Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

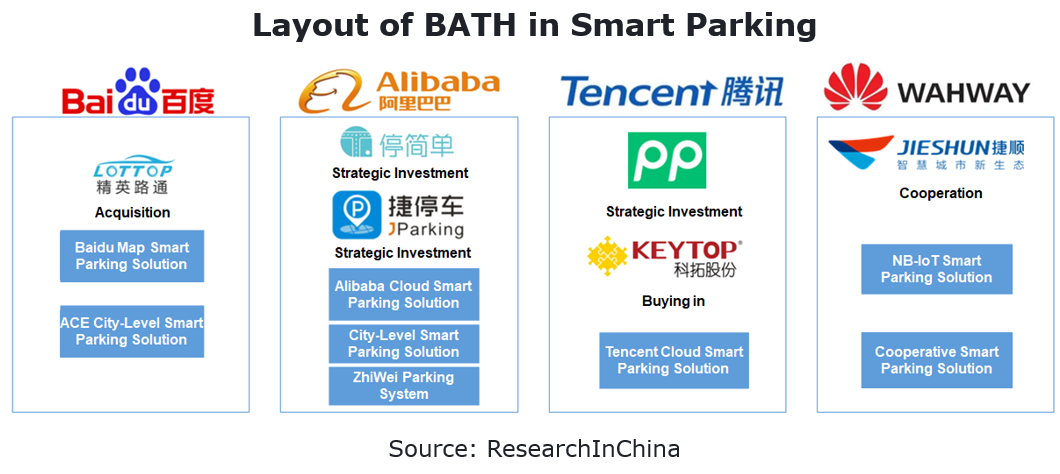

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) have set foot in.

By the end of 2021, there have been nearly 4,000 companies engaged in smart parking business across China, bringing about a very low market concentration. Smart parking companies in the core circle are divided into three major camps: system integrators, intelligent hardware companies, and investors/operators. Some of them boast both system integration and investment/operation capabilities.

Attracted by enormous potential of smart parking market, technology firms including Baidu, Alibaba, Tencent and Huawei (BATH) have also entered the market.

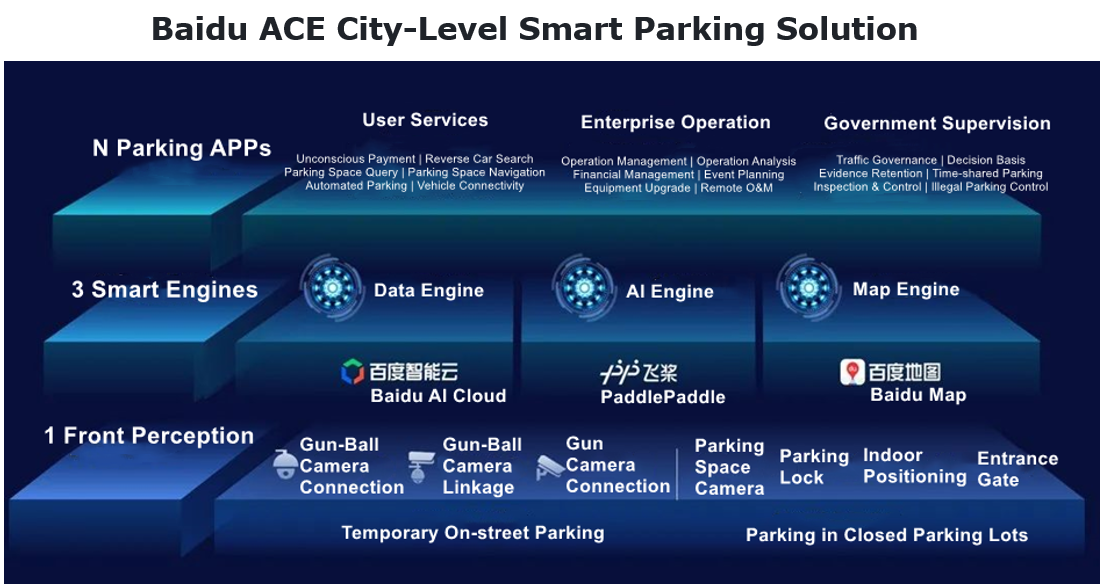

For example, Baidu previously launched Baidu Map Smart Parking Solution based on Baidu Map. In June 2021, Baidu bought a 100% stake in Beijing Lottop Technology, aiming to shore up its weak spots in static traffic smart parking and deploy city-level smart parking. In October 2021, Beijing Lottop Technology introduced "Baidu ACE City-level Smart Parking Solution". At present, Baidu has launched city-level smart parking projects in more than 30 areas.

City-level parking platform: one city, one network

The implementation of city-level parking platforms is led by local competent authorities. Within an administrative region (city/district/county), all or most parking resources are connected to a platform, providing the public with services including parking inquiry, navigation, reservation and payment and building an overall pattern of "one city, one network, one APP", through integrating static and dynamic data of parking lots. The investment in construction of a single city-level parking platform project ranges from one million to hundreds of millions of yuan. City-level smart parking is therefore the most promising smart parking segment. It is also the main development direction of smart parking in current stage.

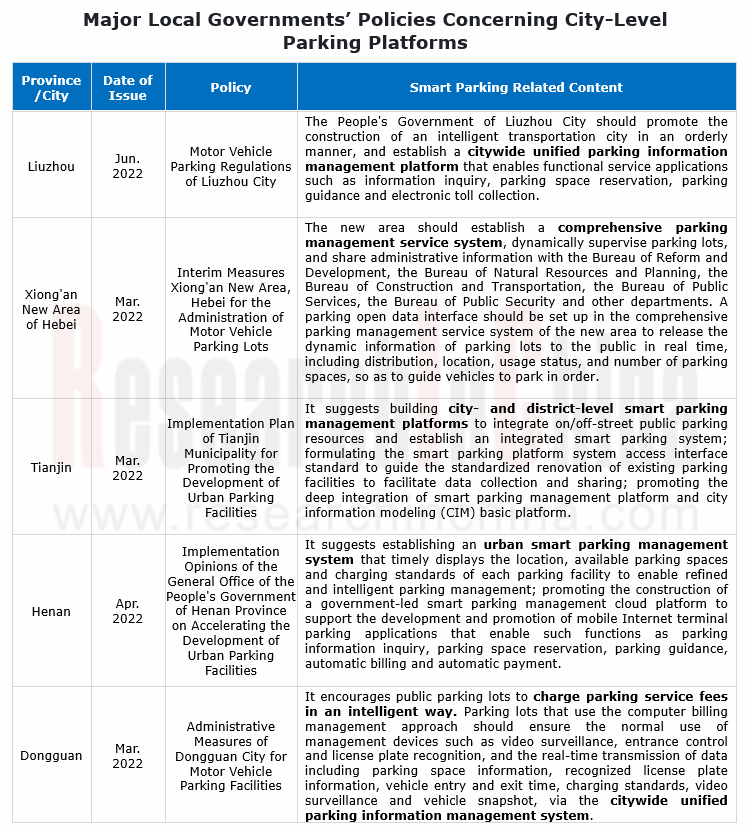

Policies and regulations favor the construction of city-level platforms: the people's governments of all cities are required to develop mobile terminal smart parking service applications that integrate service functions such as information inquiry, parking space reservation and electronic payment, and promote the deep integration of parking information management platform and city information modeling (CIM) basic platform, according to the Opinions on Promoting the Development of Urban Parking Facilities issued by the General Office of the State Council in May 2021. In addition, local governments including Liuzhou, Xiong’an New Area of Hebei, Tianjin, Henan and Dongguan have also released relevant policies requiring the building of city-level parking platforms.

Urban parking platforms mushroom in China: driven by relevant policies, about 300 cities across the country, typically Beijing, Shanghai, Kunming, Dongguan, Nanjing, Qingdao and Ningbo, have launched smart parking platforms.

In Shanghai’s case, “Shanghai Parking”, a city-level smart parking platform launched in 2020, has covered a total of 890,000 public parking spaces in more than 4,300 public parking lots (garages) and toll road parking lots in the city. In August 2022, Shanghai Parking 2.0 was introduced. It supports over 2,800 public parking lots (garages) and all toll road parking lots, offers the unified electronic payment feature "parking payment", and allows 49 hospitals to provide online parking reservation service.

Shared parking is also a smart parking application field encouraged by China. The off-peak parking sharing function in Shanghai Parking APP 2.0 has been available to 212 parking lots (garages), providing one-click inquiry and order signing services for residents in surrounding communities, that is, residents can park their cars conveniently within the usage period after signing contract online.

Layout of automakers in smart parking: improve parking experience for car owners.

According to the survey data from Parkopedia, relatively speaking, 56.6% smart parking users tend to use vehicle navigation to receive parking information, so it is necessary to embed parking information in IVI systems.

At present, major automakers have embedded smart parking functions in their telematics systems by way of cooperating with parking data service providers or telematics service providers. Typical parking data service providers are Parkopedia and EZParking, of which Parkopedia makes a global layout and often cooperates with foreign automakers such as Mercedes-Benz and Audi; EZParking deploys the Chinese market and most of its partners are Chinese automakers.

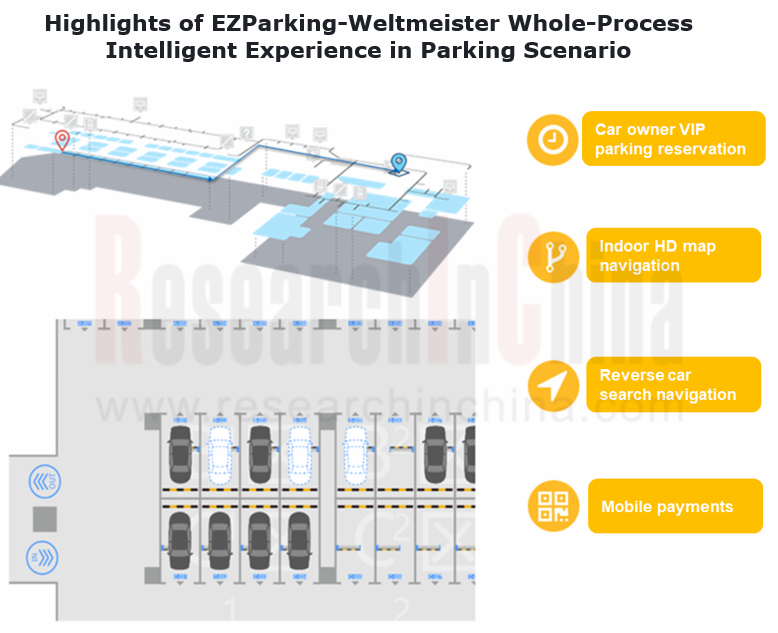

Weltmeister and EZParking joined hands in smart parking: in August 2022, the "Smart Parking" service jointly developed by Weltmeister and EZParking was launched on the WM iMOTOR APP, allowing Weltmeister owners to enjoy free inquiry services, for example, inquiring about the information of more than 10 million parking spaces (available/busy/full) of more than 70,000 parking lots (garages) in more than 100 cities.

Weltmeister will continue the iteration of its "Smart Parking" service. In the future, it will enable such functions as mobility route intelligent planning and navigation, indoor HD map navigation in parking garages, automatic parking and reverse car search, and unconscious payments when leaving parking lots.

Honda together with Parkopedia provides parking information and payment solutions for Chinese car owners: in October 2021, Honda, Parkopedia and MXNAVI together added the parking information and payment solution to the Honda CONNECT 3.0 entertainment system.

Honda owners can inquire about dynamic parking information via Honda CONNECT 3.0. The vehicle intelligent voice assistant can provide drivers with nearby parking suggestions when approaching the destination. Honda owners can also pay parking fees through the in-vehicle password-free parking payment service or the QR code displayed on the car screen.

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...

China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure This report highlights the passenger car L2+ and above (including L2+, ...

Automotive Cockpit Domain Controller Research Report, 2023

Research on cockpit domain controllers: various forms of products are mass-produced and mounted on vehicles, and product iteration speeds up.

Both quality and quantity have been improved, and the it...

Chinese Passenger Car OEMs’ Overseas Layout Research Report, 2023

OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

During 2021-2022, the global economy ...

Global and Chinese Automakers’ Modular Platform and Technology Planning Research Report, 2023

Research on modular platforms: explore intelligent evolution strategy of automakers after modular platforms become widespread.

By analyzing the planning of international automakers, Chinese conventi...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

The automo...

NXP’s Intelligence Business Analysis Report, 2022-2023

In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replace...

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR5...

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...

China Autonomous Driving Domain Controller Research Report, 2023

Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry i...

China In-Vehicle Payment Market Research Report, 2023

China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout ...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes. 01 Build up their own software and hardware capabilities...