Automotive Cockpit SoC Technology and Application Research Report, 2022

Cockpit SoC research: local chip vendors begin to come to the front, and who will rule the roost in the ten-billion-yuan market.

Cockpit SoC is the computing power supply unit of intelligent cockpits. It is mainly responsible for operation and processing of massive cockpit data, including video access of multiple cameras, network processing unit (NPU), in-car audio processing, speech, and image rendering and output (GPU/DPU) of multiple displays, in-car Bluetooth/WiFi connection, and Ethernet data interaction with other major in-vehicle ECUs (e.g., central gateway).

Cockpit SoC products featuring great computing power, multi-integration and strong AI boast ever better performance.

As intelligent cockpits gain pace, the main control SoC of cockpits not only needs to meet the needs of multi-screen scenarios such as cluster, cockpit display, and AR-HUD, but also to perform operations such as voice recognition and vehicle control. User experience indexes of cockpit systems, like response speed, boot time, and connection speed, directly determine whether an auto brand is competitive or not. Smart cars have increasingly high requirements on performance and computing power of cockpit SoC.

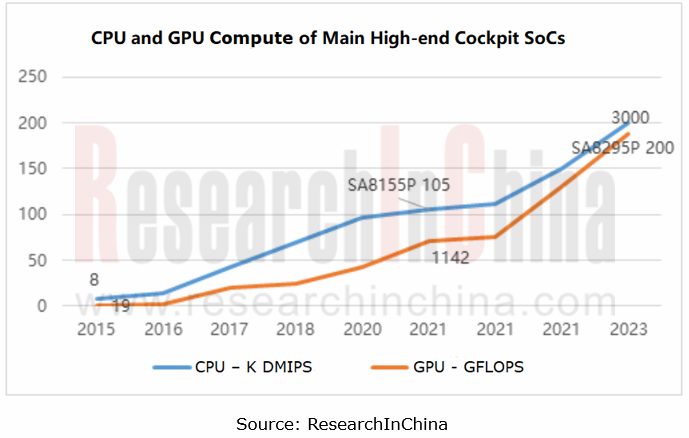

The CPU computing power of cockpit SoC has got improved significantly, from dozens of KDMIPS in the past to more than 100 KDMIPS now. At present, the CPU computing power of Qualcomm Snapdragon SA8155P is about 105KDMIPS, SA8195P about 150KDMIPS, and the 4th-generation automotive cockpit SoC SA8295 even up to over 200KDMIPS. Among Chinese vendors, the CPU computing power of Huawei Kirin 990 exceeds 75KDMIPS; SemiDrive’s latest cockpit chip X9U boasts CPU computing power of 100KDMIPS; Rockchip's newest intelligent cockpit chip RK3588M feature CPU computing power of 100KDMIPS as well.

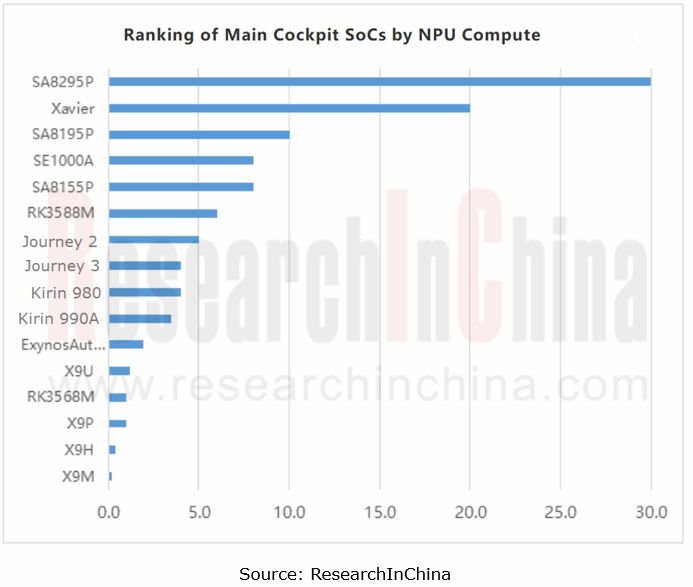

The AI computing power of cockpit SoC has also multiplied. Wherein, Samsung's production SoC Exynos Auto V910 delivers AI computing power of about 1.9TOPS. According to Samsung’s plan, the NPU computing power of Exynos Auto V920, a cockpit chip to be mass-produced around 2025 will reach about 30TOPS. Qualcomm's production chip SA8155P offers AI computing power of about 8TOPS, and its fourth-generation cockpit SoC is integrated with the NPU computing power of as high as 30TOPS. Qualcomm plans production of its cockpit SoC product launched with the greatest AI computing power in 2023.

As for Chinese cockpit SoCs, SemiDrive’s cockpit products from the mid-end to the premium are all embedded with AI computing power, of which X9U delivers AI computing power of 1.2TOPS; Rockchip's latest cockpit SoC RK3588M provides AI computing power of 6TOPS; the AI computing power of Longying No.1, a cockpit chip of SiEngine Technology under Geely, is about 8TOPS.

In terms of cockpit SoC process, the 5nm process has come out. At present, 7nm and 8nm cockpit chips have been spawned, such as Qualcomm 8155/8195, Samsung V910 and Rockchip RK3588M. Moreover Qualcomm introduced its latest 5nm chip, a 4th Generation Snapdragon Automotive Cockpit Platform, and plans to start mass production in 2023.

In the fierce cockpit SoC competition, foreign giants forge ahead steadily and Chinese vendors step up their efforts to produce chips.

In the past two years, the competition in the automotive cockpit SoC market has intensified, especially in the mid- and high-end segments. Not only are there more competing companies, but also consumer electronics chip players like Qualcomm, Intel, NVIDIA, Huawei, AMD, MediaTek are vigorous entrants, in addition to traditional automotive SoC vendors such as NXP, Renesas and TI. For example, in 2021, AMD forged into the automotive cockpit market through Tesla. From the vehicle game scenario, AMD has tailored for Tesla an intelligent cockpit SoC carrying a consumer game graphics card.

As well as overseas chip bellwethers, Chinese chip companies such as AutoChips, SemiDrive, Rockchip, Horizon Robotics and SiEngine have also joined the battlefield as independent chip vendors, which reshapes the automotive chip industry pattern. In 2021, local companies in China competed to introduce self-developed new products for a place in the cockpit SoC market.

In April 2021, SemiDrive unveiled X9U, a flagship cockpit SoC product with total CPU computing power up to 100KDMIPS, 3D graphics performance up to 300GFLOPS, and AI computing power up to 1.2TOPS. In December 2021, SiEngine, Geely’s automotive chip designer, released Longying No.1, a 7nm intelligent cockpit chip subject to AEC-Q100 Grade 3 automotive standard. It is an equivalent of Qualcomm 8155 and is projected to be produced in quantities in the third quarter of 2022.

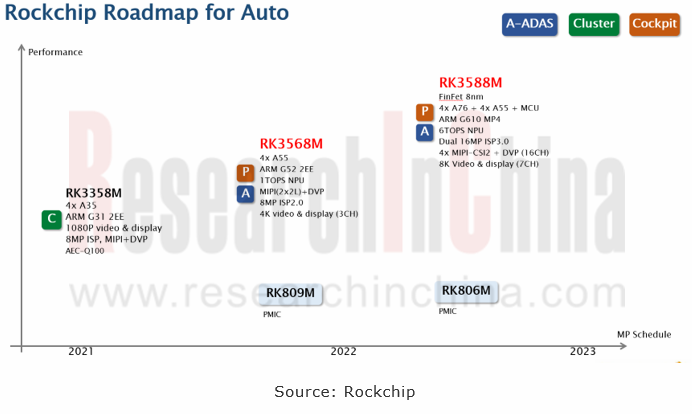

In late December 2021, Rockchip, a specialist in design and development of AIoT processors, launched a range of automotive cockpit electronics, including automotive cockpit SoCs such as RK3358M, RK3568M and RK3588M, and grouped PMIC chips RK809M and RK806M, which provide customers with high-, mid- and low-end cockpit chip solutions with different performance.

Rockchip's flagship automotive cockpit SoC RK3588M adopts 8nm process and high-performance Octa-core CPU and GPU. With CPU computing power of 100K DMIPS, GPU computing power of 512GFLOPS, and NPU AI computing power of 6TOPS, this chip enables hybrid, quantitative, multi-model parallel computing. It provides AI processing capabilities comparable with edge computing boxes, and realizes functions such as one-core multi-screen.

In addition, in 2021, some overseas companies also launched new cockpit SoC products to stabilize or break through the market pattern. For example, in July 2021, Renesas introduced a new series of R-Car Gen3e SoCs, covering six new products, which are applicable to integrated cockpit domain control and other areas and scheduled to be mass-produced in 2022; in November 2021, Samsung released Exynos Auto V7, a new ASIL-B safety standard-compliant SoC for mid-to-high-end intelligent cockpit systems, which has been applied to Volkswagen's on-board computer ICAS3.1

Cockpit SoC companies flexibly adjust their strategies to cope with the changing intelligent vehicle market amid the supply chain reconstruction and business model shift.

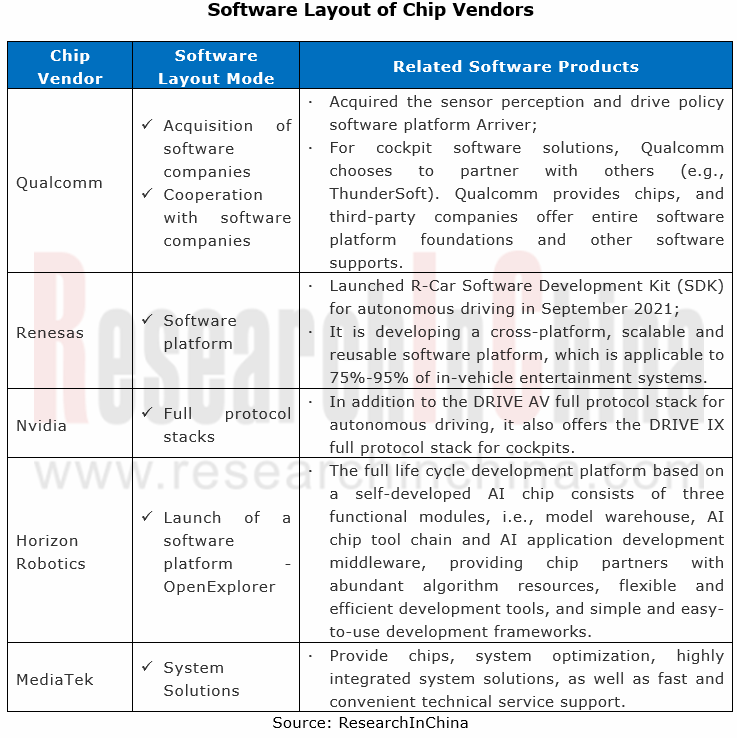

Chips need hardware and software to play their role. Software weighs more heavily in vehicle market in the context of software defined vehicles. In recent years, chip vendors have been transforming from hardware suppliers into service providers, that is, they no longer just sell chip and hardware products and have got down to developing hardware + software or even complete system solutions.

Among them, Nvidia has rolled out full protocol stacks. Nvidia which only sold chips in the past provides the DRIVE IX full protocol stack for cockpits in addition to the DRIVE AV full protocol stack for autonomous driving. DRIVE IX starts with Orin chips for autonomous driving, and also integrates previous Parker and Xavier.

In September 2021, Renesas unveiled the R-Car Software Development Kit (SDK), a complete software platform in a single package that enables quicker and easier software development and validation for smart cameras. Renesas is also developing a cross-platform, reusable and scalable software platform.

Besides, as intelligent vehicles advance and software-defined vehicles arrive, automotive business models are making a quite change. In the future users will care about iteratively upgraded software services more than conventional needs when they buy a car. This also drives change to the cockpit SoC supply relationship. OEMs not only need cockpit SoC vendors to provide original products but require them to meet customization needs and offer software capabilities compatible with OEMs or suppliers.

Chips were traded to automakers through Tier1s in the past, but now this indirect partnership is being replaced by possibly direct cooperation between chip vendors and OEMs. A new supply model where software and hardware are custom-made and co-developed has turned up.

Autonomous Driving Simulation Industry Chain Report (Foreign Companies), 2022

Simulation test research: foreign autonomous driving simulation companies forge ahead steadily with localization services.

As the functions of ADAS and autonomous driving systems are developed and th...

China Automotive Multimodal Interaction Development Research Report, 2022

Multimodal interaction research: more hardware entered the interaction, immersive cockpit experience is continuously enhanced

ResearchInChina's “China Automotive Multimodal Interaction Development Re...

Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

Basic operating system: foreign providers refine and burnish functions; Chinese ...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...

Global and China L4 Autonomous Driving and Start-ups Report, 2022

L4 autonomous driving research: the industry enters a new development phase, "dimension reduction + cost reduction".

L3/L4 autonomous driving enjoys much greater policy support.

...

Software-defined vehicle Research Report 2022- Architecture Trends and Industry Panorama

Software-defined vehicle research: 40 arenas, hundreds of suppliers, and rapidly-improved software autonomyThe overall architecture of software-defined vehicles can be divided into four layers: (1) Th...

Emerging Automaker Strategy Research Report, 2022 - Li Auto

Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended...

Commercial Vehicle Intelligent Chassis Industry Report, 2022

Commercial vehicle industry is characterized by large output value, long industry chain, high relevance, high technical requirements, wide employment and large consumer pull, and is a barometer of nat...

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...