Chinese OEMs’ telematics research: high computing power chips promote the integration of telematics with AI

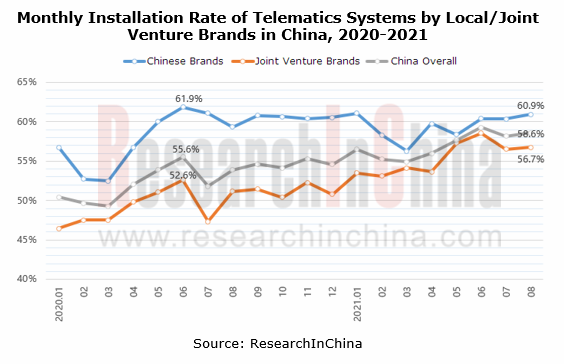

In the first eight months of 2021, 57.1% of new passenger cars in China installed telematics systems, 4.6 percentage points higher than in the same period of the previous year, of which Chinese brand passenger cars boasted a 59.6% installation rate, up 1.2 percentage points.

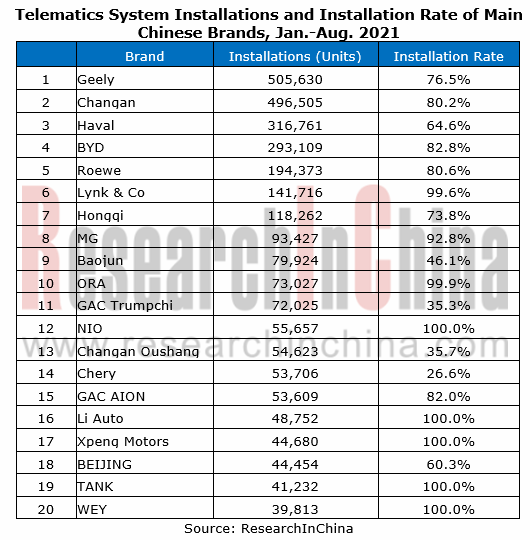

The steadily rising penetration of telematics systems in Chinese brands is benefited from the launch of intelligent platforms and creation of high-end intelligent brands, as well as close collaborations between industry chain partners. ResearchInChina surveyed that in the first eight months of 2021, all the homegrown high-end brands like Geely Lynk & Co, Great Wall WEY, Great Wall Tank, SAIC R CAR, Dongfeng Voyah, and BAIC ARCFOX boasted an over 98% installation of telematics systems.

In 2021, local brands in China race to roll out their new-generation telematics systems, highlighting the following:

1. The installation of high computing power master chips in vehicles helps to realize much greater human-computer interaction capability and far better ecological service experience.

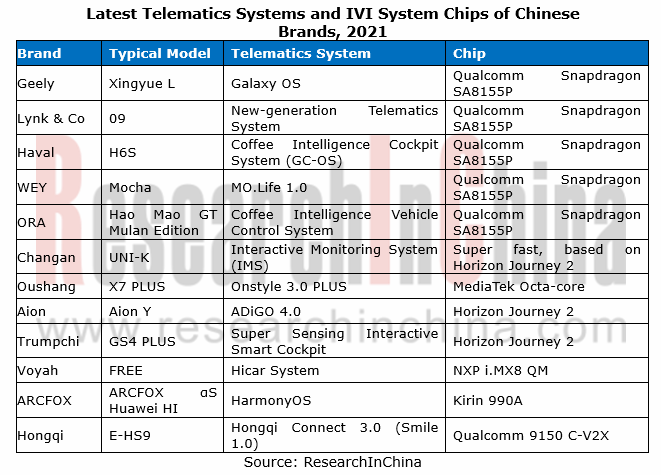

The automotive chips developed by Qualcomm, MediaTek, Horizon Robotics, NXP among others have been seen in the telematics systems of Chinese brands. Wherein, the sought-after Qualcomm Snapdragon SA8155P with super computing power so far have found application in mass-produced models including Geely Xingyue L, Lynk & Co 09, AION LX, Haval H6S/Shenshou, WEY Mocha, WEY Macchiato, ORA Cat, and LiXiang P5, Weltmeister W6 and NIO ET7.

Snapdragon SA8155P, Qualcomm’s 3rd-generation automotive cockpit platform, is powered by 7nm process and octa-core CPU, with computing power ten times greater than the previous 820A, and speeds of CPU and GPU 8.5 times and 20 times faster than the previous generation, respectively. The 8155 chip enables multi-screen display, personalized AI, immersive audio and video, 5G connectivity and other capabilities for a number of models.

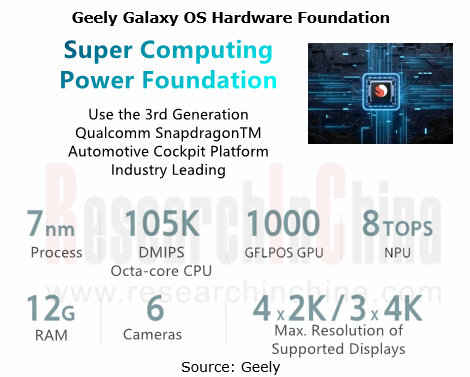

Xingyue L: run on Geely Galaxy OS, a new-generation vehicle system co-developed by ECARX and Geely, and use Qualcomm 8155 chip with 105K DMIPS CPU, 1000 GFLPOS GPU and 8 TOPS NPU.

Based on the great hardware foundation, Galaxy OS features four major core capabilities: Human Vehicle Interaction, Intelligent Vehicle Control, Edge AI, and Open Ecosystem.

Human Vehicle Interaction: Xingyue L’s four display systems of AR-HUD, dashboard, center console and co-pilot screen enable cross-screen interaction and multi-finger operation. The triple-screen display design of dashboard, center console and co-pilot screens (all 12.3 inches) allow 1/2/3-finger swipe interaction, of which: 1-inger swipe enables quick switch between controls; 2-finger swipe is for center console display split; 3-finger swipe achieve cross-screen interaction.

Edge AI: the information “preloading” technology is used to enable Baidu Apollo with local voice interaction, voice control over all body functions, human voice control in all scenarios, and 24-hour wake-up-free voice interaction at the driver’s seat, as well as self-learning and self-evolution capabilities.

Intelligent Vehicle Control: support 1,300+ body signal connections and 170+ body control functions; enable 3D rendering effects in control of air conditioner, seats and other functions.

Open Ecosystem: work with partners like Baidu, Tencent and ByteDance to build a vehicle ecosystem with abundant applications of “speaking, listening, watching and playing”, including WeChat vehicle version, Kuwo Music, Ximalaya, Aiquting, Douyin, Bilibili, iQIYI, and National K Songs.

As well as Qualcomm 8155 automotive chip, Horizon Journey 2 also enables multiple models of Changan, GAC and Chery among others, with a range of intelligent functions such as eye sight screen brightening, distraction warning, fatigue monitoring, gesture recognition, and voice-activated photographing.

Changan UNI-K: the latest Interactive Monitoring System (IMS) for this car carries the Super Fast chip developed on Horizon Journey 2. Booted in just 4.7 seconds, the system realizes 3+1 quad-screen interaction and bears iFLYTEK Feiyu OS 3.0 (a voice interaction system), all-domain gesture interaction system, face recognition, fatigue driving warning, and other features. Wherein, the powerful all-domain gesture interaction system allows the driver to use the camera above the interior rearview mirror for gesture-activated song switch, photographing, and navigation to home or office, and also offers gesture control to rear row passengers.

ARCFOX αS Huawei HI: it is the first car to adopt Huawei Kirin 990A chip and HarmonyOS, of which the Kirin 990A chip with 3.5TOPs computing power allows 5G connectivity and enables multi-display integration, face recognition, gesture recognition, four-voice-area voice recognition, 30-second continuous dialogue without wake-up, and car-home interconnection.

Voyah FREE: as the first model launched by Voyah, Dongfeng’s high-end intelligent electric vehicle brand in June 2021, it is based on NXP i.MX8QM and packs the new-generation IVI system co-developed with PATEO and Huawei, which is equipped with a lift type triple-screen integrated display and supports multi-screen interaction and multi-modal interaction (gesture, face, voice, AR navigation, touch, etc.). Soulmate AI intelligent assistant created by PATEO enables four-voice-area voice pickup, multiple rounds of voice dialogue, and active greetings and caring such as congestion prompt, route recommendation, fatigue warning, forgotten child remainder, and last-mile guidance.

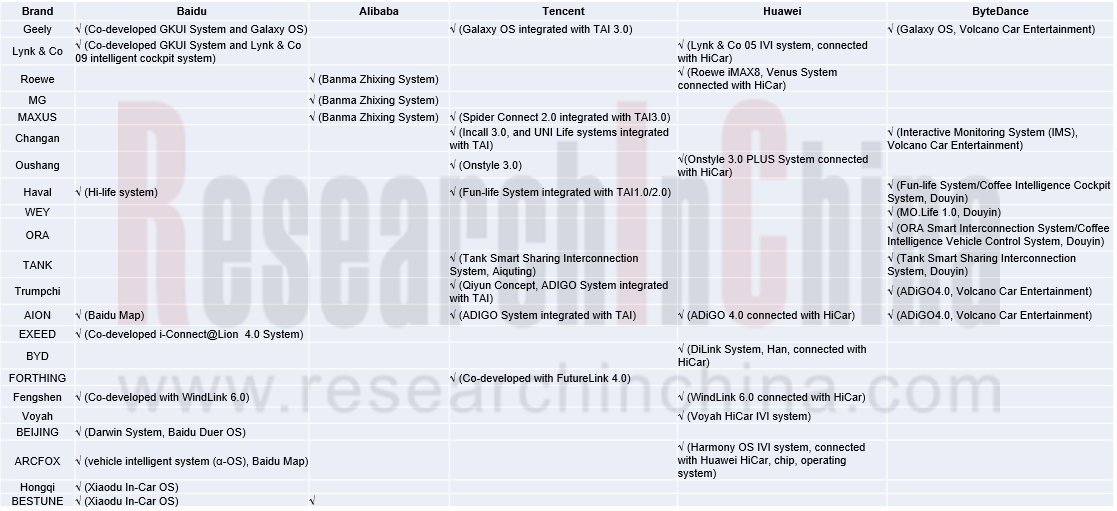

2. Partner with BATH to build an all-scenario ecosystem.

In the field of in-vehicle ecosystem, Chinese brands always partner closely with BATH (Baidu, Alibaba, Tencent and Huawei). In 2021, ByteDance (Douyin, Xigua Video, TouTiao, etc.) has joined as well.

Baidu: Carlife, Xiaodu In-Car OS, etc. have been seen in the latest telematics systems of Haval, Trumpchi, EXEED, Dongfeng Fengshen, Dongfeng Venucia, BEIJING, Hongqi and BESTUNE. For example, EXEED Lion 4.0 that packs Xiaodu In-Car OS and Intel quad-core chip is connected with Baidu’s ecosystem with 300+ services including IQiyi, QQ Music, Ximalaya FM, EXEED Changba, Qingting FM, Car KTV, Suixinkan, Baidu Map, and Smart Parking.

In August 2021, the new-generation intelligent cockpit system co-developed by Baidu and ECARX for Lynk & Co 09 made a debut. For the system, ECARX provides underlying hardware and upper-layer services; Baidu offers voice interaction, vehicle applications and scenario services. The cockpit system allows intelligent integration between people, ambient light and fragrance system according to the vehicle application scenario, for example, actively opening Burning Moment fragrance to help the driver refresh herself/himself if tired driving is detected, and adjusting the ambient light according to the driving mode.

Alibaba: the Banma Zhixing System co-released with SAIC and based on AliOS has been iterated five times so far. The new models like Roewe and MG launched in 2021 are equipped with the VENUS System (Banma Zhixing 4.0), which enables center console interface A/B display, personalized AI image setting and customization, Alibaba’s ecosystem and applets access, and car home interconnection. The ecological services introduced in 2021 include NetEase Cloud Music, Bilibili, Banma Interactive Radio, XUEXI.CN, Tmall Genie, and DingTalk vehicle version.

As AliOS IVI system came into service, Banma Zhixing rolled out OS trilogy in early 2020: Intelligent IVI OS, Intelligent Cockpit OS and Intelligent Vehicle OS; Luoshen OS, a heterogeneous integrated intelligent cockpit system launched with SAIC in October 2021, is about to be available to MG ONE and New Roewe RX5 MAX.

Based on Luoshen OS and Qualcomm Snapdragon 8155, MG ONE’s intelligent cockpit enables cross-display interaction, 0 seconds to boot, and AI semantics driven by Alibaba DAMO Engine, and has the ability to self-learn and self-evolve in seven days. It also meets young consumers’ needs for Bilibili Esport.

Tencent: the giant has forged partnerships with automakers like Geely, Changan, Haval, Trumpchi and Dongfeng Forthing. Multiple Tencent products including Tencent Map, Tencent Cloud, Xiaowei Voice, and Tencent Auto Intelligence (TAI) System have been connected. TAI 3.0 combines three features: Aiquting (QQ Music, Ximalaya, WeRead, Tencent Video, Pocket Story, etc.), Tencent Suixing (mobility assistant, and one account for mobile phone, IVI system, WeChat vehicle version, etc.), and Tencent Mini Scenario, which have been integrated into Geely Galaxy OS, Dongfeng Forthing Future Link 4.0, SAIC Maxus Spider Connect 2.0 and other systems.

Huawei: using 5G technology, Huawei HiCar System enables people-car-home interconnection in all scenarios, including smartphone integration, one-click navigation, video call, one-click remote home control, fatigue driving monitoring, gesture interaction, and smartphone application ecosystem sharing, and is also connected with 30+ vehicle ecosystems. So far HiCar System has been available to dozens of brands such as Dongfeng Fengshen, Dongfeng Fengon, Voyah, Lynk & Co, GAC Trumpchi, BYD and SAIC Roewe, with over 500 units expected to be pre-installed at the end of this year.

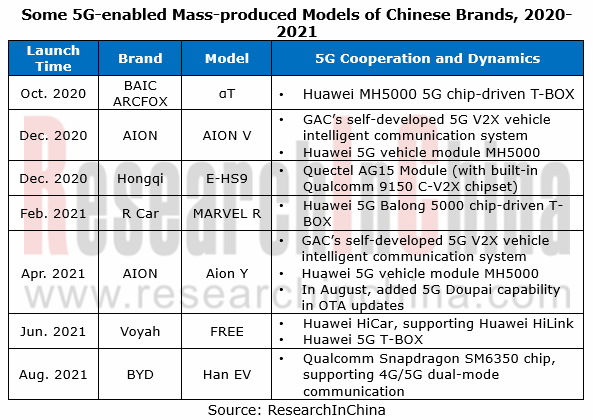

3. 5G has become available to a range of models.

Since 2020 automakers have launched multiple 5G-enabled mass-produced models.

China TSP and Ecological Construction Research Report, 2022

TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms,...

Global and China Automotive Seating Industry Report, 2022

Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positi...

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...

New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and com...

CTP, CTC and CTB Integrated Battery Industry Research Report, 2022

Integrated battery research: three trends of CTP, CTC and CTB

Basic concept of CTP, CTC and CTB

The traditional integration method of new energy vehicle power system is CTM, that is, "Cell to Module...

China Driving Recorder Market Research Report, 2022

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology s...

Autonomous Delivery Vehicle Industry Report, 2022

Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-base...

China Autonomous Heavy Truck Industry Report, 2022

Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous...