China Automotive Multimodal Interaction Development Research Report, 2021

Our China Automotive Multimodal Interaction Development Research Report, 2021 combs through and summarizes the interaction modes of mainstream auto brands.

The current automotive human-computer interaction (HMI) is characterized by the following:

1. In terms of interaction modes, in addition to conventional interaction methods such as touch control, button and knob, voice and mobile phone have become favored options in automotive HMI. Moreover, face, gesture, and car lamp have also become popular interaction options. Some brands even have begun to try new interaction ways, such as eye tracking, voiceprint, and fingerprint.

2. As concerns layout, joint-venture brands remain conservative in interaction modes. They seldom use new interaction methods except for voice and mobile phone. Yet luxury brands are pioneers of multimodal interaction. One example is Mercedes-Benz which has equipped its new-generation MBUX system with multiple new interactions like face, gesture, eye, and fingerprint. By comparison, Chinese leading brands are more active in new interaction modes, for example, Changan Auto has eyesight wake-up and Great Wall Motor offers voiceprint recognition.

Some HMI modes of mainstream auto brands inside and outside China:

Voice as a conventional interaction mode offers improvements in functions.

Besides the original capabilities of voice interaction, features like continuous dialogue, voice area lock, tone switch, and user-defined voice have become next orientations of mainstream brands.

1. Continuous dialogue and voice area lock have been used by several brands.

After a wake-up, a voice interaction system with the continuous dialogue capability needs no repeated wake-up within a certain period of time, which makes the response to instructions more coherent; the voice area lock feature with the ability to locate the voice command issuer, executes commands like “open window” and “adjust air conditioning temperature” more accurately. The brands using the two features include Geely, Changan, Great Wall, Chery, SAIC Roewe, GAC Trumpchi, Xpeng, NIO and Lixiang.

Geely Xingyue L - the “driver geek mode” of Galaxy OS frees the driver of wake-up in 24 hours, and enables lock of four voice areas.

Xpeng Motors – the voice assistant Little P delivers voice functions in all scenarios and allows 30s continuous dialogue and dual-voice area lock.

2. Tone switch refers to the availability of other speech options the voice system provides for users in addition to default voices and sounds, such as, voices of celebrities and game characters. The brands with this feature include Geely, Changan, Great Wall, BYD and Roewe, as well as emerging carmakers like NIO, Xpeng and Lixiang. For instance, Banma Zhixing Venus System mounted on SAIC Roewe RX5 offers five tone options: affinity female voice, intellectual female voice, magnetic male voice, innocent child voice, and passionate female voice.

3. User-defined voice feature allows customization of voice tones and voice functions.

“Voice tone customization” means that the system applies the uploaded voices of the user’s own or his/her families’ in scenarios such as voice response and navigation broadcast. Models carrying this capability include Geely, Great Wall, SAIC Roewe, GAC Trumpchi and R Car.

“Voice function customization” means that users can define a voice command as well as corresponding operation, which brings the voice system into full play and meets the personalized needs of users. The typical brand using this capability is Xpeng Motors.

Geely Xingyue L - Galaxy OS allows users to define voice. The customized human voice is available to all scenarios including navigation and response.

Xpeng Motors - Little P Customization allows Xpeng car owners to define voice commands and corresponding operation via their smartphone APP.

Gesture has become the third new interaction mode behind voice and face.

Gesture interaction uses the in-car camera to judge a gesture and send the data to the vehicle system control unit which will then call out the function corresponding to the gesture. Gesture control is more accurate and quicker, and easier to operate than voice control.

Brands using gesture interaction include BMW, Mercedes-Benz, Changan, Great Wall, SAIC Roewe, GAC Trumpchi, VOYAH, R Car, BAIC ARCFOX, and Xpeng, of which Great Wall and Xpeng support gesture recognition outside car.

WEY Mocha – enable gesture control over ignition, forward/backward movement, suspension, and flameout outside the car.

Changan Ford EVOS - the new-generation SYNC+ 2.0 allows gesture control over muting, music play, interface split, and back to the home interface, etc.

Light interaction is available to brands like Mercedes-Benz, HiPhi and IM Motors.

Light interaction sends a message out by way of flashing, light projection and combination headlight. Light interaction provides channels for communication with traffic participants outside the car, and enables autonomous vehicles to communicate with the surroundings at a time of implementing autonomous driving. Now brands including Mercedes-Benz, Audi, Volkswagen, Great Wall, BYD, HiPhi, IM and Xpeng have packed this interaction mode.

Mercedes-Benz - Projector headlights project warning signs, assisted markings and other information related to driving assistance systems onto the road ahead.

IM L7 - Projection headlights enable the projection of interactive alerts, navigation, vehicle information among others, offering lane-level guidance with HD maps.; combination headlights provide several patterns to show the status of users in the cockpit; interactive taillights enable display of words and emoticons, as well as information, for example, thanks, pedestrian warning and state of charge.

As well as combination headlights, some brands like BAIC and Samsung are trying to add displays at the front and rear of the body to send messages to pedestrians.

BAIC Lite 300 – LED displays at the front and rear of the body show words, emoticons, animations, state of charge and other content.

Multimodal fusion holds a future trend.

Single-modal interaction has a limited role to play in improvement of interaction experience. Multimodal fusion is obviously a feasible and efficient option for better interaction experience in future. Brands that are developing this feature are Mercedes-Benz, BMW, Huawei and Changan.

1. Voice + eye sight

Voice interaction shows little ability to recognize fuzzy pronouns like “this” and “that”. In this case, the addition of eye tracking for locking direction, plus voice commands, can make the response to commands much quicker.

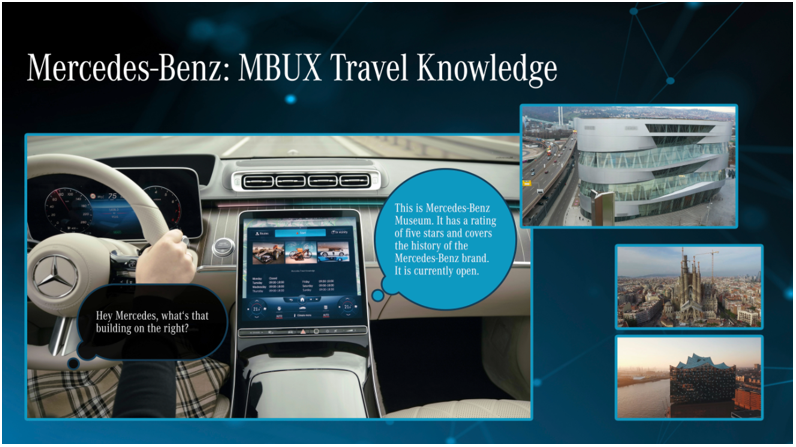

Mercedes-Benz MBUX Travel Knowledge – a driver who fixes his/her gaze on a building says “I want to know the purpose of this building”, and he/she will acquire related information. Cerence Look provides technical support.

2. Voice + lip movement recognition

Accurate acquisition of commands is a key step in the voice interaction process. Complex cockpit environment, noise and high personnel density make it harder to recognize voice. The new voice area lock feature added recently comes as a solution to the problem. Yet for its limitations, the single-model voice interaction technology has a limited effect in improving interaction experience.

The combination with lip movement recognition renders voice recognition far more accurate in voice interaction. Lip movements vary over language. In a noisy cockpit environment, combining lip movements, the system can ensure high voice recognition accuracy, even as the voice sounds low.

Automotive Smart Surface Industry Research Report, 2022

Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.Smart surfaces represent the development trend of automotive interiors and ex...

China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpi...

China Automotive Cybersecurity Hardware Research Report, 2022

Cybersecurity hardware research: security chip and HSM that meet the national encryption standards will build the automotive cybersecurity hardware foundation for China.

1. OEMs generally adopt the s...

China Automotive Cybersecurity Software Research Report, 2022

Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services establish...

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...

New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and com...

CTP, CTC and CTB Integrated Battery Industry Research Report, 2022

Integrated battery research: three trends of CTP, CTC and CTB

Basic concept of CTP, CTC and CTB

The traditional integration method of new energy vehicle power system is CTM, that is, "Cell to Module...

China Driving Recorder Market Research Report, 2022

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology s...

Autonomous Delivery Vehicle Industry Report, 2022

Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-base...

China Autonomous Heavy Truck Industry Report, 2022

Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous...

China Smart Parking Industry Report, 2022

Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) hav...

Automotive Head-up Display (HUD) Industry Report, 2022

Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way. 1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

S...