China Driving Recorder Market Research Report, 2022

-

Sept.2022

- Hard Copy

- USD

$4,000

-

- Pages:210

- Single User License

(PDF Unprintable)

- USD

$3,800

-

- Code:

ZXF006

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,700

-

- Hard Copy + Single User License

- USD

$4,200

-

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology stipulated: "Each passenger car should be equipped with an event data recorder (EDR) that complies with GB 39732. The passenger car equipped with an automotive video driving record system (driving recorder/ digital video recorder) that complies with GB/T 38892 should be deemed to meet the requirements." The regulation has been applied to newly produced vehicles from January 1, 2022. As EDRs has become the standard configuration of new cars, the OEM installation rate of driving recorders/digital video recorders (DVRs) has also risen.

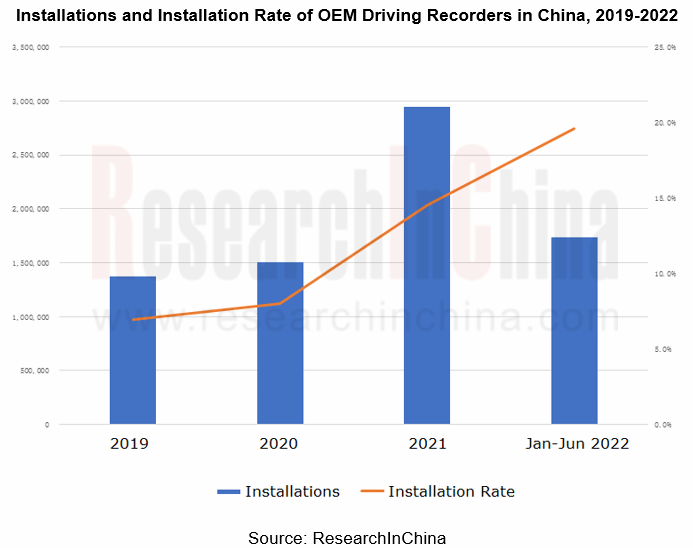

In 2022H1, the sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year

From a monthly trend, the OEM installation rate of driving recorders in passenger cars (note: the sales proportion of passenger cars with driving recorder as standard configuration as a percentage of the total passenger car sales volume) jumped from 8.9% in April 2021 to 21.9% in June 2022.

On annual basis, the OEM installation rate of driving recorders in passenger cars hit 7.0% in 2019, 8.0% in 2020, 14.5% in 2021, and 19.6% in 2022H1. It is expected to be 22% in the entire 2022.

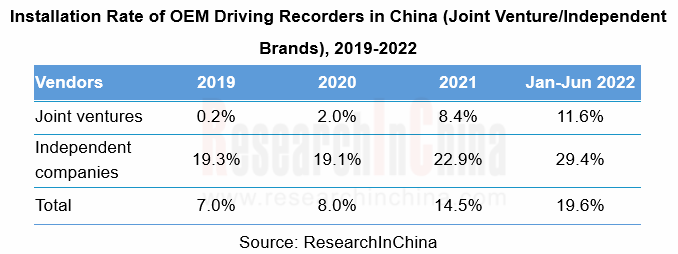

Independent brands and new energy vehicles are the main roles that include driving recorders into standard configuration

The installation rate of driving recorders as standard configuration for independent brand models has been at a relatively high level, reaching 19.3% in 2019 when joint venture brands only secured 0.2%. In 2022, independent brand models will achieve installation rate of 29.4% as the main force in the standard configuration of driving recorders.

However, since 2021, the installation rate of joint venture brands has made progress quickly, from 2.0% in 2020 to 8.4% in 2021 and 11.6% in 2022H1. Compared with 2019, it increased by 11.4 percentage points, higher than 10.1 percentage points gained by independent brands.

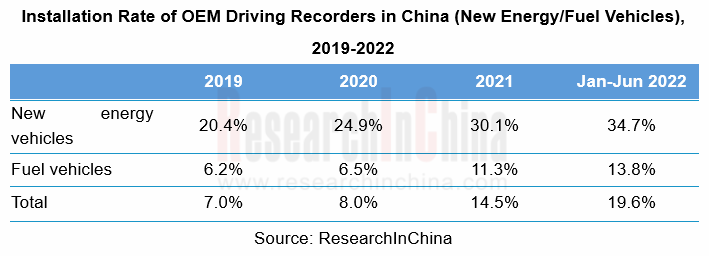

The installation rate of OEM driving recorders for new energy vehicles swelled by 14.3 percentage points from 20.4% in 2019 to 34.7% in 2022H1. For traditional fuel vehicles, the installation rate rose by 7.6 percentage points from 6.2% in 2019 to 13.8% in 2022H1. The growth in the sales volume of new energy vehicles also led to the growth of OEM driving recorders.

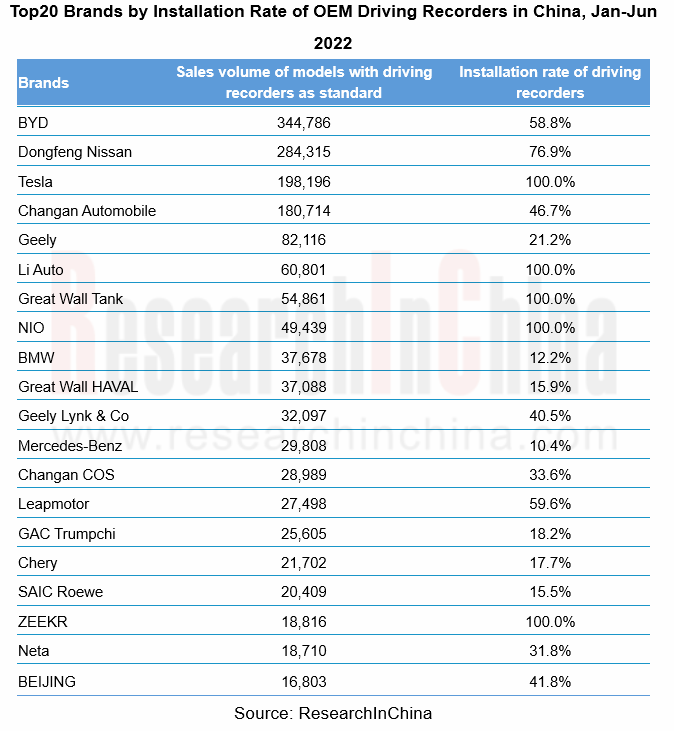

By the sales volume of models with driving recorders as standard in 2022H1, the top five brands included BYD (345,000 units), Nissan (284,000 units), Tesla (198,000 units), Changan Automobile (187,000 units) and Geely (82,000), with the respective installation rate as standard configuration of 58.8%, 76.9%, 100.0%, 46.7% and 21.2%. Chinese local new energy vehicle brands Li Auto and NIO regard driving recorders as standard, while traditional brands BMW and Mercedes-Benz only install OEM driving recorders on 12.2% and 10.4% of their vehicles respectively.

Driving recorder technology integration: ADAS, streaming media and intelligence

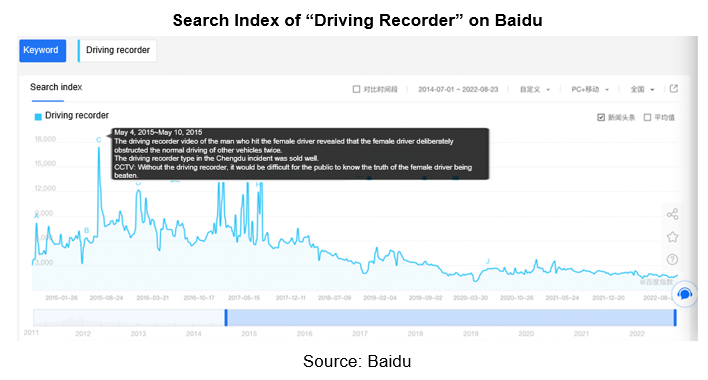

Driving recorders are undoubtedly indispensable for Chinese car owners. In 2015, the driving recorder video incident directly spurred the driving recorder aftermarket where 10 million driving recorders were sold that year as the best-selling automotive electronic products on Double 11, a Chinese unofficial e-commerce holiday and shopping festival similar to Black Friday in the U.S.

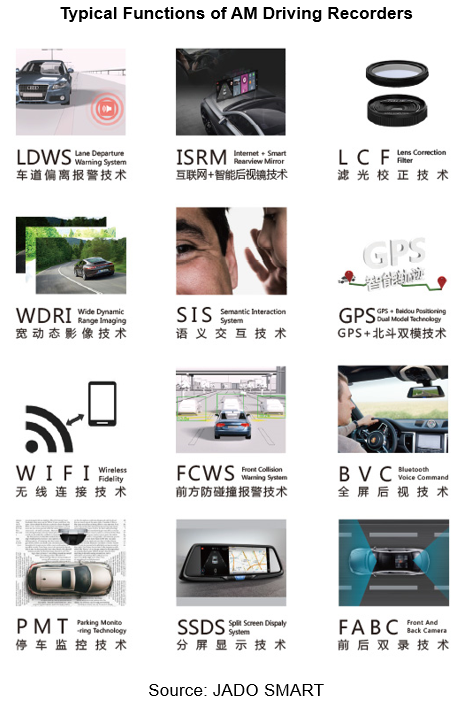

In addition to navigation, preventing accident frauds, assisting in handling traffic accident disputes and electronic violation disputes, driving recorders offer more and more functions. With the development of automotive intelligent connectivity, functions such as electronic fence, parking monitoring and alarm, and even ADAS functions like LDWS and FCWS have become standard for driving recorders, but AM driving recorders only integrate the most basic ADAS functions due to limitations of hardware, software and vehicle data acquisition.

With a higher installation rate, driving recorders can share the inputs (cameras) and outputs (displays) with other smart cockpit devices, which not only saves costs, but also better realizes integration of intelligent connection functions.

1. Driving Recorder Market Overview

1.1 Definition and Classification

1.2 Composition

1.3 Development History

1.3 Driving Recorder Baidu Index

1.4 Development Trend

2 Driving Recorder Technology Integration and Industry Trends

2.1 Fusion I: ADAS

2.1.1 Built-in ADAS of Driving Recorder Starts from AM

2.1.2 There are Inherent Deficiencies in Built-in ADAS of AM Driving Recorder

2.1.3 Driving Recorder fusion ADAS from OEM to AM

2.2 Fusion II: Streaming Rearview Mirror

2.2.1 Streaming Rearview Mirror

2.2.2 Industry Chain

2.2.3 Regulations Related to Streaming Rearview Mirror

2.2.4 Product Structure and Characteristics

2.2.5 Installation Rate of Streaming Rearview Mirror Models

2.2.6 OEM Streaming Rearview Mirror Solution

2.2.7 Suppliers and Product Solutions

2.2.8 Advantages and Future Development Trends

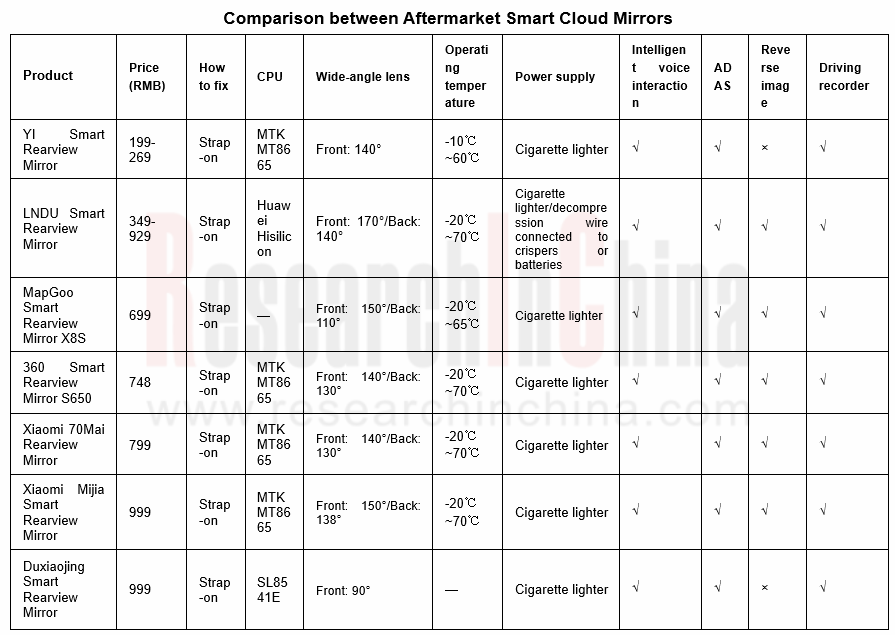

2.3 Fusion III: Intelligent Cloud Mirror

2.3.1 Industry Chain

2.3.2 Market Products

2.3.3 Development Trend

2.4 Fusion IV: Electronic Exterior Rearview Mirror

2.4.1 Development History

2.4.2 Product Advantages

2.4.3 Product structure and Characteristics

2.4.4 Market Status

2.4.5 Industry Chain

2.4.6 Models Equipped with Electronic Exterior Rearview Mirror (1)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (2)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (3)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (4)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (5)

2.4.7 Suppliers and Product Solutions

3 Driving Recorder Market Size and Forecast

3.1 Quantity and Installation Rate of OEM Driving Recorders in China, 2019-2022

3.2 Monthly Trend of Installation Rate of OEM Driving Recorders in China, 2019-2022

3.3 OEM Driving Recorder Market Size in China, 2021-2026E

3.4 AM Driving Recorder Market Size in China, 2021-2026E

3.5 Installation Rate of OEM Driving Recorder in China (by Model Price Range), 2019-2022

3.6 Installation Rate of OEM Driving Recorder in China (Joint Venture/Independent; New Energy/Fuel Vehicle), 2019-2022

3.7 Installation Rate of OEM Driving Recorder in China (by Brand), 2019-2022

3.8 Installation Rate of OEM Driving Recorder in China (by Automakers) , 2019-2022

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced below 100,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced below 100,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 10-150,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 10-150,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 15- 200,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 15- 200,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 20- 250,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 20- 250,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 25- 300,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 25- 300,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 30-350,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 30-350,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 35- 400,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 35- 400,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 40- 500,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 40- 500,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced over 500,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced over 500,000 yuan)

4 Major Driving Recorder Enterprises

4.1 Gentex

4.1.1 Profile

4.1.2 Driving Recorder - Full-screen Display Rearview Mirror

4.1.2 Driving Recorder - Electronic Rearview Mirror

4.1.2 Driving Recorder - Camera Monitoring System (CMS)

4.1.3 Financials

4.1.4 Customer Supporting Relationship

4.1.5 Application Solution

4.1.6 Development Planning

4.2 Magna

4.2.1 Profile

4.2.2 Smart Rearview Mirror Products

4.2.3 Development Planning

4.3 Ficosa

4.3.1 Profile

4.3.2 Intelligent Rearview Monitoring System (IRMS)

4.3.2 Electronic Exterior Rearview Mirror

4.3.3 Application Solution

4.4 ADAYO Group

4.4.1 Profile

4.4.2 Product Layout

4.4.3 Product Roadmap

4.4.4 Application Solutions

4.5 LongHorn

4.5.1 Profile

4.5.2 Product Layout

4.5.3 Product Revenue

4.5.4 Major Customers

4.6 Aoni Electronics

4.6.1 Profile

4.6.2 Product Layout

4.6.3 Product Revenue

4.7 Coligen

4.7.1 Profile

4.7.2 Product Layout

4.7.3 Product Revenue

4.8 Shanghai Yuxing Electronics

4.8.1 Profile

4.8.2 Product Layout

4.8.3 Application Solutions

4.9 Mobvoi

4.9.1 Profile

4.9.2 Product Layout

4.9.3 Core Technology

4.9.4 Smart Rearview Mirror Products

4.10 Banya Technology

4.10.1 Profile

4.10.2 Smart Cloud Mirror Product Solution

4.10.3 Streaming Media Rearview Mirror Product Solution

4.11 Teyes

4.11.1 Profile

4.11.2 Smart Rearview Mirror Product Solution

4.12 Shenzhen Roadrover Technology

4.12.1 Profile

4.12.2 Smart Rearview Mirror Products

4.13 Yuanfeng Technology

4.13.1 Profile

4.13.2 Business Layout: 1 + 3 + N Business Architecture

4.13.3 Product Structure Process

4.13.4 Mass Production Customers

4.13.5 Application Solutions

4.14 Willing Tech

4.14.1 Profile

4.14.2 Product Layout

4.14.3 Application Solutions

4.15 DDPAI

4.15.1 Profile

4.15.2 Product Introduction - Car Smart Screen

4.15.2 Product Introduction - X5 Pro

4.16 Haikang Automotive Electronics

4.16.1 Profile

4.16.2 Product introduction

4.16.3 Business Analysis

4.17 JADO

4.17.1 Profile

4.17.2 Product Introduction

5 OEMs' Driving Recorder Solution

5.1 Models with Driving Recorder as Standard Configuration

5.1.1 Dongfeng

5.1.2 BYD

5.1.3 Changan

5.1.4 Geely

5.1.5 Great Wall Motor

5.1.6 Chery

5.2 OEMs' Driving Recorder Solutions

5.2.1 Dongfeng Aeolus

5.2.2 Chang'an UNI-K

5.2.3 Great Wall Mocha DHT-PHEV

5.2.4 FAW E-HS9

5.2.5 FAW HS5

5.2.6 SAIC Buick GL8

5.2.7 GAC Toyota Wildlander

5.2.8 GAC Honda e

5.2.9 BAIC Mofang

6 Key Enterprises in Driving Recorder Industry Chain

6.1 Allwinner Technology

6.1.1 Profile

6.1.2 Product Layout

6.1.3 Product Solutions

6.2 Rockchip

6.2.1 Profile

6.2.2 Product Solutions

6.3 Spreadtrum Communications

6.3.1 Profile

6.3.2 Product Solutions

6.4 Qualcomm

6.4.1 Profile

6.4.2 Product Solutions

6.5 Novatek

6.5.1 Profile

6.5.2 Product Solutions

6.6 Ambarella

6.6.1 Profile

6.6.2 Product Layout

6.6.3 Product Solutions

6.6.4 Electronic Rearview Mirror Solution Based on Ambarella Chip

6.7 MediaTek

6.7.1 Profile

6.7.2 Product Solutions

6.8 Xilinx

6.8.1 Product Layout

6.8.2 Product Solutions

6.9 Camera Solutions

6.9.1 Automotive Camera Industry Chain

6.9.2 Camera Module Summary

6.9.3 OFILM Product Layout

6.9.4 Sunny Product Layout

6.9.5 Q Tech Product Layout

6.9.6 Product Layout of Lianchuang Electronic Technology

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...

China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure This report highlights the passenger car L2+ and above (including L2+, ...

Automotive Cockpit Domain Controller Research Report, 2023

Research on cockpit domain controllers: various forms of products are mass-produced and mounted on vehicles, and product iteration speeds up.

Both quality and quantity have been improved, and the it...

Chinese Passenger Car OEMs’ Overseas Layout Research Report, 2023

OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

During 2021-2022, the global economy ...

Global and Chinese Automakers’ Modular Platform and Technology Planning Research Report, 2023

Research on modular platforms: explore intelligent evolution strategy of automakers after modular platforms become widespread.

By analyzing the planning of international automakers, Chinese conventi...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

The automo...

NXP’s Intelligence Business Analysis Report, 2022-2023

In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replace...

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR5...

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...