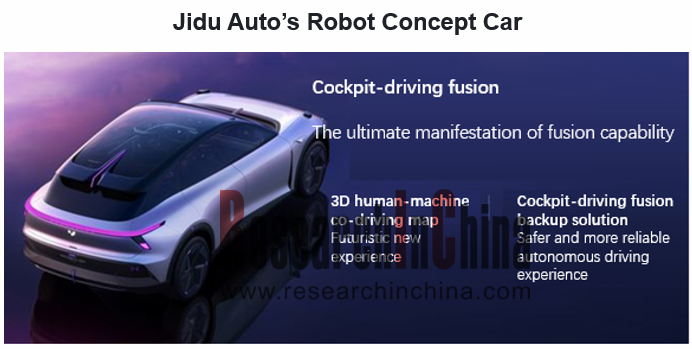

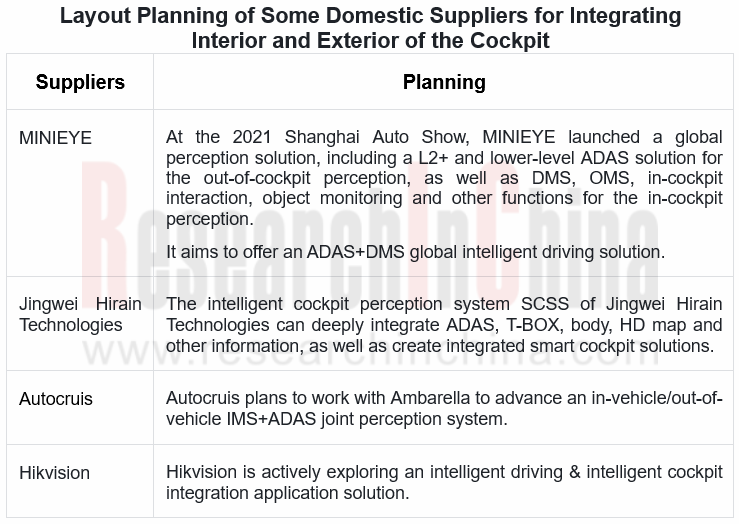

In the future, when autonomous driving technology enters an advanced stage and people need not act as drivers, the scenario application of smart cockpit will become more important. The key to the perfect user experience depends on cockpit-driving integration. Therefore, a number of domestic vision suppliers have launched solutions that integrate the interior and exterior of the cockpit.

In April 2022, Desay SV released automotive intelligent computer "Aurora", marking the company's leap from a domain controller to a central computing platform. This cockpit-driving fusion solution, based on multiple SoCs, integrates multiple functional domains such as intelligent cockpit, intelligent driving, and connected services at the functional level.

In June 2022, Jidu Auto launched a "robot" concept car. Based on self-developed SOA cockpit-driving fusion technology architecture, it allows computing power sharing, perception sharing, and service sharing. The intelligent cockpit domain controller can support system-level security redundancy when the intelligent driving system fails, and the intelligent driving domain controller enables AI interaction of intelligent cockpit 3D human-machine co-driving map.

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...

China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure This report highlights the passenger car L2+ and above (including L2+, ...

Automotive Cockpit Domain Controller Research Report, 2023

Research on cockpit domain controllers: various forms of products are mass-produced and mounted on vehicles, and product iteration speeds up.

Both quality and quantity have been improved, and the it...

Chinese Passenger Car OEMs’ Overseas Layout Research Report, 2023

OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

During 2021-2022, the global economy ...

Global and Chinese Automakers’ Modular Platform and Technology Planning Research Report, 2023

Research on modular platforms: explore intelligent evolution strategy of automakers after modular platforms become widespread.

By analyzing the planning of international automakers, Chinese conventi...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

The automo...

NXP’s Intelligence Business Analysis Report, 2022-2023

In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replace...