Automotive PCB research: vehicle intelligence and electrification bring about demand for PCBs, and local manufacturers come to the fore.

The share of electronics in curb weight of a vehicle is rising, expectedly up to 34.3% in 2020, which is accompanied by more vehicle entertainment and safety functions and the growth of new energy vehicles. This gives a direct boost to demand for automotive printed circuit boards (PCB).

The COVID-19 epidemic in 2020 slashed the global vehicle sales and led to a big shrinkage of the industry scale to USD6,261 million. Yet the gradual epidemic control has driven the sales up a lot. Moreover, the growing penetration of ADAS and new energy vehicles will favor sustained growth in demand for PCBs, which is projected to outstrip USD12 billion in 2026.

As the largest PCB manufacturing base and also the biggest vehicle production base in the world, China demands a great many of PCBs. By one estimate, China’s automotive PCB market was worth up to USD3,501 million in 2020.

Vehicle intelligence pushes up demand for PCBs.

As consumers demand safer, more comfortable, more intelligent automobiles, vehicles tend to be electrified, digitalized and intelligent. ADAS needs many PCB-based components such as sensor, controller and safety system. Vehicle intelligence therefore directly spurs demand for PCBs.

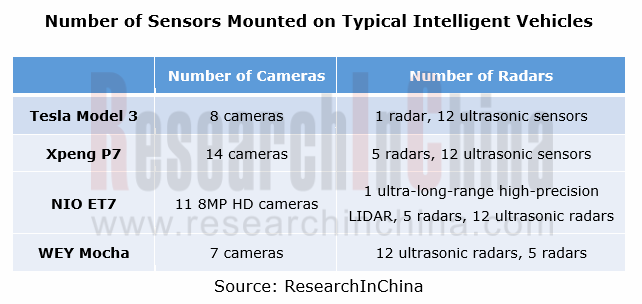

In ADAS sensor’s case, the average intelligent vehicle carries multiple cameras and radars to enable driving assistance functions. An example is Tesla Model 3 which packs 8 cameras, 1 radar and 12 ultrasonic sensors. On one estimate, the PCB for Tesla Model 3 ADAS sensors is valued at RMB536 to RMB1,364, or 21.4% to 54.6% of total PCB value, which makes it clear that vehicle intelligence boost demand for PCBs.

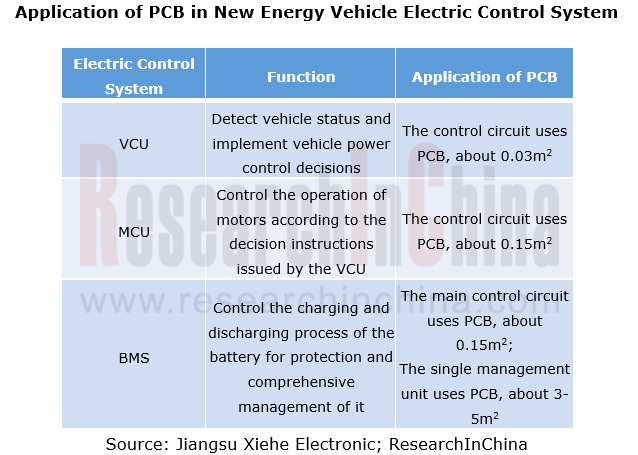

Vehicle electrification stimulates demand for PCBs.

Differing from conventional vehicles, new energy vehicles need PCB-based power systems like inverter, DC-DC, on-board charger, power management system and motor controller, which directly boosts demand for PCBs. Examples include Tesla Model 3, a model with total PCB value higher than RMB2,500, 6.25 times that of ordinary fuel-powered vehicles.

In recent years, the global penetration of new energy vehicles has been on the rise. Major countries have formulated benign new energy vehicle industry policies; mainstream automakers race to launch their development plans for new energy vehicles as well. These moves will be a major contributor to the expansion of new energy vehicles. It is conceivable that the global penetration of new energy vehicles will ramp up in the years to come.

It is predicted that the global new energy vehicle PCB market will be worth RMB38.25 billion in 2026, as new energy vehicles become widespread and the demand from higher levels of vehicle intelligence favors a growth in PCB value per vehicle.

Local vendors cut a figure in the severer market competition.

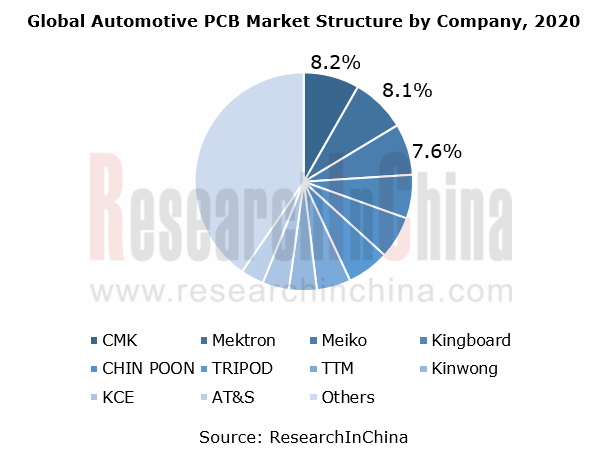

At present, the global automotive PCB market is dominated by Japanese players such as CMK and Mektron and Taiwan’s players like CHIN POON Industrial and TRIPOD Technology. The same is true of the Chinese automotive PCB market. Most of these players have built production bases in Chinese Mainland.

In Chinese Mainland, local companies take a small share in the automotive PCB market. Yet some of them already make deployments in the market, with increasing revenues from automotive PCBs. Some companies have a customer base covering the world’s leading auto parts suppliers, which means it is easier for them to secure bigger orders to gain strength. In future they may command more of the market.

Capital market helps local players.

In recent two years, automotive PCB companies seek capital support to expand capacity for more competitive edges. With the backing of capital market, local players will become more competitive as a matter of course.

Automotive PCB products head in high-end direction, and local companies make deployments.

At present, automotive PCB products are led by double-layer and multi-layer boards, with relatively low demand for HDI boards and high frequency high speed boards, high value-added PCB products which will be more in demand in future as demand for vehicle communication and interiors increases and electrified, intelligent and connected vehicles develop.

The overcapacity of low-end products and fierce price war make companies less profitable. Some local companies tend to deploy high value-added products for becoming more competitive.

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...

New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and com...

CTP, CTC and CTB Integrated Battery Industry Research Report, 2022

Integrated battery research: three trends of CTP, CTC and CTB

Basic concept of CTP, CTC and CTB

The traditional integration method of new energy vehicle power system is CTM, that is, "Cell to Module...

China Driving Recorder Market Research Report, 2022

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology s...

Autonomous Delivery Vehicle Industry Report, 2022

Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-base...

China Autonomous Heavy Truck Industry Report, 2022

Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous...

China Smart Parking Industry Report, 2022

Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) hav...

Automotive Head-up Display (HUD) Industry Report, 2022

Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way. 1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

S...

Intelligent Vehicle E/E Architecture Research Report, 2022

E/E architecture research: 14 key technologies, and innovative layout of 24 OEMsKey technologies of next-generation electronic and electrical architectures (EEA)

The definition of next-generation E/E...

China Automotive Lighting Market Research Report, 2022

Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automake...

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...

China Automotive LiDAR Industry Research Report, 2022

LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

...

China Autonomous Driving Data Closed Loop Research Report, 2022

1. The development of autonomous driving is gradually driven by data rather than technology

Today, autonomous driving sensor solutions and computing platforms have become increasingly homogeneous, an...

Overseas LiDAR Industry Research Report, 2022

LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OE...

Smart Car OTA Industry Research Report, 2022

Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According ...