China Bus Industry Report, 2015-2018

-

Aug.2015

- Hard Copy

- USD

$2,400

-

- Pages:105

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

YSJ089

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

In 2014-2015, although macro-economy would have certain impact on bus market, city buses, new energy buses, and light-duty buses, which were driven by downstream market, presented a rise in demand, thus leading to growth of overall bus market in China. In 2014, the sales volume of buses (including bus chassis) in China came to 606,900 vehicles, up 8.37% from a year earlier.

In 2014, the new energy bus became a new sport light in bus market, with sales volume hitting 27,000 vehicles, up 160% from a year earlier. In terms of power type, the plug-in hybrid bus gained in popularity in the market with its lower prices and high cost performance. And therefore it accounted for the largest share in new energy bus market, at 47.5% in 2014. Spurred by technology maturity and polices, the battery electric bus developed rapidly, representing 47% in 2014, an increase of 31 percentage points from 2013. However, the ordinary hybrid bus, which was not brought into the national subsidy list, occupied an increasingly lower market share, to 5.5% in 2014. It is expected to gradually withdraw from the market in the future.

In 2014, school bus market failed to meet market expectations, with the sales volume dropping by 14.9% year on year. In 2014, there were a total of 38 school bus manufacturers in China, a decrease of 11 from the end of 2012. That was because there had been no encouraging policies and financial support, so that quite a few enterprises chose to retreat from the market. In October 2014, the Ministry of Education brought school bus safety under control as major educational emergencies, which can be viewed as a breakthrough in school bus policy, thus bolstering the market. In the first months of 2015, the sales volume of school buses increased by 22% year on year on year to 9,400 vehicles. The market is expected to grow rapidly if good policies are introduced in the future.

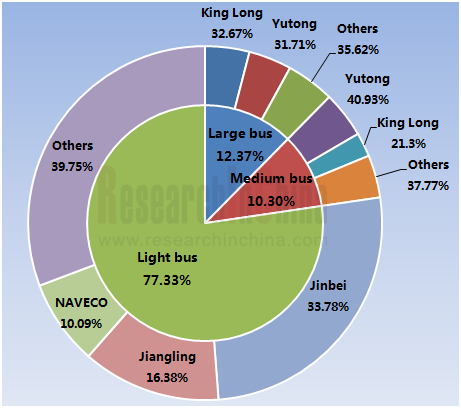

Competitive Landscape of Bus Market in China, Jan-May 2015

Source: China Bus Industry Report, 2015-2018E by ResearchInChina

As the largest large and medium-sized bus manufacturer in China, Yutong Bus sold 27,398 and 7,531 large-sized buses respectively in 2014 and Jan.-May 2015, which accounted for the market share of 33.65% and 31.71%, separately; the sales volume of medium-sized buses totaled 25,880 vehicles and 8,552 vehicles, respectively, with the market share of 41.28% and 40.93%. Yutong took the leading position in many bus market segments, For example, the company made up a market share of over 30% in school bus market and of over 25% in new energy bus market. In May 2015, Yutong Bus displayed its high-end medium-sized business bus—T7, which is positioned as high and mid-end business bus. In future, the product is expected to break the monopoly of Toyota Coaster in this market.

Shenyang Jinbei Automotive, the largest light-duty bus producer in China, saw the sales volume of 116,500 and 54,000 light-duty buses respectively in 2014 and Jan.-May 2015, which accounted for the market share of 30.24% and 33.78%. In the field of light-duty bus, the company’s leading products are HAISE and Grace. While consolidating the leading position in light-duty bus, Jinbei is extending its business to car market. At present, a complete product lineup centering on cars, light-duty buses and light-duty tracks is taking shape.

The report mainly deals with the following:

Market size, market structure, competitive landscape, import and export, and trends of China’s overall bus market (including chassis);

Market size, market structure, competitive landscape, import and export, and trends of China’s overall bus market (including chassis);

Market size, market structure, and competitive landscape of large, medium, and light bus market in China;

Market size, market structure, and competitive landscape of large, medium, and light bus market in China;

Market size, market structure, competitive landscape, and prospects of school buses in China;

Market size, market structure, competitive landscape, and prospects of school buses in China;

Market Size, competitive landscape, related policies, technology roadmap, and industrial investment of new energy buses in China;

Market Size, competitive landscape, related policies, technology roadmap, and industrial investment of new energy buses in China;

China’s bus industry chain, including the supply relationship of main upstream spare parts (transmission, wheel hub, and new energy batteries) and downstream market demand;

China’s bus industry chain, including the supply relationship of main upstream spare parts (transmission, wheel hub, and new energy batteries) and downstream market demand;

Development of Chinese bus manufacturers, including their financial data, bus production and sales, new energy bus business, capacity, cost structure, latest developments, etc.

Development of Chinese bus manufacturers, including their financial data, bus production and sales, new energy bus business, capacity, cost structure, latest developments, etc.

1 Industry Overview

1.1 Product Introduction

1.2 Product Classification

1.3 Policies

2 Overall Bus Market in China

2.1 Market Size

2.2 Market Structure

2.2.1 By Type

2.2.2 By Application

2.3 Competitive Landscape

2.3.1 Market Share

2.3.2 Performance Comparison

2.4 Imports & Exports

2.4.1 Overall Market

2.4.2 Market Segment

2.4.3 By Country

2.5 School Bus Market

2.5.1 Market Size

2.5.2 Market Structure

2.5.3 Main Applications

2.5.4 Regional Market

2.5.5 Competitive Landscape

2.5.6 Development Prospects

2.6 High-grade Bus

2.7 Trends

3 Bus Market Segments in China

3.1 Large Bus Market

3.1.1 Market Size

3.1.2 Competitive Landscape

3.1.3 Market Structure

3.2 Medium Bus Market

3.2.1 Market Size

3.2.2 Competitive Landscape

3.2.3 Market Structure

3.3 Light Bus Market

3.3.1 Market Size

3.3.2 Competitive Landscape

3.3.3 Market Structure

4 New Energy Bus Market

4.1 Market Size

4.2 Competitive Landscape

4.3 Policies

4.3.1 Policies for Reducing and Exempting Taxes

4.3.2 Policies on Fiscal Subsidies

4.3.3“Oil Reduction & Electricity Compensation” Policy

4.4 Technology Roadmap

4.5 Investment

5 Bus Industry Chain

5.1 Upstream Raw Material Market

5.2 Key Components

5.2.1 Transmission

5.2.2 Wheel Hub

5.2.3 New Energy Battery

5.3 Downstream Demand Market

5.3.1 Passenger Transport

5.3.2 Tourism

5.3.3 School Children

6 Major Enterprises

6.1 Zhengzhou Yutong Bus Co., Ltd.

6.1.1 Profile

6.1.2 Financial Survey

6.1.3 Operating Revenue Structure

6.1.4 Production and Sales

6.1.5 New Energy Bus

6.1.6 Production Capacity

6.1.7 R&D Costs

6.1.8 Cost Structure

6.1.9 Matching Accessories

6.1.10 Latest Development

6.1.11 Prospects

6.2 Xiamen King Long Motor Group Co., Ltd.

6.2.1 Profile

6.2.2 Financial Survey

6.2.3 Operating Revenue Structure

6.2.4 Operation of Major Subsidiaries

6.2.5 Production and Sales

6.2.6 New Energy Bus

6.2.7 Production Capacity

6.2.8 R&D Costs

6.2.9 Cost Structure

6.2.10 Latest Development

6.2.11 Prospects

6.3 Zhongtong Bus and Holding Co., Ltd.

6.3.1 Profile

6.3.2 Financial Survey

6.3.3 Operating Revenue Structure

6.3.4 Production and Sales

6.3.5 New Energy Bus

6.3.6 Production Capacity

6.3.7 R&D Costs

6.3.8 Cost Structure

6.3.9 Latest Development

6.3.10 Prospects

6.4 Beiqi Foton Motor Co., Ltd.

6.4.1 Profile

6.4.2 Financial Survey

6.4.3 Operating Revenue Structure

6.4.4 Production and Sales

6.4.5 New Energy Bus

6.4.6 Production Capacity

6.4.7 R&D Costs

6.4.8 Prospects

6.5 Anhui Ankai Automobile Co., Ltd.

6.5.1 Profile

6.5.2 Financial Survey

6.5.3 Operating Revenue Structure

6.5.4 Production and Sales

6.5.5 New Energy Bus

6.5.6 Production Capacity

6.5.7 R&D Costs

6.5.8 Cost Structure

6.6 Liaoning SG Automotive Group Co., Ltd.

6.6.1 Profile

6.6.2 Financial Survey

6.6.3 Operating Revenue Structure

6.6.4 Production and Sales

6.6.5 New Energy Business

6.6.6 Cost Structure

6.7 Yangzhou Asiastar Bus Co., Ltd.

6.7.1 Profile

6.7.2 Financial Survey

6.7.3 Operating Revenue Structure

6.7.4 Production and Sales

6.7.5 New Energy Bus

6.7.6 R&D Costs

6.7.7 Cost Structure

6.8 BYD Company Co., LTD

6.8.1 Profile

6.8.2 Financial Survey

6.8.3 Operating Revenue Structure

6.8.4 Production and Sales

6.8.5 New Energy Bus

6.8.6 Latest Development

6.8.7 Prospects

6.9 Anhui Jianghuai Automobile Co., Ltd.

6.9.1 Profile

6.9.2 Financial Survey

6.9.3 Operating Revenue Structure

6.9.4 Production and Sales

6.9.5 R&D Costs

6.9.6 Cost Structure

6.9.7 Prospects

6.10 Shenyang Jinbei Automotive Co., Ltd.

6.10.1 Profile

6.10.2 Financial Survey

6.10.3 Operating Revenue Structure

6.10.4 Production and Sales

6.10.5 R&D Costs

6.10.6 Cost Structure

6.10.7 Prospects

6.11 Jiangling Motors Co., Ltd.

6.11.1 Profile

6.11.2 Financial Survey

6.11.3 Operating Revenue Structure

6.11.4 Production and Sales

6.11.5 R&D Costs

6.11.6 Prospects

6.12 Dongfeng Automobile Co., Ltd.

6.12.1 Profile

6.12.2 Financial Survey

6.12.3 Operating Revenue Structure

6.12.4 Production and Sales

6.12.5 R&D Costs

6.12.6 Cost Structure

6.12.7 Prospects

6.13 NAVECO Ltd.

6.13.1 Profile

6.13.2 Production and Sales

6.13.3 Latest Development

6.14 Hebei Baoding Changan Bus Co., Ltd.

6.14.1 Profile

6.14.2 Production and Sales

6.14.3 Latest Development

6.15 SAIC Motor Commercial Vehicle Co., Ltd.

6.15.1 Profile

6.15.2 Financial Survey

6.15.3 Production and Sales

6.15.4 Latest Development

6.16 Fujian New Forta Automobile Co., Ltd.

6.16.1 Profile

6.16.2 Production and Sales

China’s Bus Production and Sales, 2005-2018E

China’s Bus Market Structure, 2005-2018E

China’s Bus Market Structure by Length, 2014

China’s Bus Market Structure by Application, 2014-2015

Top 10 Chinese Bus Enterprises, 2014

Top 10 Chinese Bus Enterprises, 2015

Revenue of Major Chinese Bus Manufacturers, 2014-2015

Net Income of Major Chinese Bus Manufacturers, 2014-2015

Gross Margin of Major Chinese Bus Manufacturers, 2014-2015

Import & Export Volume and Value of Buses in China, 2009-2015

Import Volume and Value of Buses in China by Type, 2009-2015

Export Volume and Value of Buses in China by Type, 2009-2015

China’s Bus Import Origins, 2014

China’s Bus Import Origins, 2015

China’s Top 10 Bus Export Destinations, 2014

China’s Top 10 Bus Export Destinations, 2015

Number of Registered School Buses in China, 2009-2014

Market Structure of School Buses in China by Length, 2012-2014

Market Structure of School Buses (length ≥ 5m) in China by Application, 2014

Number of Registered School Buses in China by Province/Municipality, 2014

Number of Registered School Buses in Major Cities, 2014

Number of Registered School Buses in Markets at All Levels, 2014

Number of Registered School Buses of Major Manufacturers in China, 2014

Top 10 School Bus Modes in China by Registration, 2014

Sales Volume of High-end Buses in China, 2015H1

Sales Volume of High-end Buses in China, 2009-2015

Sales Volume of High-end Buses in China by Price Range, 2009-2015H1

Sales Volume of High-end Buses in China by Major Regions, 2015H1

Output of Large-sized Buses and Chassis in China, 2005-2018E

Sales Volume of Large-sized Buses and Chassis in China, 2005-2018E

TOP 10 Large-sized Bus Manufacturers in China, 2014

Market Share of Large-sized Bus Chassis Manufacturers in China, 2014

TOP 10 Large-sized Bus Manufacturers in China, 2015

Market Share of Large-sized Bus Chassis Manufacturers in China, 2015

Market Structure of Large-sized Buses in China by Application, 2014-2015

Output of Medium-sized Buses and Chassis in China, 2005-2018E

Sales Volume of Medium-sized Buses and Chassis in China, 2005-2018E

TOP10 Medium-sized Bus Manufacturers in China, 2014

Market Share of Medium-sized Bus Chassis Manufacturers in China, 2014

TOP10 Medium-sized Bus Manufacturers in China, 2015

Market Share of Medium-sized Bus Chassis Manufacturers in China, 2015

Market Structure of Medium-sized Buses in China by Application, 2014-2015

Output of Light-duty Buses and Chassis in China, 2005-2018E

Sales Volume of Light-duty Buses and Chassis in China, 2005-2018E

TOP 10 Light-duty Bus Manufacturers in China, 2014

Market Share of Light-duty Bus Chassis Manufacturers in China, 2014

TOP 10 Light-duty Bus Manufacturers in China, 2015

Market Share of Light-duty Bus Chassis Manufacturers in China, 2015

Market Structure of Light-duty Buses in China by Application, 2014-2015

Output of New Energy Buses in China, 2011-2018E

Output Proportion of New Energy Buses in China by Power Type, 2014

Number of China’s New Energy Vehicles Exempt from Purchase Tax

China’s Subsidy Standards for New Energy Buses, 2014-2015 (the Central Government)

Raw Material Costs of Major Chinese Bus Enterprises, 2014

Market Share of Major Chinese Commercial Vehicle Transmission Manufacturers, 2014

Major Commercial Vehicle Transmission Manufacturers in China

Major Bus Wheel Hub Suppliers in China

Passenger Transport of Roads in China, 2004-2015

Passenger Transport of High-speed Rail in China, 2008-2013

Tourism Rate of Chinese Residents, 2008-2013

Number of Tourists during the Golden Week in China, 2008-2015

Enrolments in Kindergarten, Primary and Secondary Schools, 2009-2013

Main Financial Indexes of Yutong Bus, 2010-2015

Operating Revenue Structure of Yutong Bus by Business, 2013-2014

Operating Revenue Structure of Yutong Bus by Region, 2013-2014

Bus Production and Sales of Yutong Bus by Product, 2009-2015

New Energy Bus Sales Volume of Yutong Bus, 2012-2014

R&D Costs of Yutong Bus, 2009-2014

Product Cost Structure of Yutong Bus, 2013-2014

Revenue, Net Income, and Gross Margin of Yutong Bus, 2015-2018E

Main Financial Indexes of Kinglong Motor Group, 2010-2015

Operating Revenue Structure of Kinglong Motor Group by Region, 2013-2014

Revenue and Net Income of Kinglong’s Major Subsidiaries, 2013-2014

Bus Output of Kinglong’s Major Subsidiaries, 2009-2015

Bus Sales Volume of Kinglong’s Major Subsidiaries, 2009-2015

R&D Costs of Kinglong Motor Group, 2010-2014

Cost Structure of Kinglong Motor Group, 2013-2014

Revenue, Net Income, and Gross Margin of Kinglong Motor Group, 2015-2018E

Main Financial Indexes of Zhongtong Bus, 2010-2015

Operating Revenue Structure of Zhongtong Bus by Business, 2013-2014

Operating Revenue Structure of Zhongtong Bus by Region, 2013-2014

Sales Volume of Zhongtong Bus, 2014

R&D Costs of Zhongtong Bus, 2012-2014

Cost Structure of Zhongtong Bus, 2013-2014

Revenue, Net Income, and Gross Margin of Zhongtong Bus, 2015-2018E

Main Financial Indexes of Foton, 2010-2015

Operating Revenue Structure of Foton by Business, 2013-2014

Operating Revenue Structure of Foton by Region, 2013-2014

Bus Production and Sales of Foton by Type, 2009-2015

R&D Costs of Foton, 2010-2014

Revenue, Net Income, and Gross Margin of Foton, 2015-2018E

Main Financial Indexes of Anhui Ankai Automobile, 2010-2015

Operating Revenue Structure of Anhui Ankai Automobile by Business, 2013-2014

Operating Revenue Structure of Anhui Ankai Automobile by Region, 2013-2014

Bus Production and Sales of Anhui Ankai Automobile, 2009-2015

R&D Costs of Anhui Ankai Automobile, 2010-2014

Cost Structure of Anhui Ankai Automobile, 2013-2014

Main Financial Indexes of SG Automotive Group, 2010-2015

Operating Revenue Structure of SG Automotive Group by Business, 2013-2014

Operating Revenue Structure of SG Automotive Group by Region, 2013-2014

Bus Production and Sales of Dandong Huanghai Motors, 2009-2015

Cost Structure of SG Automotive Group, 2013-2014

Main Financial Indexes of Asiastar, 2010-2015

Operating Revenue Structure of Asiastar by Business, 2013-2014

Operating Revenue Structure of Asiastar by Region, 2013-2014

Bus Production and Sales of Asiastar, 2009-2015

R&D Costs of Asiastar, 2010-2014

Cost Structure of Asiastar, 2013-2014

Main Financial Indexes of BYD, 2010-2015

Operating Revenue Structure of BYD by Business, 2013-2014

Operating Revenue Structure of BYD by Region, 2013-2014

Bus Production and Sales of BYD, 2011-2015

Revenue, Net Income, and Gross Margin of BYD, 2015-2018E

Main Financial Indexes of JAC, 2010-2015

Operating Revenue Structure of JAC by Business, 2013-2014

Operating Revenue Structure of JAC by Region, 2013-2014

Bus Production and Sales of JAC, 2009-2015

R&D Costs of JAC, 2010-2014

Cost Structure of JAC, 2013-2014

JAC’s Revenue, Net Income, and Gross Margin, 2015-2018E

Main Financial Indexes of Shenyang Jinbei Automotive, 2010-2015

Operating Revenue Structure of Shenyang Jinbei Automotive by Business, 2013-2014

Operating Revenue Structure of Shenyang Jinbei Automotive by Region, 2013-2014

Bus Production and Sales of Shenyang Jinbei Automotive, 2009-2015

R&D Costs of Shenyang Jinbei Automotive, 2012-2014

Cost Structure of Shenyang Jinbei Automotive. 2013-2014

Revenue, Net Income, and Gross Margin of Shenyang Jinbei Automotive of Shenyang Jinbei Automotive, 2015-2018E

Main Financial Indexes of JMC, 2010-2015

Operating Revenue Structure of JMC by Business, 2013-2014

Operating Revenue Structure of JMC by Region, 2013-2014

Bus Production and Sales of JMC, 2009-2015

R&D Costs of JMC, 2010-2014

JMC’s Revenue, Net Income, and Gross Margin, 2015-2018E

Main Financial Indexes of Dongfeng Motor Corporation, 2010-2015

Operating Revenue Structure of Main Financial Indexes of Dongfeng Motor Corporation by Business, 2013-2014

Operating Revenue Structure of Main Financial Indexes of Dongfeng Motor Corporation by Region,2013-2014

Bus Production and Sales of Main Financial Indexes of Dongfeng Motor Corporation, 2009-2015

R&D Costs of Dongfeng Motor Corporation, 2010-2014

Cost Structure of Dongfeng Motor Corporation, 2013-2014

Revenue, Net Income, and Gross Margin of Dongfeng Motor Corporation, 2015-2018E

Revenue of SAIC Commercial Vehicle, 2011-2014

Bus Production and Sales of SAIC Commercial Vehicle, 2011-2015

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...