Research on hybrid vehicles: Five global major hybrid technologies compete fiercely in China

The hybrid technology is one of the important technology roadmaps to achieve emission peak, carbon neutrality and dual credit compliance.

In September 2020, President Xi Jinping pledged that China would reach its CO2 emissions peak before 2030 and achieve carbon neutrality before 2060. For this goal, China proposes to carry out transformation and innovation in ten fields, among which the construction of a green low-carbon transportation system and the promotion of green and low-carbon technological innovation involve automotive energy-saving technologies covering electric vehicles, hybrid, and hydrogen fuel cells.

Measures for the Parallel Management of Average Fuel Consumption of Passenger Car Companies and New Energy Vehicle Credits (hereinafter referred to as the dual credit policy) stipulates the average fuel consumption credits of passenger car companies and new energy vehicle credits. In 2020, the passenger car industry’s fuel consumption credits were -7.33 million and new energy vehicle credits 3.3 million. In the face of the regulation on emission peak, carbon neutrality and double integration, hybrid technology will be one of the important technical routes for automakers to meet the standards for automakers.

Energy-Saving and New Energy Vehicle Technology Roadmap 2.0 released by China-SAE points out the development goal of China’s automobile industry: “the total industrial carbon emissions should reach the peak around 2028 in advance of the national carbon emission reduction commitment, and the total emissions should drop by more than 20% from the peak by 2035. The sales volume of new hybrid passenger cars should account for 50%-60% of traditional energy passenger cars by 2025, 75%-85% by 2030, and 100% by 2035. This clarifies that energy-saving vehicles do not represent a transitional technology, but a high-efficiency technology that allows engines and motors to complement each other, replaces internal combustion engine vehicles on a large scale within a reasonable price range, and reduces fuel consumption.

Five global major hybrid technologies compete fiercely in China

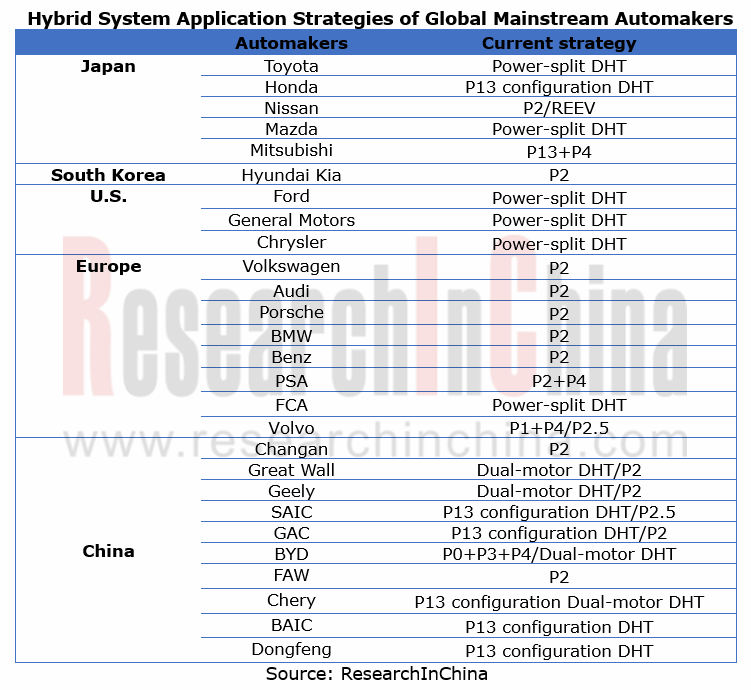

Currently, hybrid power is mainly being developed in Japan, the United States, Europe, and China which choose different hybrid technology roadmaps according to their technical reserves and development goals:

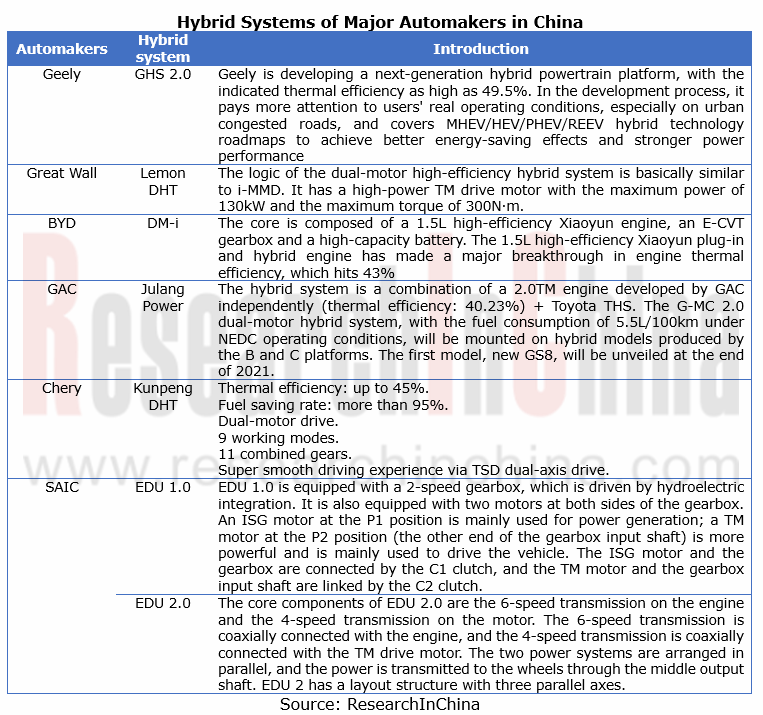

- Japanese cars are mainly powered by Toyota's Power-split (PS) and Honda's i-MMD series-parallel hybrid. Through strong hybrid, the best fuel-saving effect can be achieved. For example, Toyota THS available in Toyota Prius adopts a single planetary row structure design to maximize fuel economy in common vehicle speed ranges. Toyota is committed to licensing the hybrid technology to Chinese automakers. For example, the new-generation GAC Trumpchi GS8 hybrid system is planned to be equipped with the Julang Hybrid System composed of Trumpchi 2.0T engine and Toyota THS; Hunan Corun New Energy has purchased the core technology Toyota's THS for RMB1 and promoted the application in conjunction with Geely.

- American cars are mainly based on Power-split (PS) of GM and Ford; for example, the general hybrid power system of GM LaCrosse adopts a dual-row planetary structure design to achieve two “power split” modes (high and low speed modes) and one or multiple fixed gears so as to further improve the fuel economy and transmission efficiency of the car.

- German cars are mainly based on 48V low-voltage and high-voltage hybrid technology arranged in P0/P2. The system replaces traditional lead-acid batteries with power-type lithium-ion batteries with a voltage of 48V and an energy of less than 1kW·h, and replaces traditional starter motors and generators with B/ISG motors. A large number of Chinese plug-in models have exploited German technology roadmap and suppliers.

- Chinese automakers have transferred from the original technology diversification to the dual-motor-based series-parallel mode. For example, the GAC Trumpchi Electromechanical Coupling System (G-MC) adopts the series-parallel mode, which is mainly used for plug-in hybrid; BYD's DM-i super hybrid technology adopts the EHS to open up a new technology system in addition to Toyota's THS Power-split and Honda's i-MMD.

- The series extended-range hybrid power roadmap is represented by Nissan e-Power, Lixiang ONE, Dongfeng Voyah, etc.; In series mode, the engine and the electric motor are not mechanically connected, so the engine can obtain the best efficiency at different vehicle speeds and loads. In 2020, 32,600 Lixiang ONE cars were sold, ranking first in the extended-range field.

The world's mainstream OEMs have conducted diversified explorations in hybrid systems, and finally chose the hybrid strategy that is most suitable for their own models. We have summarized the hybrid strategies of the global mainstream automakers.

Chinese automakers have developed hybrid systems independently to seize the hybrid market

In the context of energy saving and emission reduction, Chinese automakers have made efforts to develop the hybrid technology in recent years. They have launched self-developed hybrid systems, such as Great Wall Lemon DHT Hybrid System, BYD DM-i Super Hybrid, GAC Julang Hybrid System, Chery Kunpeng DHT System, etc.

Sales Volume of China's Hybrid Vehicle Market Segments

(1) PHEV passenger cars

According to CPCA (China Passenger Car Association)’s data, the sales volume of PHEV passenger cars in China increased by 2.7% year-on-year to approximately 211,900 units in 2020. From January to June 2021, the sales volume reached 183,200 units.

At present, China's PHEV passenger cars companies are mainly represented by BYD, SAIC, and Lixiang. In 2020, SAIC ranked first with the sales volume of 59,900 PHEV passenger cars, followed by BYD and Lixiang with the sales volume of 51,700 and 32,600 respectively.

(2) HEV passenger cars

According to the data from CAAM (China Association of Automobile Manufacturers), the sales volume of HEV passenger cars in China jumped by 21.9% year-on-year to about 290,400 units in 2020, approximately 272,400 units in H1 2021. It is expected to hit 500,000 units in 2021;

In 2021, the sales volume of HEV passenger cars in China soars. On the one hand, Toyota has added dual-engine to a variety of models to meet demand for energy-efficient and fuel-efficient vehicles. On the other hand, China has raised higher requirements on carbon emission, which forces automakers to reduce emissions. Automakers mainly promote lower-displacement dual-engine vehicle models.

At present, the sales volume of HEV passenger cars in China is mainly contributed by GAC Toyota, FAW Toyota, GAC Honda, and Dongfeng Honda. The sales volume of GAC Toyota’s HEV passenger cars accounted for 32% of the total in 2020, and 41% in H1 2021 with a spike of 9 percentage points. Under the pressure of carbon emissions, Toyota actively boosts dual-engine models and has installed the dual engine technology on multiple models.

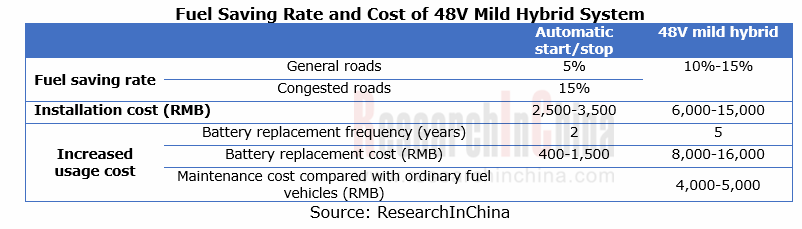

(3) 48V mild hybrid system

The 48V mild hybrid system is evolved from the 12V electrical system which is not completely abolished but continues to exist. The biggest advantage of the 48V mild hybrid system is that it can save much more energy and reduce emissions to comply with stringent emission policies at low costs:

1. The application of start-stop technology makes the carrying capacity of the traditional 12V system approach the limit. Electrical systems with higher carrying power are needed to achieve better energy-saving effects;

2. More and more electronic functions are integrated in a single vehicle, while the 12V system cannot match high-power electrical equipment.

In 2020, the sales volume of passenger cars equipped with the 48V mild hybrid system in China was swelled 39% year-on-year to 331,000 units. According to China Association of Automobile Manufacturers, 20.178 million passenger cars were sold in China in 2020, of which only 1.64% was 48V mild hybrid cars. By 2025, the sales volume of passenger cars with the 48V mild hybrid system in China will reach 3.12 million units.

The 48V mild hybrid system can reduce fuel consumption to a certain extent at a low cost. Considering carbon emissions and costs, automakers are keen to install the 48V mild hybrid system on traditional fuel vehicles. However, from a consumer's point of view, the fuel saved by the 48V system is not obvious, so the subsequent promotion still requires continuous technological progress and cost reduction.

Of course, 48V mild hybrid is only a transitional technology, not a solution that can be done once and for all. The 48V system can meet the average fuel consumption limit of passenger cars in the fourth and fifth stage (the fourth stage: 5.0L/100km (2020); the fifth stage: 4.0L/100km (2025) with a reduction of 42%), but it is difficult to realize the goal in the sixth stage (3.2L/100km (2030)). Therefore, Chinese automakers need to step up research and development of strong HEV, PHEV, high-efficiency engines and other advanced technologies while introducing the 48V mild hybrid technology so as to prompt the long-term development.

China Driving Recorder Market Research Report, 2022

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology s...

Autonomous Delivery Vehicle Industry Report, 2022

Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-base...

China Autonomous Heavy Truck Industry Report, 2022

Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous...

China Smart Parking Industry Report, 2022

Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) hav...

Automotive Head-up Display (HUD) Industry Report, 2022

Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way. 1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

S...

Intelligent Vehicle E/E Architecture Research Report, 2022

E/E architecture research: 14 key technologies, and innovative layout of 24 OEMsKey technologies of next-generation electronic and electrical architectures (EEA)

The definition of next-generation E/E...

China Automotive Lighting Market Research Report, 2022

Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automake...

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...

China Automotive LiDAR Industry Research Report, 2022

LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

...

China Autonomous Driving Data Closed Loop Research Report, 2022

1. The development of autonomous driving is gradually driven by data rather than technology

Today, autonomous driving sensor solutions and computing platforms have become increasingly homogeneous, an...

Overseas LiDAR Industry Research Report, 2022

LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OE...

Smart Car OTA Industry Research Report, 2022

Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According ...

Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Drivi...

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...

China Smart-Road Roadside Perception Industry Report, 2022

Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financ...

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...