Global and China Molybdenum Industry Report, 2012-2015

-

Apr.2013

- Hard Copy

- USD

$2,050

-

- Pages:86

- Single User License

(PDF Unprintable)

- USD

$1,950

-

- Code:

ZL001

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,100

-

- Hard Copy + Single User License

- USD

$2,250

-

In 2012, the global economic growth was weak, the bulk commodity demand was reduced, and the prices generally declined. As a result, the molybdenum market remained in the doldrums, the prices showed a downward trend, and the annual average price was USD 12.74 per pound of molybdenum, a decrease of 17.5% from 2011. At the end of 2012, the supply of molybdenum ore decreased, the demand from steel mills increased, and the molybdenum price began to rise.

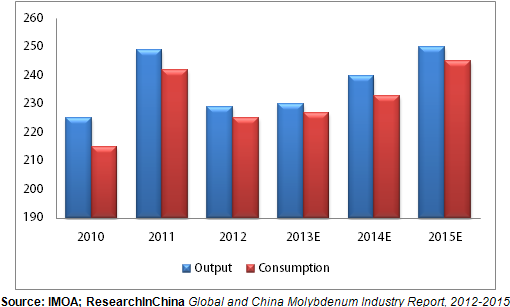

In 2012, the global molybdenum output was 229 kilotons and the consumption was 225 kilotons, basically in balance. With the recovery of steel demand since the fourth quarter of 2012, the demand for molybdenum is expected to resume growth. After 2014, some mines currently under construction will start production, such as Chile’s Sierra Gorda copper-molybdenum mine (controlled by KGHM and Sumitomo Metal) that is expected to start production in 2014. In addition, Grupo Mexico and Rio Tinto also plan to increase production.

Global Molybdenum Output and Consumption, 2010-2015 (Unit: kiloton)

China is a large producer and consumer of molybdenum in the world, and the global increment in the production and consumption of molybdenum in the past two years mainly came from China. In 2012, China produced 92 kilotons of molybdenum (equivalent to metal content), accounting for 40.2% of the global molybdenum output, and consumed 85 kilotons, accounting for 37.8% of the global molybdenum consumption. Due to the national protection on strategic resources, molybdenum resources will be concentrated in large enterprises, and the supply will be effectively controlled.

Global molybdenum producers are mainly concentrated in countries with rich molybdenum reserves such as China, the United States and Chile. Global top 10 molybdenum producers account for 2/3 of the global output. Mineral resources are controlled by major molybdenum companies, and the access to large-quantity and high-quality molybdenum ore resources has become the biggest obstacle to entering the industry.

In 2012, top 10 molybdenum producers accounted for 66.4% of the global output, and the U.S. Freeport was the largest molybdenum producer with a share of 17%, followed by Chile’s Codelo and GMexico.

Chinese molybdenum production enterprises are mainly concentrated in the regions with rich molybdenum reserves such as Henan, Shaanxi and Liaoning. Jinduicheng Molybdenum and Luoyang Molybdenum, the owners of world-class molybdenum mines Jinduicheng Molybdenum Mine and Luanchuan Molybdenum Mine respectively, are in the forefront of the world, and ranked fourth and fifth respectively in the world in terms of molybdenum output in 2012.

With six chapters and 89 charts, Global and China Molybdenum Industry Report, 2012-2015 makes an in-depth analysis of the development background, current status and market pattern of molybdenum industry in China and worldwide, and sheds light on the production, operation and development trend of global molybdenum industry leaders such as FCX and GMexico as well as Chinese enterprises including Jinduicheng Molybdenum and Luoyang Molybdenum.

1. Molybdenum Industry Overview

1.1 Basic Properties of Molybdenum

1.2 Classification of Molybdenum Products

1.3 Industry Chain

1.4 Application

2. Development of Global Molybdenum Industry

2.1 Global Molybdenum Reserves and Distribution

2.2 Exploitation

2.3 Supply

2.3.1 Supply Structure

2.3.2 Major Molybdenum Producers

2.4 Demand

2.5 Competition Pattern of Corporations Worldwide

2.6 Summary and Prospect

3. Development of China Molybdenum Industry

3.1 Policy Adjustment

3.1.1 Entry Policy

3.1.2 Export Quota Policy

3.1.3 Export Duty Policy

3.2 Molybdenum Reserves and Distribution in China

3.3 Supply

3.4 Consumer Demand

3.5 Prices

3.5.1 Prices in China

3.6 Summary and Prospect

4. Import and Export of China Molybdenum Industry

4.1 Net Export Scale of Molybdenum Products

4.2 Import and Export of Main Molybdenum Products

4.2.1 Import and Export Structure of Molybdenum Products in China

4.2.2 Primary Molybdenum Products

4.2.3 Molybdenum Chemical Products

4.2.4 Molybdenum Metal Products

4.3 Summary

5. Key Corporations Worldwide

5.1 FCX

5.1.1 Profile

5.1.2 Molybdenum Reserves

5.1.3 Operation

5.2 Codelco

5.2.1 Profile

5.2.2 Production

5.2.3 Operation

5.3 GMexico

5.3.1 Profile

5.3.2 Operation

5.4 Thompson Creek

5.4.1 Profile

5.4.2 Molybdenum Reserves

5.4.3 Production

5.4.4 Operation

5.5 Summary

6. Key Players in China

6.1 China Molybdenum Co., Ltd

6.1.1 Profile

6.1.2 Molybdenum Reserves

6.1.3 Operation

6.2 Jinduicheng Molybdenum

6.2.1 Profile

6.2.2 Molybdenum Reserves

6.2.3 Capacity Expansion

6.2.4 Operation

6.3 Jinzhou New China Dragon Moly Co., Ltd

6.3.1 Profile

6.3.2 Capacity Expansion

6.3.3 Operation

6.3.4 Strategic Planning

6.4 Tianbao Mining Group

6.4.1 Profile

6.4.2 Operation

6.4.3 Major Events

6.5 Xiamen Tungsten Co., Ltd

6.5.1 Profile

6.5.2 Operation

6.5.3 Summy

6.6 Huludao Wonful Resources Inc.

6.6.1 Profile

6.6.2 Operation

6.7 Shunchi Tungsten & Molybdenum Products Co., Ltd

6.7.1 Profile

6.7.2 Operation

6.7.3 Key Projects

6.8 Wanxin Tungsten & Molybdenum Products Co., Ltd

6.8.1 Profile

6.8.2 Operation

6.9 Rongxin Molybdenum

6.9.1 Profile

6.9.2 Operation

6.10 Daheishan Molybdenum

6.10.1 Profile

6.10.2 Molybdenum Reserves

6.10.3 Production

6.10.4 Operation

6.11 Summary

Molybdenum Output and Consumption in China, 2005-2015E

Global Molybdenum Output and Consumption, 2010-2015E

Basic Properties of Molybdenum

Classification of Major Molybdenum Products in the World

Molybdenum Industry Chain

Global Distribution of Direct Molybdenum Consumption by Product, 2012

Types of Major Molybdenum Mines in the World

Distribution of Molybdenum Reserves (Equivalent to Metal Content) by Country, 2012

Available Years of Global Molybdenum Reserves for Mining

Global Molybdenum Output (Equivalent to Metal Content), 2005-2012

Global Molybdenum Output (Equivalent to Metal Content) by Country/Region, 2008-2012

Global Byproduct Molybdenum Output (Equivalent to Metal Content) and Its Proportion in Total Molybdenum Output, 2005-2015E

Molybdenum Output of Major Molybdenum Producers in the World, 2007-2012

Global Molybdenum Projects under Construction, 2012

Global Molybdenum Consumption, 2005-2012

Global Consumer Demand for Molybdenum (by Country/Region), 2012

Market Share of Molybdenum Producers Worldwide, 2012

Global Molybdenum Output and Consumption, 2010-2015E

Entry Policies for China Molybdenum Industry, 2006-2012

Export Quota of Chinese Molybdenum Products, 2008-2012

Primary Molybdenum Products Enterprises with Export Quota in China, 2012

Molybdenum Chemical Products Enterprises with Export Quota in China, 2012

Molybdenum Metal Products Enterprises with Export Quota in China, 2012

Distribution of Molybdenum Reserves in China, 2012

Main Molybdenum Reserves in China, 2012

Molybdenum Output of China (Equivalent to Metal Content), 2005-2012

Distribution of Molybdenum Concentrate Output in China, 2012

Molybdenum Consumption (Equivalent to Metal Content) in China, 2005-2012

Market Prices of Molybdenum Iron in Europe, 2003-2012

Market Prices of Molybdenum Concentrate in China, 2004-2012

Market Prices of Molybdenum Iron in China, 2011-2013Q1

Molybdenum Output and Market Share of Key Producers in China, 2008-2012

Molybdenum Output and Consumption in China, 2005-2015E

Molybdenum Net Export Volume (Equivalent to Metal Content) in China, 2003-2012

Import Structure of Molybdenum Products (by Product) in China, 2006-2012

Export Structure of Molybdenum Products (by Product) in China, 2006-2012

Import & Export Volume of Primary Molybdenum Products in China, 2006-2012

Import & Export Volume of Molybdenum Chemical Products in China, 2006-2012

Import & Export Volume of Molybdenum Metal Products in China, 2006-2012

Import Volume of Molybdenum Products in China, 2006-2012

Export Volume of Molybdenum Products in China, 2006-2012

Organizational Chart of FCX

Products of Climax Molybdenum

Preliminary Recoverable Proven and Probable Reserves of FCX, December 31, 2012

Molybdenum Output and Sales of FCX, 2010-2015E

Operating Revenue and Net Income of FCX Molybdenum Business, 2010-2015

Molybdenum Sales of Codelco, 2009-2015E

Molybdenum Sales Breakdown of Codelco by Region, Q1-Q3 2012

Mining Products Output of AMC, 2010-2012

Sales and Net Income of AMC, 2010-2015E

Sales Breakdown of AMC, 2012

Molybdenum Reserves of Thompson Creek

Molybdenum Output of Thompson Creek, 2008-2015E

Operating Revenue and Net Income of Thompson Creek, 2008-2012

Molybdenum Output of Famous Molybdenum Manufacturers, 2010-2012

Main Molybdenum Products of China Molybdenum Co., Ltd.

Molybdenum Reserves of China Molybdenum

Operating Revenue and Net Income of China Molybdenum, 2009-2015E

Operating Revenue of China Molybdenum Co., Ltd (by Product), 2009-2012

Export Quotas and Market Share of China Molybdenum, 2011-2012

Main Products of Jinduicheng Molybdenum

Metal Molybdenum Reserves of Jinduicheng Molybdenum, 2012

Operating Revenue and Net Income of Jinduicheng Molybdenum, 2008-2015

Operating Revenue of Jinduicheng Molybdenum (by Product), 2009-2012

Molybdenum Products Capacity of Major Subsidiaries of New China Dragon Moly Co., Ltd.

Main Molybdenum Products of New China Dragon Moly Co., Ltd.

Molybdenum Products Capacity of New China Dragon Moly Co., Ltd., 2009-2012

Molybdenum Products Output of New China Dragon Moly Co., Ltd., 2010-2012

Operating Revenue and Net Income of New China Dragon Moly, 2009-2015E

Operating Revenue of New China Dragon Moly by product, 2009-2012

Gross Margin of New China Dragon Moly by Business, 2008-2012

Molybdenum Metal Reserves of Tianbao Mining Group

Operating Revenue and Net Income of Tianbao Mining Group, 2007-2009

Operating Revenue Structure of Tianbao Mining Group (by Product), H1 2009

Major Molybdenum Enterprises of Tianbao Mining Group

Operating Revenue and Net Income of Xiamen Tungsten Co., Ltd, 2009-2015E

Operating Revenue and Net Income of Molybdenum Subsidiary of Xiamen Tungsten Co., Ltd, 2012

Export Quota of Primary Molybdenum Products of Wonful, 2008-2012

Prime Operating Revenue and Total Profit of Wonful, 2007-2009

Main Molybdenum Products of Shunchi Tungsten & Molybdenum Products Co., Ltd

Export Quota of Shunchi Tungsten & Molybdenum Products Co., Ltd., 2009-2012

Prime Operating Revenue and Total Profit of Shunchi Tungsten & Molybdenum Products Co., Ltd., 2004-2008

Export Quota of WanXin Tungsten & Molybdenum Products Co., Ltd., 2008-2012

Prime Operating Revenue and Total Profit of WanXin Tungsten & Molybdenum Products Co., Ltd., 2004-2009

Branches of Rongxin Molybdenum

Prime Operating Revenue and Total Profit of Rongxin Molybdenum, 2004-2008

Major Capacity Expansion Projects of Daheishan Molybdenum, 2007-2009

Output and Sales of Molybdenum concentrate of Daheishan Molybdenum, 2008-2011

Operating Revenue and Net Income of Daheishan Molybdenum, 2007-2011

Operating Revenue, Net Income and Business of Molybdenum Manufacturers in China, 2012

Global and China Vanadium Industry Report, 2018-2023

Vanadium, deemed as the “vitamin” of metals, finds wide application in steel, chemicals, new materials and new energy. There is now global research and development of vanadium for applying it to more ...

Global and China Cobalt Industry Report, 2018-2023

Cobalt, an essential raw material for lithium battery, is widely used in electric vehicles as well as computer, communication and consumer electronics. 59% of cobalt was used in lithium battery global...

Global and China Nickel Industry Report, 2017-2020

Global primary nickel output in 2016 fell 1.5% to 1.934 million tons. In 2017, as China’s nickel pig iron project in Indonesia reaches design capacity gradually, nickel metal supply is expected to hit...

Global and China Cobalt Industry Report, 2017-2021

In recent years, the global refined cobalt market has been in a state of oversupply, but the inventory has been decreasing year by year. In 2016, the global refined cobalt output and consumption were ...

China Silicon Carbide Industry Report, 2016-2020

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, sweeping more than 80% of the global total. However, excessive capacity expansi...

China Antimony Industry Report, 2016-2020

According to USGS, global antimony reserves totaled 2 million tons and antimony ore production 150,000 tons in 2015. In China, the reserves of antimony stood at 950,000 tons and antimony ore productio...

Global and China Cobalt Industry Report, 2016-2020

Cobalt is an important strategic metal used in lithium battery manufacturing, hard alloy smelting and superalloy production, mainly available in Congo, Australia, Cuba and other countries.

In 2015, t...

China Silicon Carbide Industry Report, 2015-2019

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, accounting for more than 80% of the global total. In 2014, the total silicon ca...

Global and China Antimony Industry Report, 2015

Since 2015, China’s antimony industry has been characterized by the followings:

China sees a continued decline in the output of antimony concentrates and antimony products. Owing to weak demand from ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2015-2018

Since the year 2012, due to the aftermath of the global financial crisis and the sub-prime crisis, the prosperity index of manufacturing in China has continued to decline, and the machine tool industr...

Global and China Aluminum Alloy Automotive Sheet Industry Report, 2014-2017

In recent years, driven by energy conservation and emissions reduction and improvement of fuel efficiency, auto industry has been required to develop towards an increasingly lightweight trend. A great...

China Silicon Carbide Industry Report, 2014-2017

As a major producer and exporter of silicon carbide, China contributes about 80% to the global silicon carbide capacity. In 2013, China exported 286,800 tons of silicon carbide after the abolition of ...

China Antimony Industry Report, 2014-2017

Since 2014, China’s antimony industry has been characterized by the following:

First, China holds a stable position as a major antimony producer. According to the statistics by USGS, in 2013, up...

Global and China Bi-Metal Band Saw Blade Industry Report, 2014-2017

The sales volume of bi-metal band saw blade continued to slide in China, totaling 49.45 million meters throughout the year 2013, down 2.5% year on year, largely due to international financial crisis, ...

Global and China Germanium Industry Report, 2013-2016

Germanium is a typical rare and dispersed element, associating with lignite, lead-zinc deposit and copper ore. Global proven recoverable deposits of germanium amount to 8,600 metal metric tons (MMT), ...

China Petroleum and Natural Gas Drilling and Transmission Steel Pipe Market Report, 2013-2016

Along with the sustained and stable development of China's economy as well as the accelerated industrialization, China’s demand for oil and natural gas has kept rising rapidly in recent years. In 2013...

China Aluminum Rolling Industry Report, 2013-2016

As of late 2013, the capacity of aluminum foil in China, as the world’s largest producer of aluminum sheets, strips and foils, hit 3.4 million tons/a; the capacity of aluminum cold rolling sheet/strip...

China Magnesium and Magnesium Alloy Industry Report, 2013-2016

Magnesium which is featured with low density and high strength can form high-strength alloy with aluminum, copper, zinc and other metals as an important alloying element. Currently, China is a major p...