Infrared night vision research: as 60% traffic accidents happen at night, infrared imaging technology comes as an effective solution.

This report combs through development trends and market size of automotive infrared night vision, technology routes of main Chinese and foreign night vision system suppliers, and night vision system application of OEMs.

The statistics show that China saw nearly 200,000 traffic accidents happen every year in recent years, 60% of which took place at night and caused 50% of death toll. It is more dangerous to drive at night for the factors such as insufficient lighting and low visibility make drivers miss out or misjudge road conditions. Infrared thermography which is free of visible light can recognize targets with vital signs accurately either in the daytime or at night. With its anti-glare merit, this technology has great potential to protect driving safety at night.

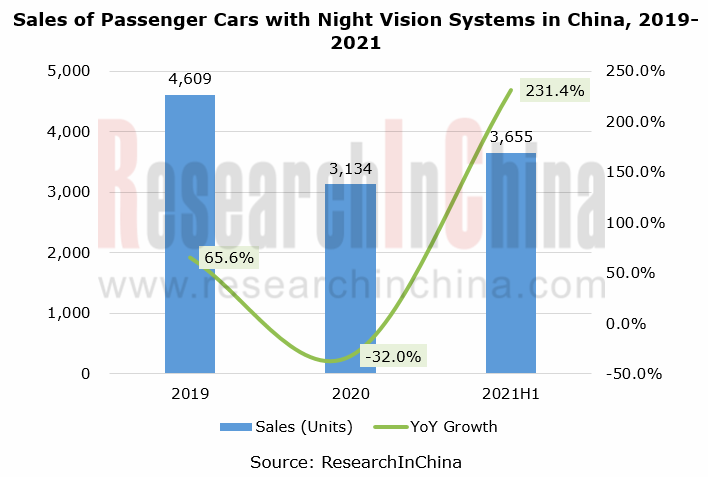

In 2021H1, the sales of passenger cars equipped with night vision systems surged.

From the sales of passenger cars packing night vision systems in China, it can be seen that despite an annualized plunge of 32.0% during the COVID-19 pandemic in 2020, the automobile industry has resumed production in China’s efforts to control the outbreak, selling 3,655 cars with night vision systems in the first half of 2021 alone, a like-on-like spurt of 231.4%. Wherein, Cadillac, Audi and Volkswagen models were the key contributors to the soaring sales of night vision systems in this period.

In current stage, night vision systems still tend to be mounted on high-class models. Through the lens of the sales of passenger cars packing night vision systems in recent two years, those priced above RMB300,000 swept over 85% of the sales, of which the higher than RMB500,000 cars occupied over 60% share. Meanwhile, cars with prices ranging from RMB250,000 to RMB300,000 carried night vision systems as well, sharing 10.3% of the sales in 2020.

The declining cost of infrared detectors and the improving policies make automotive infrared night vision a promising market.

In the past, high price was an enduring constraint on wide adoption of automotive infrared night vision systems. The technology advances have driven down the cost fast:

- The maturing wafer-level and 3D packaging helps to lower the cost of detectors, a key component of infrared night vision system.

- The homemade infrared sensors break the foreign monopoly, having a considerable cost advantage.

- Smaller pixel size drags down the cost of both infrared detector and system integration. Raytron Technology already develops the world’s first large area array uncooled infrared detector with pixel spacing of 8μm and area array size of 1920× 1080, meeting the needs of high-end products that require high resolution and light weight.

The National Technical Committee of Auto Standardization has released the Automotive Active Infrared Detection System (Draft for Comments) and the Automotive Passive Infrared Detection System (Draft for Comments). The deadline for comments is September 27, 2021. The European New Car Assessment Program (E-NCAP) again introduced a range of new tests in the E-NCAP 2018, including AEB cyclist test, pedestrian detection in dark and hazy lighting conditions, and vehicle under test (VUT) hid by obstacles. As the relevant laws and regulations are further improved, the automotive night vision system market has a rosy prospect.

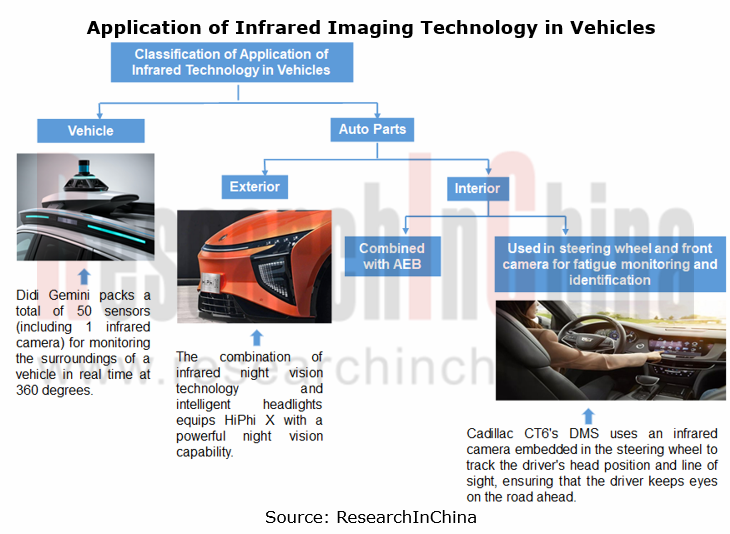

Infrared imaging technology finds ever wider application in autonomous driving.

The application of infrared imaging technology in autonomous driving has become more widespread over the past years, for example:

- In December 2020, Zoox introduced its first autonomous battery electric vehicle equipped with the thermal imaging camera provided by Teledyne FLIR. This device can accurately recognize and classify objects in urban streets around the clock.

- In March 2021, Apple was granted a patent for the night vision system that combines visible light, near-infrared (NIR), and long-wave infrared (LWIR) sensors. The system is applicable to autonomous vehicles.

- On the first day of the Auto Shanghai 2021, Didi Autonomous Driving and Volvo jointly launched “DiDi Gemini”, a new-generation L4 autonomous test vehicle which packs a total of 50 sensors including 1 infrared camera.

- In May 2021, ADASTEC integrated two Teledyne FLIR thermal imagers into its flowride.ai automation platform, with the primary focus on improving detection and safety of all vulnerable road users on or near the road and at bus stops.

Safety is a frequent topic of autonomous driving. Also, autonomous driving needs to have the ability to perceive beyond visual range and work 24/7, in all weather conditions. Infrared imaging technology can meet its needs.

Infrared sensors are a complement to visible light cameras that fail to detect pedestrians in dark conditions. They are not only more affordable than LiDAR but a remedy for the natural defect of LiDAR that it cannot classify objects.

Moreover, infrared sensors can work all day long, which is required by autonomous driving, and provides a longer visual range (the average active vehicle infrared night vision system detects 150m to 200m, and the average passive vehicle infrared night vision system up to 300m). Infrared thermography thus becomes an indispensable technology in the autonomous driving night vision field. The technology will fuse and work with other sensors to make driving safer by playing their respective role. As its price goes down, it will expedite the application of autonomous driving technologies.

As Adasky, an infrared night vision device vendor, said, its Viper infrared thermal imager is not launched to replace a certain type of sensor but works with this sensor to fill the targeted gaps left by other solutions in autonomous driving, so that vehicles have a stronger ability to perceive the surroundings and make decisions.

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...

New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and com...

CTP, CTC and CTB Integrated Battery Industry Research Report, 2022

Integrated battery research: three trends of CTP, CTC and CTB

Basic concept of CTP, CTC and CTB

The traditional integration method of new energy vehicle power system is CTM, that is, "Cell to Module...

China Driving Recorder Market Research Report, 2022

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology s...

Autonomous Delivery Vehicle Industry Report, 2022

Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-base...

China Autonomous Heavy Truck Industry Report, 2022

Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous...

China Smart Parking Industry Report, 2022

Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) hav...

Automotive Head-up Display (HUD) Industry Report, 2022

Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way. 1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

S...

Intelligent Vehicle E/E Architecture Research Report, 2022

E/E architecture research: 14 key technologies, and innovative layout of 24 OEMsKey technologies of next-generation electronic and electrical architectures (EEA)

The definition of next-generation E/E...

China Automotive Lighting Market Research Report, 2022

Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automake...

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...

China Automotive LiDAR Industry Research Report, 2022

LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

...

China Autonomous Driving Data Closed Loop Research Report, 2022

1. The development of autonomous driving is gradually driven by data rather than technology

Today, autonomous driving sensor solutions and computing platforms have become increasingly homogeneous, an...

Overseas LiDAR Industry Research Report, 2022

LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OE...

Smart Car OTA Industry Research Report, 2022

Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According ...

Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Drivi...

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...