New Energy Vehicle Thermal Management System Market Research Report, 2021

Research on EV Thermal Management System: Fast iterative Application of New Technologies such as Heat Pump Air conditioning and Fourth-generation Refrigerant

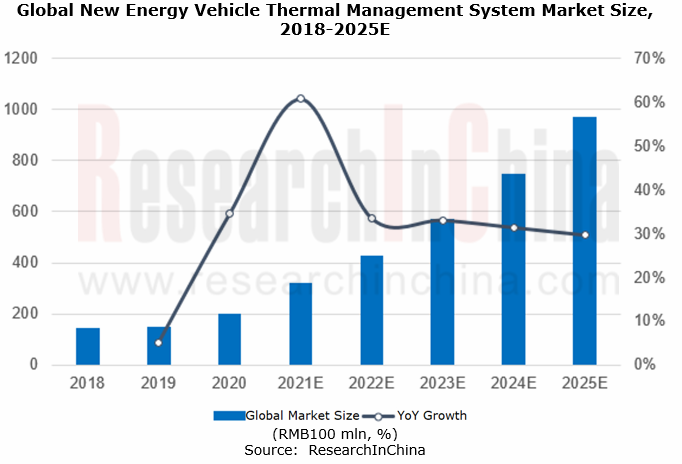

China's new energy vehicle thermal management system market size will exceed RMB40 billion in 2025

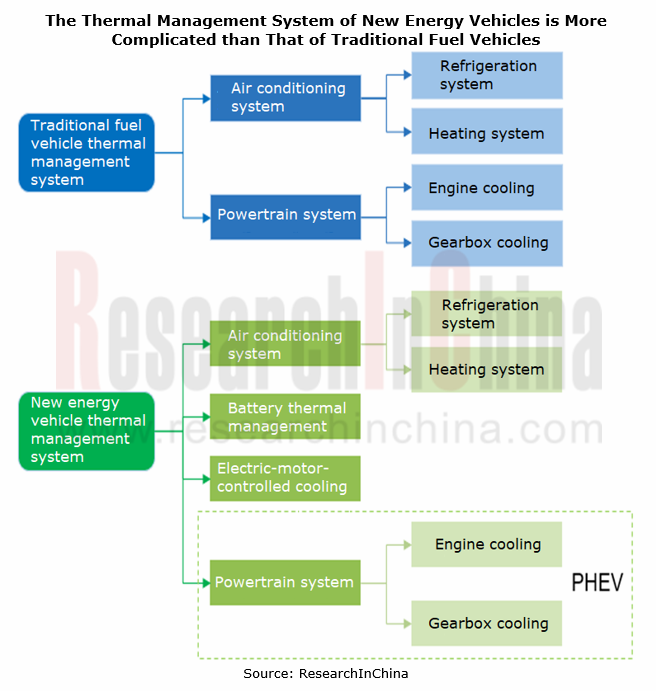

Due to the low efficiency of the internal combustion engine and the sufficient residual heat from the engine, the temperature management of traditional fuel vehicles mainly focuses on cooling and heat dissipation, with a relatively simple structure. In contrast, the new energy vehicle thermal management system is more complex, including refrigeration system, heating system (PTC/heat pump), battery thermal management system (air cooling /liquid cooling /direct cooling), and electric-motor-controlled cooling system (liquid cooling/independent heat exchange) and PHEV's unique engine cooling and gearbox cooling systems. Therefore, the value of a new energy vehicle is higher.

With the popularization of new energy vehicles, the automotive thermal management system has become complicated, with an increasingly complex structure and a higher integration level. The upgrade from independent modules to system engineering directly makes the cost of the automotive thermal management system swell from RMB1,600-2,500 (traditional fuel models) to RMB6,000-7,000 (new energy models). By 2025, 15 million new energy vehicles will be sold globally, so that China's new energy vehicle thermal management system market size is expected to hit RMB40.1 billion, accounting for more than 40% of the global scale.

As new technologies evolve rapidly, the application of the heat pump air conditioning system and the fourth-generation refrigerants like CO2 and R1234yf will accelerate

(1) Heat pump air conditioners will gradually be included in the standard configuration of high-end new energy passenger cars

At present, there are two main air conditioning system solutions for battery-electric vehicles: (1) Air conditioning system with cooling function only + PTC (Positive Temperature Coefficient) heating; (2) Heat pump air conditioning system.

For new energy passenger cars, most domestic air conditioning system manufacturers use PTC air heaters for heating (PTC water heaters are generally available in plug-in hybrid vehicles), that is, PTC is heated by consuming battery power, which features high energy consumption. The heat pump air conditioning system adopts air as the heat source, and its heating and cooling share the same system. Thanks to heating, dehumidification and high energy efficiency ratio, it is the perfect solution for the high energy consumption of new energy vehicle air conditioners and longer recharge mileage of electric vehicles.

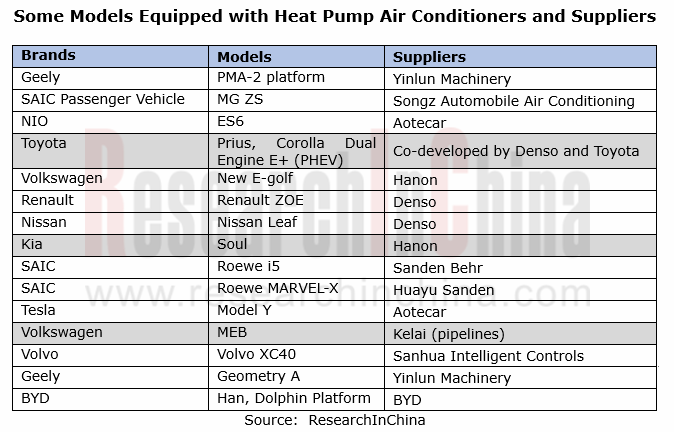

At present, more and more new energy vehicle manufacturers, including Nissan, Renault, BMW, Volkswagen, Audi, Toyota, Tesla, BYD, SAIC, GAC and Geely, have adopted heat pump air conditioning systems.

(2) The fourth-generation air conditioning refrigerants will become the main technical direction of automakers in the future

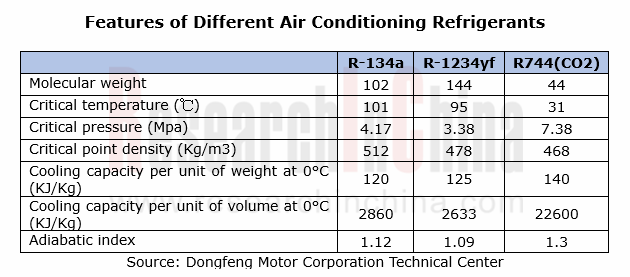

With a long history, refrigerants are an indispensable part of the air conditioning system. As people’s awareness of environmental protection improves and requirements are proposed on the performance of air conditioning systems, refrigerants have undergone several updates since 1830:

1. The first generation of refrigerants mainly focus on workability. Main representatives: NH3, etc.;

2. The second-generation refrigerants mainly feature safety and toxicity. Main representatives: R11, R12, etc.;

3. The third-generation refrigerants, mainly the refrigerants with low ODP (ozone depletion potential), pay attention to the destruction of the ozone layer. Main representatives: R22, R134a, etc.;

4. The fourth-generation refrigerants, like the refrigerants with zero ODP and low GWP (global warming potential), begin to be involved with the issue of global warming. Main representatives: CO2, R1234yf, etc.

Automotive air conditioning refrigerants are transitioning from the third generation to the fourth generation. The first-generation refrigerants, mainly R11 and R12, damage the ozone layer severely and pose a greenhouse effect. Now, R12 has been eliminated and been banned on new cars in China since 2002. With the steady progress of environmental protection policies, the replacement of R-134a is inevitable, but automakers have different opinions on using which refrigerant, R-1234yf or CO2, to substitute it.

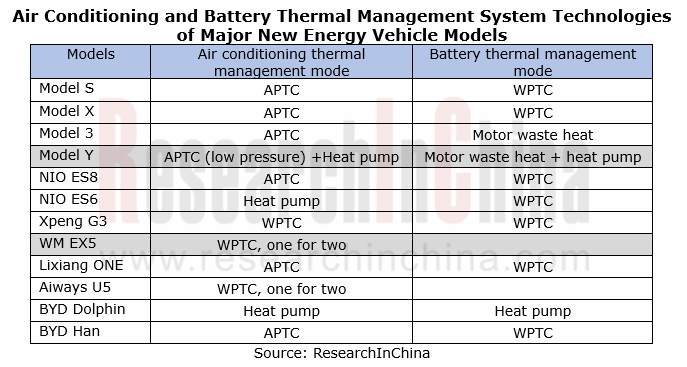

OEMs choose thermal management technology roadmaps and system architectures according to their own needs, bringing many development opportunities for domestic suppliers.

Compared with mature fuel vehicles, automakers are still exploring and redefining the technology roadmaps and system architectures of the thermal management system for new energy vehicles. Major automakers have proposed their own solutions, especially Tesla and Volkswagen are the forerunners whose exploration in the thermal management system of new energy vehicles may indicate the future development direction of the industry.

Tesla’s thermal management system solutions have evolved into the fourth generation. From Model S to Model 3, then to Model Y, the architecture of Tesla’s thermal management system is becoming more and more complex, with much more working modes. Volkswagen started to explore heat pump air conditioning technology earlier and has accumulated rich experience. However, due to the small scale of new energy vehicles, its heat pump technology has not been widely promoted within the group. In the future, with the mass production of models on the battery-electric MEB platform, Volkswagen's sophisticated heat pump technology will bolster its new energy products greatly.

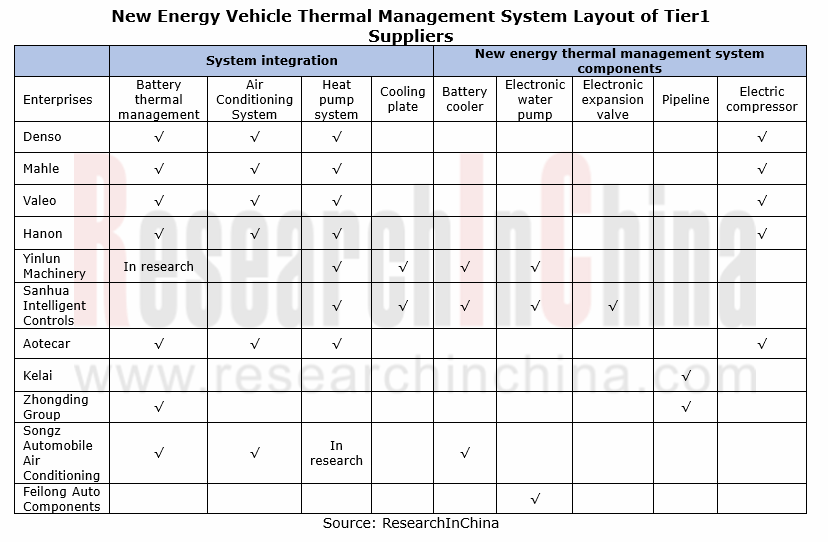

In the thermal management system market for traditional energy and new energy vehicles, traditional foreign-funded giants such as Denso, Valeo, Hanon, Mahle, etc. still dominate the supply of first-level system integration by virtue of deep technology accumulation and enormous customer resources, while domestic counterparts supply system components.

With the popularization of new energy vehicles in China, domestic manufacturers, such as Yinlun Machinery and Sanhua Intelligent Controls, quickly seize domestic new energy vehicle companies thanks to rapid response, cost control and geographical advantages, and have obtained experience in mass production of thermal management integrated systems. On April 18, 2021, Huawei released TMS 2.0, a smart car thermal management solution, which will be mass-produced in 2022. Compared with TMS 1.0 installed on BAIC ARCFOX, it has a higher level of integration, and it is improved in energy efficiency, calibration efficiency and experience.

Domestic Tier1 companies started with parts in the early stage, focusing on the R&D and production of valves, pumps, and pipelines. They have broken the foreign monopoly, mastered the key technology of core components, entered the thermal management industry, endorsed the scale and products of key customers by binding foreign system integration customers, and accumulated valuable experience in system integration. On this basis, they are gradually transforming into suppliers of automotive thermal management solutions, offering more product types to domestic OEMs.

Global and China HD Map Industry Report, 2022

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first ha...

Automotive Software Providers and Business Models Research Report, 2022

Research on software business models: four business forms and charging models of automotive software providers.

In an age of software-defined vehicles, automotive software booms, and providers step u...

China Automotive Integrated Die Casting Industry Research Report, 2022

Integrated Die Casting Research: Upstream, midstream and downstream companies are making plans and layouts in this booming field

Automotive integrated die casting is an automotive manufacturing proce...

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...

New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and com...

CTP, CTC and CTB Integrated Battery Industry Research Report, 2022

Integrated battery research: three trends of CTP, CTC and CTB

Basic concept of CTP, CTC and CTB

The traditional integration method of new energy vehicle power system is CTM, that is, "Cell to Module...

China Driving Recorder Market Research Report, 2022

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology s...

Autonomous Delivery Vehicle Industry Report, 2022

Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-base...

China Autonomous Heavy Truck Industry Report, 2022

Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous...

China Smart Parking Industry Report, 2022

Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) hav...

Automotive Head-up Display (HUD) Industry Report, 2022

Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way. 1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

S...

Intelligent Vehicle E/E Architecture Research Report, 2022

E/E architecture research: 14 key technologies, and innovative layout of 24 OEMsKey technologies of next-generation electronic and electrical architectures (EEA)

The definition of next-generation E/E...

China Automotive Lighting Market Research Report, 2022

Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automake...

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...