China Commercial Vehicle Industry Report, 2021-2026

-

Jan.2022

- Hard Copy

- USD

$3,400

-

- Pages:175

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZJF181

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

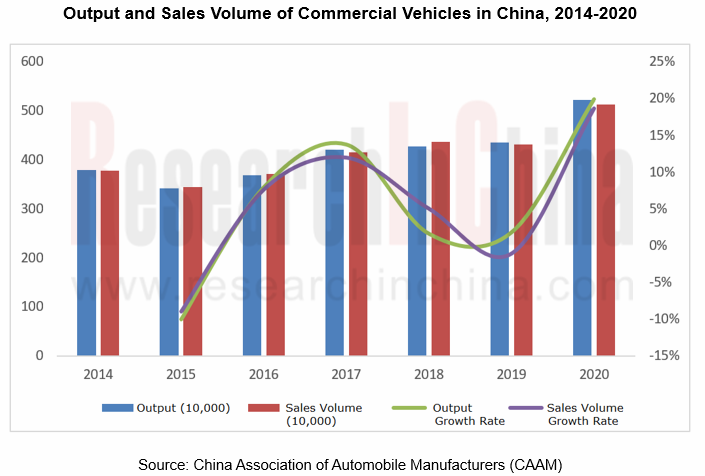

In terms of design and technical characteristics, commercial vehicles are used to transport people and goods. Commercial vehicles include trucks and buses with more than 9 seats, so in general, commercial vehicles can be divided into two categories: buses and trucks. In recent years, driven by trucks, China's commercial vehicle market has grown rapidly. Despite the COVID -19 pandemic, China's commercial vehicle industry saw five consecutive years of growth in 2020, particularly heavy trucks, medium trucks and micro trucks all achieved double-digit growth.

From the perspective of the output and sales volume of specific models, trucks are the main models that support the constant and high growth of commercial vehicles, especially heavy and light trucks contribute significantly to the growth. In 2020, China sold 1.6194 million heavy trucks, 159,000 medium trucks, 2.1978 million light trucks, and 708,400 minivans. Due to the COVID-19 pandemic, the cumulative sales volume of buses in China fell sharply to 448,200 units in 2020, down 5.58% from 2019. The domestic market continues to be sluggish, and the market demand is saturated.

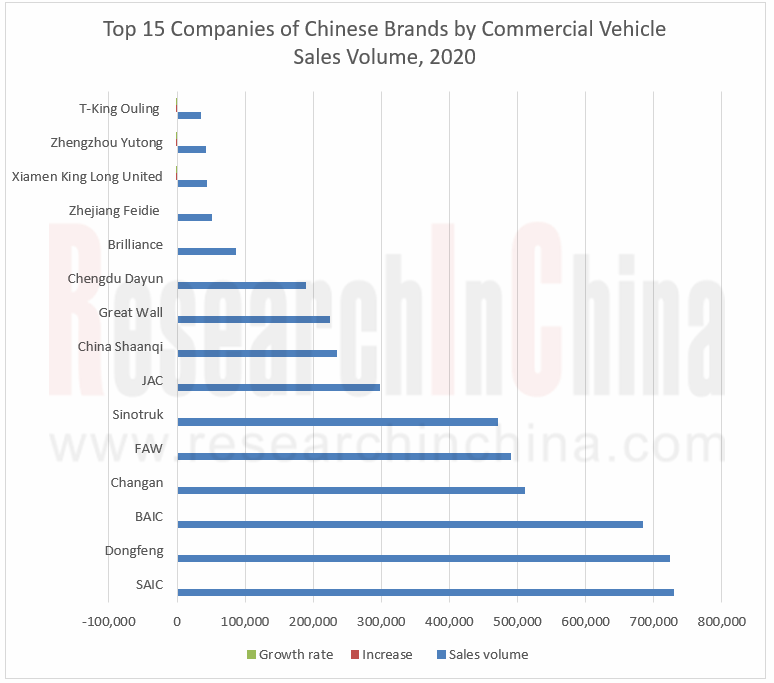

As for the competitive landscape, the top ten Chinese commercial vehicle companies by sales volume include SAIC, Dongfeng Motor, BAIC, Changan Automobile, China FAW, Sinotruk, JAC, China Shaanqi, Great Wall Motor and Chengdu Dayun Automobile. Among them, SAIC ranks first in sales volume with nearly 729,000 units cumulatively, while Sinotruk ranks first in growth with the cumulative sales volume of 471,000 units, followed by Great Wall with 225,000 units and China FAW with 490,000 units.

By sales volume, the top ten bus manufacturers --- JMC, SAIC MAXUS, Beiqi Foton, Zhengzhou Yutong, Changan Automobile, Nanjing Iveco, Xiamen King Long United, Xiamen Golden Dragon Bus, Zhongtong Bus and Brilliance Renault sold 91,100 units, 59,700 units, 42,700 units, 41,800 units, 38,700 units, 28,400 units, 20,300 units, 16,300 units, 10,800 units and 10,400 units in 2020 respectively. Compared with the previous year, the market performance of the top three companies was more prominent, and their sales volume soared year-on-year, particularly SAIC MAXUS saw a more significant growth rate, Nanjing Iveco also secured the growth rate of more than 10%, while the other six companies represented by Brilliance Renault suffered decline.

The top ten truck manufacturers by sales volume in 2020---Dongfeng Motor, Beiqi Foton, SAIC-GM-Wuling, FAW, Sinotruk, JAC, Changan Automobile, China Shaanqi, Great Wall Motor and JMC sold 647,800 units, 600,400 units, 504,500 units, 489,300 units, 470,300 units, 281,400 units, 236,300 units, 235,100 units, 225,000 units and 194,100 units respectively. Among them, Dongfeng Motor, Beiqi Foton, FAW, Sinotruk and SAIC focused on heavy trucks, SAIC-GM-Wuling centered on micro trucks, and others were based on light trucks.

The expected trends in the commercial vehicle market in the future mainly include: the performance of traditional fuel vehicles will be improved quickly, and the upgrade and iteration are mainly reflected in automation, lightweight, energy saving, comfort, safety and environmental protection; the load and power of vehicles will increase; the current models with displacement of 11L and 13L will transition to 15L and 16L during the "14th Five-Year Plan" period; among battery-electric models, the development of heavy trucks will accelerate, especially the benefits of battery-electric models are significantly more than those of fuel vehicles in fixed scenarios and conditions; intelligent and autonomous driving have just be practically used in the field of commercial vehicles.

China Commercial Vehicle Industry Report, 2021-2026 highlights the followings:

Bus industry overview (definition, classification, development trend, industrial policy, etc.);

Bus industry overview (definition, classification, development trend, industrial policy, etc.);

Overall development of China bus industry (output, sales volume, ownership, etc.);

Overall development of China bus industry (output, sales volume, ownership, etc.);

Overview of bus market segments in China, including large bus, medium bus and Small Bus (output, sales volume, competitive pattern, etc.);

Overview of bus market segments in China, including large bus, medium bus and Small Bus (output, sales volume, competitive pattern, etc.);

China new energy bus market (output, sales volume, competitive pattern, industrial policy, etc.);

China new energy bus market (output, sales volume, competitive pattern, industrial policy, etc.);

Bus industry chain in China, involving raw materials market, downstream application market, etc.;

Bus industry chain in China, involving raw materials market, downstream application market, etc.;

Overview of truck industry in China (product definition, classification, technology source, latest policy, development orientation, etc.);

Overview of truck industry in China (product definition, classification, technology source, latest policy, development orientation, etc.);

Status quo of China truck industry (ownership, output, sales volume, market structure, import & export, competitive pattern, etc.);

Status quo of China truck industry (ownership, output, sales volume, market structure, import & export, competitive pattern, etc.);

Overview of truck market segments in China, covering heavy truck, medium truck, light truck and mini truck (output, sales volume, competitive pattern, etc.);

Overview of truck market segments in China, covering heavy truck, medium truck, light truck and mini truck (output, sales volume, competitive pattern, etc.);

Truck industry chain in China, involving raw materials market, downstream application market, etc.;

Truck industry chain in China, involving raw materials market, downstream application market, etc.;

16 commercial vehicle manufacturers (like Yutong Bus, Zhongtong Bus, King Long Motor, FAW Group, Dongfeng Motor Corporation, Sinotruk, Foton, JMC, JAC), including profile, financial situation, output, sales volume, pillar products, distribution of production bases, latest news, etc.

16 commercial vehicle manufacturers (like Yutong Bus, Zhongtong Bus, King Long Motor, FAW Group, Dongfeng Motor Corporation, Sinotruk, Foton, JMC, JAC), including profile, financial situation, output, sales volume, pillar products, distribution of production bases, latest news, etc.

1 Overview of Bus Industry

1.1 Introduction to Product

1.2 Product Classification

1.3 Policies

1.4 Commercial Vehicle Telematics

2. China Bus Market

2.1 Market Size

2.2 Market Structure

2.3 Competitive Landscape

2.3.1 Market Share

2.3.2 Performance Comparison

2.4 Main Market Segments

2.4.1 Coach

2.4.2 City Bus

2.4.3 School Bus

2.5 Natural Gas School Bus

3 Bus Market Segments in China

3.1 Large Bus

3.1.1 Market Size

3.1.2 Competitive Pattern

3.2 Medium Bus

3.2.1 Market Size

3.2.2 Competitive Pattern

3.3 Small Bus

3.3.1 Market Size

3.3.2 Competitive Pattern

4 New Energy Bus Market

4.1 Market Size

4.2 Market Segments

4.3 Competitive Landscape

4.4 Supporting

4.5 Fuel Cell Bus

5 Bus Industry Chain

5.2 Main Parts

5.2.1 Transmission

5.2.2 New Energy Battery

5.3 Downstream Demand

5.3.1 Passenger Transport

5.3.2 Substitution of HSR

5.3.3 Tourism

Part II Truck Industry

6 Overview of the Truck Industry

6.1 Definition and Classification

6.2 Technology Introduction

7 Truck Market

7.1 Ownership

7.2 Output and Sales Volume

7.2.1 Output

7.2.2 Sales Volume

7.3 Market Structure

7.4 Import and Export

7.5 Competitive Pattern

8 Truck Market Segments

8.1 Heavy-duty Truck

8.1.1 Output and Sales Volume

8.1.2 Competitive Pattern

8.2 Medium Truck

8.2.1 Output and Sales Volume

8.2.2 Competitive Pattern

8.3 Light Truck

8.3.1 Output and Sales Volume

8.3.2 Competitive Pattern

8.4 Mini Truck

8.4.1 Output and Sales Volume

8.4.2 Competitive Pattern

9 Truck Industry Chain

9.1 Overview of Industrial Chain

9.2 Key Components

9.2.1 Cost Structure

9.2.2 Supporting

9.3 Raw Materials Market

9.3.1 Iron & Steel

9.3.2 Rubber

9.4 Downstream Market

9.4.1 Infrastructure Construction

9.4.2 Real Estate Development

9.4.3 Highway Freight

Part III Companies

10. Companies

10.1 Yutong Bus

10.1.1 Profile

10.1.2 Financial Situation

10.1.3 Revenue Structure

10.1.4 Output and Sales

10.1.5 New Energy Bus

10.1.6 Production Capacity

10.1.7 R&D

10.2 Xiamen King Long Motor Group

10.2.1 Profile

10.2.2 Financial Situation

10.2.3 Revenue Structure

10.2.4 Operation of Key Subsidiaries

10.2.5 Output and Sales

10.2.6 New Energy Bus

10.2.7 Production Capacity

10.2.8 R&D Expenses

10.2.9 Autonomous Driving &intelligent connectivity

10.3 Zhongtong Bus

10.3.1 Profile

10.3.2 Financial Situation

10.3.3 Revenue Structure

10.3.4 Output and Sales

10.3.5 New Energy Bus

10.3.6 R&D Expenses

10.3.7 Autonomous Driving

10.4 Beiqi Foton Motor Co., Ltd.

10.4.1 Profile

10.4.2 Financial Situation

10.4.3 Revenue Structure

10.4.4 Output and Sales

10.4.5 New Energy Commercial Vehicle

10.4.7 Production Capacity

10.4.8 R&D Expenses

10.4.9 intelligent connectivity

10.5 Ankai Automobile

10.5.1 Profile

10.5.2 Financial Situation

10.5.3 Revenue Structure

10.5.4 Output and Sales

10.5.5 New Energy Bus

10.5.6 Production Capacity

10.5.7 R&D Expenses

10.5.8 Autonomous Driving

10.6 Liaoning SG Automotive Group Co., Ltd.

10.6.1 Profile

10.6.2 Financial Situation

10.6.3 Revenue Structure

10.6.4 Output and Sales

10.6.5 New Energy Business

10.7 Yangzhou Asiastar Bus Co., Ltd.

10.7.1 Profile

10.7.2 Financial Situation

10.7.3 Revenue Structure

10.7.4 Output and Sales

10.7.5 New Energy Bus

10.7.6 R&D Expenses

10.7.7 Autonomous Driving

10.8 BYD

10.8.1 Profile

10.8.2 Financial Situation

10.8.3 Revenue Structure

10.8.4 Output and Sales

10.8.5 Autonomous Driving

10.9 JAC

10.9.1 Profile

10.9.2 Financial Situation

10.9.3 Revenue Structure

10.9.4 Output and Sales

10.9.5 Capacity Distribution

10.9.6 R&D Expenses

10.9.7 Autonomous Driving

10.10 SINOTRUK

10.10.1 Profile

10.10.2 Operation

10.10.3 Heavy Truck Business

10.10.4 Autonomous Driving

10.11 Jiangling Motors Co., Ltd. (JMC)

10.11.1 Profile

10.11.2 Financial Situation

10.11.3 Revenue Structure

10.11.4 Output and Sales

10.11.5 R&D Expenses

10.11.6 Autonomous Driving

10.12 Dongfeng Motor Corporation

10.12.1 Profile

10.12.2 Financial Situation

10.12.3 Revenue Structure

10.12.4 Output and Sales

10.12.5 R&D Expenses

10.12.8 Autonomous Driving

10.13 SAIC Motor

10.13.1 Profile

10.13.2 Financial Situation

10.13.3 Revenue Structure

10.13.4 Output and Sales

10.13.5 SAIC MAXUS Automotive Co., Ltd.

10.13.6 Nanjing IVECO Automobile Co., Ltd.(NAVECO)

10.13.7 SAIC-IVECO Hongyan

10.13.8 SAIC GM Wuling (SGMW)

10.14 FAW Jiefang Automotive Co., Ltd.

10.14.1 Profile

10.14.2 Financial Situation

10.14.3 Revenue Structure

10.14.4 Production

10.14.5 Sales

10.14.6 New Energy Vehicle

10.14.7 New Format

10.15 Hanma Technology

10.15.1 Profile

10.15.2 Operation

10.15.3 Truck Business

10.15.4 Output and Sales

10.16 QingLing Motors (Group) Co., Ltd.

10.16.1 Profile

10.16.2 Operation

10.16.3 Truck Business

10.16.4 Autonomous Driving

Connectivity and Intelligence Comparison between Passenger Cars and Commercial Vehicle

Policies for Commercial Vehicle Telematics

OEM and AM Market Size Forecast of Commercial Vehicle Telematics in China

Market Space for Different Types of Commercial Vehicle Intelligent Equipment (Active Safety)

Output and Sales Volume of Bus in China, 2005-2020

Bus Market Structure in China, 2005-2020

TOP10 Bus Enterprises in China, 2020

Revenue of Major Bus Enterprises in China, 2019-2021

Net Income of Major Bus Enterprises in China, 2019-2021

Gross Margin of Major Bus Enterprises in China, 2019-2021

Sales Volume of Buses in China by Purpose, 2019-2020

coach Sales Volume by Type, 2019-2020

City Bus Sales Volume by Type, 2019-2020

Sales Volume of School Bus in China, 2019-2020

Output and Sales Volume of Natural Gas Bus in China, 2019-2020

Output of Large Bus and Chassis in China, 2005-2020

Sales Volume of Large Bus and Chassis in China, 2005-2020

Large Bus Output (including Incomplete Vehicles) in China, 2019-2020

Large Bus Sales Volume (including Incomplete Vehicles) in China, 2019-2020

Output of Medium Bus and Chassis in China, 2005-2020

Sales Volume of Medium Bus and Chassis in China, 2005-2020

Medium Bus Output (including Incomplete Vehicles) in China, 2019-2020

Medium Bus Sales Volume (including Incomplete Vehicles) in China, 2019-2020

Output of Small Bus and Chassis in China, 2005-2020

Sales Volume of Small Bus and Chassis in China, 2005-2020

Small Bus Output (including Incomplete Vehicles) in China, 2019-2020

Small Bus Sales Volume (including Incomplete Vehicles) in China, 2019-2020

Monthly New Energy Bus Sales Volume, 2018-2021

New Energy Bus Sales Volume by Type, 2018-2021

New Energy Bus Sales Volume by Application Field, 2018-2021

New Energy Bus Sales Volume, 2018-2021

New Energy Bus Power Battery, 2020

New Energy Bus motor, 2020

New Energy Bus Ranking by Installations of Drive Motors, 2020

Distribution of Major Hydrogen Fuel Cell Bus Manufacturers in China by Sales Volume, 2018-2021

Market Share of Major Commercial Vehicle Transmission Enterprises in China

Major Commercial Vehicle Transmission Suppliers in China

China’s Power Lithium Battery Manufacturers and Supported Models

Highway Passenger Transport in China, 2005-2020

Operating Mileage of High-speed Railways in China, 2013-2020

Total Tourism Revenue in China, 2010-2020

Truck (Freight Vehicle) Segments

Applications of Truck by Sector

Technology Introduction of Major Heavy Truck Manufacturers in China

Truck Ownership and Growth in China, 2015-2020

Structure of Truck Ownership in China, 2016-2020

Truck Tonnage and Growth in China, 2015-2020

Tonnage of Regular Trucks and Special Trucks in China, 2015-2020

Output of Trucks in China, 2010-2020

Sales Volume of Trucks in China, 2010-2020

Truck Output by Fuel in China, 2019-2020

Truck Output by Gross Weight in China, 2019-2020

Truck Output by Purpose in China, 2019-2020

Truck Import Volume and Value in China, 2016-2021

Truck Export Volume and Value in China, 2016-2021

Sales Volume and Market Share of TOP10 Truck Enterprises in China, 2020

Output of Heavy Truck in China, 2010-2020

Sales Volume of Heavy Truck in China, 2010-2020

Sales Volume of Heavy Truck Manufacturers in China, 2019-2020

Output of Heavy Truck Manufacturers in China, 2019-2020

Output of Medium Truck in China, 2010-2020

Sales Volume of Medium Truck in China, 2010-2020

Sales Volume of TOP Complete Medium Truck Enterprises in China, 2019-2020

Sales Volume of TOP Incomplete Medium Truck Enterprises in China, 2019-2020

Output of Complete Light Truck in China, 2010-2020

Sales Volume of Light Truck in China, 2010-2020

Sales Volume of TOP Light Truck Enterprises in China, 2019-2020

Production Volume of TOP Light Truck Enterprises in China, 2019-2020

Output of Mini Truck in China, 2010-2020

Sales Volume of Mini Truck in China, 2010-2020

Output of Top Mini Truck Manufacturers in China, 2019-2020

Sales Volume of Top Mini Truck Manufacturers in China, 2019-2020

Automotive Industry Chain

Cost Structure of Truck Industry

Transmission Supply of Major Heavy Truck Manufacturers in China

China's Galvanized Sheet (Strip) Output and Sales Volume, 2016-2021

China's (Shanghai) Galvanized Coil Price, 2011-2021

China's Cold-rolled Thin Sheet Weekly Output, 2016-2021

China's (Shanghai) Cold-rolled Coil Price, 2015-2021

China's Natural Rubber Spot and Future Price, 2011-2021

China's Investment in Fixed Assets, 2010-2017

China's Investment in Real Estate Development, 2010-2020

China's New Housing Start Area and Sales Area, 2005-2020

China's Highway Freight Volume and Turnover, 2005-2020

Main Financial Indices of Zhengzhou Yutong Bus, 2016-2021

Operating Revenue Structure of Zhengzhou Yutong Bus by Business, 2020-2021

Operating Revenue Structure of Zhengzhou Yutong Bus by Region, 2019-2020

Output and Sales Volume of Zhengzhou Yutong Bus by Product, 2019-2021

Sales Volume of Zhengzhou Yutong Bus by Region, 2019-2020

Output of New Energy Bus of Zhengzhou Yutong Bus, 2017-2020

Sales Volume of New Energy Bus of Zhengzhou Yutong Bus, 2017-2020

Capacity Layout (Including New Energy Bus) of Zhengzhou Yutong Bus, 2020

R&D Costs of Zhengzhou Yutong Bus, 2016-2021

Key Financial Indicators of Xiamen King Long Motor Group, 2016-2021

Operating Revenue and Gross Margin of Xiamen King Long Motor Group's Major Products, 2019-2020

Operating Revenue Structure of Xiamen King Long Motor Group by Region, 2019-2020

Revenue and Net Income of Major Subsidiaries of Xiamen King Long Motor Group, 2019-2020

Bus Output and Sales Volume of Xiamen King Long Motor Group, 2019-2020

Sales Volume of Xiamen King Long Motor Group by Region, 2019-2020

New Energy Bus Output of Xiamen King Long Motor Group, 2017-2020

New Energy Bus Sales Volume of Xiamen King Long Motor Group, 2017-2020

New Energy Bus Sales of Xiamen King Long Motor Group by Length, 2019-2020

New Energy Bus Sales of Xiamen King Long Motor Group by Application, 2019-2020

Xiamen King Long Motor Group’s Capacity by Enterprise, 2020

R&D Costs of Xiamen King Long Motor Group, 2014-2020

Schematic of Apollo

Autonomous Driving of Apollo

Main Financial Indicators of Zhongtong Bus, 2016-2021

Operating Revenue Structure of Zhongtong Bus by Business, 2019-2020

Operating Revenue Structure of Zhongtong Bus by Region, 2019-2020

Output and Sales of Zhongtong Bus, 2019-2020

New Energy Bus Output of Zhongtong Bus, 2019-2020

Suppliers of New Energy Bus of Zhongtong Bus

R&D Costs of Zhongtong Bus, 2014-2021

L4 Autonomous Vehicles of Zhongtong Bus

Main Financial Indicators of Beiqi Foton Motor, 2010-2017

Revenue Structure of Beiqi Foton Motor by Business, 2019-2020

Revenue Structure of Beiqi Foton Motor by Region, 2019-2020

Bus Output and Sales of Beiqi Foton Motor by Type, 2019-2021

New Energy Bus Output and Sales of Beiqi Foton Motor, 2014-2021

Major Suppliers of New Energy Bus of Beiqi Foton Motor

New Energy Truck Output and Sales of Beiqi Foton Motor, 2016-2021

R&D Costs of Beiqi Foton Motor, 2014-2020

Autonomous Vehicles of Beiqi Foton Motor

Financial Indicators of Anhui Ankai Automobile, 2016-2021

Operating Revenue Structure of Anhui Ankai Automobile by Business, 2019-2020

Operating Revenue Structure of Anhui Ankai Automobile by Region, 2019-2020

Output and Sales of Anhui Ankai Automobile, 2019-2020

Core Suppliers for Electric Bus of Anhui Ankai Automobile

Capacity Layout of Bus (Including New Energy Bus) of Anhui Ankai Automobile, 2020

R&D Costs of Anhui Ankai Automobile, 2014-2020

Autonomous Vehicles of Anhui Ankai Automobile

Financial Indicators of SG Automotive Group, 2016-2021

Revenue Structure of SG Automotive Group by Business, 2019-2020

Revenue Structure of SG Automotive Group by Region, 2019-2020

Huanghai Bus Output and Sales Volume of SG Automotive Group, 2017-2020

Huanghai New Energy Bus Output of SG Automotive Group, 2015-2020

Financial Indicators of Asiastar Bus, 2016-2021

Operating Revenue Structure of Asiastar Bus by Business, 2019-2020

Operating Revenue Structure of Asiastar Bus by Region, 2019-2020

Output and Sales of Asiastar, 2017-2020

Sales Distribution of Asiastar by Region, 2019-2020

New Energy Bus Sales Volume of Asiastar, 2017-2020

Asiastar’s Income from New Energy Bus Subsidies, 2018-2020

R&D Costs of Asiastar, 2012-2020

Autonomous Commercial Vehicles of Asiastar

Financial Indicators of BYD, 2016-2021

Revenue Structure of BYD by Business, 2019-2021

Revenue Structure of BYD by Region, 2019-2021

New Energy Vehicle Output and Sales Volume of BYD, 2019-2020

Main New Energy Buses of BYD

Financial Indicators of JAC, 2016-2021

Revenue Structure of JAC by Business, 2019-2020

Revenue Structure of JAC by Region, 2019-2020

JAC’s Commercial Vehicle Output and Sales Volume, 2019-2020

Truck Capacity Distribution of JAC, 2016

JAC’s R&D Expenses, 2014-2020

JAC HyperTruck One

Sinotruk’s Revenue and Net Income, 2014-2021

Sinotruk’s Gross Margin, 2014-2021

Sinotruk’s Revenue Structure by Business, 2020

Sinotruk’s Heavy Truck Product Family Genealogy

Sinotruk’s Main Product Configuration

Sinotruk’s Truck Output and Sales Volume, 2016-2020

HOWO T5G Electric Truck

Financial Indicators of JMC, 2016-2021

Revenue Structure of JMC by Business, 2019-2020

Commercial Vehicle Output and Sales of JMC, 2019-2020

R&D Costs of JMC, 2014-2020

JMC WeRide Robovan

Financial Indicators of Dongfeng Motor, 2016-2021

Revenue Structure of Dongfeng Motor by Business, 2019-2020

Revenue Structure of Dongfeng Motor by Region, 2019-2020

Commercial Vehicle Output and Sales of Dongfeng Motor, 2017-2021

Capacity and Utilization of Dongfeng Motor’s Main Products, 2020

New Energy Vehicle Capacity and Utilization of Dongfeng Motor, 2020

New Energy Vehicle Output and Sales Volume of Dongfeng Motor, 2017-2020

R&D Costs of Dongfeng Motor, 2014-2020

Autonomous Container Trucks of Dongfeng Motor,

Financial Indicators of SAIC Motor, 2016-2021

Revenue Structure of SAIC Motor by Business, 2019-2020

Revenue Structure of Dongfeng Motor by Region, 2019-2020

Commercial Vehicle Capacity of SAIC Motor, 2020

Commercial Vehicle Output and Sales of SAIC Motor, 2019-2020

Commercial Vehicle Sales of SAIC Motor by Region, 2019-2020

New Energy Vehicle Output and Sales Volume of SAIC Motor, 2019-2020

Commercial Vehicle Capacity Distribution of SAIC MAXUS

Vehicle Sales Volume of SAIC MAXUS, 2015-2021

Product Lineup of SAIC HONGYAN

Development History of SAIC GM Wuling

Main Trucks (Mini Trucks) of SAIC GM Wuling

Distribution of SAIC GM Wuling’s Production Bases

Domestic Business Layout of FAW Jiefang

Financial Indicators of FAW Jiefang, 2018-2021

Revenue Structure of FAW Jiefang by Business, 2019-2020

Revenue Structure of FAW Jiefang by Region, 2019-2020

Products of FAW Jiefang

Main Truck Manufacturing Bases of FAW Group

Commercial Vehicle Output and Sales of FAW Jiefang, 2019-2020

Sales Network of FAW Jiefang in China

Overseas Sales Network of FAW Jiefang

Medium and Heavy Truck Sales Volume of FAW Jiefang, 2016-2021

Light Truck Sales Volume of FAW Jiefang, 2016-2021

Automotive Power and ICV Layout of FAW Jiefang

New Energy Strategy of FAW Jiefang

New Format - Columbus Smart Logistics Open Plan of FAW Jiefang

Main Production Bases of Hanma Technology

Hanma Technology’s Assets and Net Income, 2012-2020

Revenue Structure of Hanma Technology by Business, 2019-2020

Hanma Technology’s Products Series

New Energy Vehicle Development History of Hanma Technology

New Energy Vehicles of Hanma Technology

Hanma Technology’s Truck Output and Sales Volume, 2019-2020

Hanma Technology’s Truck Sales at Home and Abroad, 2019-2020

Qingling Motors’ Revenue and Net Income, 2014-2021

Qingling Motors’ Gross Margin, 2013-2020

Qingling Motors’ Revenue Breakdown by Product, 2019-2020

Qingling Motors’ Output and Sales Volume, 2015-2020

Qingling Motors’ Electric Vehicles

Qingling Motors’ Hydrogen Fuel Vehicles

Qingling Motors’ L3 Autonomous Vehicles

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...