Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-based delivery and drone delivery) and indoor robot delivery. This report focuses on researching outdoor ground-based autonomous delivery vehicles.

1. The autonomous delivery industry has transitioned from test run to large-scale operation.

In May 2021, the first batch of autonomous delivery vehicles in China was allowed to run on public roads in demonstration areas. During the epidemic in Shanghai in 2022, more than 500 autonomous delivery vehicles were assembled to serve the affected areas. After going through adaptation to different scenarios and technical optimization and verification in this period of time, autonomous delivery vehicles are finding ever wider application. Autonomous express delivery, autonomous takeaway delivery, supermarket delivery and autonomous retail have penetrated scenarios like communities, industrial parks, college campuses, smart scenic spots, AI parks and business districts.

In Neolix’s case, as of July 2022 its autonomous vehicles have successfully been used in over 100 scenarios in 40 cities of 13 countries, delivering more than 2 million orders to over 300,000 users. The company has delivered and deployed a total of more than 1,000 vehicles. In the meantime, Unity Drive’s products have landed in over 100 large- and medium-sized cities and run in over 150 parks across China. As of July 2022, GoFurther.AI’s intelligent autonomous delivery vehicles have delivered 1.3 million parcels.

As concerns application, as of May 2022, JD Logistics has had nearly 400 intelligent delivery vehicles operated normally in over 25 cities across China, including Beijing, Tianjin and Changshu. During 2022-2023, JD will push on with research and development and put into use thousands of intelligent delivery vehicles for a wider coverage of autonomous delivery. In more than 200 colleges and universities in China, Cainiao has introduced more than 500 Xiaomanlu autonomous vehicles to serve millions of teachers and students, realizing normal operation.

Companies’ quicker pace of carrying out their large-scale implementation plans has a strong bond with maturing autonomous delivery vehicle technology and declining vehicle cost.

2. The partnerships between industry chain companies expand, and the cost of autonomous delivery vehicles dwindles.

In April 2022, Haomo.AI introduced Little Magic Camel, an intelligent vehicle packing 3 mechanical LiDARs and a 360TOPS computing platform. The price of the vehicle is as low as RMB130,000, equivalent to the annual salary of a courier working in a big city.

Previously, the prices of autonomous delivery vehicles ranged at RMB500,000-600,000 in 2020, and dropped to RMB200,000-300,000 in 2021 before falling to RMB130,000 in 2022. From 2023 to 2025, the cost of autonomous delivery vehicles will be lowered to less than RMB100,000.

Autonomous delivery vehicles vary in specification and functional purpose, and their prices thus differ greatly as a matter of course. In addition to prices, autonomous vehicles also come with hidden costs. Almost all ongoing autonomous delivery projects are equipped with autonomous driving engineers to participate in the whole process or remotely control at the backend, in a bid to intervene at any time in the case of emergencies.

Unity Drive’s remote cockpit (ultralow latency: ≤50ms)

From a cost perspective, autonomous delivery vehicles have yet to gain a big replacement edge over labor. The adoption of autonomous delivery vehicles at the earliest and acquisition of more long-tail scenario data is the only path for products and technology to mature.

The autonomous delivery vehicle market has boosted development of local components suppliers. Independent components companies participate in the autonomous delivery supply chain more deeply, and autonomous delivery vehicle manufacturers also cut down their costs with the help of local suppliers. Taking LiDAR as an example, Modai 20 carries Hesai long-range high-resolution Pandar Series LiDAR and mid-range XT Series LiDAR; GoFurther.AI’s autonomous delivery vehicles bear the combined LiDAR solution (RS-LiDAR-16+RS-Bpearl) from RoboSense.

As companies promote and deploy their projects on large scale, especially signing city-level contracts (e.g., Unity Drive + Yancheng City, MOVE-X + Wuwei City, and JD + Changshu City), the hardware and O&M costs per autonomous delivery vehicle will be reduced with bulk purchase.

At present, both production capacity and output of autonomous delivery vehicles in China keeps growing. For example, MOVE-X’s smart factory boasts planned annual capacity of 20,000 units; Haomo.AI already has annual capacity of 10,000 units.

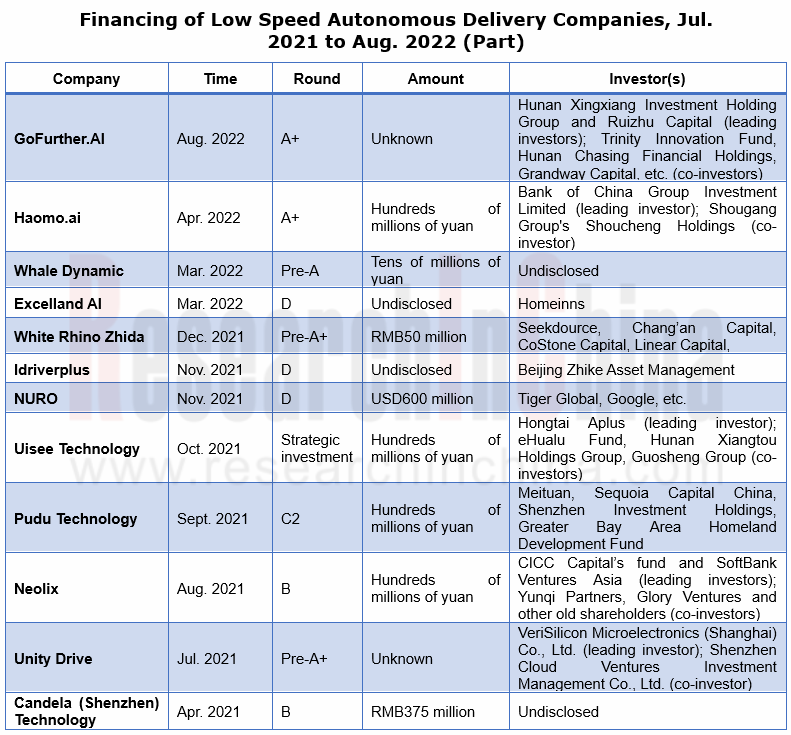

The development of autonomous delivery vehicles is inseparable from capital support. In the past year, autonomous delivery companies like Pudu Technology and Neolix acquired hundreds of millions of yuan in investment.

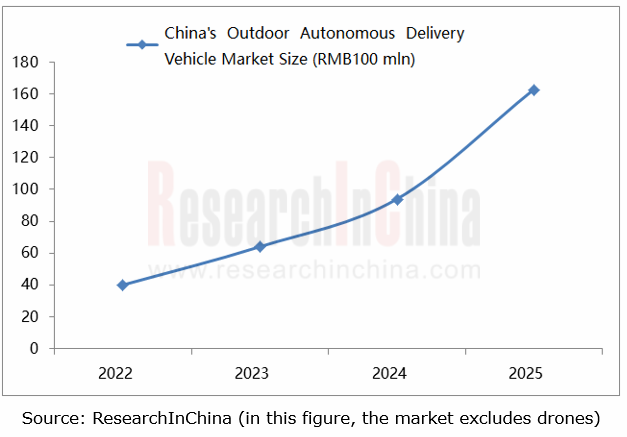

3. The autonomous delivery market sustains rapid growth and will be worth RMB17 billion in 2025.

According to data from State Post Bureau of China, from January to July 2022, the courier service companies in China handled a total of 60.87 billion parcels (including 51.22 billion pieces delivered from January to June, a year-on-year increase of 3.7%, and 9.65 billion pieces in July, up 8.0%). By the end of 2021, express couriers in China have numbered 4.5 million, and food takeout delivery riders have exceeded 13 million, including 6 million Meituan riders.

Companies badly need to reduce costs and improve efficiency. Meituan plans to deploy 10,000 autonomous delivery vehicles nationwide within three years. On our estimate, China's outdoor autonomous delivery vehicle market will be valued at about RMB17 billion in 2025.

Some companies are also exploring new models for how to maximize efficiency of cooperative delivery between manpower and machines. For example, the autonomous delivery vehicle adoption program launched by JD is a typical case.

To reduce work intensity of couriers, JD Logistics has introduced "Autonomous Vehicle Adoption Program". In areas covered by autonomous delivery, the couriers of JD Logistics can apply for "adoption" of a certain number of autonomous delivery vehicles to help them work. Couriers thus become the "commander" of a robot delivery squad, handing the standard delivery work over to autonomous delivery vehicles, and themselves take on dynamic collection or other personalized services. This adoption program has favored an over 50% growth in JD’s order delivery during peak seasons.

4. Autonomous delivery vehicles have a greater ability to connect scenarios.

Connecting to more public roads:

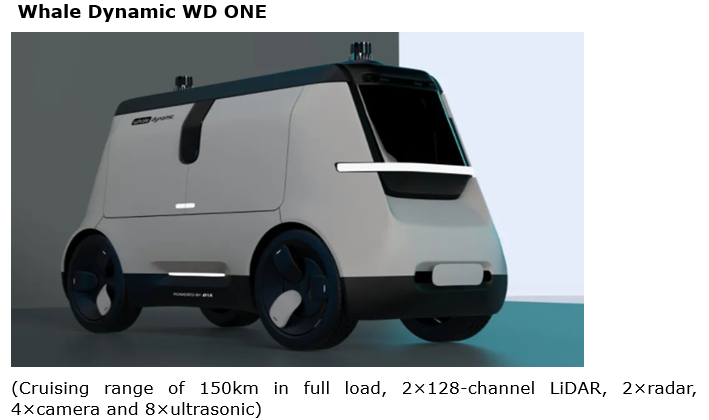

From fixed-area scenarios (e.g., campuses, scenic spots, communities, demonstration areas, hospitals and factories) to densely populated business districts, plazas and subway entrances, autonomous delivery is becoming more widespread, and plus continuous technological iterations and Corner Case scenario data accumulation, autonomous delivery vehicles offer higher safety and reliability and are applicable to more public road scenarios. Some companies have begun to enhance their road-level autonomous delivery business. One example is Whale Dynamic.

Whale Dynamic uses L4 passenger car autonomous driving technology to build integrated solutions for small autonomous vehicles, targeting the road autonomous delivery market.

In September 2021, Alibaba announced that DAMO Academy is working to develop "Damanlu", a L4 autonomous light truck product for urban distribution scenarios, delivering goods from distribution stations to Cainiao Courier Stations in parks. In June 2022, Deqing County of Zhejiang became China’s first city to issue public road test licenses for L4 autonomous trucks with “no people at the driver’s seat”, and Alibaba acquired one of the first two licenses. Damanlu carried out road tests in designated areas in Deqing, including some highway sections.

There are also companies trying to get through terminal distribution within 5 kilometers outdoors and enable free mobility in indoor and semi-enclosed environments. For example, Candela's split product, the Sunny new-generation autonomous logistics vehicle features automatic unloading and loading cabinet, real-time obstacle avoidance, cloud mapping, and multi-vehicle intelligent scheduling. The front large screen has the capabilities of human-computer interaction and advertising display. The vehicle has come into commercial operation. Candela realizes the seamless connection of indoor and outdoor logistics and distribution through the cooperative scheduling of outdoor Sunny autonomous vehicles and indoor Candlelight robots.

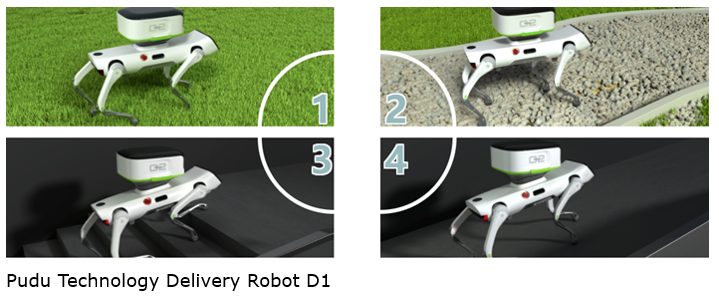

Unlike wheeled autonomous vehicles, quadruped robots are among the most complex and challenging types in robotics industry. On March 24, 2022, Pudu Technology unveiled D1, a quadruped delivery robot equipped with a dedicated pan-tilt delivery box. The active control via control algorithm allows pan-tilt delivery box to automatically adjust pitch attitude. When the robot walks and climbs slopes, the pan-tilt delivery box can always stay level. D1 can be used for the "last-three-kilometer" delivery in office buildings, parks, and residential quarters.

In January 2022, R3, the third-generation battery electric autonomous delivery vehicle jointly developed and designed by BYD and Nuro, made a debut. The biggest feature of this vehicle is the airbag installed outside to protect pedestrians on roads. The model is expected to be mass-produced in 2023.

At present, the logistics and food delivery giants, JD, Meituan and Cainiao are each phasing in their plans of introducing 10,000 autonomous delivery vehicles in the next three years. Other players have also increased the activities of daily autonomous delivery. White Rhino Zhida plans to realize daily delivery by 5,000 autonomous vehicles within five years.

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...

China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure This report highlights the passenger car L2+ and above (including L2+, ...

Automotive Cockpit Domain Controller Research Report, 2023

Research on cockpit domain controllers: various forms of products are mass-produced and mounted on vehicles, and product iteration speeds up.

Both quality and quantity have been improved, and the it...

Chinese Passenger Car OEMs’ Overseas Layout Research Report, 2023

OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

During 2021-2022, the global economy ...

Global and Chinese Automakers’ Modular Platform and Technology Planning Research Report, 2023

Research on modular platforms: explore intelligent evolution strategy of automakers after modular platforms become widespread.

By analyzing the planning of international automakers, Chinese conventi...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

The automo...

NXP’s Intelligence Business Analysis Report, 2022-2023

In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replace...

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR5...

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...

China Autonomous Driving Domain Controller Research Report, 2023

Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry i...